Attorney-Approved Vehicle Repayment Agreement Template

The Vehicle Repayment Agreement form serves as a crucial document for individuals and businesses involved in financing or leasing vehicles. This form outlines the terms and conditions under which a borrower agrees to repay the loan or lease, ensuring that both parties have a clear understanding of their obligations. Key components of the agreement typically include the total amount financed, the interest rate, the payment schedule, and any fees associated with late payments. Additionally, it may address the consequences of default, such as repossession of the vehicle. By detailing these aspects, the form protects the rights of both the lender and the borrower, fostering transparency and accountability throughout the repayment process. Understanding the intricacies of this agreement is essential for anyone entering into a vehicle financing arrangement, as it lays the groundwork for a successful financial relationship.

Common mistakes

-

Incomplete Information: One of the most common mistakes is leaving sections of the form blank. Every field is important and must be filled out accurately to avoid delays.

-

Incorrect Vehicle Details: Providing wrong information about the vehicle, such as the VIN (Vehicle Identification Number) or make and model, can lead to issues in processing the agreement.

-

Failure to Sign: Forgetting to sign the agreement is a frequent oversight. A signature is necessary to validate the document and confirm your acceptance of the terms.

-

Not Reading Terms Carefully: Skimming through the terms and conditions can result in misunderstandings. Take the time to read everything to ensure you are aware of your obligations.

-

Providing Incorrect Contact Information: Listing an incorrect phone number or email address can hinder communication. Make sure your contact details are current and accurate.

-

Ignoring Payment Schedule: Not paying attention to the payment schedule can lead to missed payments. Ensure you understand when payments are due and how much you owe.

-

Overlooking Additional Fees: Failing to account for any additional fees associated with the agreement can lead to unexpected costs. Be sure to inquire about all potential charges.

-

Not Keeping a Copy: After submitting the form, not retaining a copy for your records is a mistake. Always keep a copy of any signed agreement for future reference.

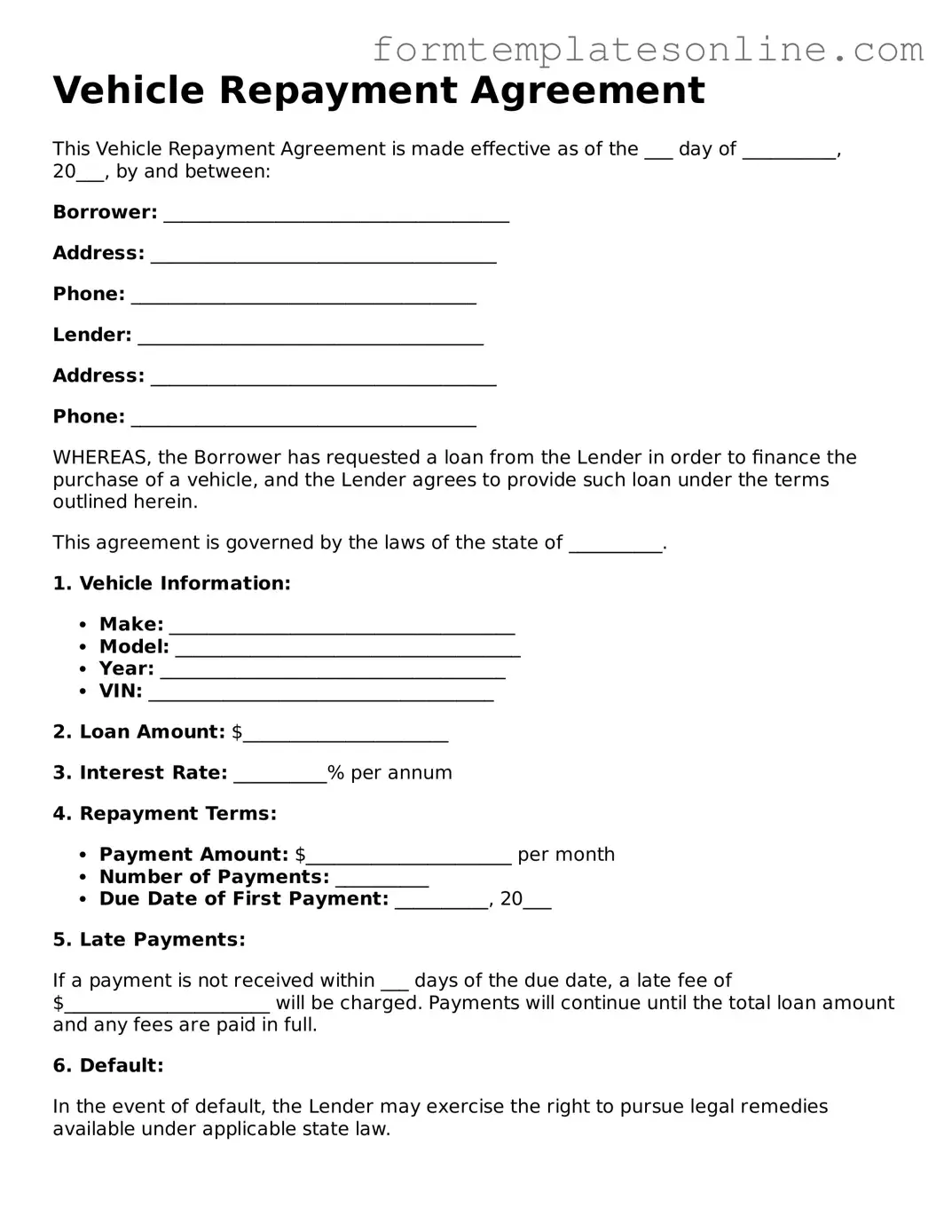

Example - Vehicle Repayment Agreement Form

Vehicle Repayment Agreement

This Vehicle Repayment Agreement is made effective as of the ___ day of __________, 20___, by and between:

Borrower: _____________________________________

Address: _____________________________________

Phone: _____________________________________

Lender: _____________________________________

Address: _____________________________________

Phone: _____________________________________

WHEREAS, the Borrower has requested a loan from the Lender in order to finance the purchase of a vehicle, and the Lender agrees to provide such loan under the terms outlined herein.

This agreement is governed by the laws of the state of __________.

1. Vehicle Information:

- Make: _____________________________________

- Model: _____________________________________

- Year: _____________________________________

- VIN: _____________________________________

2. Loan Amount: $______________________

3. Interest Rate: __________% per annum

4. Repayment Terms:

- Payment Amount: $______________________ per month

- Number of Payments: __________

- Due Date of First Payment: __________, 20___

5. Late Payments:

If a payment is not received within ___ days of the due date, a late fee of $______________________ will be charged. Payments will continue until the total loan amount and any fees are paid in full.

6. Default:

In the event of default, the Lender may exercise the right to pursue legal remedies available under applicable state law.

7. Governing Law: This agreement shall be construed in accordance with the laws of the state of __________.

IN WITNESS WHEREOF, the parties hereto have executed this Vehicle Repayment Agreement as of the day and year first above written.

Borrower's Signature: _____________________________

Date: __________, 20___

Lender's Signature: _____________________________

Date: __________, 20___

More About Vehicle Repayment Agreement

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a legal document that outlines the terms and conditions under which a borrower agrees to repay a loan taken out for the purchase of a vehicle. This form serves to protect both the lender and the borrower by clearly defining the repayment schedule, interest rates, and any penalties for late payments.

Who needs to complete the Vehicle Repayment Agreement form?

Any individual or entity that is borrowing money to purchase a vehicle will need to complete the Vehicle Repayment Agreement form. This includes private buyers, dealerships, and financial institutions. The form is essential for ensuring that all parties involved understand their obligations and rights regarding the repayment of the loan.

What information is required to fill out the form?

To complete the Vehicle Repayment Agreement form, you will need to provide several key pieces of information. This includes the borrower's full name and contact information, the lender's details, the vehicle's make, model, and identification number (VIN), the total loan amount, the interest rate, and the repayment schedule. Additionally, any fees or penalties for late payments should be clearly stated.

What happens if I miss a payment?

If a borrower misses a payment, the consequences will depend on the terms outlined in the Vehicle Repayment Agreement form. Typically, the lender may charge a late fee, and repeated missed payments could lead to more severe actions, such as repossession of the vehicle. It is crucial to communicate with the lender as soon as possible to discuss any potential issues with making payments.

Can the terms of the agreement be modified after signing?

Yes, the terms of the Vehicle Repayment Agreement can be modified, but both parties must agree to any changes. It is advisable to document any modifications in writing and have both parties sign the amended agreement. This helps prevent misunderstandings and ensures that all parties are aware of the new terms.

Is the Vehicle Repayment Agreement form legally binding?

Yes, once both parties have signed the Vehicle Repayment Agreement form, it becomes a legally binding contract. This means that both the lender and the borrower are obligated to adhere to the terms set forth in the agreement. If either party fails to comply, the other party may have legal recourse to enforce the agreement.

What should I do if I have questions about the form?

If you have questions about the Vehicle Repayment Agreement form, it is best to consult with a legal professional or a financial advisor. They can provide guidance specific to your situation and help clarify any terms or conditions that may be confusing. Additionally, lenders may also have representatives available to assist with inquiries regarding the form.

Where can I obtain a Vehicle Repayment Agreement form?

A Vehicle Repayment Agreement form can typically be obtained from financial institutions, car dealerships, or online legal document services. It is essential to ensure that the form you are using is up-to-date and complies with local laws and regulations. Always verify that you are using the correct form for your specific needs.

Key takeaways

When filling out and using the Vehicle Repayment Agreement form, it is essential to keep a few key points in mind. These takeaways will help ensure that the process goes smoothly and that all parties involved understand their obligations.

- Complete All Required Fields: Ensure that every section of the form is filled out accurately. Missing information can lead to delays or complications later.

- Review Terms Carefully: Take the time to read through the repayment terms. Understanding the payment schedule and any interest rates is crucial for both parties.

- Sign and Date Appropriately: Both parties must sign and date the agreement to make it legally binding. Without signatures, the agreement holds no weight.

- Keep Copies: After the form is completed and signed, make copies for both parties. This ensures that everyone has a record of the agreement.

- Communicate Changes Promptly: If any changes to the repayment schedule occur, communicate them as soon as possible. Keeping open lines of communication helps prevent misunderstandings.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form is designed to outline the terms under which a borrower agrees to repay a loan for a vehicle. |

| Parties Involved | This agreement typically involves two parties: the borrower (who receives the loan) and the lender (who provides the funds). |

| Governing Law | The laws governing the Vehicle Repayment Agreement may vary by state. For example, in California, the relevant laws include the California Civil Code. |

| Payment Terms | Payment terms, including the amount, frequency, and method of payments, are clearly outlined in the agreement to avoid any misunderstandings. |

| Consequences of Default | The agreement specifies the consequences if the borrower fails to make payments as agreed, which may include repossession of the vehicle. |

| Signatures Required | Both parties must sign the agreement to indicate their acceptance of the terms. This signature process formalizes the commitment. |

| Amendments | Any changes to the original agreement must be documented and signed by both parties to ensure clarity and enforceability. |

Other Templates:

Ucc 1-308 Without Prejudice - This form encourages individuals to take charge of their legal status.

For those exploring crucial documentation, the Investment Letter of Intent essentials play a vital role in the investment process, providing a fundamental framework for discussions between investors and companies.

Consolation Tournament - This format seeks to maintain engagement until the end of the tournament.

Dos and Don'ts

When filling out the Vehicle Repayment Agreement form, it’s important to ensure that you complete it accurately and thoroughly. Here’s a list of things you should and shouldn’t do:

- Do: Read the entire form carefully before starting.

- Do: Provide accurate and complete information about your vehicle and financial situation.

- Do: Double-check all numbers and signatures before submitting the form.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any sections blank unless instructed to do so.

- Don't: Rush through the form; take your time to ensure accuracy.

By following these guidelines, you can help ensure a smoother process in managing your vehicle repayment agreement.