Attorney-Approved Transfer-on-Death Deed Template

Planning for the future can feel overwhelming, especially when it comes to managing your assets. One tool that can simplify the process is the Transfer-on-Death (TOD) deed. This legal document allows property owners to designate beneficiaries who will inherit their real estate upon their death, bypassing the often lengthy probate process. With a TOD deed, the property remains under the owner's control during their lifetime, meaning they can sell or modify the property as they see fit. Importantly, this deed must be properly executed and recorded to be valid, and it can be revoked or changed at any time before the owner's passing. Understanding the nuances of a Transfer-on-Death deed can help individuals make informed decisions about their estate planning, ensuring that their wishes are honored and their loved ones are taken care of after they are gone.

State-specific Transfer-on-Death Deed Documents

Common mistakes

-

Not including the full legal name of the property owner. It's essential to ensure that the name matches the name on the title.

-

Failing to provide accurate property descriptions. A vague or incorrect description can lead to complications.

-

Omitting the names of the beneficiaries. All intended beneficiaries must be clearly listed to avoid confusion.

-

Not signing the deed in the presence of a notary. A signature without notarization may render the deed invalid.

-

Forgetting to date the document. A missing date can lead to questions about the deed's validity.

-

Neglecting to check local laws regarding Transfer-on-Death Deeds. Different states may have specific requirements that must be followed.

-

Using incorrect forms or outdated versions. Always ensure that the latest form is being used.

-

Not discussing the deed with family members. Open communication can prevent misunderstandings and disputes later on.

-

Failing to store the deed in a safe place. A lost deed can complicate the transfer process significantly.

-

Assuming that a Transfer-on-Death Deed replaces a will. While it serves a different purpose, it should not be seen as a substitute for comprehensive estate planning.

Example - Transfer-on-Death Deed Form

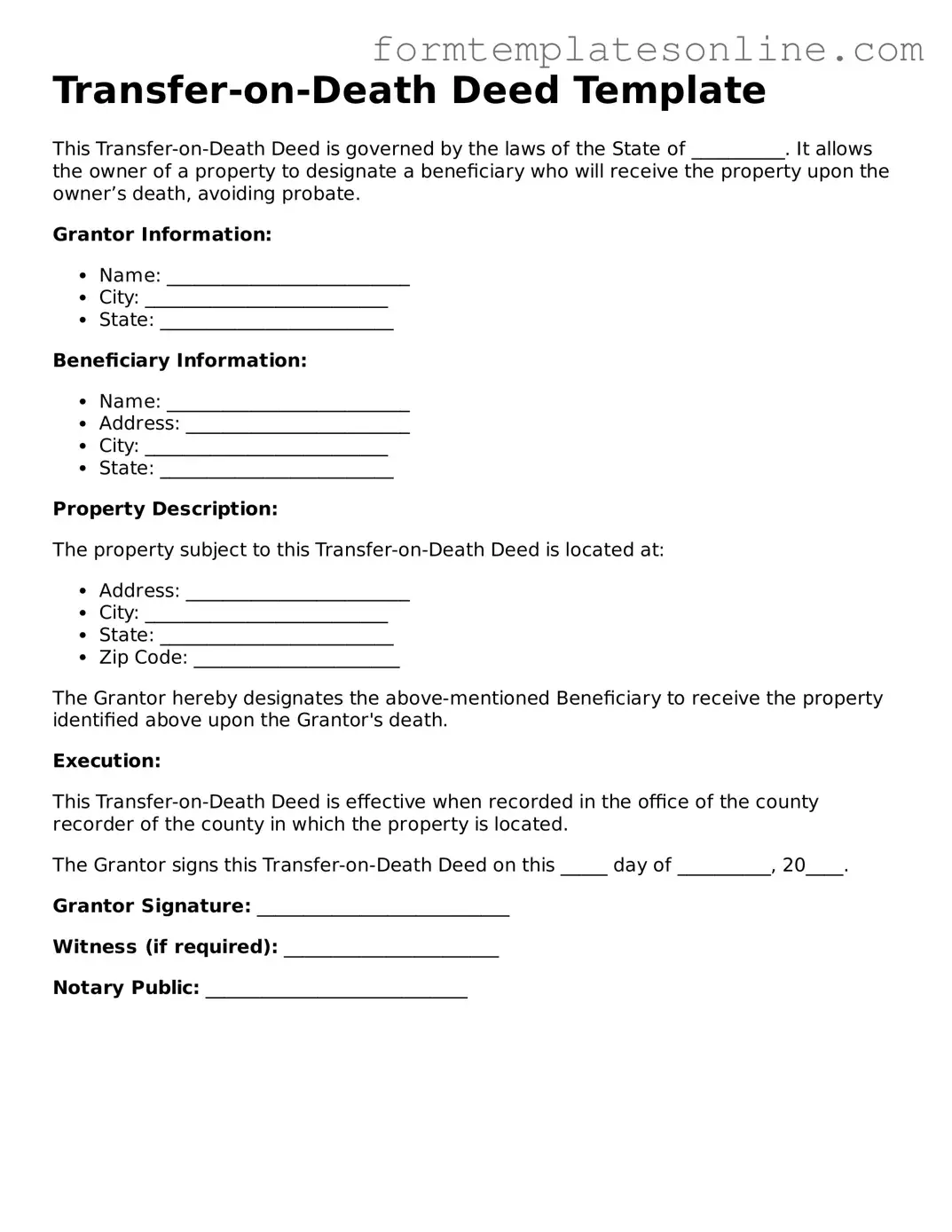

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is governed by the laws of the State of __________. It allows the owner of a property to designate a beneficiary who will receive the property upon the owner’s death, avoiding probate.

Grantor Information:

- Name: __________________________

- City: __________________________

- State: _________________________

Beneficiary Information:

- Name: __________________________

- Address: ________________________

- City: __________________________

- State: _________________________

Property Description:

The property subject to this Transfer-on-Death Deed is located at:

- Address: ________________________

- City: __________________________

- State: _________________________

- Zip Code: ______________________

The Grantor hereby designates the above-mentioned Beneficiary to receive the property identified above upon the Grantor's death.

Execution:

This Transfer-on-Death Deed is effective when recorded in the office of the county recorder of the county in which the property is located.

The Grantor signs this Transfer-on-Death Deed on this _____ day of __________, 20____.

Grantor Signature: ___________________________

Witness (if required): _______________________

Notary Public: ____________________________

More About Transfer-on-Death Deed

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD) is a legal document that allows a property owner to designate one or more beneficiaries to receive their real estate upon their death. This deed effectively transfers ownership without the need for probate, simplifying the process for heirs and ensuring a smooth transition of property ownership.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate can utilize a Transfer-on-Death Deed. This includes homeowners, landlords, and property investors. However, it's essential to check state laws, as the availability and specific requirements for a TOD deed can vary by state.

How does a Transfer-on-Death Deed work?

When a property owner completes a TOD deed and files it with the appropriate county office, the designated beneficiaries are named to inherit the property automatically upon the owner's death. The deed remains revocable, meaning the owner can change or revoke it at any time before their death. Upon the owner's passing, the beneficiaries can claim the property without going through probate.

Are there any limitations on using a Transfer-on-Death Deed?

Yes, there are some limitations. For instance, a TOD deed cannot be used for properties held in joint tenancy or for properties that are part of a trust. Additionally, some states may have restrictions on the types of properties that can be transferred using this deed, such as commercial properties or properties subject to liens.

What are the benefits of using a Transfer-on-Death Deed?

The primary benefit of a Transfer-on-Death Deed is that it allows property to pass directly to beneficiaries without going through the probate process, which can be time-consuming and costly. This deed also provides the owner with the flexibility to retain full control of the property during their lifetime, as it can be revoked or altered as needed.

How do I create a Transfer-on-Death Deed?

Creating a Transfer-on-Death Deed typically involves filling out a specific form that includes details about the property, the owner, and the beneficiaries. It's advisable to consult with a legal professional to ensure that the deed complies with state laws and accurately reflects your intentions. After completing the form, it must be signed, notarized, and filed with the appropriate county office.

Can I revoke a Transfer-on-Death Deed?

Yes, you can revoke a Transfer-on-Death Deed at any time before your death. This can be done by filing a revocation form with the county office where the original deed was recorded. It's important to ensure that the revocation is properly documented to avoid any confusion for your beneficiaries in the future.

What happens if I don’t use a Transfer-on-Death Deed?

If you choose not to use a Transfer-on-Death Deed, your property will likely go through probate after your death. This process can be lengthy and may incur various fees, potentially reducing the inheritance your beneficiaries receive. Without a TOD deed, the distribution of your property will follow state intestacy laws if you do not have a will, which may not align with your wishes.

Is a Transfer-on-Death Deed the right choice for everyone?

A Transfer-on-Death Deed can be a great option for many property owners, but it may not be suitable for everyone. Consider your specific circumstances, such as the size of your estate, your family dynamics, and your long-term plans for the property. Consulting with an estate planning professional can help you determine if a TOD deed is the best fit for your needs.

Key takeaways

Understanding the Transfer-on-Death Deed (TOD) form is essential for ensuring a smooth transition of property upon death. Here are some key takeaways to consider:

- Purpose: The TOD deed allows property owners to transfer their real estate directly to beneficiaries without going through probate.

- Eligibility: This deed can be used for various types of real estate, including residential properties, but it may not be applicable to all types of property.

- Filling Out the Form: Ensure that all required fields are completed accurately. This includes the property description and the names of the beneficiaries.

- Signatures: The deed must be signed by the property owner in the presence of a notary public to be legally valid.

- Recording: After completion, the TOD deed should be recorded with the local county recorder’s office to ensure it is enforceable.

- Revocation: Property owners have the right to revoke the TOD deed at any time before their death, allowing for changes in beneficiaries or property ownership.

By following these guidelines, individuals can effectively utilize the Transfer-on-Death Deed to manage their property and ensure their wishes are honored after their passing.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows an individual to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The law governing Transfer-on-Death Deeds varies by state. For example, in California, it is governed by the California Probate Code. |

| Revocability | The deed can be revoked or changed at any time before the property owner’s death, ensuring flexibility for the owner. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries. If multiple beneficiaries are named, the property is divided among them. |

| Tax Implications | Transfer-on-Death Deeds generally do not trigger gift taxes during the owner's lifetime, but estate taxes may apply upon death. |

| Recording Requirement | To be effective, the deed must be recorded with the appropriate county office before the property owner’s death. |

More Transfer-on-Death Deed Types:

What Is a Gift Deed in Real Estate - This form may eliminate the need for probate when a property owner passes away.

Where Can I Get a Quit Claim Deed Form - A Quitclaim Deed is typically simpler and faster than a Warranty Deed.

A Georgia Quitclaim Deed form is a legal document used to transfer interest in real estate from one person to another without any guarantees about the title being clear. This form is often employed between family members or to clear up title issues. For those looking to obtain this form, resources are available at OnlineLawDocs.com, and it is crucial for individuals considering using this deed to understand its implications fully.

California Corrective Deed - It can address issues caused by previous deeds or transfers.

Dos and Don'ts

When filling out the Transfer-on-Death Deed form, it's essential to ensure accuracy and compliance with state laws. Here are five important things to do and avoid during this process:

- Do verify that you meet the eligibility requirements for using a Transfer-on-Death Deed.

- Do provide complete and accurate information about the property and the beneficiaries.

- Do ensure that the deed is signed and notarized according to your state's requirements.

- Do keep a copy of the completed deed for your records.

- Do file the deed with the appropriate county office to make it effective.

- Don't leave any sections of the form blank, as this can lead to complications.

- Don't use outdated forms; always check for the most current version.

- Don't forget to consult with a legal professional if you have questions.

- Don't overlook the importance of informing the beneficiaries about the deed.

- Don't assume that the deed is valid without proper filing.