Valid Transfer-on-Death Deed Form for Texas

The Texas Transfer-on-Death Deed (TODD) offers a unique way for property owners to ensure their real estate is passed on to their chosen beneficiaries without the complications of probate. This legal document allows an individual to designate one or more beneficiaries who will automatically receive the property upon the owner’s death. One of the key features of the TODD is that it does not take effect until the owner has passed away, meaning the owner retains full control of the property during their lifetime. Additionally, this form is relatively straightforward to complete and can be revoked or modified at any time before the owner's death. Importantly, the TODD can help streamline the transfer process and may reduce the emotional and financial burden on loved ones left behind. Understanding how to properly execute and record a Transfer-on-Death Deed is essential for anyone considering this option, as it ensures that their wishes are honored and that the transition of property ownership is as smooth as possible.

Common mistakes

-

Incomplete Information: Many people fail to provide all necessary details when filling out the form. This can include missing the property description or not including the full names of the beneficiaries. Ensure that all sections are completed accurately.

-

Improper Signatures: Some individuals overlook the requirement for proper signatures. The deed must be signed by the property owner in the presence of a notary public. Failing to have the document notarized can render it invalid.

-

Not Recording the Deed: After completing the Transfer-on-Death Deed, it is essential to record it with the county clerk's office. Many people neglect this step, thinking that simply filling out the form is sufficient. Without recording, the deed may not be enforceable.

-

Confusing Beneficiaries: Sometimes, individuals mistakenly name beneficiaries who are not clearly identified. This can lead to disputes among heirs. It is crucial to use full names and, if possible, include additional identifying information such as addresses or relationship to the property owner.

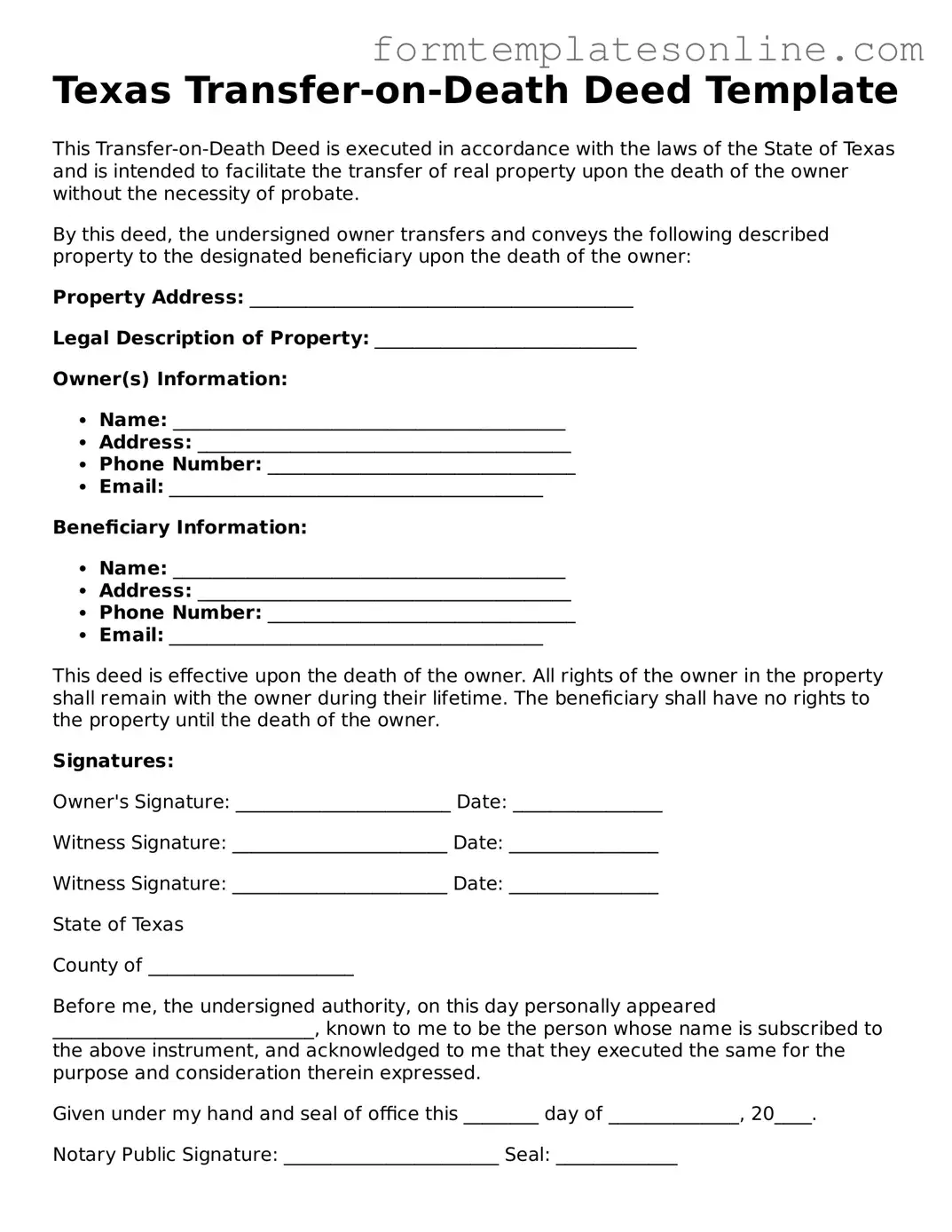

Example - Texas Transfer-on-Death Deed Form

Texas Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the laws of the State of Texas and is intended to facilitate the transfer of real property upon the death of the owner without the necessity of probate.

By this deed, the undersigned owner transfers and conveys the following described property to the designated beneficiary upon the death of the owner:

Property Address: _________________________________________

Legal Description of Property: ____________________________

Owner(s) Information:

- Name: __________________________________________

- Address: ________________________________________

- Phone Number: _________________________________

- Email: ________________________________________

Beneficiary Information:

- Name: __________________________________________

- Address: ________________________________________

- Phone Number: _________________________________

- Email: ________________________________________

This deed is effective upon the death of the owner. All rights of the owner in the property shall remain with the owner during their lifetime. The beneficiary shall have no rights to the property until the death of the owner.

Signatures:

Owner's Signature: _______________________ Date: ________________

Witness Signature: _______________________ Date: ________________

Witness Signature: _______________________ Date: ________________

State of Texas

County of ______________________

Before me, the undersigned authority, on this day personally appeared ____________________________, known to me to be the person whose name is subscribed to the above instrument, and acknowledged to me that they executed the same for the purpose and consideration therein expressed.

Given under my hand and seal of office this ________ day of ______________, 20____.

Notary Public Signature: _______________________ Seal: _____________

More About Texas Transfer-on-Death Deed

What is a Texas Transfer-on-Death Deed?

A Texas Transfer-on-Death Deed is a legal document that allows a property owner to designate a beneficiary who will receive the property upon the owner’s death. This deed ensures that the property does not go through probate, simplifying the transfer process for the beneficiary.

Who can create a Transfer-on-Death Deed in Texas?

Any individual who is the owner of real property in Texas can create a Transfer-on-Death Deed. The owner must be at least 18 years old and of sound mind. Joint owners can also use this deed to designate beneficiaries for their respective interests in the property.

What information is required to complete the deed?

To complete a Transfer-on-Death Deed, the property owner must provide the legal description of the property, the name and address of the beneficiary, and the owner’s signature. It is also important to include the date of execution and have the deed notarized for it to be valid.

How does a Transfer-on-Death Deed affect the property during the owner’s lifetime?

The property remains under the owner’s control during their lifetime. The owner can sell, lease, or mortgage the property without any restrictions. The beneficiary has no rights to the property until the owner passes away.

Can a Transfer-on-Death Deed be revoked?

Yes, a Transfer-on-Death Deed can be revoked at any time before the owner's death. This can be done by executing a new deed that explicitly revokes the previous one or by recording a written revocation with the county clerk's office where the original deed was filed.

What happens if the beneficiary predeceases the owner?

If the designated beneficiary passes away before the property owner, the Transfer-on-Death Deed becomes void. The owner may then choose to designate a new beneficiary or let the property pass according to their will or state intestacy laws.

Is it necessary to file the Transfer-on-Death Deed with the county?

Yes, the Transfer-on-Death Deed must be filed with the county clerk's office where the property is located. It should be recorded before the owner's death to ensure that the beneficiary can inherit the property without going through probate.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications for the owner when creating a Transfer-on-Death Deed. However, the beneficiary may be subject to property taxes and other assessments once they inherit the property. It is advisable to consult with a tax professional for specific guidance.

Can a Transfer-on-Death Deed be used for all types of property?

A Transfer-on-Death Deed can be used for residential and commercial real estate, but it cannot be used for personal property like vehicles or bank accounts. It is specifically designed for real property ownership and must meet Texas legal requirements to be valid.

Key takeaways

Filling out and using the Texas Transfer-on-Death Deed form can be an effective way to ensure that your property is transferred to your chosen beneficiaries without going through probate. Here are some key takeaways to keep in mind:

- Eligibility: Only real property, such as land or a house, can be transferred using this deed.

- Revocability: The Transfer-on-Death Deed can be revoked at any time before the owner’s death, allowing for flexibility in estate planning.

- Beneficiary Designation: You can name one or multiple beneficiaries, and they can be individuals or entities, such as a trust.

- No Immediate Ownership: The beneficiary does not gain ownership of the property until the owner passes away, which helps maintain control during the owner’s lifetime.

- Filing Requirements: The deed must be filed with the county clerk’s office where the property is located to be effective.

- Form Specifics: Ensure that the form is completed accurately, including the property description and the names of the beneficiaries.

- Consideration of Taxes: Beneficiaries may be subject to property taxes and other responsibilities once the property is transferred.

- Legal Advice: Consulting with a legal professional is advisable to understand the implications and ensure that the deed aligns with your overall estate plan.

- State-Specific Rules: Familiarize yourself with Texas laws regarding Transfer-on-Death Deeds, as they may differ from those in other states.

Understanding these points can help simplify the process and ensure that your intentions are clearly communicated and legally binding.

File Details

| Fact Name | Description |

|---|---|

| Purpose | A Transfer-on-Death Deed allows property owners in Texas to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Texas Estates Code, Chapter 114. |

| Eligibility | Any individual who owns real property in Texas can create a Transfer-on-Death Deed. |

| Revocation | The deed can be revoked at any time before the owner's death by filing a new deed or a revocation document. |

| Beneficiary Designation | Property owners can name one or more beneficiaries, and they can specify different shares for each beneficiary. |

| Execution Requirements | The deed must be signed by the owner and acknowledged by a notary public to be valid. |

| Filing | The Transfer-on-Death Deed must be filed with the county clerk's office where the property is located to take effect. |

Consider Some Other Transfer-on-Death Deed Forms for US States

Free Printable Transfer on Death Deed Form Florida - For those planning to leave specific real estate to certain people, this deed serves as an effective designation tool.

Beneficiary Deed Georgia - It must be executed and recorded during the owner’s lifetime to be valid.

For those looking to establish a clear working relationship, understanding the fundamental elements of an Independent Contractor Agreement is crucial. This form serves as a foundation for outlining roles, responsibilities, and compensation, ensuring both parties remain aligned throughout the duration of their agreement.

House Deed Transfer - Careful attention to applicable state laws assures that the deed complies with all necessary legal requirements.

Transfer on Death Affidavit - Involves clear identification of the property being transferred to avoid confusion later on.

Dos and Don'ts

When filling out the Texas Transfer-on-Death Deed form, it is essential to follow specific guidelines to ensure the document is valid and effective. Here are six important dos and don'ts to consider:

- Do ensure that the deed is signed by the property owner in front of a notary public.

- Do include a legal description of the property being transferred.

- Do clearly identify the beneficiaries by their full names.

- Don't forget to record the deed with the county clerk's office where the property is located.

- Don't use vague terms when describing the property or beneficiaries.

- Don't attempt to change the deed after it has been recorded without proper legal procedures.