Valid Real Estate Purchase Agreement Form for Texas

The Texas Real Estate Purchase Agreement form is a crucial document in the process of buying or selling property in Texas. This form outlines the terms and conditions agreed upon by both the buyer and the seller, ensuring that all parties are on the same page regarding the transaction. Key aspects of the agreement include the purchase price, the description of the property, and the closing date. Additionally, it addresses important contingencies, such as financing and inspections, which can affect the sale. The form also includes provisions for earnest money, which demonstrates the buyer's commitment to the purchase. By clearly stating the responsibilities and expectations of each party, the Texas Real Estate Purchase Agreement helps facilitate a smoother transaction and minimizes potential disputes. Understanding this form is essential for anyone involved in real estate transactions in Texas, as it serves as the foundation for a successful property transfer.

Common mistakes

-

Incomplete Information: Buyers often leave sections blank, which can lead to confusion or delays in the transaction.

-

Incorrect Property Description: Failing to provide an accurate legal description of the property can cause issues during closing.

-

Missing Signatures: All required parties must sign the agreement. Missing signatures can invalidate the contract.

-

Improper Dates: Entering the wrong dates for the contract or closing can lead to misunderstandings about timelines.

-

Ignoring Contingencies: Not including necessary contingencies, such as financing or inspection, can expose buyers to risks.

-

Failure to Specify Earnest Money: Not stating the amount or terms for earnest money can create uncertainty about the buyer's commitment.

-

Neglecting to Review Terms: Skimming over terms and conditions without understanding them can result in unfavorable obligations.

-

Omitting Disclosure Requirements: Buyers must be aware of and include any required disclosures to comply with state laws.

-

Forgetting to Include Addenda: If there are additional agreements or clauses, failing to attach them can lead to disputes.

-

Not Consulting Professionals: Relying solely on personal knowledge without seeking legal or real estate advice can lead to costly mistakes.

Example - Texas Real Estate Purchase Agreement Form

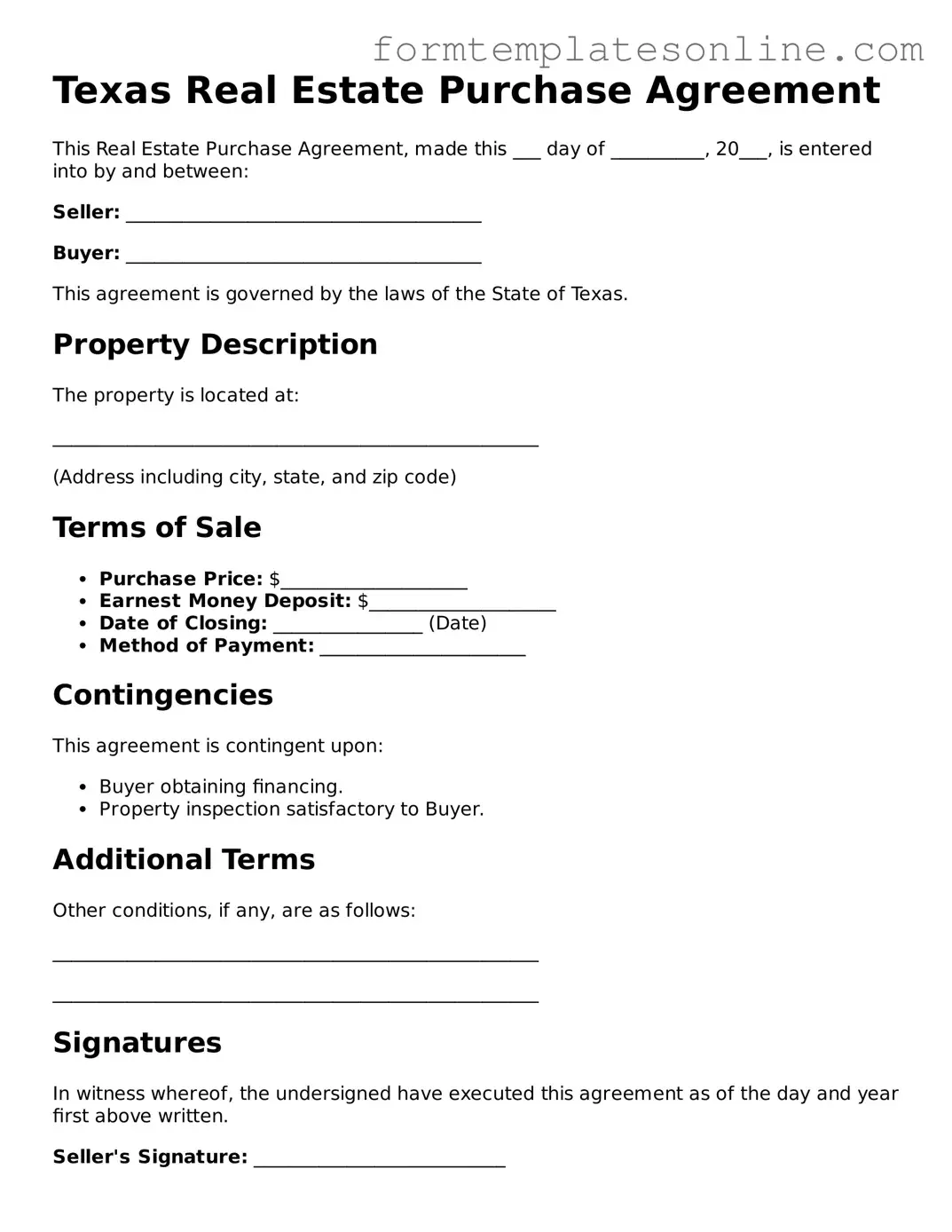

Texas Real Estate Purchase Agreement

This Real Estate Purchase Agreement, made this ___ day of __________, 20___, is entered into by and between:

Seller: ______________________________________

Buyer: ______________________________________

This agreement is governed by the laws of the State of Texas.

Property Description

The property is located at:

____________________________________________________

(Address including city, state, and zip code)

Terms of Sale

- Purchase Price: $____________________

- Earnest Money Deposit: $____________________

- Date of Closing: ________________ (Date)

- Method of Payment: ______________________

Contingencies

This agreement is contingent upon:

- Buyer obtaining financing.

- Property inspection satisfactory to Buyer.

Additional Terms

Other conditions, if any, are as follows:

____________________________________________________

____________________________________________________

Signatures

In witness whereof, the undersigned have executed this agreement as of the day and year first above written.

Seller's Signature: ___________________________

Date: ________________________

Buyer's Signature: ___________________________

Date: ________________________

More About Texas Real Estate Purchase Agreement

What is a Texas Real Estate Purchase Agreement?

The Texas Real Estate Purchase Agreement is a legally binding document used when buying or selling real estate in Texas. This agreement outlines the terms and conditions of the sale, including the purchase price, financing details, and any contingencies that may apply. It serves as a foundation for the transaction and protects the interests of both the buyer and the seller.

What are the key components of the agreement?

The agreement typically includes several important sections. These include the identification of the parties involved, a description of the property, the purchase price, earnest money details, financing contingencies, inspection rights, and closing information. Each section is designed to clarify expectations and responsibilities for both parties.

Is it necessary to have a real estate agent to use this form?

No, it is not mandatory to have a real estate agent to use the Texas Real Estate Purchase Agreement. However, having an agent can provide valuable guidance throughout the process. They can help ensure that the agreement is filled out correctly and that all necessary terms are included, reducing the risk of misunderstandings.

Can the agreement be modified after it is signed?

Yes, the Texas Real Estate Purchase Agreement can be modified after it is signed, but both parties must agree to the changes. Any modifications should be documented in writing and signed by both the buyer and the seller to ensure that they are enforceable. Verbal agreements or informal changes are not advisable.

What happens if the buyer backs out of the agreement?

If the buyer decides to back out of the agreement without a valid reason, they may forfeit their earnest money deposit. The seller may also have the right to pursue legal action for breach of contract. However, if the buyer backs out due to a contingency outlined in the agreement, such as failing to secure financing, they may be able to do so without penalty.

Are there any contingencies commonly included in the agreement?

Yes, several common contingencies can be included in the Texas Real Estate Purchase Agreement. These often involve financing, home inspections, and the sale of the buyer's current home. Contingencies protect the buyer by allowing them to withdraw from the agreement if certain conditions are not met.

What is earnest money, and how does it work?

Earnest money is a deposit made by the buyer to demonstrate their serious intent to purchase the property. This amount is typically held in escrow and applied toward the purchase price at closing. If the transaction goes through, the earnest money is credited to the buyer. If the buyer backs out without a valid reason, the seller may keep the earnest money as compensation for the time and effort invested in the transaction.

How long is the typical closing period in Texas?

The typical closing period in Texas is around 30 to 45 days from the date the purchase agreement is signed. However, this timeline can vary based on the specifics of the transaction and the needs of both parties. It's essential for buyers and sellers to communicate openly about their timelines to ensure a smooth closing process.

What should I do if I have questions about the agreement?

If you have questions about the Texas Real Estate Purchase Agreement, it is advisable to consult with a real estate attorney or a qualified real estate professional. They can provide clarity on specific terms and conditions, ensuring that you fully understand your rights and obligations before proceeding with the transaction.

Key takeaways

When dealing with the Texas Real Estate Purchase Agreement form, several important aspects should be kept in mind to ensure a smooth transaction. Here are four key takeaways:

- Clarity is Crucial: Ensure that all details regarding the property, including the address and legal description, are clearly stated. Ambiguities can lead to misunderstandings or disputes later on.

- Contingencies Matter: Pay attention to the contingencies included in the agreement. These clauses protect buyers and sellers by outlining conditions that must be met for the sale to proceed.

- Review Deadlines: Be aware of the timelines for various actions, such as inspections and financing. Missing these deadlines can jeopardize the agreement.

- Legal Review is Recommended: Consider having a qualified real estate attorney review the agreement before signing. Their expertise can help identify potential issues and ensure your interests are protected.

File Details

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Real Estate Purchase Agreement is governed by Texas state law. |

| Purpose | This form is used to outline the terms and conditions of a real estate transaction in Texas. |

| Parties Involved | The agreement identifies the buyer and seller, detailing their roles in the transaction. |

| Property Description | A detailed description of the property being sold is required, including its address and legal description. |

| Purchase Price | The agreement specifies the purchase price and any earnest money deposit required. |

| Contingencies | Buyers can include contingencies, such as financing or inspection, which must be satisfied for the sale to proceed. |

| Closing Date | The form sets a closing date, which is the date when the property ownership is officially transferred. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

Consider Some Other Real Estate Purchase Agreement Forms for US States

Purchasing Agreement - Includes stipulations regarding title insurance requirements.

Free Ohio Real Estate Purchase Contract for Sale by Owner - May provide information about property taxes and assessments.

Free Florida Purchase and Sale Agreement - Access rights to the property before closing can be negotiated and incorporated into the agreement.

Dos and Don'ts

When filling out the Texas Real Estate Purchase Agreement form, it is crucial to approach the task with care. Here are some essential dos and don’ts to keep in mind.

- Do read the entire agreement thoroughly before filling it out. Understanding the terms and conditions is vital.

- Do provide accurate and complete information. Inaccuracies can lead to legal issues later on.

- Do consult with a real estate agent or attorney if you have questions. Their expertise can help clarify complex points.

- Do ensure all parties sign the agreement. An unsigned document may not be enforceable.

- Do keep a copy of the completed agreement for your records. This is important for future reference.

- Don't rush through the form. Taking your time can prevent mistakes.

- Don't leave any sections blank unless instructed. Missing information can cause delays.

- Don't ignore deadlines. Timely submission is essential in real estate transactions.

- Don't use ambiguous language. Clear and precise wording is necessary to avoid misunderstandings.

- Don't forget to review the agreement with all parties involved. Communication is key to a successful transaction.