Valid Quitclaim Deed Form for Texas

The Texas Quitclaim Deed form serves as a vital tool for property owners looking to transfer their interest in real estate without the complexities often associated with traditional property transfers. Unlike a warranty deed, which provides guarantees about the title, a quitclaim deed offers no such assurances. It simply conveys whatever interest the grantor has in the property, if any, to the grantee. This form is frequently used in situations such as divorce settlements, property settlements among family members, or when transferring property into a trust. Understanding the nuances of this deed is essential for both parties involved, as it can affect future ownership rights and responsibilities. Additionally, while the quitclaim deed is relatively straightforward to complete, proper execution and recording are crucial to ensure that the transfer is legally recognized. In Texas, specific requirements must be met, including the need for notarization and adherence to local recording laws, making it essential for individuals to familiarize themselves with the process before proceeding.

Common mistakes

-

Incomplete Information: One common mistake is leaving out essential details. The form requires specific information about the grantor (the person transferring the property) and the grantee (the person receiving the property). Omitting names, addresses, or the legal description of the property can lead to delays or even invalidation of the deed.

-

Incorrect Legal Description: The legal description of the property must be precise. Many people mistakenly use informal descriptions or fail to include necessary details. An inaccurate legal description can create confusion and may result in the deed being unenforceable.

-

Not Notarizing the Document: A Quitclaim Deed must be notarized to be legally valid. Some individuals forget this critical step. Without a notary's signature, the document may not be accepted by the county clerk or in a court of law.

-

Failing to Record the Deed: After completing the Quitclaim Deed, it is vital to record it with the county clerk's office. Many people overlook this step, thinking that signing the document is sufficient. Failing to record the deed can lead to disputes over property ownership in the future.

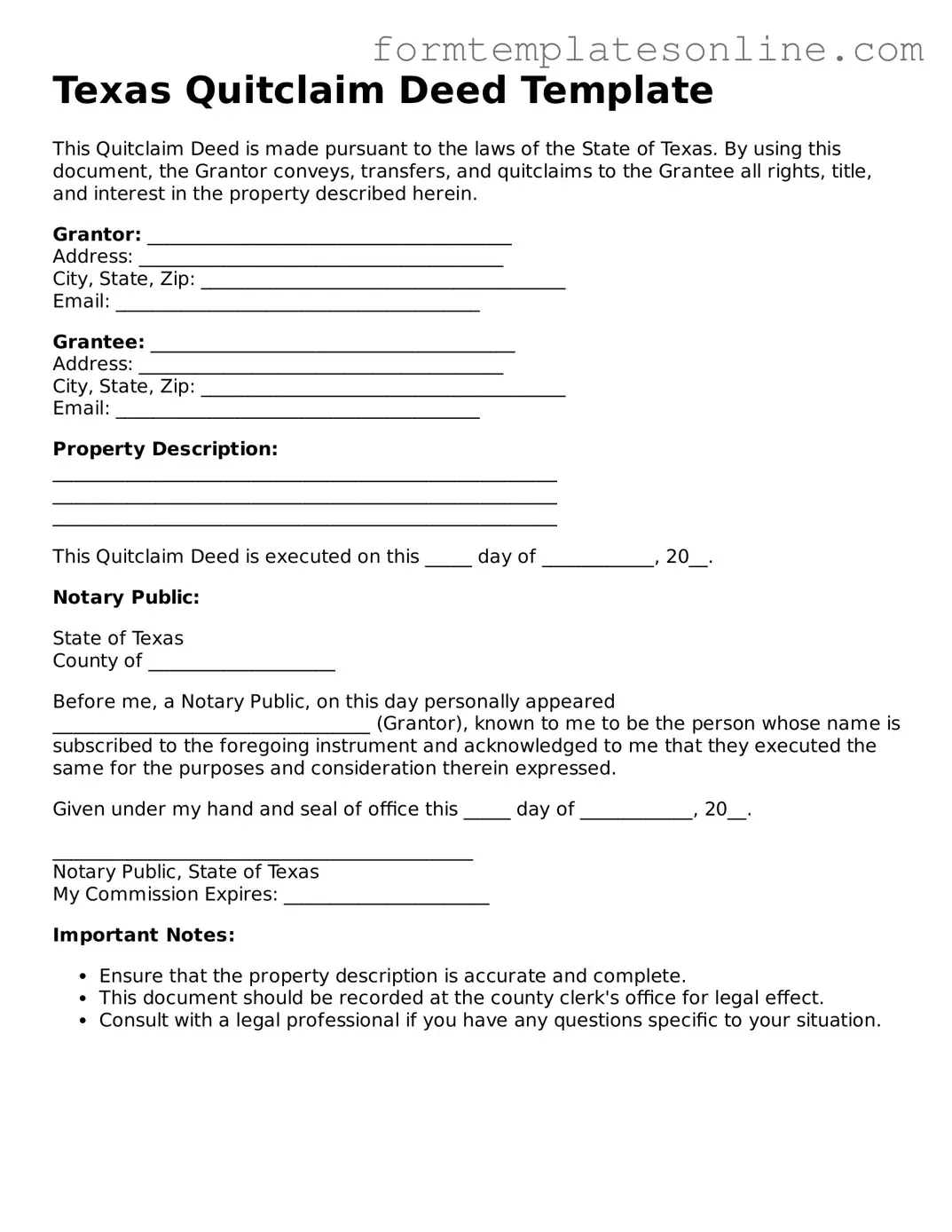

Example - Texas Quitclaim Deed Form

Texas Quitclaim Deed Template

This Quitclaim Deed is made pursuant to the laws of the State of Texas. By using this document, the Grantor conveys, transfers, and quitclaims to the Grantee all rights, title, and interest in the property described herein.

Grantor: _______________________________________

Address: _______________________________________

City, State, Zip: _______________________________________

Email: _______________________________________

Grantee: _______________________________________

Address: _______________________________________

City, State, Zip: _______________________________________

Email: _______________________________________

Property Description:

______________________________________________________

______________________________________________________

______________________________________________________

This Quitclaim Deed is executed on this _____ day of ____________, 20__.

Notary Public:

State of Texas

County of ____________________

Before me, a Notary Public, on this day personally appeared __________________________________ (Grantor), known to me to be the person whose name is subscribed to the foregoing instrument and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal of office this _____ day of ____________, 20__.

_____________________________________________

Notary Public, State of Texas

My Commission Expires: ______________________

Important Notes:

- Ensure that the property description is accurate and complete.

- This document should be recorded at the county clerk's office for legal effect.

- Consult with a legal professional if you have any questions specific to your situation.

More About Texas Quitclaim Deed

What is a Texas Quitclaim Deed?

A Texas Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another without making any guarantees about the property title. This means the person transferring the property (the grantor) does not assure the recipient (the grantee) that the title is clear or free from liens. Instead, the grantor simply conveys whatever interest they may have in the property.

When should I use a Quitclaim Deed in Texas?

This type of deed is commonly used in situations where property is being transferred between family members, such as during divorce settlements or inheritance. It is also used when the parties involved trust each other and do not require a warranty on the title. However, it is not recommended for transactions involving buyers and sellers who do not know each other.

How do I complete a Quitclaim Deed in Texas?

To complete a Quitclaim Deed, you will need to include specific information such as the names of the grantor and grantee, a legal description of the property, and the date of the transfer. You must also sign the document in front of a notary public. After signing, the deed should be filed with the county clerk in the county where the property is located to make the transfer official.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed and a Warranty Deed are different. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantees, making it a riskier option for the grantee.

Do I need an attorney to create a Quitclaim Deed?

Are there any fees associated with filing a Quitclaim Deed in Texas?

Yes, there are typically fees associated with filing a Quitclaim Deed. These fees can vary by county, so it is important to check with the local county clerk’s office for the exact amount. Additionally, there may be costs related to notarization and obtaining copies of the deed.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and filed, it cannot be revoked unilaterally. However, the grantor and grantee can agree to reverse the transaction through another deed. This new deed would need to be executed and filed to officially transfer the property back.

Will a Quitclaim Deed affect my property taxes?

Generally, transferring property via a Quitclaim Deed may trigger a reassessment of property taxes, depending on local laws. It is wise to consult with your local tax assessor’s office to understand how the transfer may impact your property tax obligations.

What happens if the grantor has outstanding liens on the property?

If the grantor has outstanding liens or debts associated with the property, these obligations do not disappear with the Quitclaim Deed. The grantee may inherit these issues, which could affect their ownership rights. It is crucial to conduct a title search before accepting a Quitclaim Deed to identify any potential liens.

Can a Quitclaim Deed be used to transfer property into a trust?

Yes, a Quitclaim Deed can be used to transfer property into a trust. This is often done to facilitate estate planning. The grantor would execute the Quitclaim Deed, naming the trust as the grantee, thereby transferring ownership to the trust. It is advisable to consult with an estate planning attorney to ensure the process is handled correctly.

Key takeaways

Filling out and using the Texas Quitclaim Deed form requires careful attention to detail. Here are some key takeaways to keep in mind:

- Understand the Purpose: A quitclaim deed transfers ownership of property without guaranteeing that the title is clear. Use it when you trust the person receiving the property.

- Identify the Parties: Clearly list the grantor (the person transferring the property) and the grantee (the person receiving the property). Full names and addresses are essential.

- Describe the Property: Provide a detailed description of the property being transferred. This includes the legal description, which can often be found in previous deeds or tax records.

- Signatures Matter: The grantor must sign the deed in front of a notary public. Without this signature, the deed is not valid.

- Consider Recording: After completing the quitclaim deed, consider recording it with the county clerk. This protects the new owner's interests and provides public notice of the transfer.

- Consult with Professionals: It’s wise to consult with a real estate attorney or a title company to ensure the deed is filled out correctly and to understand any implications.

- Tax Implications: Be aware of potential tax implications. Transferring property can affect property taxes and may have gift tax consequences.

- Keep Copies: Always keep a copy of the signed and notarized quitclaim deed for your records. This can be important for future transactions or disputes.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Texas Quitclaim Deed is a legal document that transfers ownership of real property without any warranties or guarantees about the title. |

| Governing Law | The Texas Quitclaim Deed is governed by the Texas Property Code, specifically Chapter 5. |

| Purpose | This form is often used to transfer property between family members or to clear up title issues. |

| Consideration | While a quitclaim deed can be executed for little or no consideration, it is advisable to include a nominal amount to validate the transaction. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) in front of a notary public. |

| Recording | To provide public notice of the transfer, the deed should be recorded in the county where the property is located. |

| Limitations | Since a quitclaim deed offers no warranties, the grantee assumes the risk of any title issues that may arise. |

Consider Some Other Quitclaim Deed Forms for US States

House Deed Transfer - Make sure to have all parties sign the Quitclaim Deed to make it valid.

Michigan Quit Claim Deed Pdf - Many homeowners utilize Quitclaim Deeds to transfer property into a trust.

Quit Claim Deed Form Florida - A quitclaim deed can simplify the process of dividing inherited property.

Quit Claim Deed Georgia - The transaction can be completed quickly if both parties agree to use a quitclaim deed.

Dos and Don'ts

When filling out the Texas Quitclaim Deed form, it is important to follow certain guidelines to ensure the document is completed correctly. Below are five do's and don'ts to keep in mind.

- Do provide accurate property descriptions.

- Do include the names of all parties involved in the transaction.

- Do sign the document in the presence of a notary public.

- Don't leave any blank spaces on the form.

- Don't forget to check local recording requirements.

By adhering to these guidelines, you can help ensure that your Quitclaim Deed is valid and enforceable.