Valid Promissory Note Form for Texas

The Texas Promissory Note form is an essential document for anyone involved in lending or borrowing money in Texas. This form outlines the borrower's promise to repay a loan under specific terms, including the amount borrowed, interest rate, repayment schedule, and any late fees that may apply. It serves as a legal agreement that protects both the lender and the borrower by clearly stating the obligations of each party. In Texas, this form can be customized to fit various lending situations, whether it's for personal loans, business transactions, or real estate financing. Understanding the key components of the Texas Promissory Note is crucial for ensuring that all parties are on the same page and that the terms are enforceable in a court of law. By using this form, individuals can create a transparent and trustworthy lending relationship, minimizing the risk of misunderstandings and disputes down the line.

Common mistakes

-

Incorrect Borrower Information: Many individuals fail to provide accurate details about the borrower. This includes the full name, address, and contact information. Inaccurate information can lead to difficulties in enforcing the note later.

-

Missing Lender Details: Just as with the borrower, it’s essential to include complete information about the lender. Omitting the lender's name or contact information can complicate the collection process if the borrower defaults.

-

Improper Loan Amount: Some people mistakenly enter an incorrect loan amount. Whether it’s a typographical error or a misunderstanding of the terms, this mistake can have significant legal implications.

-

Failure to Specify Interest Rate: Not clearly stating the interest rate is a common oversight. Without this detail, it may be unclear how much the borrower owes over time, leading to disputes.

-

Omitting Payment Terms: The payment schedule must be clearly defined. Whether payments are due monthly, quarterly, or on another schedule, this information is vital to avoid confusion and potential legal issues.

-

Neglecting Signatures: A promissory note is not valid without the necessary signatures. Often, individuals forget to sign or have the other party sign, which can render the document unenforceable.

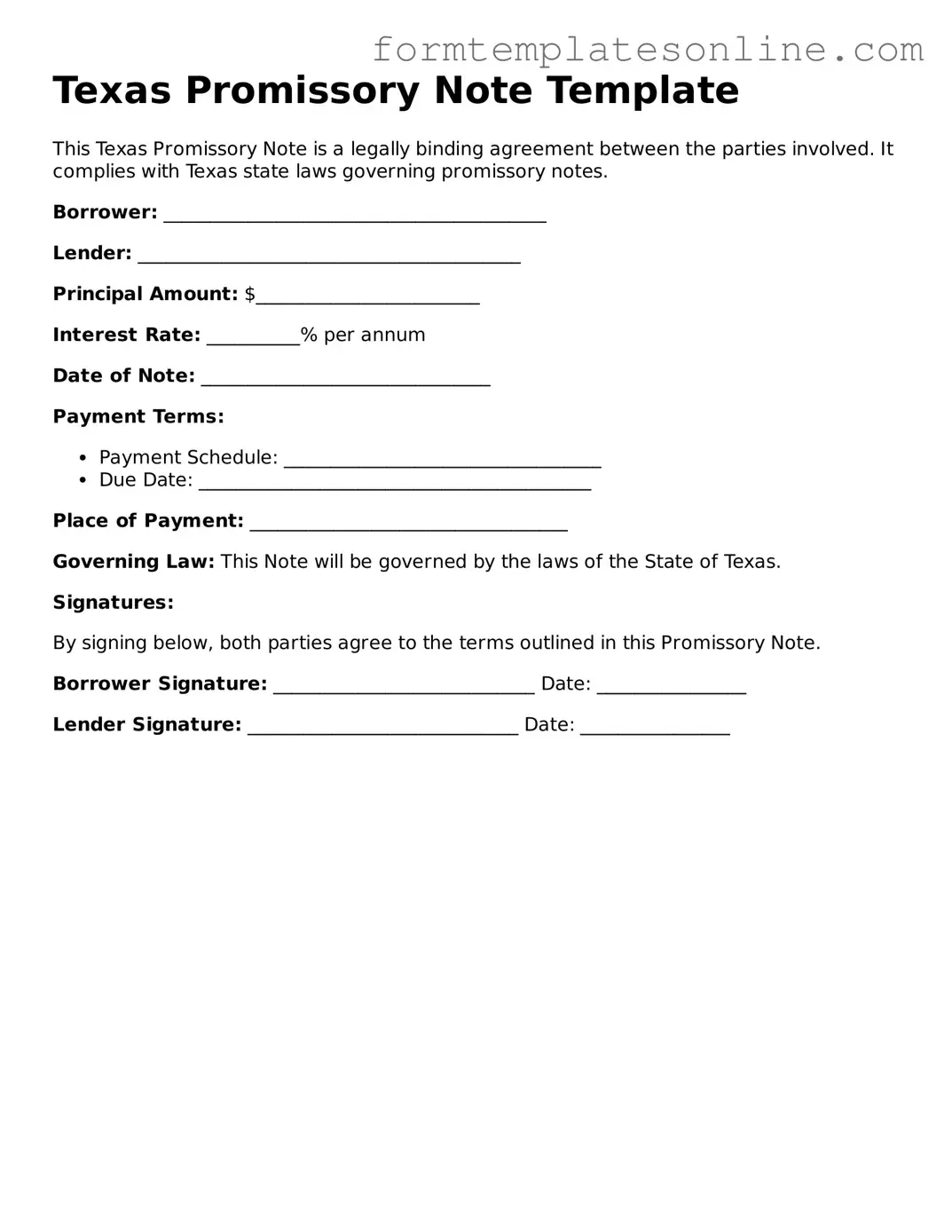

Example - Texas Promissory Note Form

Texas Promissory Note Template

This Texas Promissory Note is a legally binding agreement between the parties involved. It complies with Texas state laws governing promissory notes.

Borrower: _________________________________________

Lender: _________________________________________

Principal Amount: $________________________

Interest Rate: __________% per annum

Date of Note: _______________________________

Payment Terms:

- Payment Schedule: __________________________________

- Due Date: __________________________________________

Place of Payment: __________________________________

Governing Law: This Note will be governed by the laws of the State of Texas.

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

Borrower Signature: ____________________________ Date: ________________

Lender Signature: _____________________________ Date: ________________

More About Texas Promissory Note

What is a Texas Promissory Note?

A Texas Promissory Note is a legal document that outlines a borrower's promise to repay a loan to a lender. It includes details such as the loan amount, interest rate, repayment schedule, and any consequences for defaulting on the loan. This document serves as a written record of the agreement between the parties involved.

What information is required in a Texas Promissory Note?

The note must include the names and addresses of both the borrower and the lender, the principal amount of the loan, the interest rate, the repayment terms, and any late fees or penalties for missed payments. Additionally, the note should specify whether the loan is secured or unsecured.

Is a Texas Promissory Note legally binding?

Yes, once both parties sign the document, it becomes legally binding. This means that both the borrower and lender are obligated to adhere to the terms outlined in the note. If either party fails to meet their obligations, the other party may seek legal recourse.

Can a Texas Promissory Note be modified after it is signed?

Yes, a Texas Promissory Note can be modified, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note to ensure clarity and legality.

What happens if the borrower defaults on the Texas Promissory Note?

If the borrower defaults, the lender may take legal action to recover the owed amount. This could include filing a lawsuit or seeking a judgment against the borrower. If the note is secured, the lender may also have the right to seize any collateral specified in the agreement.

Are there different types of Texas Promissory Notes?

Yes, there are various types of promissory notes, including secured and unsecured notes. A secured note is backed by collateral, while an unsecured note does not have collateral backing. Additionally, notes can vary based on the repayment structure, such as installment payments or a balloon payment at the end of the term.

Do I need a lawyer to create a Texas Promissory Note?

While it is not legally required to have a lawyer draft a promissory note, it is highly recommended. A legal professional can ensure that the document complies with Texas laws and adequately protects your interests.

Can a Texas Promissory Note be used for personal loans?

Yes, a Texas Promissory Note can be used for personal loans between individuals. It provides a clear record of the loan terms and can help prevent misunderstandings. However, it is important to ensure that both parties fully understand the terms before signing.

How long is a Texas Promissory Note valid?

The validity of a Texas Promissory Note typically depends on the statute of limitations for debt collection in Texas, which is generally four years for written contracts. However, the terms of the note may specify a repayment period that could affect its enforceability.

Key takeaways

When dealing with the Texas Promissory Note form, it's essential to understand the key elements that ensure the document serves its purpose effectively. Here are some important takeaways to keep in mind:

- Clear Identification: Clearly identify the borrower and lender. Include full names and addresses to avoid confusion.

- Loan Amount: Specify the exact amount of money being borrowed. This amount should be written in both numerical and written form.

- Interest Rate: Clearly state the interest rate, if applicable. Make sure it complies with Texas usury laws to avoid legal issues.

- Repayment Terms: Outline the repayment schedule. Specify when payments are due, how often they should be made, and the total duration of the loan.

- Default Conditions: Include terms that define what happens in case of default. This can help protect the lender's interests.

- Signatures: Ensure that both parties sign the document. This validates the agreement and makes it legally binding.

- Witness or Notary: Consider having a witness or a notary public sign the document. This adds an extra layer of authenticity.

- Keep Copies: After signing, both parties should keep a copy of the signed Promissory Note for their records. This can be crucial in case of disputes.

By following these guidelines, you can create a Texas Promissory Note that is clear, effective, and legally sound.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date or on demand. |

| Governing Law | The Texas Promissory Note is governed by the Texas Business and Commerce Code, specifically Chapter 3, which outlines the laws regarding negotiable instruments. |

| Essential Elements | To be valid, a promissory note must include the principal amount, interest rate, payment terms, and signatures of the parties involved. |

| Interest Rates | Texas law does not impose a maximum interest rate for promissory notes, but the terms must be clearly defined to avoid disputes. |

| Enforceability | A properly executed Texas Promissory Note is legally enforceable in court, provided it meets all necessary legal requirements. |

Consider Some Other Promissory Note Forms for US States

Promissory Note Template Georgia - The clarity the note provides contributes to a transparency that benefits all parties involved.

For anyone looking to navigate the intricate steps of firearm ownership, a thorough understanding of the Firearm Bill of Sale requirements is crucial. This document ensures that all transactions are legally compliant and secure, protecting both the buyer and seller in the process. You can find more information about this important form here: Firearm Bill of Sale form details.

Promissory Note Ohio - Both parties should keep a copy of the note for their records.

Dos and Don'ts

When completing the Texas Promissory Note form, attention to detail is essential. Below is a list of actions to consider, both positive and negative, to ensure the form is filled out correctly.

- Do: Read the instructions carefully before starting to fill out the form.

- Do: Provide accurate information regarding the borrower and lender.

- Do: Clearly state the loan amount and interest rate.

- Do: Include the repayment schedule and due dates.

- Do: Sign and date the form in the designated areas.

- Don't: Leave any sections blank; all fields must be completed.

- Don't: Use white-out or erase any mistakes; instead, cross out errors and initial them.

Following these guidelines can help ensure that the Promissory Note is valid and enforceable. Proper completion of the form is crucial for both parties involved in the transaction.