Valid Operating Agreement Form for Texas

The Texas Operating Agreement form serves as a crucial document for limited liability companies (LLCs) operating within the state. This form outlines the structure and management of the LLC, detailing the rights and responsibilities of its members. It typically includes information about ownership percentages, profit distribution, and decision-making processes. Additionally, the agreement addresses how new members can be added and how existing members can exit the company. By clearly defining these aspects, the Operating Agreement helps prevent misunderstandings and disputes among members. Furthermore, it provides a framework for the company’s operations, which can be especially beneficial in times of transition or growth. Understanding the key components of this form is essential for anyone looking to establish or manage an LLC in Texas.

Common mistakes

-

Incomplete Information: One common mistake is failing to fill out all required sections of the form. Every member's name, address, and ownership percentage should be clearly stated. Omitting any of these details can lead to confusion or disputes later on.

-

Incorrect Member Designations: People often mislabel members as managers or vice versa. Understanding the roles of each member is crucial. This error can affect decision-making processes and responsibilities within the organization.

-

Not Specifying Voting Rights: Many overlook the importance of clearly defining voting rights. Without this information, it can be unclear how decisions are made. This may result in disagreements among members regarding the direction of the business.

-

Failing to Update the Agreement: Once the agreement is completed, some individuals forget to revisit and update it as necessary. Changes in membership or business structure should be documented. Neglecting this can lead to outdated information that does not reflect the current state of the business.

Example - Texas Operating Agreement Form

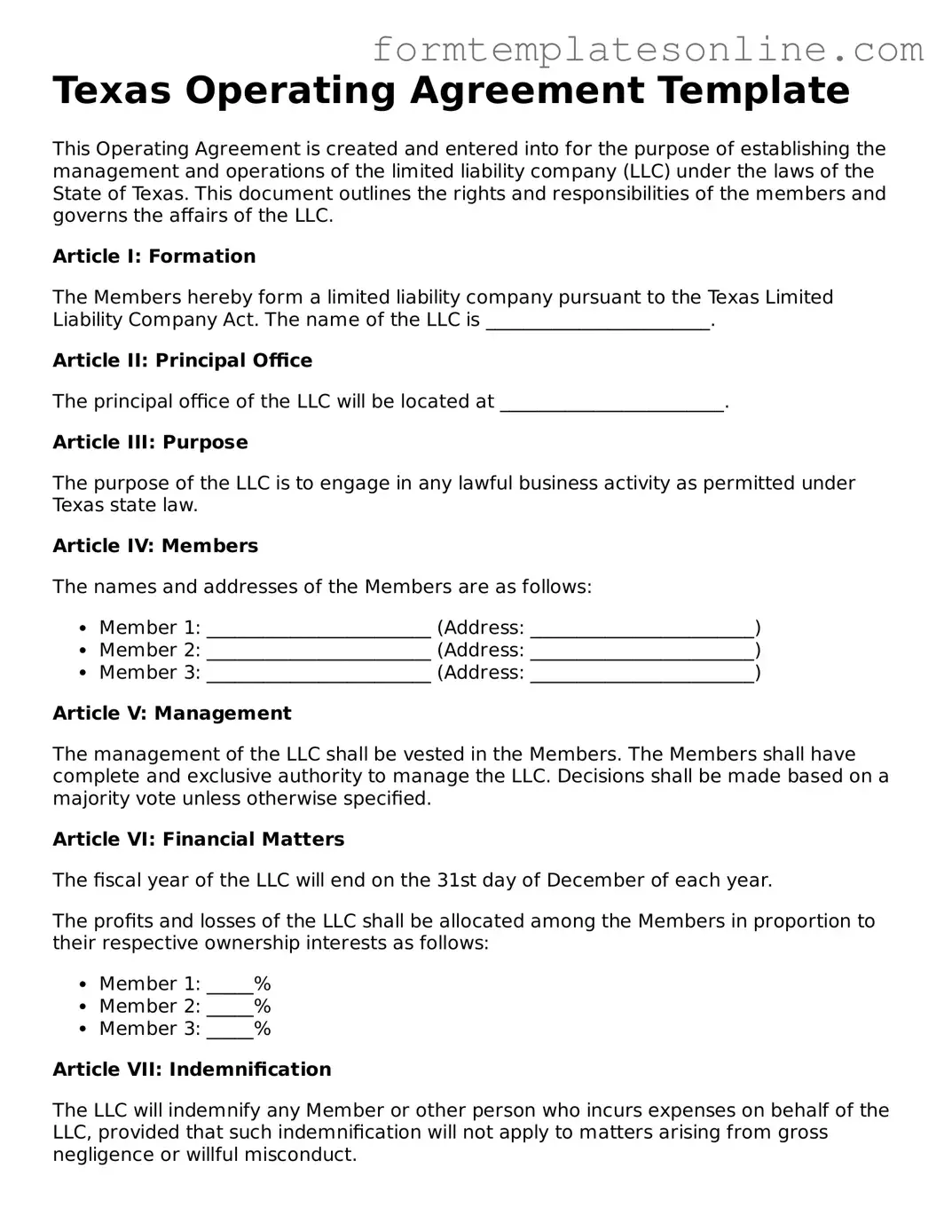

Texas Operating Agreement Template

This Operating Agreement is created and entered into for the purpose of establishing the management and operations of the limited liability company (LLC) under the laws of the State of Texas. This document outlines the rights and responsibilities of the members and governs the affairs of the LLC.

Article I: Formation

The Members hereby form a limited liability company pursuant to the Texas Limited Liability Company Act. The name of the LLC is ________________________.

Article II: Principal Office

The principal office of the LLC will be located at ________________________.

Article III: Purpose

The purpose of the LLC is to engage in any lawful business activity as permitted under Texas state law.

Article IV: Members

The names and addresses of the Members are as follows:

- Member 1: ________________________ (Address: ________________________)

- Member 2: ________________________ (Address: ________________________)

- Member 3: ________________________ (Address: ________________________)

Article V: Management

The management of the LLC shall be vested in the Members. The Members shall have complete and exclusive authority to manage the LLC. Decisions shall be made based on a majority vote unless otherwise specified.

Article VI: Financial Matters

The fiscal year of the LLC will end on the 31st day of December of each year.

The profits and losses of the LLC shall be allocated among the Members in proportion to their respective ownership interests as follows:

- Member 1: _____%

- Member 2: _____%

- Member 3: _____%

Article VII: Indemnification

The LLC will indemnify any Member or other person who incurs expenses on behalf of the LLC, provided that such indemnification will not apply to matters arising from gross negligence or willful misconduct.

Article VIII: Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members.

Article IX: Governing Law

This Operating Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

IN WITNESS WHEREOF, the undersigned have executed this Operating Agreement as of the ___ day of _______________, 20__.

___________________________ (Member 1)

___________________________ (Member 2)

___________________________ (Member 3)

More About Texas Operating Agreement

What is a Texas Operating Agreement?

A Texas Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Texas. It serves as a foundational agreement among the members of the LLC, detailing their rights, responsibilities, and the operational guidelines of the business.

Why is an Operating Agreement important for an LLC in Texas?

This agreement is crucial because it helps define the roles of each member and establishes how the LLC will operate. It can prevent misunderstandings and disputes among members by clearly laying out the rules. Additionally, having an Operating Agreement can provide protection against personal liability and ensure that the LLC is recognized as a separate legal entity.

Do I need to file the Operating Agreement with the state?

No, you do not need to file the Operating Agreement with the Texas Secretary of State. However, it is advisable to keep it on file for your records and to provide it to any members or managers of the LLC as needed. Having it readily accessible can help resolve any potential disputes in the future.

Can I create my own Operating Agreement?

Yes, you can create your own Operating Agreement. Many resources are available online to guide you through the process. However, it is often beneficial to consult with a legal professional to ensure that your agreement complies with Texas law and adequately addresses your specific business needs.

What should be included in a Texas Operating Agreement?

Key elements typically include the names of the members, the management structure, voting rights, profit distribution, procedures for adding or removing members, and guidelines for handling disputes. It can also cover financial matters, such as capital contributions and how profits and losses will be allocated among members.

How can an Operating Agreement help in case of disputes?

An Operating Agreement can provide a clear framework for resolving disputes among members. By outlining the procedures for conflict resolution, such as mediation or arbitration, it can help members address disagreements in a structured manner. This can save time and resources compared to litigation.

Is an Operating Agreement required by law in Texas?

While Texas law does not require LLCs to have an Operating Agreement, it is highly recommended. Without one, the LLC will be governed by the default rules set forth in the Texas Limited Liability Company Act, which may not align with the members' intentions or business practices.

Can I amend my Operating Agreement after it has been created?

Yes, you can amend your Operating Agreement. Most agreements will include a section outlining the process for making amendments. Typically, this requires the consent of a certain percentage of the members. Keeping the agreement updated is essential to reflect any changes in the business or membership structure.

What happens if I don’t have an Operating Agreement?

If you do not have an Operating Agreement, your LLC will be subject to Texas’s default laws regarding LLCs. This can lead to unexpected outcomes, such as how profits are distributed or how decisions are made. It may also increase the risk of personal liability for members, as the protections that an Operating Agreement provides may not be in place.

Key takeaways

When filling out and using the Texas Operating Agreement form, keep the following key takeaways in mind:

- Understand the purpose: An Operating Agreement outlines the management structure and operating procedures of your business entity.

- Identify members: Clearly list all members involved in the business. This ensures everyone’s roles and responsibilities are defined.

- Specify ownership percentages: Document each member's ownership interest in the business. This clarity helps prevent future disputes.

- Outline decision-making processes: Detail how decisions will be made, including voting rights and procedures for major decisions.

- Include provisions for profit distribution: Clearly state how profits and losses will be shared among members. This is crucial for financial transparency.

- Address changes in membership: Outline procedures for adding or removing members. This prepares the business for future changes.

- Consider dispute resolution: Establish a method for resolving conflicts among members. This can save time and resources down the line.

- Review and update regularly: Revisit the Operating Agreement periodically to ensure it reflects current business practices and membership.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Texas Operating Agreement outlines the management structure and operating procedures for a limited liability company (LLC). |

| Governing Law | The agreement is governed by the Texas Business Organizations Code. |

| Members | It specifies the rights and responsibilities of each member of the LLC. |

| Management Structure | The agreement can define whether the LLC is member-managed or manager-managed. |

| Profit Distribution | It outlines how profits and losses will be distributed among members. |

| Amendments | The agreement typically includes a process for making amendments in the future. |

| Duration | The duration of the LLC can be specified within the agreement. |

| Dispute Resolution | It often includes provisions for resolving disputes among members. |

| Importance | A well-drafted Operating Agreement can help prevent misunderstandings and conflicts among members. |

Consider Some Other Operating Agreement Forms for US States

North Carolina Llc Operating Agreement Template - This form helps to ensure compliance with state regulations regarding LLCs.

How to Get My Llc - The Operating Agreement may provide a timeline for annual reviews of the document.

California Llc Operating Agreement Requirements - An Operating Agreement outlines the management structure of a Limited Liability Company (LLC).

Operating Agreement Llc Pa Template - It can outline protocols for financial audits and reviews of the LLC's performance.

Dos and Don'ts

When filling out the Texas Operating Agreement form, it is essential to approach the task with care and attention. Here are some important guidelines to consider.

- Do read the entire form carefully before starting. Understanding each section will help you provide accurate information.

- Do ensure that all members of the LLC are listed clearly. This promotes transparency and accountability among members.

- Do specify the purpose of the LLC. A clear purpose statement helps define the scope of your business activities.

- Do include provisions for profit and loss distribution. This ensures that all members understand how profits will be shared.

- Don't leave any sections blank. Incomplete forms can lead to delays or complications in processing.

- Don't use vague language. Clarity is key in legal documents; avoid ambiguous terms that could lead to misunderstandings.

- Don't forget to date and sign the agreement. An unsigned document may not hold legal validity.

- Don't overlook the importance of having a witness or notary, if required. This adds an extra layer of legitimacy to your agreement.

By following these guidelines, you can ensure that your Texas Operating Agreement form is filled out correctly and comprehensively.