Valid Mobile Home Bill of Sale Form for Texas

The Texas Mobile Home Bill of Sale form is an important document used in the transfer of ownership for mobile homes within the state. This form serves to provide a clear record of the transaction between the seller and the buyer, ensuring that both parties understand the terms of the sale. It typically includes essential details such as the names and addresses of both the seller and buyer, a description of the mobile home being sold, and the sale price. Additionally, the form may require the seller to disclose any existing liens or encumbrances on the mobile home, which protects the buyer from unexpected financial obligations. Properly completing this form is crucial, as it not only facilitates a smooth transaction but also helps in the future registration of the mobile home with the appropriate authorities. Understanding the components and requirements of the Texas Mobile Home Bill of Sale form is vital for anyone involved in the buying or selling of a mobile home in Texas.

Common mistakes

-

Incomplete Information: One of the most common mistakes is not providing all the required details. This includes the names and addresses of both the buyer and the seller, as well as the mobile home’s identification number. Omitting any of these can lead to complications later.

-

Incorrect Identification Number: Each mobile home has a unique identification number, often referred to as a VIN (Vehicle Identification Number). Failing to write this number accurately can create confusion and may even jeopardize the transfer of ownership.

-

Not Including Sale Price: Some people forget to specify the sale price of the mobile home. This detail is crucial not only for record-keeping but also for tax purposes. Without it, the transaction may be questioned by tax authorities.

-

Ignoring Signatures: Both parties must sign the document for it to be legally binding. Neglecting to obtain the necessary signatures can invalidate the bill of sale, leaving both parties without clear proof of the transaction.

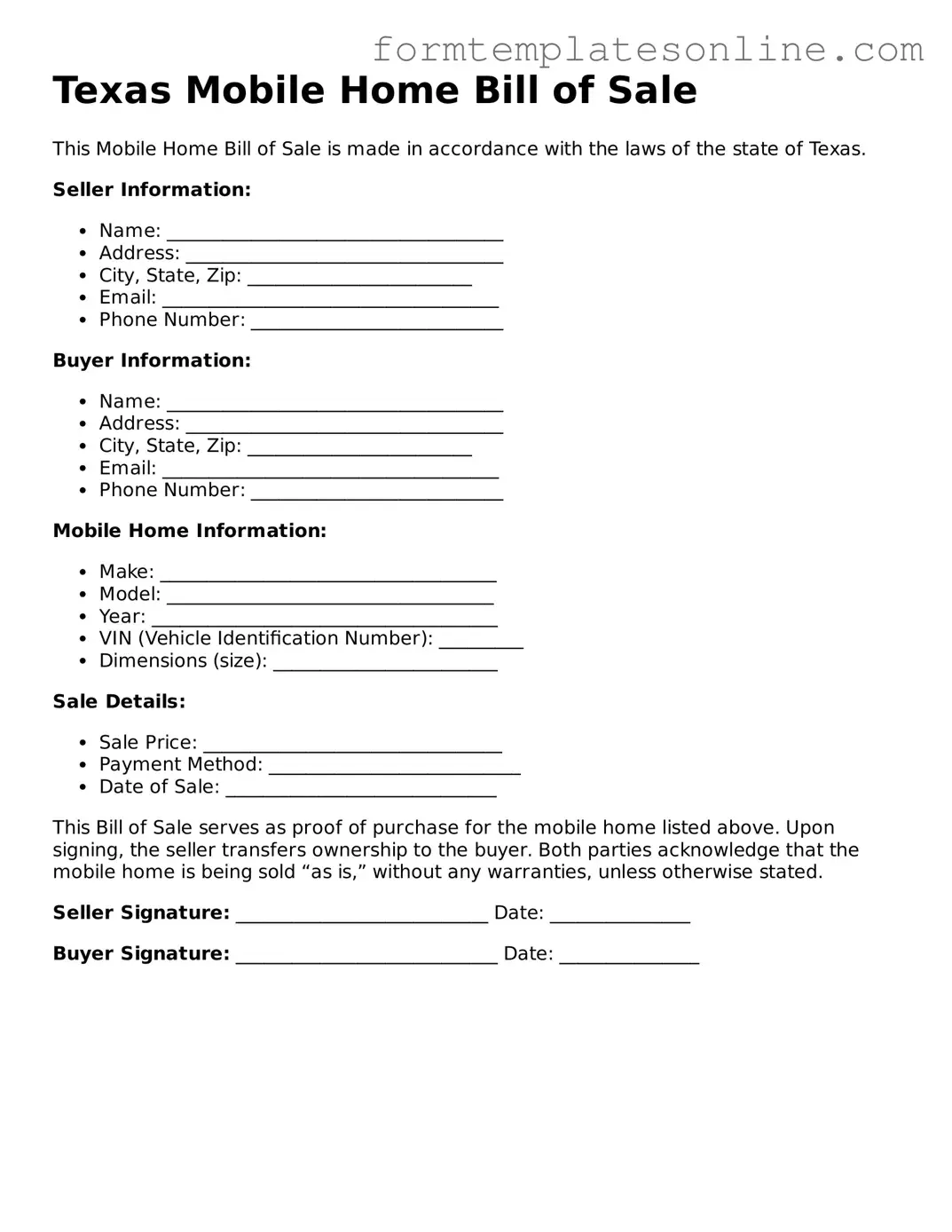

Example - Texas Mobile Home Bill of Sale Form

Texas Mobile Home Bill of Sale

This Mobile Home Bill of Sale is made in accordance with the laws of the state of Texas.

Seller Information:

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip: ________________________

- Email: ____________________________________

- Phone Number: ___________________________

Buyer Information:

- Name: ____________________________________

- Address: __________________________________

- City, State, Zip: ________________________

- Email: ____________________________________

- Phone Number: ___________________________

Mobile Home Information:

- Make: ____________________________________

- Model: ___________________________________

- Year: _____________________________________

- VIN (Vehicle Identification Number): _________

- Dimensions (size): ________________________

Sale Details:

- Sale Price: ________________________________

- Payment Method: ___________________________

- Date of Sale: _____________________________

This Bill of Sale serves as proof of purchase for the mobile home listed above. Upon signing, the seller transfers ownership to the buyer. Both parties acknowledge that the mobile home is being sold “as is,” without any warranties, unless otherwise stated.

Seller Signature: ___________________________ Date: _______________

Buyer Signature: ____________________________ Date: _______________

More About Texas Mobile Home Bill of Sale

What is a Texas Mobile Home Bill of Sale form?

The Texas Mobile Home Bill of Sale form is a legal document used to transfer ownership of a mobile home from one party to another. It provides essential details about the transaction, including the buyer, seller, and specific information about the mobile home itself. This form is crucial for ensuring that the sale is documented properly and can help avoid disputes in the future.

Why is a Bill of Sale necessary for a mobile home transaction?

A Bill of Sale serves as proof of ownership transfer. It protects both the buyer and seller by clearly outlining the terms of the sale. This document can be essential for the buyer to register the mobile home with the state and obtain any necessary permits. For the seller, it provides evidence that they are no longer responsible for the property.

What information is typically included in the Bill of Sale?

The Bill of Sale generally includes the names and addresses of both the buyer and seller, the purchase price, a description of the mobile home (including its make, model, year, and identification number), and the date of the transaction. Additional details, such as any warranties or conditions of the sale, may also be included.

Do I need to have the Bill of Sale notarized?

In Texas, notarization is not typically required for a Bill of Sale for a mobile home. However, having it notarized can add an extra layer of protection and authenticity. It may be beneficial, especially if there are any potential disputes regarding the sale in the future.

Can I create my own Bill of Sale, or do I need a specific form?

You can create your own Bill of Sale, but it must include all the necessary information to be valid. Using a specific form designed for mobile home transactions can simplify the process and ensure that you don’t miss any critical details. Many online resources offer templates that comply with Texas law.

What happens if the mobile home has a lien on it?

If there is a lien on the mobile home, it’s crucial to address it before completing the sale. The seller should either pay off the lien or ensure that the buyer is aware of it. The Bill of Sale should clearly state the status of any liens to protect both parties. Failure to disclose a lien can lead to legal complications down the road.

Is there a fee for filing the Bill of Sale with the state?

In Texas, there is no fee to file a Bill of Sale for a mobile home. However, the buyer may need to pay fees when registering the mobile home with the Texas Department of Housing and Community Affairs. It’s essential to check with local authorities for any specific requirements or fees associated with registration.

How can I ensure that the Bill of Sale is valid?

To ensure the Bill of Sale is valid, make sure it includes all required information, is signed by both parties, and is dated. Keeping a copy for your records is also wise. If possible, consider having witnesses present during the signing. This can help bolster the document’s legitimacy if any disputes arise later.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, the buyer should take it to their local tax office or the Texas Department of Housing and Community Affairs to register the mobile home in their name. The seller should keep a copy of the signed document for their records. This ensures that both parties have proof of the transaction.

Can I cancel the sale after signing the Bill of Sale?

Once the Bill of Sale is signed, it generally represents a binding agreement. Canceling the sale can be complicated and may depend on the terms outlined in the document. If both parties agree to cancel, it’s best to document this agreement in writing to avoid any misunderstandings.

Key takeaways

When filling out and using the Texas Mobile Home Bill of Sale form, consider the following key takeaways:

- Accurate Information: Ensure that all details about the mobile home, including the make, model, year, and Vehicle Identification Number (VIN), are filled out correctly. This information is crucial for proper identification.

- Seller and Buyer Details: Both the seller and buyer must provide their full names and contact information. This establishes clear ownership transfer and allows for communication if needed.

- Notarization: Although notarization is not always required, having the document notarized can add an extra layer of authenticity and may be necessary for certain transactions or local regulations.

- Consider Local Laws: Be aware of any local laws or regulations that may affect the sale of mobile homes in your area. This can include zoning laws or requirements for transferring titles.

- Keep Copies: After completing the form, both the seller and buyer should keep a copy for their records. This documentation serves as proof of the transaction and can be useful in the future.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Texas Mobile Home Bill of Sale form is used to transfer ownership of a mobile home from one party to another. |

| Governing Laws | This form is governed by Texas Property Code, Chapter 1201, which covers the regulation of manufactured homes. |

| Required Information | Buyers and sellers must provide details such as names, addresses, and the mobile home's identification number. |

| Signatures | Both the seller and buyer must sign the document to validate the sale and ensure legal transfer of ownership. |

Consider Some Other Mobile Home Bill of Sale Forms for US States

How to Sell Manufactured Home - Ultimately, the Mobile Home Bill of Sale is key to documenting the sale transaction.

When entering into a financial arrangement, a well-drafted Loan Agreement is essential; it not only details the terms and conditions between the borrower and lender but also ensures clarity regarding the loan amount, interest rates, and repayment obligations. To access templates or examples of such agreements, you can visit OnlineLawDocs.com, which provides valuable resources for both parties to understand their rights and responsibilities.

Simple Bill of Sale Florida - The Mobile Home Bill of Sale acts as an official record of purchase for the buyer.

Dos and Don'ts

When filling out the Texas Mobile Home Bill of Sale form, it's essential to pay attention to detail. Here are ten important dos and don'ts to guide you through the process.

- Do ensure that all information is accurate and complete.

- Do include the correct Vehicle Identification Number (VIN) for the mobile home.

- Do provide the full names and addresses of both the buyer and seller.

- Do specify the sale price clearly to avoid any confusion.

- Do sign and date the form to make it legally binding.

- Don't leave any fields blank; incomplete forms may cause delays.

- Don't use abbreviations or shorthand that could be misinterpreted.

- Don't forget to check for any local requirements that might apply.

- Don't sign the document without reading it thoroughly first.

- Don't overlook the importance of keeping a copy for your records.