Valid Loan Agreement Form for Texas

The Texas Loan Agreement form is a crucial document for anyone entering into a lending arrangement in the state of Texas. This form outlines the specific terms and conditions under which a loan is made, ensuring that both the lender and the borrower have a clear understanding of their rights and obligations. Key components of the agreement include the loan amount, interest rate, repayment schedule, and any applicable fees. Additionally, it may specify collateral requirements, which serve to protect the lender in case of default. The form also addresses potential consequences of late payments or non-payment, providing a framework for dispute resolution. By having a well-structured loan agreement, parties can mitigate misunderstandings and promote transparency throughout the lending process. Understanding the intricacies of this document is essential for both lenders and borrowers, as it serves not only as a legal contract but also as a safeguard for financial interests.

Common mistakes

-

Failing to provide accurate personal information. Ensure that your name, address, and contact details are correct.

-

Not specifying the loan amount clearly. The amount should be stated in both numbers and words to avoid confusion.

-

Omitting the purpose of the loan. Clearly state why you are borrowing the money.

-

Ignoring the repayment terms. Make sure to outline the repayment schedule, including the due dates and amounts.

-

Neglecting to include interest rates. Specify whether the rate is fixed or variable and detail how it is calculated.

-

Not signing the document. A signature is required to validate the agreement.

-

Leaving out co-signer information if applicable. If someone else is backing the loan, include their details.

-

Failing to read the fine print. Review all terms and conditions thoroughly before submission.

-

Submitting the form without a copy for your records. Always keep a copy of the signed agreement for your files.

Example - Texas Loan Agreement Form

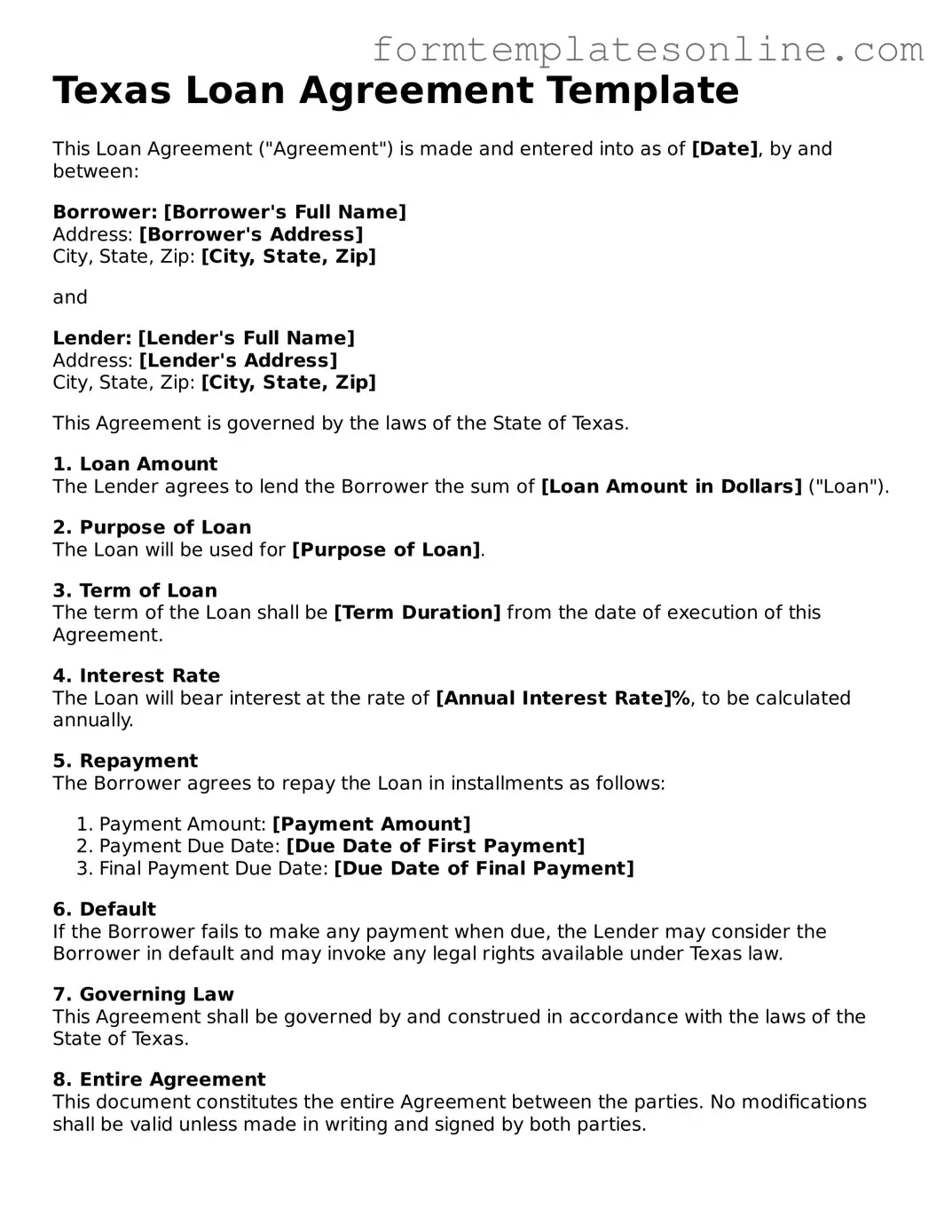

Texas Loan Agreement Template

This Loan Agreement ("Agreement") is made and entered into as of [Date], by and between:

Borrower: [Borrower's Full Name]

Address: [Borrower's Address]

City, State, Zip: [City, State, Zip]

and

Lender: [Lender's Full Name]

Address: [Lender's Address]

City, State, Zip: [City, State, Zip]

This Agreement is governed by the laws of the State of Texas.

1. Loan Amount

The Lender agrees to lend the Borrower the sum of [Loan Amount in Dollars] ("Loan").

2. Purpose of Loan

The Loan will be used for [Purpose of Loan].

3. Term of Loan

The term of the Loan shall be [Term Duration] from the date of execution of this Agreement.

4. Interest Rate

The Loan will bear interest at the rate of [Annual Interest Rate]%, to be calculated annually.

5. Repayment

The Borrower agrees to repay the Loan in installments as follows:

- Payment Amount: [Payment Amount]

- Payment Due Date: [Due Date of First Payment]

- Final Payment Due Date: [Due Date of Final Payment]

6. Default

If the Borrower fails to make any payment when due, the Lender may consider the Borrower in default and may invoke any legal rights available under Texas law.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of Texas.

8. Entire Agreement

This document constitutes the entire Agreement between the parties. No modifications shall be valid unless made in writing and signed by both parties.

IN WITNESS WHEREOF, the parties have executed this Loan Agreement as of the day and year first written above.

Borrower's Signature: _________________________

Date: _________________________

Lender's Signature: _________________________

Date: _________________________

More About Texas Loan Agreement

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in the state of Texas. It details the amount borrowed, the interest rate, repayment schedule, and any collateral involved. This form serves to protect both parties by clearly defining their rights and obligations.

Who can use a Texas Loan Agreement form?

Anyone who is lending or borrowing money in Texas can use this form. This includes individuals, businesses, and organizations. It is particularly useful for personal loans, business loans, or any situation where a formal agreement is beneficial to ensure clarity and legal protection.

What are the key components of a Texas Loan Agreement?

The key components typically include the names and addresses of the parties involved, the loan amount, the interest rate, the repayment terms, and any collateral securing the loan. Additionally, it may include clauses on default, prepayment, and governing law.

Is a Texas Loan Agreement legally binding?

Yes, a properly executed Texas Loan Agreement is legally binding. Once both parties sign the agreement, they are obligated to adhere to its terms. If either party fails to comply, the other party may have the right to pursue legal action to enforce the agreement.

Do I need a lawyer to create a Texas Loan Agreement?

While it is not mandatory to hire a lawyer to create a Texas Loan Agreement, it is advisable, especially for larger loans or complex terms. A legal professional can help ensure that the agreement complies with Texas laws and adequately protects your interests.

Can I modify a Texas Loan Agreement after it is signed?

Yes, a Texas Loan Agreement can be modified after it is signed, but both parties must agree to the changes. It is best to document any modifications in writing and have both parties sign the amended agreement to avoid disputes later on.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may take several actions based on the terms outlined in the agreement. This could include demanding immediate repayment, charging late fees, or taking legal action to recover the owed amount. The specific consequences should be clearly stated in the loan agreement.

Where can I obtain a Texas Loan Agreement form?

You can obtain a Texas Loan Agreement form from various sources, including online legal document providers, local legal offices, or financial institutions. Ensure that the form you choose is up to date and complies with Texas laws.

Key takeaways

Filling out the Texas Loan Agreement form requires attention to detail and clarity. Here are some key takeaways to keep in mind:

- Ensure that all parties involved are clearly identified. This includes full names and contact information.

- Specify the loan amount. Clearly state how much money is being borrowed.

- Define the repayment terms. Include the schedule for payments, interest rates, and any late fees.

- Include a section for collateral if applicable. This secures the loan and protects the lender's interests.

- Both parties should sign and date the agreement. This confirms that everyone agrees to the terms outlined.

- Keep a copy of the signed agreement for your records. This is important for future reference and accountability.

- Consider consulting with a legal professional if you have questions. This can help ensure the agreement meets all legal requirements.

By following these steps, you can create a clear and effective loan agreement that protects both the lender and the borrower.

File Details

| Fact Name | Description |

|---|---|

| Governing Law | The Texas Loan Agreement form is governed by the Texas Business and Commerce Code. |

| Parties Involved | The form typically includes a borrower and a lender, clearly identifying both parties. |

| Loan Amount | The agreement specifies the exact amount of money being loaned to the borrower. |

| Interest Rate | The form outlines the interest rate applicable to the loan, which must comply with Texas usury laws. |

| Repayment Terms | Details on how and when the borrower must repay the loan are included in the agreement. |

| Default Clause | The agreement includes provisions outlining what constitutes a default and the consequences thereof. |

| Security Interest | If applicable, the form may detail any collateral securing the loan. |

| Governing Jurisdiction | The agreement may specify the jurisdiction for any disputes arising from the loan. |

| Signatures | Both parties must sign the agreement to make it legally binding. |

Consider Some Other Loan Agreement Forms for US States

New York Promissory Note - It establishes a mutual agreement that can foster healthy financial relationships.

Free Promissory Note Template California - It is advisable to have legal advice before signing the loan agreement.

Florida Promissory Note Template - Provides space for signatures to indicate acceptance of the terms.

Understanding the importance of having a properly executed Georgia Trailer Bill of Sale form is essential for both buyers and sellers involved in the transaction. This document provides clarity and security in the sale process, as it contains crucial information regarding the trailer and the parties involved. For those looking to access this form conveniently, resources such as OnlineLawDocs.com can be incredibly helpful.

Promissory Note Illinois - This agreement helps ensure compliance with applicable lending regulations.

Dos and Don'ts

When filling out the Texas Loan Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are seven things to keep in mind:

- Do read the entire form carefully before starting.

- Do provide accurate personal information, including your full name and address.

- Do double-check all financial details, such as loan amount and interest rate.

- Do sign and date the form where required.

- Don't leave any fields blank; fill in all required sections.

- Don't use white-out or erase mistakes; instead, draw a line through errors and initial them.

- Don't rush through the process; take your time to ensure everything is correct.

Following these guidelines will help you complete the Texas Loan Agreement form accurately and efficiently. Ensure you take each step seriously to avoid delays or complications.