Valid Lady Bird Deed Form for Texas

The Texas Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their real estate to beneficiaries while retaining the right to live on and use the property during their lifetime. This deed offers a straightforward way to avoid probate, ensuring a smooth transition of ownership upon the owner’s passing. One of its most notable features is the ability to maintain control over the property, as the original owner can sell, mortgage, or change the terms of the deed without needing the consent of the beneficiaries. Additionally, the Lady Bird Deed provides flexibility; it can be revoked or modified at any time, allowing for changes in family dynamics or personal circumstances. This form not only simplifies the transfer process but also helps protect the property from potential claims by creditors after the owner's death. Understanding the benefits and implications of the Texas Lady Bird Deed is essential for anyone considering it as part of their estate planning strategy.

Common mistakes

-

Failing to include all property owners. Make sure every owner of the property is listed on the deed. Omitting a co-owner can lead to complications.

-

Not specifying the beneficiaries clearly. Clearly identify who will inherit the property. Use full names and, if possible, include their relationship to you.

-

Using outdated or incorrect legal descriptions. Ensure the property description is accurate and matches the county records. An incorrect description can invalidate the deed.

-

Neglecting to sign the deed. All parties must sign the deed for it to be valid. A missing signature can render the document ineffective.

-

Not having the deed notarized. A Lady Bird Deed must be notarized to be legally binding. Skipping this step can lead to disputes.

-

Forgetting to record the deed with the county. After completing the deed, it must be filed with the county clerk's office. Failing to do so means the deed may not be recognized.

-

Overlooking tax implications. Understand how the transfer of property may affect taxes. Consulting a tax professional can help avoid unexpected liabilities.

-

Not considering the implications of Medicaid. If you are applying for Medicaid, transferring property through a Lady Bird Deed can have consequences. Be informed before proceeding.

-

Using vague language. Be specific in your wording. Ambiguities can lead to misunderstandings or disputes among beneficiaries.

-

Ignoring state-specific requirements. Each state may have unique rules regarding property deeds. Ensure compliance with Texas laws to avoid issues.

Example - Texas Lady Bird Deed Form

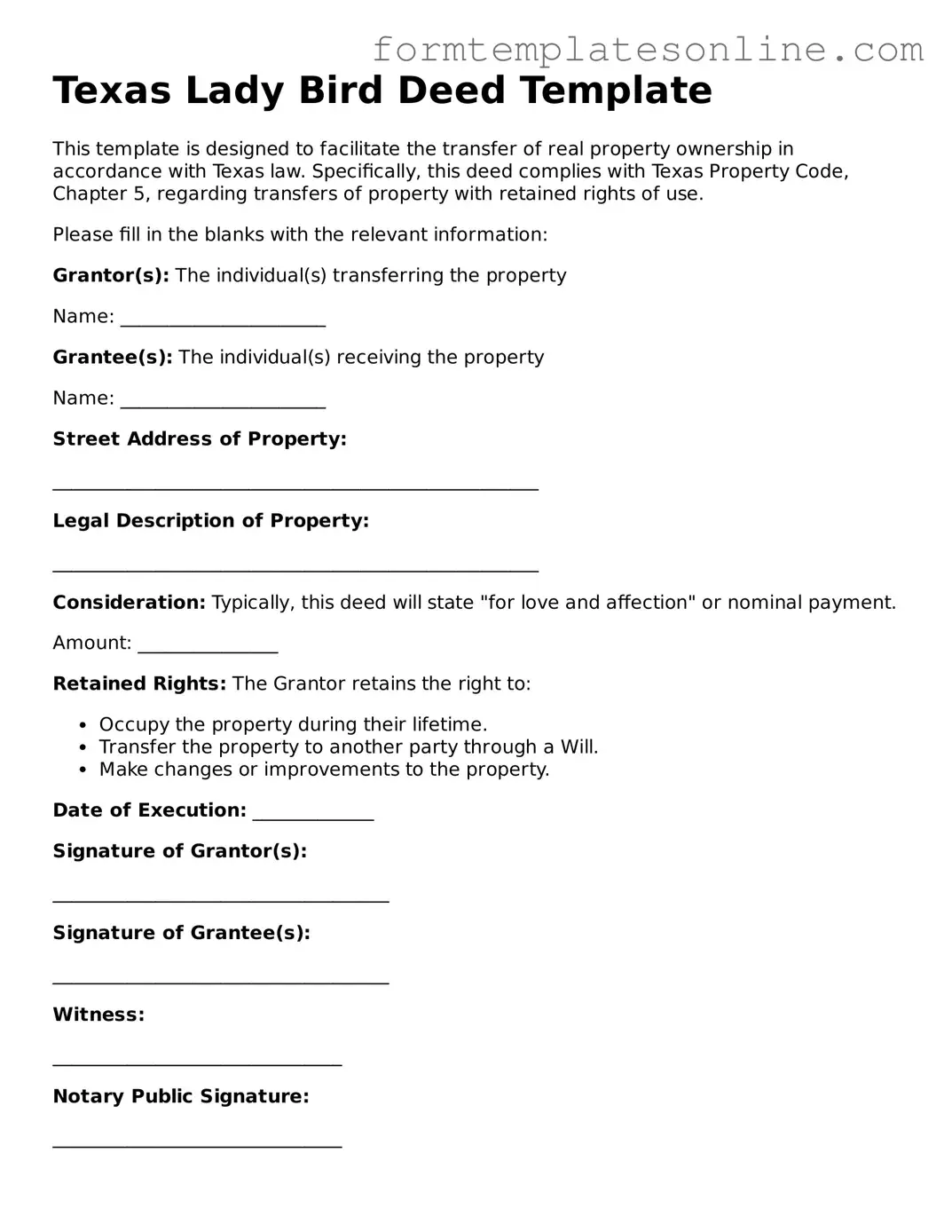

Texas Lady Bird Deed Template

This template is designed to facilitate the transfer of real property ownership in accordance with Texas law. Specifically, this deed complies with Texas Property Code, Chapter 5, regarding transfers of property with retained rights of use.

Please fill in the blanks with the relevant information:

Grantor(s): The individual(s) transferring the property

Name: ______________________

Grantee(s): The individual(s) receiving the property

Name: ______________________

Street Address of Property:

____________________________________________________

Legal Description of Property:

____________________________________________________

Consideration: Typically, this deed will state "for love and affection" or nominal payment.

Amount: _______________

Retained Rights: The Grantor retains the right to:

- Occupy the property during their lifetime.

- Transfer the property to another party through a Will.

- Make changes or improvements to the property.

Date of Execution: _____________

Signature of Grantor(s):

____________________________________

Signature of Grantee(s):

____________________________________

Witness:

_______________________________

Notary Public Signature:

_______________________________

Make sure to have the deed notarized for it to be legally binding. Consult with a qualified attorney to ensure all local regulations and requirements are satisfied before completing any legal transaction.

More About Texas Lady Bird Deed

What is a Lady Bird Deed in Texas?

A Lady Bird Deed, also known as an enhanced life estate deed, allows a property owner to transfer their property to a beneficiary while retaining the right to use and enjoy the property during their lifetime. This type of deed is unique because it avoids probate, meaning the property can pass directly to the beneficiary upon the owner's death without going through the lengthy and often costly probate process.

What are the benefits of using a Lady Bird Deed?

One of the main benefits of a Lady Bird Deed is that it helps avoid probate. This can save time and money for your heirs. Additionally, the property owner retains control over the property during their lifetime, which means they can sell, lease, or mortgage it without needing the beneficiary's consent. This deed also provides some protection from creditors, as the property is not considered part of the owner's estate until their death.

Who can be named as a beneficiary in a Lady Bird Deed?

Any individual or entity can be named as a beneficiary in a Lady Bird Deed. This includes family members, friends, or even organizations. It’s important to choose someone you trust, as they will receive the property directly upon your passing. You can also name multiple beneficiaries if you wish to divide the property among them.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or changed at any time while the property owner is still alive and competent. The property owner simply needs to execute a new deed to replace the existing one. This flexibility allows for adjustments based on changes in relationships or circumstances.

Is a Lady Bird Deed recognized in other states?

While the Lady Bird Deed is specific to Texas, other states may have similar forms of deeds, such as life estate deeds or transfer-on-death deeds. However, the rules and benefits may vary significantly from state to state. If you own property in multiple states, it's advisable to consult with a legal professional familiar with the laws of each state.

What happens if the beneficiary predeceases the property owner?

If the beneficiary named in a Lady Bird Deed passes away before the property owner, the property will not automatically transfer to the beneficiary's heirs. Instead, it will revert back to the property owner's estate unless the deed specifies an alternate beneficiary. It’s wise to have a backup plan in place to ensure the property is passed on according to your wishes.

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed involves drafting the deed with the appropriate legal language and including the necessary information about the property and the beneficiaries. It's highly recommended to work with a qualified attorney to ensure the deed complies with Texas laws and accurately reflects your intentions. Once the deed is prepared, it must be signed, notarized, and recorded with the county clerk’s office where the property is located.

Key takeaways

When considering the Texas Lady Bird Deed, it’s essential to understand its implications and how to properly fill it out. Here are some key takeaways to keep in mind:

- The Lady Bird Deed allows property owners to transfer their property to a beneficiary while retaining the right to live in and control the property during their lifetime.

- This type of deed can help avoid probate, simplifying the transfer of property upon the owner's death.

- It is important to clearly identify the property being transferred, including the legal description, to avoid any confusion or disputes later.

- Beneficiaries must be named explicitly in the deed to ensure they receive the property automatically upon the owner's death.

- The deed should be signed and notarized to ensure its validity. Without proper execution, the deed may not hold up in court.

- Consulting with a legal professional is advisable to navigate any potential tax implications or other legal considerations.

- Once the deed is executed, it must be filed with the county clerk’s office where the property is located to be effective.

File Details

| Fact Name | Description |

|---|---|

| What is a Lady Bird Deed? | A Lady Bird Deed allows property owners in Texas to transfer their property to beneficiaries while retaining control during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Texas Property Code, Section 255.001. |

| Benefits of a Lady Bird Deed | This deed helps avoid probate, allows for easy transfer of property, and can protect the property from creditors. |

| Retained Control | Property owners can sell, mortgage, or change the property during their lifetime without needing consent from beneficiaries. |

| Tax Implications | Beneficiaries receive a stepped-up basis for tax purposes, which can reduce capital gains taxes upon sale. |

| Revocability | The deed can be revoked or altered by the property owner at any time before their death. |

| Who Can Use It? | Any individual who owns real property in Texas can create a Lady Bird Deed. |

| Execution Requirements | The deed must be signed by the property owner and notarized to be valid. |

| Recording the Deed | To be effective, the Lady Bird Deed must be recorded in the county where the property is located. |

Consider Some Other Lady Bird Deed Forms for US States

Free Michigan Lady Bird Deed Pdf - It aligns with a growing trend of estate planning that prioritizes simplicity and transparency.

A Georgia Quitclaim Deed form is a legal document used to transfer interest in real estate from one person to another without any guarantees about the title being clear. This form is often employed between family members or to clear up title issues. It is crucial for individuals considering using this deed to understand its implications fully. For more information, you can visit OnlineLawDocs.com.

North Carolina Lady Bird Deed - This deed is recognized in several states and can vary in its execution depending on local laws.

Dos and Don'ts

When filling out the Texas Lady Bird Deed form, it is essential to approach the task with care and attention. Below are some important dos and don'ts to keep in mind.

- Do ensure you have the correct property description. Accurate details are crucial for the deed's validity.

- Do consult with a legal professional if you have any questions. Their guidance can help clarify complex aspects of the deed.

- Do clearly identify the beneficiaries. This step ensures that your intentions are understood and legally binding.

- Do sign the deed in the presence of a notary. This action is necessary for the deed to be recognized legally.

- Don't rush through the process. Take your time to review each section carefully to avoid mistakes.

- Don't leave any sections blank. Every part of the form must be completed to prevent delays or issues later on.

By following these guidelines, you can help ensure that your Texas Lady Bird Deed is completed correctly and serves its intended purpose effectively.