Valid Horse Bill of Sale Form for Texas

When buying or selling a horse in Texas, having a Horse Bill of Sale form is essential for both parties involved in the transaction. This document serves as a legal record of the sale, detailing important information such as the buyer's and seller's names and contact information, the horse's description, and the sale price. It also outlines any terms and conditions agreed upon by both parties, which can include payment methods and any warranties regarding the horse's health or soundness. By using this form, individuals protect their rights and establish clear expectations, reducing the likelihood of misunderstandings or disputes in the future. Additionally, this form can be useful for registration purposes or when transferring ownership, making it a vital part of the equine transaction process in Texas.

Common mistakes

-

Incomplete Information: Many individuals forget to fill in all required fields. Ensure that the names, addresses, and contact information of both the buyer and seller are fully completed.

-

Incorrect Horse Description: Failing to provide an accurate description of the horse can lead to confusion. Include details like breed, age, color, and any unique markings.

-

Omitting Sale Price: Some people neglect to state the sale price. This information is crucial for both parties and should be clearly indicated.

-

Not Including Payment Terms: If there are specific terms regarding payment, such as installments or deposits, these should be clearly outlined to avoid misunderstandings.

-

Failure to Sign: A common mistake is forgetting to sign the document. Both the buyer and seller must sign the bill of sale for it to be valid.

-

Neglecting Witnesses: In some cases, having a witness can provide additional security. Not including a witness signature when required can weaken the document's validity.

-

Ignoring Local Laws: Some individuals overlook specific state or local requirements. It’s important to be aware of any additional regulations that may apply to horse sales in Texas.

Example - Texas Horse Bill of Sale Form

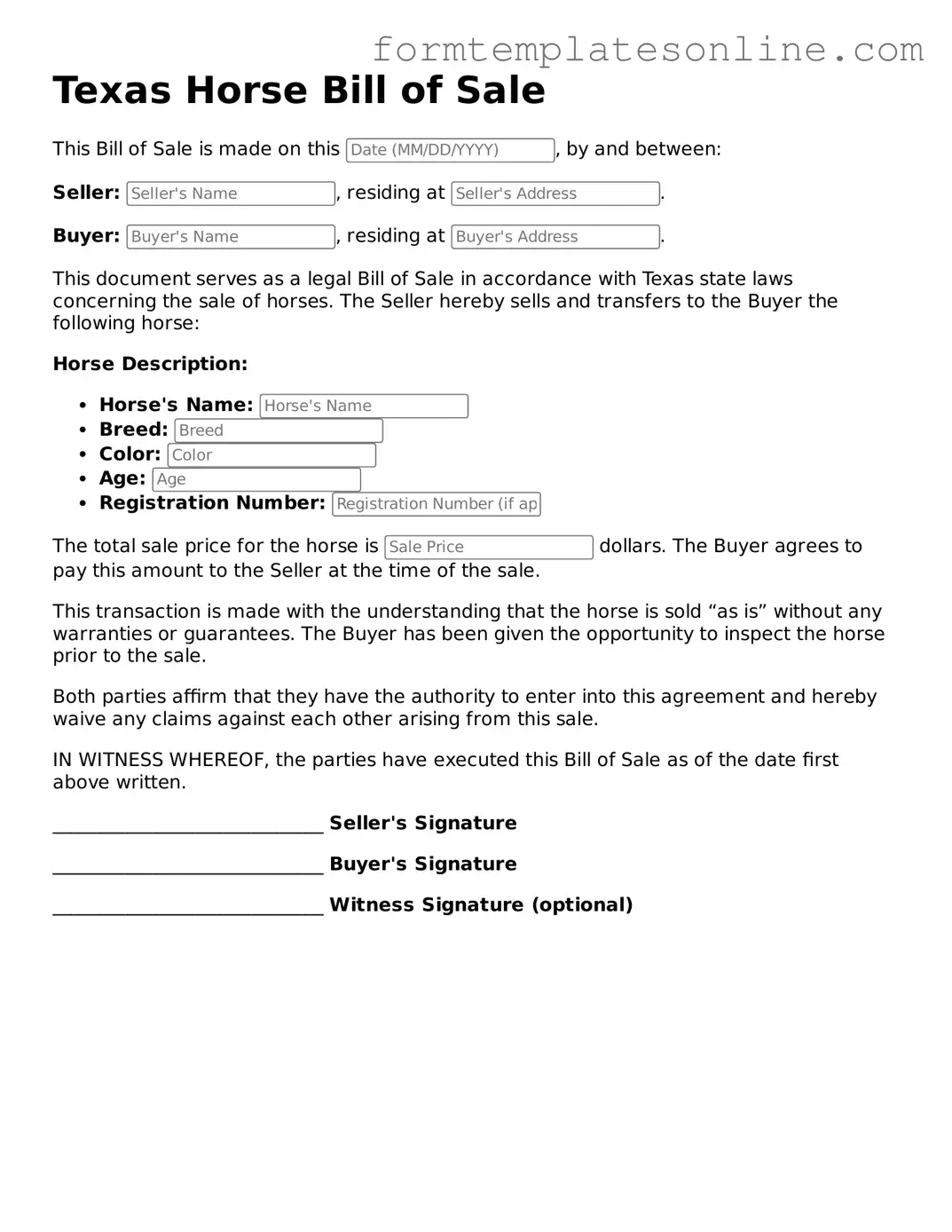

Texas Horse Bill of Sale

This Bill of Sale is made on this , by and between:

Seller: , residing at .

Buyer: , residing at .

This document serves as a legal Bill of Sale in accordance with Texas state laws concerning the sale of horses. The Seller hereby sells and transfers to the Buyer the following horse:

Horse Description:

- Horse's Name:

- Breed:

- Color:

- Age:

- Registration Number:

The total sale price for the horse is dollars. The Buyer agrees to pay this amount to the Seller at the time of the sale.

This transaction is made with the understanding that the horse is sold “as is” without any warranties or guarantees. The Buyer has been given the opportunity to inspect the horse prior to the sale.

Both parties affirm that they have the authority to enter into this agreement and hereby waive any claims against each other arising from this sale.

IN WITNESS WHEREOF, the parties have executed this Bill of Sale as of the date first above written.

_____________________________ Seller's Signature

_____________________________ Buyer's Signature

_____________________________ Witness Signature (optional)

More About Texas Horse Bill of Sale

What is a Texas Horse Bill of Sale?

A Texas Horse Bill of Sale is a legal document that records the sale and transfer of ownership of a horse. This form provides important details about the transaction, including the buyer and seller's information, the horse's description, and the sale price. It serves as proof of ownership and can be useful for future reference.

Is a Horse Bill of Sale required in Texas?

While it is not legally required to have a Horse Bill of Sale in Texas, it is highly recommended. This document protects both the buyer and seller by clearly outlining the terms of the sale and providing a record of the transaction. Having a bill of sale can help avoid disputes later on.

What information should be included in the Horse Bill of Sale?

The Horse Bill of Sale should include several key pieces of information: the names and addresses of the buyer and seller, a detailed description of the horse (including breed, age, color, and any identifying marks), the sale price, and the date of the transaction. It's also a good idea to include any warranties or guarantees related to the horse's health or condition.

Do I need a notary for the Horse Bill of Sale?

In Texas, a notary is not required for a Horse Bill of Sale to be valid. However, having the document notarized can add an extra layer of authenticity and may be beneficial if any disputes arise in the future. It can also help with registration or other legal processes related to the horse.

Can I use a generic bill of sale for my horse?

Yes, you can use a generic bill of sale for your horse, but it's best to use a form specifically designed for horse sales. A specialized Horse Bill of Sale will include all the necessary details and clauses that pertain to equine transactions, making it more comprehensive and useful.

What if the horse has health issues?

If the horse has known health issues, it's important to disclose this information in the Horse Bill of Sale. This transparency protects both parties and helps prevent future disputes. You might also consider including a clause that specifies whether the sale is "as-is" or if any warranties are provided regarding the horse's health.

How do I transfer ownership of the horse?

Ownership of the horse is transferred when the Horse Bill of Sale is signed by both the buyer and seller. After the sale, the buyer should keep a copy of the signed document for their records. If applicable, the buyer may also need to register the horse with a breed association or local authorities to complete the ownership transfer.

What if I change my mind after the sale?

Once the Horse Bill of Sale is signed and the transaction is completed, it is generally considered a final agreement. If you change your mind, it may be difficult to reverse the sale unless both parties agree to it. It's crucial to be sure about the sale before signing the document.

Can I sell a horse that I don’t own outright?

No, you should not sell a horse that you do not own outright. If the horse is financed or has a lien against it, you need to resolve those issues before selling. Selling a horse without clear ownership can lead to legal complications and disputes.

Where can I find a Texas Horse Bill of Sale form?

You can find a Texas Horse Bill of Sale form online through various legal document websites or equine organizations. Many of these resources provide templates that you can customize to fit your specific needs. Always ensure that the form you choose complies with Texas laws and includes all necessary information.

Key takeaways

When it comes to buying or selling a horse in Texas, having a well-prepared Horse Bill of Sale is essential. Here are some key takeaways to keep in mind:

- Identification of the Horse: Clearly describe the horse being sold. Include details such as breed, age, color, and any unique markings.

- Seller and Buyer Information: Both parties must provide their full names and contact information. This ensures clear communication throughout the transaction.

- Purchase Price: State the agreed-upon price for the horse. This should be clear and unambiguous to avoid any misunderstandings later.

- Payment Terms: Specify how the payment will be made. Whether it’s cash, check, or another method, clarity is key.

- Health and Condition: Include a statement about the horse's health and condition at the time of sale. This can protect both parties in case of disputes.

- Warranties and Guarantees: Clearly outline any warranties or guarantees regarding the horse. This might include health guarantees or performance expectations.

- Transfer of Ownership: Indicate when the ownership will officially transfer. This is typically at the time of payment, but it should be explicitly stated.

- Signatures: Ensure both the buyer and seller sign the document. This is crucial for validating the sale.

- Record Keeping: Keep a copy of the signed bill of sale for your records. This documentation can be important for future reference.

By following these guidelines, both buyers and sellers can navigate the process of horse transactions in Texas with greater confidence and clarity.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Texas Horse Bill of Sale form is used to document the sale of a horse in Texas. |

| Parties Involved | The form includes information about the buyer and the seller, ensuring both parties are clearly identified. |

| Horse Description | A detailed description of the horse, including breed, age, color, and registration number, is required. |

| Purchase Price | The agreed-upon purchase price must be stated in the document to clarify the transaction. |

| Governing Law | This form is governed by Texas law, specifically the Texas Business and Commerce Code. |

| Signatures | Both the buyer and seller must sign the form to make it legally binding. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed Bill of Sale for their records. |

Consider Some Other Horse Bill of Sale Forms for US States

Equine Bill of Sale - Allows for verification of the seller’s ownership before sale.

For those seeking to manage their affairs effectively, the Florida General Power of Attorney document is a vital legal instrument that permits an individual to designate someone to act on their behalf in a variety of situations, ensuring their preferences are honored even in their absence.

Equine Bill of Sale - Provides an official record for insurance purposes.

Dos and Don'ts

When filling out the Texas Horse Bill of Sale form, it is important to ensure accuracy and completeness. Here are six things to keep in mind:

- Do provide accurate information about the horse, including its breed, age, and any distinguishing features.

- Don't leave any fields blank; all sections of the form should be completed to avoid confusion.

- Do include the purchase price and payment method to clarify the terms of the sale.

- Don't forget to sign and date the form; both the buyer and seller should provide their signatures.

- Do keep a copy of the completed form for your records, as it serves as proof of the transaction.

- Don't use vague language; be clear and specific to prevent misunderstandings later on.