Valid Golf Cart Bill of Sale Form for Texas

In Texas, the Golf Cart Bill of Sale form serves as a crucial document for anyone looking to buy or sell a golf cart. This form not only facilitates the transfer of ownership but also provides essential details about the transaction, ensuring both parties are protected. Key aspects of the form include the identification of the seller and buyer, a thorough description of the golf cart being sold—including its make, model, and Vehicle Identification Number (VIN)—and the agreed-upon sale price. Additionally, the form may outline any terms or conditions related to the sale, such as warranties or disclosures about the cart's condition. By documenting these details, the Golf Cart Bill of Sale helps to prevent misunderstandings and disputes in the future, making it an indispensable tool for a smooth transaction. Understanding the importance of this form is vital for both buyers and sellers, as it solidifies the sale and provides legal proof of ownership transfer.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to issues later. Ensure that both the seller and buyer’s names, addresses, and contact information are clearly provided.

-

Incorrect Vehicle Identification Number (VIN): The VIN must match the golf cart being sold. Double-check the number to avoid discrepancies that could complicate ownership transfer.

-

Omitting the Sale Price: Leaving the sale price blank may create confusion. Clearly state the agreed-upon amount to establish a legal record of the transaction.

-

Neglecting Signatures: Both parties must sign the document. Without signatures, the bill of sale is not valid, and ownership may not be legally transferred.

-

Not Including Date of Sale: Forgetting to add the date can lead to misunderstandings. Always include the date of the transaction to provide a clear timeline.

-

Failure to Provide Copies: Not giving a copy to both parties can create issues in the future. Each party should retain a signed copy for their records.

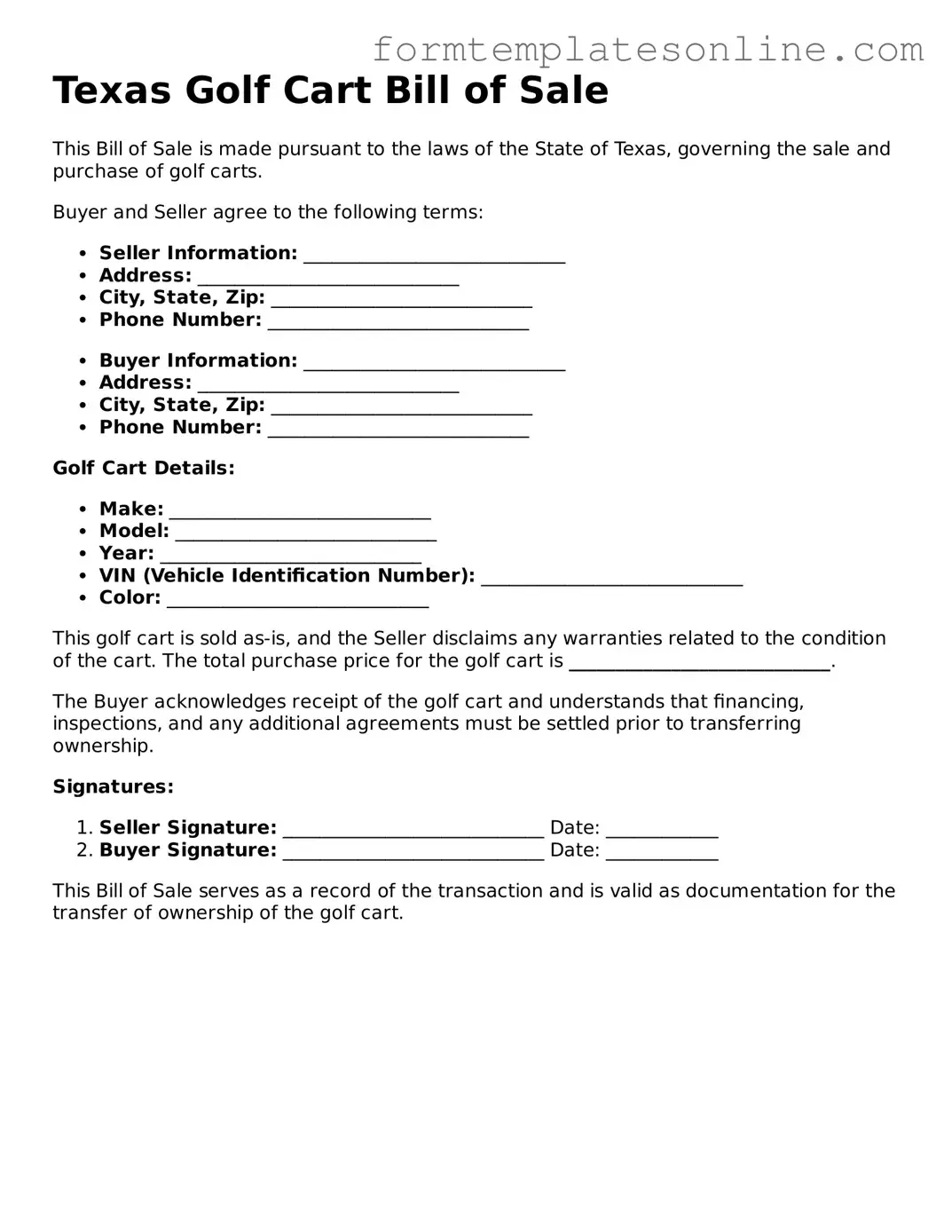

Example - Texas Golf Cart Bill of Sale Form

Texas Golf Cart Bill of Sale

This Bill of Sale is made pursuant to the laws of the State of Texas, governing the sale and purchase of golf carts.

Buyer and Seller agree to the following terms:

- Seller Information: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

- Buyer Information: ____________________________

- Address: ____________________________

- City, State, Zip: ____________________________

- Phone Number: ____________________________

Golf Cart Details:

- Make: ____________________________

- Model: ____________________________

- Year: ____________________________

- VIN (Vehicle Identification Number): ____________________________

- Color: ____________________________

This golf cart is sold as-is, and the Seller disclaims any warranties related to the condition of the cart. The total purchase price for the golf cart is ____________________________.

The Buyer acknowledges receipt of the golf cart and understands that financing, inspections, and any additional agreements must be settled prior to transferring ownership.

Signatures:

- Seller Signature: ____________________________ Date: ____________

- Buyer Signature: ____________________________ Date: ____________

This Bill of Sale serves as a record of the transaction and is valid as documentation for the transfer of ownership of the golf cart.

More About Texas Golf Cart Bill of Sale

What is a Texas Golf Cart Bill of Sale form?

A Texas Golf Cart Bill of Sale form is a legal document that records the sale of a golf cart between a seller and a buyer. It serves as proof of the transaction and includes important details such as the names of the parties involved, the date of sale, and a description of the golf cart. This form can help protect both the buyer and seller by providing a clear record of the agreement.

Do I need a Bill of Sale to sell a golf cart in Texas?

While it is not legally required to have a Bill of Sale to sell a golf cart in Texas, it is highly recommended. This document provides evidence of the transaction and can help prevent disputes in the future. Having a Bill of Sale can also make it easier for the buyer to register the golf cart if needed.

What information should be included in the Bill of Sale?

A Texas Golf Cart Bill of Sale should include several key pieces of information. This includes the names and addresses of both the seller and buyer, the date of the sale, a detailed description of the golf cart (including make, model, year, and VIN if applicable), and the sale price. It may also be helpful to include any warranties or conditions agreed upon during the sale.

Is a Bill of Sale the same as a title?

No, a Bill of Sale is not the same as a title. The title is the official document that proves ownership of the golf cart. The Bill of Sale is a record of the transaction. When selling a golf cart, the seller should provide the title to the buyer along with the Bill of Sale to complete the transfer of ownership.

Can I create my own Bill of Sale for a golf cart?

Yes, you can create your own Bill of Sale for a golf cart. However, it is important to ensure that it includes all necessary information to protect both parties. Many templates are available online to help guide you in creating a comprehensive and clear document. Make sure to keep a copy for your records after the sale is complete.

Key takeaways

When filling out and using the Texas Golf Cart Bill of Sale form, keep these key takeaways in mind:

- Accurate Information: Ensure that all details about the golf cart, including make, model, year, and Vehicle Identification Number (VIN), are correct. This prevents future disputes.

- Seller and Buyer Details: Include full names and addresses of both the seller and the buyer. This information is essential for legal purposes.

- Sale Price: Clearly state the sale price of the golf cart. This figure is important for tax purposes and to document the transaction.

- Signatures: Both parties must sign the document. Without signatures, the bill of sale is not legally binding.

- Date of Sale: Record the date of the transaction. This helps establish a timeline for ownership and any potential warranty claims.

- Keep Copies: After completing the form, both the seller and buyer should keep a copy. This serves as proof of the transaction.

- Registration Requirements: Understand that in Texas, golf carts may need to be registered depending on local laws. Check with your local DMV for specific requirements.

By following these guidelines, you can ensure a smooth transaction when buying or selling a golf cart in Texas.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Texas Golf Cart Bill of Sale form is used to document the sale or transfer of ownership of a golf cart. |

| Governing Law | This form is governed by Texas state law, specifically the Texas Transportation Code. |

| Seller Information | The form requires the seller's name, address, and contact information to ensure clear identification. |

| Buyer Information | Buyer's name and address must also be included to establish ownership transfer. |

| Golf Cart Details | Details about the golf cart, including make, model, year, and Vehicle Identification Number (VIN), are essential for identification. |

| Signatures | Both the seller and buyer must sign the form to validate the transaction and acknowledge the transfer of ownership. |

Consider Some Other Golf Cart Bill of Sale Forms for US States

Do Golf Carts Have Titles in Texas - Useful for tracking ownership and sale history of a golf cart.

When engaging in a trailer sale, utilizing the Georgia Trailer Bill of Sale form is essential for both parties to ensure a smooth transaction. This document not only legitimizes the sale but also safeguards the interests of the buyer and seller by outlining key details of the agreement. For those looking for a reliable resource, the necessary forms can be accessed through OnlineLawDocs.com, which simplifies the process and provides peace of mind.

How to Write a Bill of Sale in Georgia - Provides a clear starting point for future golf cart ownership transfers.

Dos and Don'ts

When completing the Texas Golf Cart Bill of Sale form, it is essential to follow certain guidelines to ensure accuracy and legality. Below is a list of things you should and shouldn't do:

- Do provide accurate information about the golf cart, including the make, model, and year.

- Do include the Vehicle Identification Number (VIN) to uniquely identify the golf cart.

- Do clearly state the sale price to avoid any confusion later on.

- Do ensure both the buyer and seller sign the document to validate the transaction.

- Don't leave any fields blank; incomplete forms can lead to issues during registration.

- Don't use outdated or incorrect forms; always use the latest version of the Bill of Sale.

- Don't forget to provide contact information for both parties in case follow-up is needed.

- Don't rush the process; take your time to review all information before submitting the form.