Valid Gift Deed Form for Texas

The Texas Gift Deed form serves as a vital legal document that facilitates the transfer of property from one individual to another without any exchange of money. This form is particularly significant for those looking to give real estate as a gift, whether it be to family members, friends, or charitable organizations. It outlines essential details such as the names of both the donor and the recipient, a clear description of the property being gifted, and the intent of the donor to make the transfer without expecting anything in return. Additionally, the Texas Gift Deed requires the signature of the donor and may also need to be notarized to ensure its validity. Understanding the nuances of this form can help individuals navigate the gifting process smoothly, ensuring that all legal requirements are met while also providing peace of mind for both parties involved. By using this form correctly, donors can make meaningful contributions to their loved ones or causes they care about, all while maintaining compliance with Texas property laws.

Common mistakes

-

Incomplete Information: Many people forget to fill out all required fields. Missing information can lead to delays or even rejection of the deed.

-

Incorrect Property Description: The property must be described accurately. Vague descriptions can create confusion and potential legal issues later.

-

Not Notarizing the Document: A gift deed needs to be notarized to be legally valid. Failing to have it notarized can invalidate the transfer.

-

Improper Signatures: All parties involved must sign the deed. Missing signatures can result in the deed being considered incomplete.

-

Ignoring Local Laws: Each county may have specific requirements. Not checking local regulations can lead to complications.

-

Not Keeping Copies: After filing the deed, it is important to keep copies for personal records. Losing the original can complicate future transactions.

Example - Texas Gift Deed Form

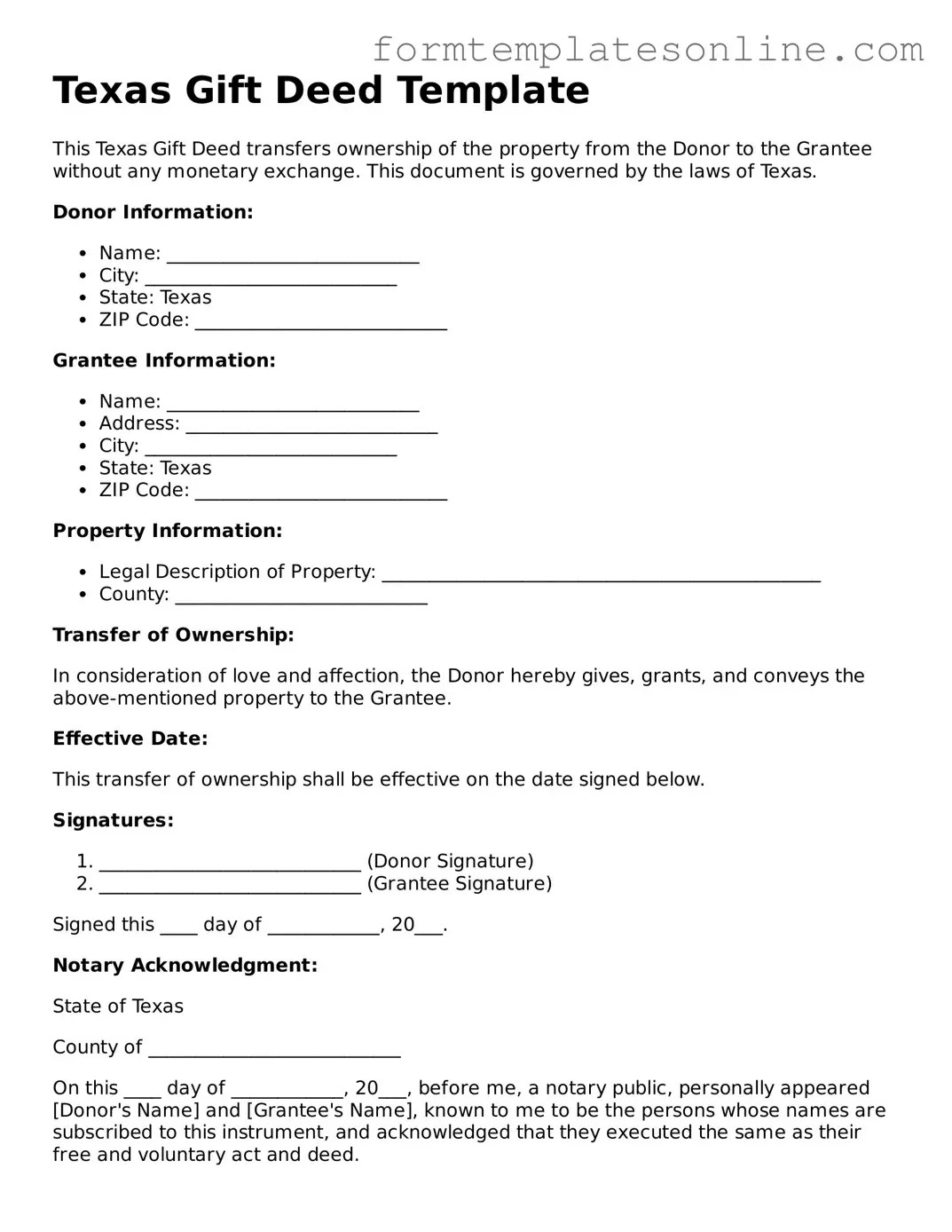

Texas Gift Deed Template

This Texas Gift Deed transfers ownership of the property from the Donor to the Grantee without any monetary exchange. This document is governed by the laws of Texas.

Donor Information:

- Name: ___________________________

- City: ___________________________

- State: Texas

- ZIP Code: ___________________________

Grantee Information:

- Name: ___________________________

- Address: ___________________________

- City: ___________________________

- State: Texas

- ZIP Code: ___________________________

Property Information:

- Legal Description of Property: _______________________________________________

- County: ___________________________

Transfer of Ownership:

In consideration of love and affection, the Donor hereby gives, grants, and conveys the above-mentioned property to the Grantee.

Effective Date:

This transfer of ownership shall be effective on the date signed below.

Signatures:

- ____________________________ (Donor Signature)

- ____________________________ (Grantee Signature)

Signed this ____ day of ____________, 20___.

Notary Acknowledgment:

State of Texas

County of ___________________________

On this ____ day of ____________, 20___, before me, a notary public, personally appeared [Donor's Name] and [Grantee's Name], known to me to be the persons whose names are subscribed to this instrument, and acknowledged that they executed the same as their free and voluntary act and deed.

____________________________

Notary Public, State of Texas

My commission expires: ________________

More About Texas Gift Deed

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of real property from one individual to another without any exchange of money. This type of deed is often utilized when a property owner wishes to give their property as a gift to a family member or friend. The deed must be signed, notarized, and filed with the county clerk's office to be legally binding.

What information is required to complete a Texas Gift Deed?

To complete a Texas Gift Deed, several key pieces of information are needed. This includes the full names and addresses of both the donor (the person giving the gift) and the recipient (the person receiving the gift). Additionally, a legal description of the property must be included, along with any existing liens or encumbrances. It is also important to specify that the transfer is a gift, not a sale.

Are there any tax implications associated with a Texas Gift Deed?

Yes, there may be tax implications when transferring property via a Gift Deed. The donor may be subject to gift tax if the value of the property exceeds the annual exclusion limit set by the IRS. It is advisable for both the donor and recipient to consult with a tax professional to understand potential tax liabilities and reporting requirements associated with the transfer.

Do I need to have the Gift Deed notarized?

Yes, a Texas Gift Deed must be notarized to be considered valid. The donor must sign the document in the presence of a notary public, who will then affix their seal to the deed. This step helps ensure the authenticity of the signatures and protects against fraud.

Can a Texas Gift Deed be revoked after it is executed?

Once a Texas Gift Deed is executed and delivered, it generally cannot be revoked unilaterally. However, if the donor retains certain rights or interests in the property, such as the right to live in the property for a certain period, this may create a situation where the gift can be contested. Legal advice should be sought if there are concerns about revocation or contesting the deed.

How do I file a Texas Gift Deed?

To file a Texas Gift Deed, the completed and notarized document must be submitted to the county clerk’s office in the county where the property is located. There may be a filing fee, which varies by county. It is important to ensure that the deed is properly recorded to protect the recipient's ownership rights.

Is legal assistance recommended when preparing a Texas Gift Deed?

Key takeaways

When filling out and using the Texas Gift Deed form, consider the following key takeaways:

- Understand the Purpose: A Gift Deed is used to transfer property ownership without any exchange of money.

- Identify the Parties: Clearly list the names of both the donor (giver) and the recipient (receiver) of the gift.

- Describe the Property: Provide a detailed description of the property being gifted, including its address and any relevant legal descriptions.

- Signatures Required: Ensure that the donor signs the deed. In Texas, the signature must be notarized for the deed to be valid.

- Consider Tax Implications: Be aware that gifting property may have tax consequences for both the donor and recipient.

- Record the Deed: File the completed Gift Deed with the county clerk’s office where the property is located to make the transfer official.

- Review State Laws: Familiarize yourself with Texas laws regarding gift deeds to ensure compliance with all requirements.

- Consult a Professional: If uncertain, seek legal advice to avoid mistakes that could affect the validity of the deed.

- Keep Copies: Retain copies of the signed and recorded Gift Deed for your records and for future reference.

- Use Clear Language: Avoid ambiguous terms in the deed to prevent misunderstandings about the transfer of property rights.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Texas Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The Texas Gift Deed is governed by Texas Property Code, specifically Chapter 5, which outlines the requirements for property transfers. |

| Requirements | To be valid, the deed must be in writing, signed by the donor, and must clearly identify the property being transferred. |

| Recording | While not mandatory, recording the Gift Deed with the county clerk is advisable to provide public notice of the property transfer. |

| Tax Implications | Gift taxes may apply depending on the value of the property and the relationship between the donor and the recipient, as outlined by the IRS regulations. |

Consider Some Other Gift Deed Forms for US States

Transfer House Title - A Gift Deed transfers property ownership without payment.

In addition to providing essential details about the transaction, a Georgia Motorcycle Bill of Sale can also be conveniently obtained from resources such as OnlineLawDocs.com, ensuring all necessary information is included to facilitate a smooth transfer of ownership.

Dos and Don'ts

When filling out the Texas Gift Deed form, it’s essential to approach the task with care. Here’s a list of things you should and shouldn’t do to ensure the process goes smoothly.

- Do provide accurate information about the donor and the recipient.

- Do clearly describe the property being gifted.

- Do sign the deed in the presence of a notary public.

- Do ensure that the deed is dated correctly.

- Do keep a copy of the signed deed for your records.

- Don't leave any sections of the form blank.

- Don't use vague descriptions for the property.

- Don't forget to check for any local requirements that may apply.

- Don't attempt to fill out the form without understanding its terms.