Valid Deed in Lieu of Foreclosure Form for Texas

The Texas Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing financial difficulties and the looming threat of foreclosure. This legal document allows a property owner to voluntarily transfer their property title back to the lender in exchange for the cancellation of the mortgage debt. By opting for this process, homeowners can avoid the lengthy and often stressful foreclosure proceedings, potentially preserving their credit score and allowing them to move forward with their lives more swiftly. The form outlines essential details, including the names of the parties involved, a description of the property, and any existing liens or encumbrances. Additionally, it may stipulate specific terms regarding the condition of the property at the time of transfer and any agreements related to the release of liability for the homeowner. Understanding the implications of this form is vital, as it can significantly impact both the homeowner's financial future and the lender's recovery process. In Texas, this option often provides a more amicable resolution for both parties, making it an appealing alternative to traditional foreclosure routes.

Common mistakes

-

Failing to Read the Entire Document: Many individuals rush through the Deed in Lieu of Foreclosure form, missing critical details that could impact their rights and obligations. Taking the time to read every section ensures clarity and understanding.

-

Incorrect Property Description: It's vital to provide an accurate description of the property involved. Omitting details or making errors can lead to complications or delays in the process.

-

Not Including All Owners: If multiple people own the property, all owners must sign the deed. Failing to include every owner can invalidate the deed and create legal challenges.

-

Ignoring Outstanding Liens: Before signing, it’s essential to check for any outstanding liens on the property. Ignoring these can result in continued financial responsibility even after the deed is executed.

-

Not Consulting with a Professional: Skipping legal or financial advice can lead to costly mistakes. Consulting with a real estate attorney or financial advisor can provide valuable insights and guidance.

-

Not Understanding Tax Implications: Some individuals overlook the potential tax consequences of transferring ownership through a deed in lieu of foreclosure. Being informed about these implications is crucial for financial planning.

-

Failing to Keep Copies: After completing the form, it’s important to keep copies of the signed deed and any related documents. This documentation is vital for future reference and proof of the transaction.

-

Not Notifying the Lender: Some people forget to formally notify the lender about the deed in lieu of foreclosure. Proper communication with the lender is essential to avoid misunderstandings or further legal issues.

-

Rushing the Process: Taking your time is key. Rushing through the deed can lead to mistakes that may have lasting consequences. Patience and thoroughness are important in this process.

Example - Texas Deed in Lieu of Foreclosure Form

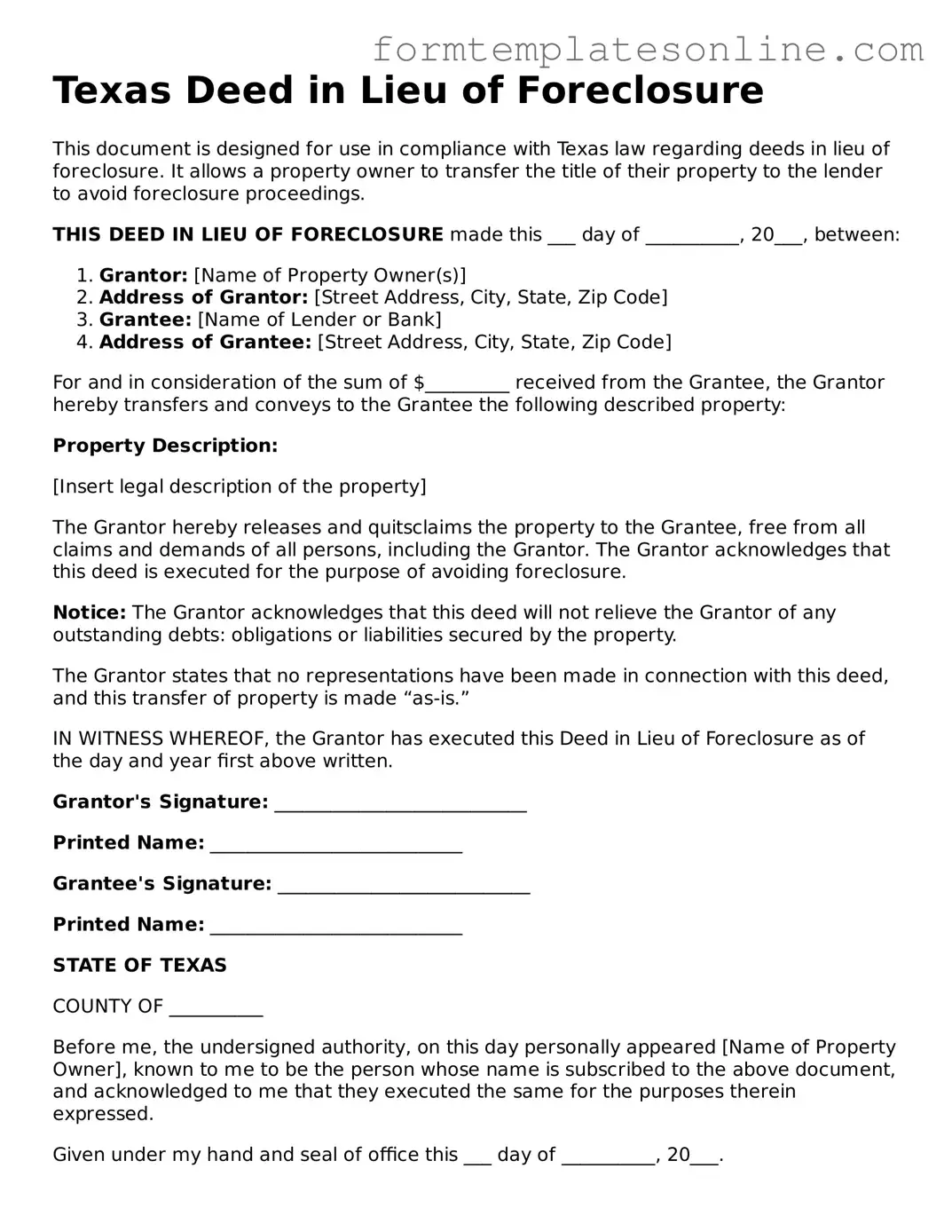

Texas Deed in Lieu of Foreclosure

This document is designed for use in compliance with Texas law regarding deeds in lieu of foreclosure. It allows a property owner to transfer the title of their property to the lender to avoid foreclosure proceedings.

THIS DEED IN LIEU OF FORECLOSURE made this ___ day of __________, 20___, between:

- Grantor: [Name of Property Owner(s)]

- Address of Grantor: [Street Address, City, State, Zip Code]

- Grantee: [Name of Lender or Bank]

- Address of Grantee: [Street Address, City, State, Zip Code]

For and in consideration of the sum of $_________ received from the Grantee, the Grantor hereby transfers and conveys to the Grantee the following described property:

Property Description:

[Insert legal description of the property]

The Grantor hereby releases and quitsclaims the property to the Grantee, free from all claims and demands of all persons, including the Grantor. The Grantor acknowledges that this deed is executed for the purpose of avoiding foreclosure.

Notice: The Grantor acknowledges that this deed will not relieve the Grantor of any outstanding debts: obligations or liabilities secured by the property.

The Grantor states that no representations have been made in connection with this deed, and this transfer of property is made “as-is.”

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor's Signature: ___________________________

Printed Name: ___________________________

Grantee's Signature: ___________________________

Printed Name: ___________________________

STATE OF TEXAS

COUNTY OF __________

Before me, the undersigned authority, on this day personally appeared [Name of Property Owner], known to me to be the person whose name is subscribed to the above document, and acknowledged to me that they executed the same for the purposes therein expressed.

Given under my hand and seal of office this ___ day of __________, 20___.

Notary Public's Signature: ___________________________

Notary Public's Printed Name: ___________________________

My Commission Expires: __________

More About Texas Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender in order to avoid foreclosure. This process can help the homeowner eliminate the burden of mortgage debt and avoid the negative consequences of a foreclosure on their credit report. By agreeing to this arrangement, the lender typically agrees to forgive the remaining mortgage balance, provided that the property is in good condition and there are no other liens attached to it.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

There are several benefits associated with a Deed in Lieu of Foreclosure. First, it can be a quicker and less costly alternative to the foreclosure process, which can take several months. Homeowners may also avoid the public stigma of foreclosure, as the transaction is private. Additionally, a Deed in Lieu can help preserve the homeowner's credit score to some extent compared to a foreclosure, although it may still have a negative impact. Finally, this option allows homeowners to walk away from their mortgage obligation without facing legal repercussions.

What are the requirements to qualify for a Deed in Lieu of Foreclosure?

To qualify for a Deed in Lieu of Foreclosure, homeowners generally need to demonstrate financial hardship and an inability to continue making mortgage payments. Lenders often require that the homeowner has attempted to sell the property or has explored other loss mitigation options before considering this route. Additionally, the property must be free of other liens, and the homeowner must be willing to vacate the premises upon completion of the transfer. Each lender may have specific criteria, so it is important to communicate directly with them.

How does the process of executing a Deed in Lieu of Foreclosure work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then review the homeowner's financial situation and the property’s condition. If approved, both parties will sign the Deed in Lieu of Foreclosure document, which transfers ownership of the property to the lender. After the deed is executed, the lender will usually release the homeowner from the mortgage obligation. It is advisable for homeowners to seek legal advice to ensure that their rights are protected throughout this process.

Will a Deed in Lieu of Foreclosure affect my credit score?

Yes, a Deed in Lieu of Foreclosure will impact your credit score, though generally less severely than a full foreclosure. While it is recorded as a negative mark on your credit report, it may not carry the same weight as a foreclosure, which can remain on your credit report for up to seven years. The exact impact on your score can vary based on your overall credit history and other factors. It is important to consider this when deciding on the best course of action for your financial situation.

Key takeaways

- The Texas Deed in Lieu of Foreclosure is a legal document used to transfer property ownership from a borrower to a lender to avoid foreclosure.

- This process can be less stressful and less damaging to a borrower's credit score compared to a foreclosure.

- Before filling out the form, ensure that the mortgage is in default and that all parties agree to the deed transfer.

- It is important to provide accurate property information, including the legal description and address.

- Both the borrower and lender must sign the deed for it to be valid.

- Consider consulting with a legal professional to understand the implications of signing the deed.

- The deed should be recorded with the county clerk's office to ensure it is legally binding.

- Borrowers may want to negotiate any potential deficiency judgments before signing the deed.

- The lender may require the borrower to vacate the property upon acceptance of the deed.

- Using this deed can provide a quicker resolution to financial difficulties, potentially allowing the borrower to move on more swiftly.

File Details

| Fact Name | Details |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | The Texas Deed in Lieu of Foreclosure is governed by Texas Property Code, Chapter 51. |

| Purpose | This form helps borrowers avoid the negative impact of foreclosure on their credit score. |

| Eligibility | Typically, borrowers must be in default on their mortgage to consider this option. |

| Process | The borrower must negotiate with the lender and complete the deed transfer process. |

| Consequences | While it helps avoid foreclosure, borrowers may still face tax implications and credit score impacts. |

Consider Some Other Deed in Lieu of Foreclosure Forms for US States

Foreclosure Deed - A deed in lieu of foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure.

To facilitate a smooth transaction, it is advisable to utilize a reliable resource for guidance on the necessary paperwork. A comprehensive guide to the ATV Bill of Sale requirements can be found at this link, ensuring both buyers and sellers are well-informed.

Deed in Lieu Vs Foreclosure - Submitting a Deed in Lieu can be a proactive way to address mortgage difficulties promptly.

Dos and Don'ts

When completing the Texas Deed in Lieu of Foreclosure form, it is important to adhere to specific guidelines to ensure the process goes smoothly. Below is a list of things to do and avoid.

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information about the property.

- Do sign the form in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Do consult with a legal professional if you have questions.

- Don't leave any sections of the form blank unless instructed.

- Don't use white-out or other correction methods on the form.

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to check for any additional documents that may be required.

- Don't submit the form without reviewing it for errors.