Valid Deed Form for Texas

The Texas Deed form serves as a crucial legal instrument in the transfer of real property ownership within the state. This document not only identifies the parties involved in the transaction—the grantor, or seller, and the grantee, or buyer—but also provides essential details about the property being conveyed. Key aspects of the form include a clear description of the property, typically through a legal description that outlines boundaries and dimensions, ensuring there is no ambiguity about what is being transferred. The form also requires the inclusion of consideration, which is the value exchanged for the property, often in the form of money. Additionally, it may contain warranties or covenants that assure the grantee of the grantor's right to sell the property and the absence of encumbrances. Proper execution, including signatures and notarization, is vital for the deed to be legally binding and enforceable. Understanding these components is essential for anyone involved in a real estate transaction in Texas, as they lay the groundwork for a smooth transfer of ownership and help protect the rights of all parties involved.

Common mistakes

-

Not including the correct legal description of the property. This is crucial, as the legal description identifies the exact boundaries of the property being transferred.

-

Failing to sign the deed. Both the grantor (the person transferring the property) and the grantee (the person receiving the property) must sign the document for it to be valid.

-

Using the wrong type of deed. Different types of deeds serve different purposes, such as warranty deeds, quitclaim deeds, and special warranty deeds. Choosing the wrong one can lead to legal complications.

-

Neglecting to include the date of the transaction. This information is important for establishing the timeline of ownership and can impact future legal matters.

-

Forgetting to notarize the deed. A notary public must witness the signing of the deed to ensure its authenticity and prevent fraud.

-

Not providing adequate consideration. This refers to the value exchanged in the transaction. Even if the property is a gift, it should still be stated clearly.

-

Omitting the grantee’s full name. The grantee's name must be spelled correctly and include any necessary suffixes, such as Jr. or Sr., to avoid confusion.

-

Including incorrect or outdated property information. Always verify that the property details match the latest records to prevent disputes.

-

Failing to check local regulations. Some counties may have specific requirements or additional forms needed for the deed to be valid.

-

Not retaining copies of the deed. After filing, it's essential to keep copies for personal records and future reference.

Example - Texas Deed Form

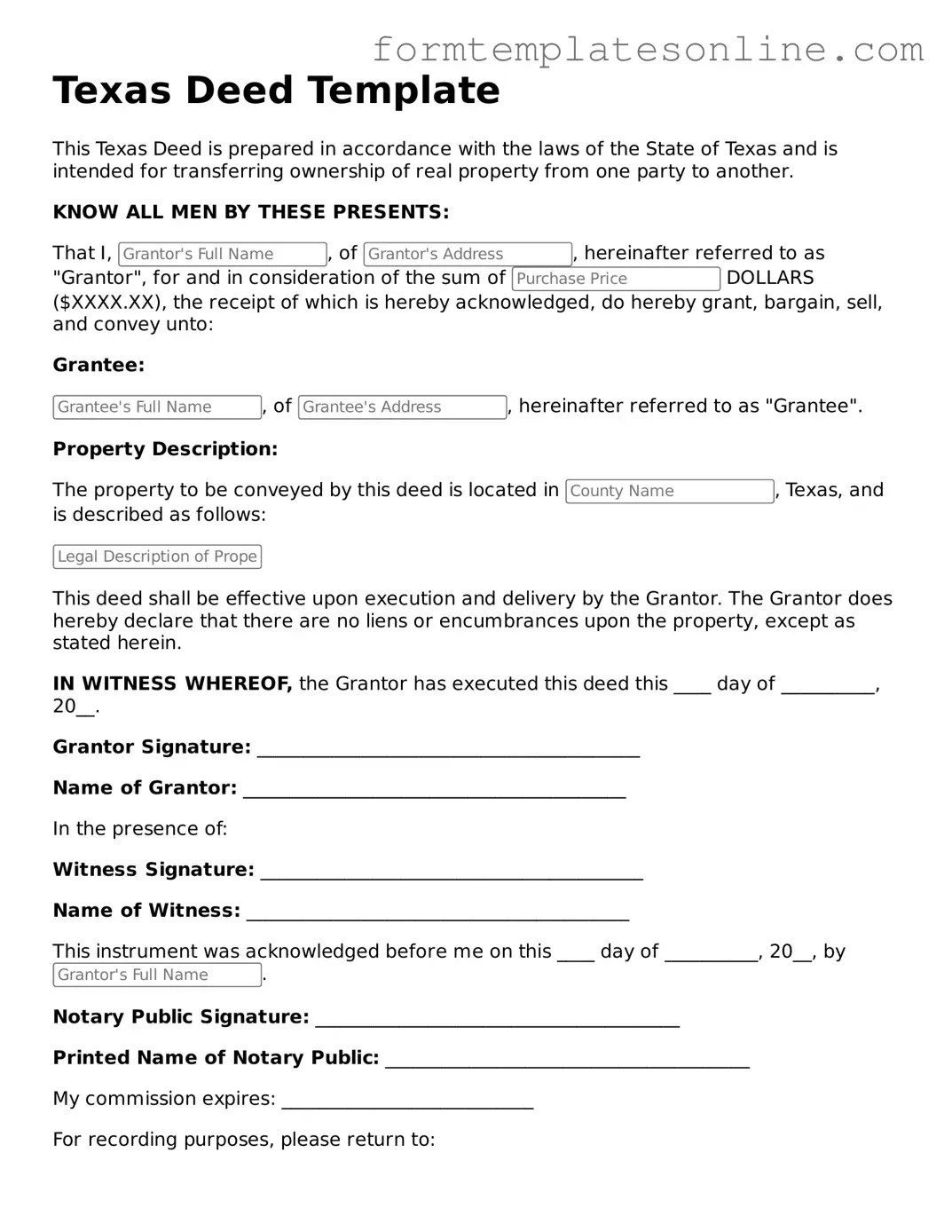

Texas Deed Template

This Texas Deed is prepared in accordance with the laws of the State of Texas and is intended for transferring ownership of real property from one party to another.

KNOW ALL MEN BY THESE PRESENTS:

That I, , of , hereinafter referred to as "Grantor", for and in consideration of the sum of DOLLARS ($XXXX.XX), the receipt of which is hereby acknowledged, do hereby grant, bargain, sell, and convey unto:

Grantee:

, of , hereinafter referred to as "Grantee".

Property Description:

The property to be conveyed by this deed is located in , Texas, and is described as follows:

This deed shall be effective upon execution and delivery by the Grantor. The Grantor does hereby declare that there are no liens or encumbrances upon the property, except as stated herein.

IN WITNESS WHEREOF, the Grantor has executed this deed this ____ day of __________, 20__.

Grantor Signature: _________________________________________

Name of Grantor: _________________________________________

In the presence of:

Witness Signature: _________________________________________

Name of Witness: _________________________________________

This instrument was acknowledged before me on this ____ day of __________, 20__, by .

Notary Public Signature: _______________________________________

Printed Name of Notary Public: _______________________________________

My commission expires: ___________________________

For recording purposes, please return to:

More About Texas Deed

What is a Texas Deed form?

A Texas Deed form is a legal document used to transfer ownership of real property in Texas. This form outlines the details of the transaction, including the names of the buyer and seller, a description of the property, and any conditions of the sale. It serves as proof of ownership and is essential for recording the transaction with the county clerk's office.

What types of deeds are available in Texas?

In Texas, several types of deeds can be used, including General Warranty Deeds, Special Warranty Deeds, and Quitclaim Deeds. A General Warranty Deed provides the most protection to the buyer, as it guarantees that the seller holds clear title to the property. A Special Warranty Deed offers limited guarantees, while a Quitclaim Deed transfers whatever interest the seller has without any warranties.

Do I need an attorney to prepare a Texas Deed?

While it is not legally required to have an attorney prepare a Texas Deed, it is highly recommended. An attorney can ensure that the deed complies with state laws, accurately reflects the terms of the sale, and protects your interests. If you choose to prepare the deed yourself, be sure to follow all legal requirements carefully.

How do I fill out a Texas Deed form?

Filling out a Texas Deed form involves providing specific information, such as the names of the grantor (seller) and grantee (buyer), a legal description of the property, and the consideration (purchase price). It's crucial to ensure that all information is accurate and complete to avoid any issues during the transfer process.

Where do I file a Texas Deed?

After completing the Texas Deed form, it must be filed with the county clerk's office in the county where the property is located. Filing the deed officially records the transfer of ownership and makes it a matter of public record. Be sure to check for any local filing fees that may apply.

Is there a specific format for a Texas Deed?

Yes, Texas Deeds must follow a specific format to be valid. They should include the names of the parties involved, a legal description of the property, the date of the transaction, and the signatures of the grantor and any witnesses, if required. Ensuring that the deed meets these requirements is essential for its enforceability.

What happens if I don’t record my Texas Deed?

If you do not record your Texas Deed, you may face challenges in proving your ownership of the property. Additionally, if someone else records a deed for the same property after you, they may be recognized as the legal owner. Recording your deed protects your rights and interests in the property.

Can a Texas Deed be revoked or changed?

Once a Texas Deed is executed and recorded, it generally cannot be revoked or changed without the consent of all parties involved. If changes are necessary, a new deed must be created and recorded. This process ensures that any modifications are legally recognized.

Are there any tax implications when transferring property with a Texas Deed?

Yes, transferring property can have tax implications. In Texas, property transfers may be subject to transfer taxes or capital gains taxes, depending on the circumstances. It is advisable to consult with a tax professional to understand the potential tax consequences of your property transfer.

What should I do if I lose my Texas Deed?

If you lose your Texas Deed, you can obtain a copy by contacting the county clerk's office where the deed was originally filed. They can provide you with a certified copy of the deed, which can serve as a replacement. Keeping a safe copy of important documents is always a good practice.

Key takeaways

When filling out and using the Texas Deed form, it is essential to understand several key aspects to ensure the process goes smoothly. Below are important takeaways to keep in mind:

- Understand the Types of Deeds: Texas recognizes several types of deeds, including warranty deeds, quitclaim deeds, and special warranty deeds. Each serves different purposes.

- Identify the Grantor and Grantee: Clearly state the names of the person transferring the property (grantor) and the person receiving it (grantee). Accuracy is crucial.

- Provide a Legal Description: Include a precise legal description of the property. This is not the same as a street address and is essential for clarity.

- Consider Notarization: In Texas, a deed must be notarized to be legally binding. Ensure that the signatures are witnessed by a notary public.

- File with the County Clerk: After completing the deed, it must be filed with the county clerk in the county where the property is located. This step is vital for public record.

- Check for Liens: Before transferring property, verify that there are no outstanding liens or claims against it. This protects both the grantor and grantee.

- Use Clear Language: Avoid using ambiguous terms. Clear and straightforward language helps prevent misunderstandings in the future.

- Seek Legal Advice if Necessary: If there are complexities involved in the property transfer, consulting with a real estate attorney can provide valuable guidance.

- Keep Copies for Records: After filing the deed, retain copies for personal records. This documentation is important for future reference.

By paying attention to these key points, individuals can navigate the process of filling out and using the Texas Deed form more effectively. Properly managing this documentation ensures a smoother transfer of property rights.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Texas Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types of deeds in Texas include Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. |

| Governing Laws | The Texas Property Code governs the use and requirements of deeds in Texas. |

| Signature Requirement | The deed must be signed by the grantor (the person transferring the property) to be valid. |

| Recording | To provide public notice, the deed should be recorded in the county where the property is located. |

Consider Some Other Deed Forms for US States

What Does a House Deed Look Like in Pa - This form can facilitate the transfer of property between family members.

The New York Boat Bill of Sale form is a crucial document used to transfer ownership of a boat from one party to another. This form provides essential details about the vessel, including its make, model, and hull identification number. Properly completing this document ensures a smooth transaction and establishes clear ownership records, and you can find a template for it at https://documentonline.org/blank-new-york-boat-bill-of-sale.

Ohio Warranty Deed - Can establish precedents in property law and ownership disputes.

Estate Title - The Deed becomes legally binding once it is properly executed and delivered.

Dos and Don'ts

When filling out a Texas Deed form, it's important to follow certain guidelines to ensure the document is completed correctly. Here are five things you should and shouldn't do:

- Do: Ensure all names are spelled correctly. Mistakes in names can lead to legal complications down the line.

- Do: Provide a clear description of the property. Include details like the address and legal description to avoid confusion.

- Do: Sign the deed in front of a notary public. This step is crucial for the document's validity.

- Don't: Leave any required fields blank. Omitting information can render the deed invalid.

- Don't: Use white-out or erase any mistakes. Instead, draw a single line through the error and initial it.

By adhering to these guidelines, you can help ensure that your Texas Deed form is completed accurately and legally binding.