Valid Bill of Sale Form for Texas

The Texas Bill of Sale form serves as a vital document for individuals engaging in the sale or transfer of personal property within the state. This form is designed to provide a clear and legally binding record of the transaction between the seller and buyer. It typically includes essential details such as the names and addresses of both parties, a description of the item being sold, and the sale price. Additionally, the form may outline any warranties or representations made by the seller regarding the condition of the item. While the Texas Bill of Sale is often associated with vehicles, it can also be used for various types of personal property, including boats, trailers, and equipment. This document not only protects the interests of both parties but also helps facilitate a smooth transfer of ownership, ensuring that all necessary information is documented and agreed upon. By using this form, individuals can avoid potential disputes and misunderstandings in the future, making it an essential tool for anyone involved in buying or selling property in Texas.

Common mistakes

-

Failing to include complete names of both the buyer and seller. This can lead to confusion and disputes later on.

-

Not providing accurate contact information. Always include phone numbers and addresses to ensure communication is clear.

-

Omitting vehicle identification numbers (VIN) for vehicle sales. This information is crucial for registration and title transfer.

-

Forgetting to specify the purchase price. This detail is essential for both parties and for tax purposes.

-

Neglecting to include date of sale. This helps establish a timeline for ownership and liability.

-

Using incomplete descriptions of the item being sold. A detailed description helps avoid misunderstandings.

-

Not having both parties sign the document. Signatures are necessary to validate the agreement.

-

Failing to include witness signatures when required. Some transactions may need a witness to be legally binding.

-

Ignoring state-specific requirements. Each state may have different rules regarding bill of sale forms.

-

Not keeping a copy of the bill of sale for personal records. Always retain a copy for future reference.

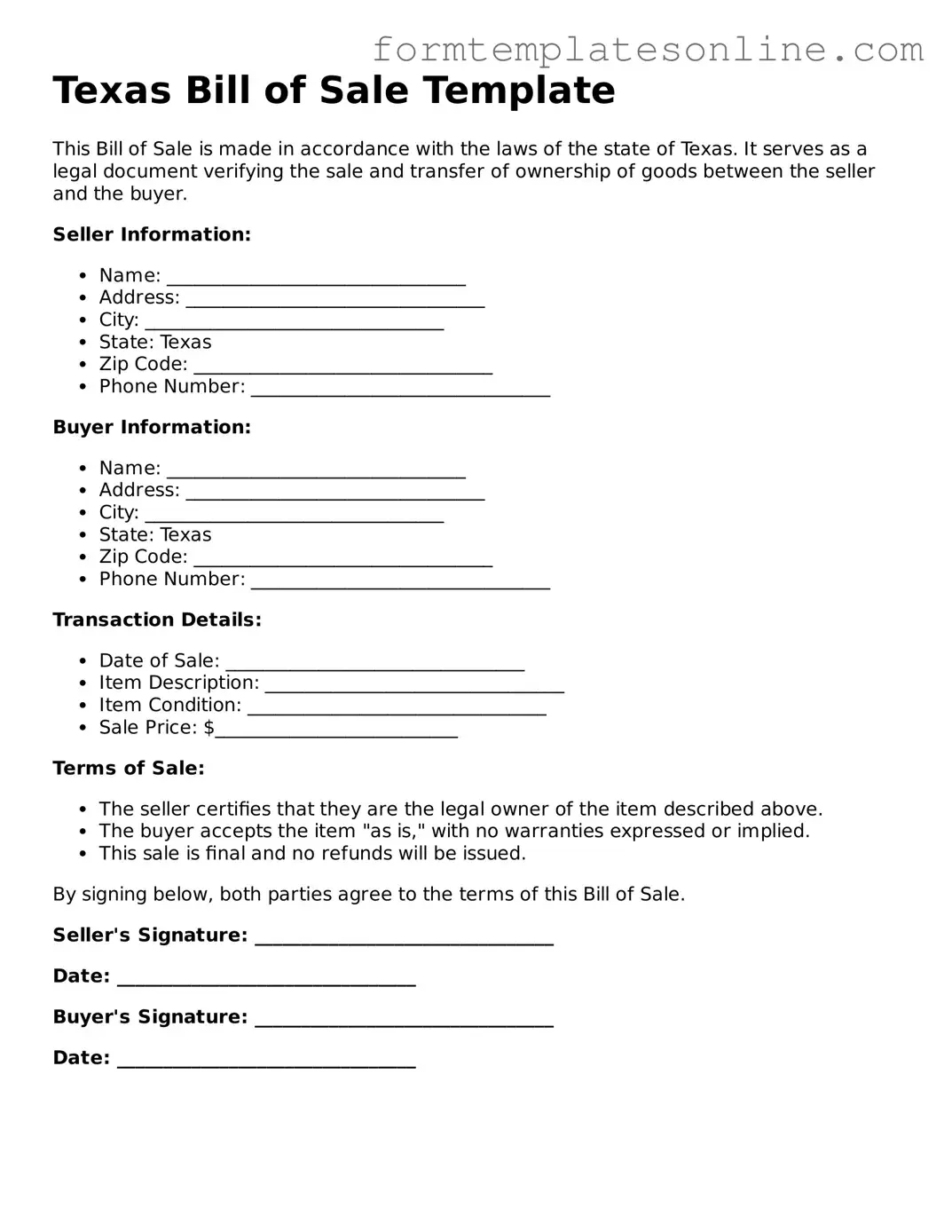

Example - Texas Bill of Sale Form

Texas Bill of Sale Template

This Bill of Sale is made in accordance with the laws of the state of Texas. It serves as a legal document verifying the sale and transfer of ownership of goods between the seller and the buyer.

Seller Information:

- Name: ________________________________

- Address: ________________________________

- City: ________________________________

- State: Texas

- Zip Code: ________________________________

- Phone Number: ________________________________

Buyer Information:

- Name: ________________________________

- Address: ________________________________

- City: ________________________________

- State: Texas

- Zip Code: ________________________________

- Phone Number: ________________________________

Transaction Details:

- Date of Sale: ________________________________

- Item Description: ________________________________

- Item Condition: ________________________________

- Sale Price: $__________________________

Terms of Sale:

- The seller certifies that they are the legal owner of the item described above.

- The buyer accepts the item "as is," with no warranties expressed or implied.

- This sale is final and no refunds will be issued.

By signing below, both parties agree to the terms of this Bill of Sale.

Seller's Signature: ________________________________

Date: ________________________________

Buyer's Signature: ________________________________

Date: ________________________________

More About Texas Bill of Sale

What is a Texas Bill of Sale?

A Texas Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. It serves as proof of the transaction and can be used for various items, including vehicles, boats, and other personal goods. This document is important for both the buyer and the seller to ensure a clear understanding of the sale.

Do I need a Bill of Sale for every transaction in Texas?

While a Bill of Sale is not required for every transaction in Texas, it is highly recommended for significant purchases, especially for vehicles and trailers. Having a Bill of Sale helps protect both parties by providing a written record of the sale and the agreed-upon terms.

What information should be included in a Texas Bill of Sale?

A Texas Bill of Sale should include the names and addresses of both the buyer and seller, a description of the item being sold (including make, model, and VIN for vehicles), the sale price, and the date of the transaction. It’s also helpful to include any warranties or conditions of the sale.

Is the Bill of Sale required to be notarized in Texas?

No, a Bill of Sale does not need to be notarized in Texas. However, notarization can add an extra layer of security and authenticity to the document. If you choose to have it notarized, both parties should be present during the signing.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale. Just make sure to include all the necessary information and details about the transaction. There are also templates available online that can help guide you in drafting a comprehensive document.

What if there are disputes after the sale?

If disputes arise after the sale, the Bill of Sale can serve as evidence of the transaction. It’s important to keep a copy of the document in a safe place. If issues cannot be resolved amicably, you may need to consult with a legal professional for guidance.

Are there any fees associated with a Bill of Sale in Texas?

There are no state fees specifically for creating a Bill of Sale. However, if you are transferring ownership of a vehicle, you may need to pay fees to the Texas Department of Motor Vehicles for title transfer and registration. Always check for any applicable fees based on the type of property being sold.

Where can I find a Texas Bill of Sale form?

You can find Texas Bill of Sale forms online through various legal websites or local government resources. Many templates are available for free, making it easy to download and customize for your specific transaction.

Key takeaways

Filling out and using the Texas Bill of Sale form is essential for ensuring a smooth transaction when buying or selling personal property. Here are key takeaways to keep in mind:

- Complete Information: Ensure all required fields are filled out accurately. This includes the names and addresses of both the buyer and seller, as well as a detailed description of the item being sold.

- Signatures Required: Both parties must sign the Bill of Sale. This signature confirms that the transaction has occurred and that both parties agree to the terms outlined in the document.

- Consider Notarization: While notarization is not mandatory in Texas, having the Bill of Sale notarized adds an extra layer of authenticity and can be beneficial in case of disputes.

- Keep Copies: After completing the form, both the buyer and seller should retain copies. This documentation serves as proof of the transaction and can be useful for future reference.

File Details

| Fact Name | Description |

|---|---|

| Purpose | A Texas Bill of Sale serves as a legal document that records the transfer of ownership of personal property from one party to another. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Governing Laws | The Texas Bill of Sale is governed by the Texas Business and Commerce Code, particularly sections relating to the sale of goods. |

| Notarization | While notarization is not required for all bills of sale in Texas, it is recommended for certain transactions, especially those involving vehicles. |

| Buyer and Seller Information | The form must include the full names and addresses of both the buyer and the seller to establish clear ownership transfer. |

| Property Description | A detailed description of the property being sold is essential. This may include make, model, year, and VIN for vehicles. |

| Consideration | The Bill of Sale should state the purchase price or consideration exchanged for the property, ensuring clarity in the transaction. |

| As-Is Clause | Including an "as-is" clause can protect the seller from future claims regarding the condition of the property after the sale. |

| Record Keeping | Both parties should retain a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

Consider Some Other Bill of Sale Forms for US States

Bill of Sale Michigan - A Bill of Sale is an important aspect of responsible buying and selling practices.

What Does a Bill of Sale Look Like for a Car - Including “as-is” language in a Bill of Sale can clarify the condition of the items sold.

Dos and Don'ts

When filling out the Texas Bill of Sale form, it’s essential to ensure that the document is accurate and complete. Here are some important dos and don’ts to keep in mind:

- Do provide accurate information about the buyer and seller, including full names and addresses.

- Do include a detailed description of the item being sold, such as make, model, year, and VIN for vehicles.

- Do specify the sale price clearly to avoid any misunderstandings later.

- Do have both parties sign the document to validate the transaction.

- Don’t leave any sections blank; incomplete forms can lead to issues down the line.

- Don’t forget to keep a copy of the signed Bill of Sale for your records.

- Don’t use white-out or make alterations to the form after it has been signed, as this can invalidate the document.