Valid Articles of Incorporation Form for Texas

In Texas, the Articles of Incorporation form serves as a foundational document for establishing a corporation within the state. This form outlines essential details about the corporation, including its name, duration, and the purpose for which it is being formed. Additionally, it requires information about the registered agent, who will act as the official point of contact for legal matters. The form also specifies the number of shares the corporation is authorized to issue and may include provisions for the management structure. Completing the Articles of Incorporation is a critical step in the incorporation process, as it not only legitimizes the business entity but also provides a framework for its governance and operation. Understanding the requirements and implications of this form is vital for anyone looking to start a corporation in Texas.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all necessary details. This includes missing the names of the initial directors or not specifying the purpose of the corporation. Each section must be filled out completely to avoid delays.

-

Incorrect Registered Agent Information: A registered agent must be designated for the corporation. People often provide inaccurate names or addresses. This can lead to issues with receiving legal documents and notifications.

-

Failure to Include the Corporate Structure: Some applicants overlook the importance of stating whether the corporation will be a profit or nonprofit entity. This classification is crucial as it affects taxation and compliance requirements.

-

Not Following Submission Guidelines: Each submission must adhere to specific formatting and filing instructions. Errors such as incorrect signatures or failing to include the required fee can result in rejection of the application.

Example - Texas Articles of Incorporation Form

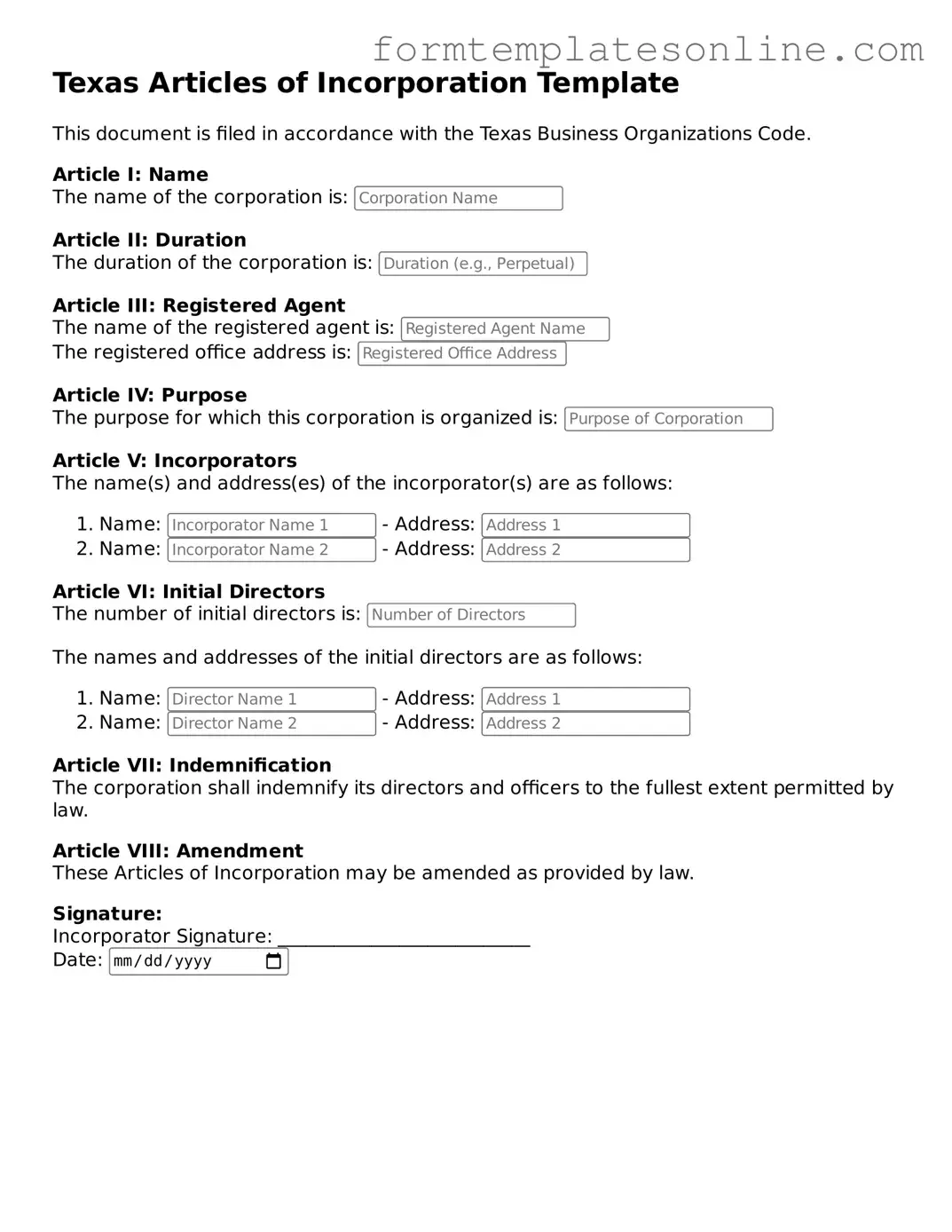

Texas Articles of Incorporation Template

This document is filed in accordance with the Texas Business Organizations Code.

Article I: Name

The name of the corporation is:

Article II: Duration

The duration of the corporation is:

Article III: Registered Agent

The name of the registered agent is:

The registered office address is:

Article IV: Purpose

The purpose for which this corporation is organized is:

Article V: Incorporators

The name(s) and address(es) of the incorporator(s) are as follows:

- Name: - Address:

- Name: - Address:

Article VI: Initial Directors

The number of initial directors is:

The names and addresses of the initial directors are as follows:

- Name: - Address:

- Name: - Address:

Article VII: Indemnification

The corporation shall indemnify its directors and officers to the fullest extent permitted by law.

Article VIII: Amendment

These Articles of Incorporation may be amended as provided by law.

Signature:

Incorporator Signature: ___________________________

Date:

More About Texas Articles of Incorporation

What is the Texas Articles of Incorporation form?

The Texas Articles of Incorporation form is a legal document used to establish a corporation in Texas. This form outlines the basic details of the corporation, including its name, purpose, and the number of shares it is authorized to issue. Filing this document with the Texas Secretary of State is a crucial step in forming a corporation, as it officially creates the entity under Texas law.

What information do I need to provide on the form?

You will need to provide several key pieces of information on the Texas Articles of Incorporation form. This includes the corporation's name, which must be unique and not similar to existing entities. You will also need to state the purpose of the corporation, which can be broad or specific. Additionally, you must indicate the number of shares the corporation is authorized to issue and include the name and address of the registered agent who will receive legal documents on behalf of the corporation.

How do I file the Texas Articles of Incorporation?

To file the Texas Articles of Incorporation, you can complete the form online or download a paper version from the Texas Secretary of State's website. If filing online, follow the prompts to input your information. For paper submissions, print the completed form and mail it to the appropriate address along with the required filing fee. Ensure that you keep a copy for your records after submission.

What is the filing fee for the Articles of Incorporation in Texas?

The filing fee for the Texas Articles of Incorporation varies depending on the type of corporation you are forming. As of October 2023, the fee for a for-profit corporation is typically around $300. Nonprofit corporations have a reduced fee, generally around $25. Always check the Texas Secretary of State's website for the most current fee schedule before filing.

How long does it take to process the Articles of Incorporation?

The processing time for the Texas Articles of Incorporation can vary. Typically, online filings are processed faster, often within a few business days. Paper filings may take longer, sometimes up to two weeks or more. If you need expedited service, the Texas Secretary of State offers options for faster processing at an additional cost. Always check for the most current processing times to plan accordingly.

Key takeaways

Filling out the Texas Articles of Incorporation form is a crucial step for anyone looking to establish a corporation in the Lone Star State. Here are some key takeaways to keep in mind:

- Understand the purpose: The Articles of Incorporation serve as the foundational document for your corporation, outlining its basic structure and purpose.

- Choose a unique name: Your corporation's name must be distinguishable from existing entities in Texas. Conduct a name search to ensure availability.

- Designate a registered agent: This individual or business entity will receive legal documents on behalf of your corporation. Choose someone reliable and accessible.

- Specify the duration: Indicate whether your corporation will exist indefinitely or for a specific period. Most corporations opt for perpetual existence.

- Outline the initial directors: Provide the names and addresses of the individuals who will serve on the board of directors. This information is vital for governance.

- Include the purpose statement: Clearly articulate the nature of your business activities. A well-defined purpose can guide your corporation’s operations.

- File with the Secretary of State: Once completed, submit your Articles of Incorporation to the Texas Secretary of State, along with the required filing fee.

By keeping these points in mind, you can navigate the process of incorporating in Texas with confidence and clarity. This foundational step sets the stage for your corporation's future success.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Texas Articles of Incorporation form is used to officially create a corporation in Texas. |

| Governing Law | The form is governed by the Texas Business Organizations Code. |

| Filing Requirement | It must be filed with the Texas Secretary of State to establish legal existence. |

| Information Needed | Key information includes the corporation's name, purpose, and registered agent. |

| Registered Agent | A registered agent must be designated to receive legal documents on behalf of the corporation. |

| Filing Fee | A filing fee is required when submitting the Articles of Incorporation. |

| Effective Date | The corporation can specify an effective date for its formation, which can be immediate or a future date. |

| Amendments | Any changes to the Articles of Incorporation require filing an amendment with the Secretary of State. |

| Public Record | Once filed, the Articles of Incorporation become a public record, accessible to anyone. |

Consider Some Other Articles of Incorporation Forms for US States

Secretary of State New York - Facilitates compliance with state and federal laws.

Registration Certificate - They may also set limitations on the powers of the directors and officers.

Form California Llc - Sets forth the duration of the corporation's existence.

When dealing with golf cart transactions, having the right documentation is crucial. For those in need of a reliable template, the formal Florida Golf Cart Bill of Sale serves as an invaluable resource, ensuring that the sale process is smooth and legally binding.

Florida Corporation - Indicates the principal office address.

Dos and Don'ts

When filling out the Texas Articles of Incorporation form, it’s important to follow certain guidelines to ensure a smooth process. Here’s a helpful list of things to do and avoid:

- Do carefully read the instructions provided with the form to understand all requirements.

- Do provide accurate and complete information about your business, including the name and address.

- Do choose a unique name for your corporation that complies with Texas naming rules.

- Do include the purpose of your corporation clearly and concisely.

- Do designate a registered agent who will receive legal documents on behalf of the corporation.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't use abbreviations or acronyms for the corporation's name unless they are part of the official name.

- Don't forget to sign and date the form before submitting it.

- Don't submit the form without the required filing fee, as it will not be processed.

- Don't rush through the process; take your time to review everything for accuracy.

By following these guidelines, you can help ensure that your Articles of Incorporation are filled out correctly and submitted without issues. Good luck with your new venture!