Stock Transfer Ledger PDF Form

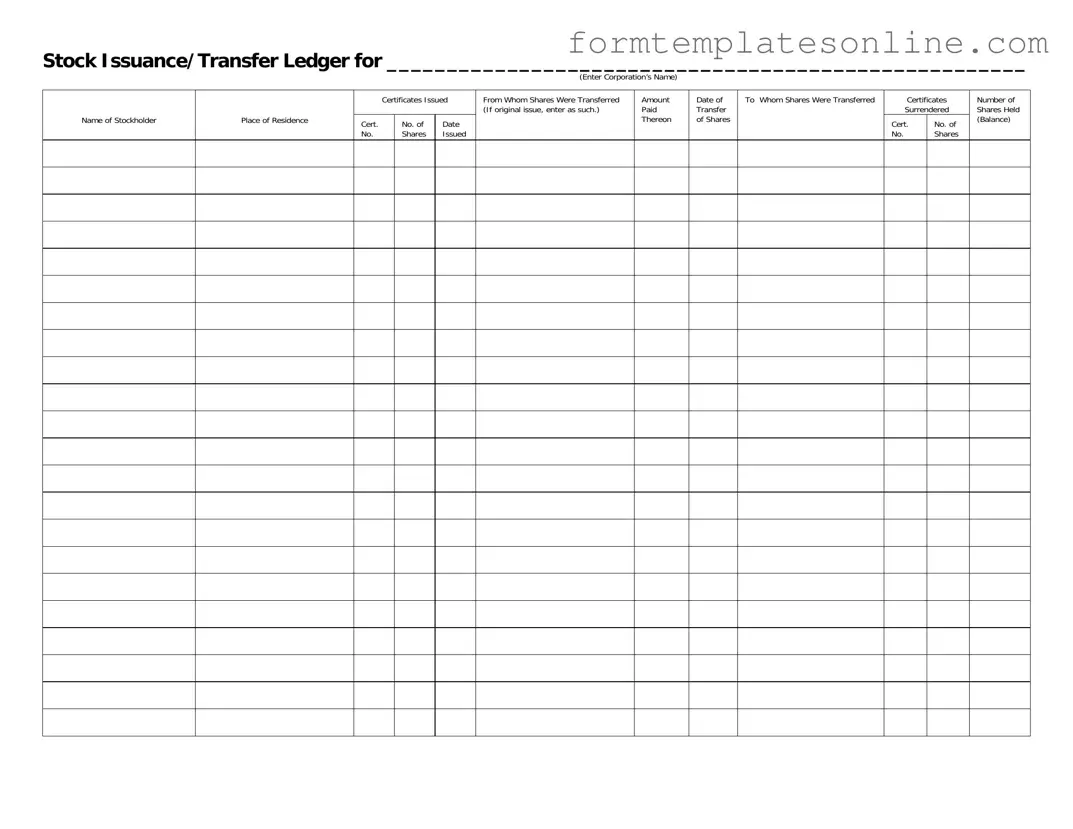

The Stock Transfer Ledger form serves a crucial role in documenting the transfer of shares within a corporation. This form captures essential details, starting with the corporation's name, ensuring that all transactions are accurately linked to the correct entity. Each stockholder's information, including their place of residence, is recorded, providing a clear record of ownership. The form lists the certificates issued, detailing the certificate numbers and the dates when shares were issued. It also specifies from whom the shares were transferred, which is particularly important for tracking the history of ownership. If the shares are part of an original issue, this is noted for clarity. Furthermore, the amount paid for the shares is documented, along with the date of transfer and the recipient of the shares. The form requires information on the certificates surrendered, which helps maintain an accurate count of the shares in circulation. Finally, it summarizes the number of shares held by the stockholder, ensuring that the ledger reflects the current balance. This comprehensive documentation helps maintain transparency and accountability in corporate share transactions.

Common mistakes

-

Incomplete Information: Many people forget to fill in all required fields. For example, failing to enter the corporation’s name or the stockholder’s name can lead to confusion and delays. Each section of the form is important for proper record-keeping.

-

Incorrect Certificate Numbers: Some individuals mistakenly enter the wrong certificate numbers. This can cause issues in tracking ownership. Always double-check the certificate numbers to ensure they match the records.

-

Missing Signatures: Signatures are often overlooked. Without a proper signature from the stockholder or the authorized party, the transfer may not be valid. Ensure that all necessary signatures are included before submitting the form.

-

Failure to Update Balances: After a transfer, it is crucial to update the number of shares held. Neglecting to adjust the balance can lead to discrepancies in ownership records. Always calculate and record the new balance accurately.

Example - Stock Transfer Ledger Form

Stock Issuance/Transfer Ledger for _____________________________________________________

(Enter Corporation’s Name)

Name of Stockholder

Place of Residence

Certificates Issued

Cert. |

No. of |

Date |

No. |

Shares |

Issued |

From Whom Shares Were Transferred (If original issue, enter as such.)

Amount

Paid

Thereon

Date of

Transfer

of Shares

To Whom Shares Were Transferred

Certificates

Surrendered

Cert. |

No. of |

No. |

Shares |

Number of Shares Held (Balance)

More About Stock Transfer Ledger

What is a Stock Transfer Ledger form?

The Stock Transfer Ledger form is a record-keeping document used by corporations to track the issuance and transfer of stock shares. It provides a detailed account of stockholders, the number of shares issued, and any transfers that occur between individuals or entities. This form is essential for maintaining accurate ownership records and ensuring compliance with corporate regulations.

What information is required on the Stock Transfer Ledger form?

The form requires specific details, including the corporation's name, the name and place of residence of the stockholder, the certificates issued, the certificate numbers, the number of shares issued, and the details of any transfers. It also asks for the amount paid for the shares, the date of transfer, and the certificates surrendered. Lastly, it includes a section for the number of shares held after the transfer.

Why is it important to maintain a Stock Transfer Ledger?

Maintaining a Stock Transfer Ledger is crucial for several reasons. First, it helps ensure that the corporation has accurate records of stock ownership, which is vital for voting rights and dividend distributions. Second, it serves as a legal document that can be referenced in case of disputes regarding ownership. Lastly, it aids in compliance with state and federal regulations governing corporate governance and reporting.

Who is responsible for completing the Stock Transfer Ledger form?

The responsibility for completing the Stock Transfer Ledger typically falls on the corporation's secretary or another designated officer. This individual must ensure that all information is accurate and up to date. It is also advisable for stockholders to verify their information periodically to avoid discrepancies.

How often should the Stock Transfer Ledger be updated?

The Stock Transfer Ledger should be updated each time there is a stock issuance or transfer. This includes recording new shares issued to stockholders, as well as any transfers of shares between individuals or entities. Keeping the ledger current helps maintain the integrity of the corporation's records and supports smooth operations.

Can the Stock Transfer Ledger be used for electronic records?

Yes, the Stock Transfer Ledger can be maintained electronically, provided that the electronic format complies with applicable laws and regulations. Many corporations opt for digital record-keeping systems, which can streamline the process of tracking stock transactions and make it easier to access and manage records. However, it is important to ensure that electronic records are secure and backed up regularly.

What should be done if there is an error in the Stock Transfer Ledger?

If an error is discovered in the Stock Transfer Ledger, it should be corrected promptly. The corporation should document the correction, including the date and nature of the change. It's essential to maintain transparency and ensure that all stockholders are informed of any adjustments that may affect their ownership status. Keeping accurate records helps prevent misunderstandings and potential legal issues.

Key takeaways

When using the Stock Transfer Ledger form, it is essential to understand its purpose and how to fill it out correctly. Here are some key takeaways:

- Accurate Information: Ensure that all fields are filled out accurately. This includes the corporation’s name, stockholder details, and specifics about the shares issued.

- Certificates Issued: Clearly indicate the certificate numbers and the number of shares issued. This information is vital for tracking ownership.

- Transfer Details: Document the date of transfer and the parties involved. It is important to note from whom the shares were transferred and to whom they are being transferred.

- Payment Information: Include the amount paid for the shares. This helps establish the value of the shares during the transfer process.

- Certificates Surrendered: Record the certificate numbers of any shares that are being surrendered as part of the transfer. This ensures that the records are up-to-date.

- Balance of Shares: Maintain a clear record of the number of shares held after the transfer. This balance is crucial for both the corporation and the stockholder.

- Regular Updates: Keep the Stock Transfer Ledger updated regularly. This practice helps prevent discrepancies and ensures accurate tracking of stock ownership.

Using the Stock Transfer Ledger form correctly will facilitate smooth transactions and maintain accurate records for all parties involved.

Form Attributes

| Fact Name | Details |

|---|---|

| Purpose | The Stock Transfer Ledger is used to document the issuance and transfer of stock shares in a corporation. |

| Required Information | Essential details include the corporation's name, stockholder's name, place of residence, and certificate information. |

| Transfer Documentation | The form captures who the shares were transferred from and to, ensuring a clear chain of ownership. |

| Governing Laws | In many states, the issuance and transfer of stock are governed by state corporate laws, such as the Delaware General Corporation Law. |

| Share Certificates | The ledger includes details about certificates issued and surrendered, which is crucial for maintaining accurate records. |

| Balance Tracking | It allows for tracking the number of shares held by each stockholder after transfers, ensuring accurate ownership records. |

| Legal Compliance | Maintaining a Stock Transfer Ledger is important for compliance with state laws and for protecting shareholder rights. |

| Accessibility | This form should be readily accessible to corporate officers and stockholders for transparency and record-keeping purposes. |

Other PDF Forms

Erc Forms - Clarify the primary financing methods available for buyers.

In Georgia, the Trailer Bill of Sale is essential for accurately documenting the sale of a trailer, safeguarding both parties in the transaction. This form not only captures vital details like the purchase price and specific trailer characteristics, but it also acts as a formal acknowledgment of the sale. For those seeking a reliable resource, OnlineLawDocs.com provides an effective platform to obtain this important legal document.

Gift Coupon Template - Help someone treat themselves with this generous gift certificate.

Dos and Don'ts

When filling out the Stock Transfer Ledger form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do enter the corporation's name clearly at the top of the form.

- Do provide accurate information for each stockholder, including their name and place of residence.

- Do ensure that the certificate numbers and the number of shares issued are correctly filled in.

- Do indicate the date of transfer clearly to avoid any confusion.

- Don't leave any fields blank; all sections must be completed to ensure validity.

- Don't use abbreviations or shorthand that may lead to misunderstandings.

- Don't forget to include the amount paid for the shares, as this information is essential.

- Don't submit the form without double-checking for errors or omissions.