Attorney-Approved Single-Member Operating Agreement Template

When establishing a single-member LLC, having a well-drafted operating agreement is essential. This document serves as the foundation for your business, outlining key aspects such as management structure, decision-making processes, and financial arrangements. A Single-Member Operating Agreement clarifies the roles and responsibilities of the owner, ensuring that personal and business liabilities remain separate. It also provides guidance on how to handle potential disputes, transfer of ownership, and dissolution of the business. By detailing these elements, the agreement not only protects the owner’s interests but also enhances the credibility of the LLC in the eyes of banks, investors, and potential partners. Understanding the significance of this form can lead to better business practices and a smoother operational flow.

Common mistakes

-

Failing to include the name of the LLC. This is crucial for identification purposes.

-

Not specifying the principal office address. This address is necessary for official correspondence.

-

Omitting the purpose of the LLC. A clear purpose helps define the business activities.

-

Using vague language in the management structure. Clearly outline whether the member will manage the LLC or appoint a manager.

-

Neglecting to include capital contributions. Specify how much the member is investing and in what form.

-

Forgetting to address profit and loss distribution. Clearly state how profits and losses will be allocated.

-

Not including provisions for amendments. This allows for future changes to the agreement if necessary.

-

Leaving out dispute resolution procedures. Having a plan in place can save time and money later.

-

Failing to provide signatures and dates. Without these, the agreement may not be legally binding.

-

Not keeping a copy of the completed agreement. Retaining a copy is essential for record-keeping and future reference.

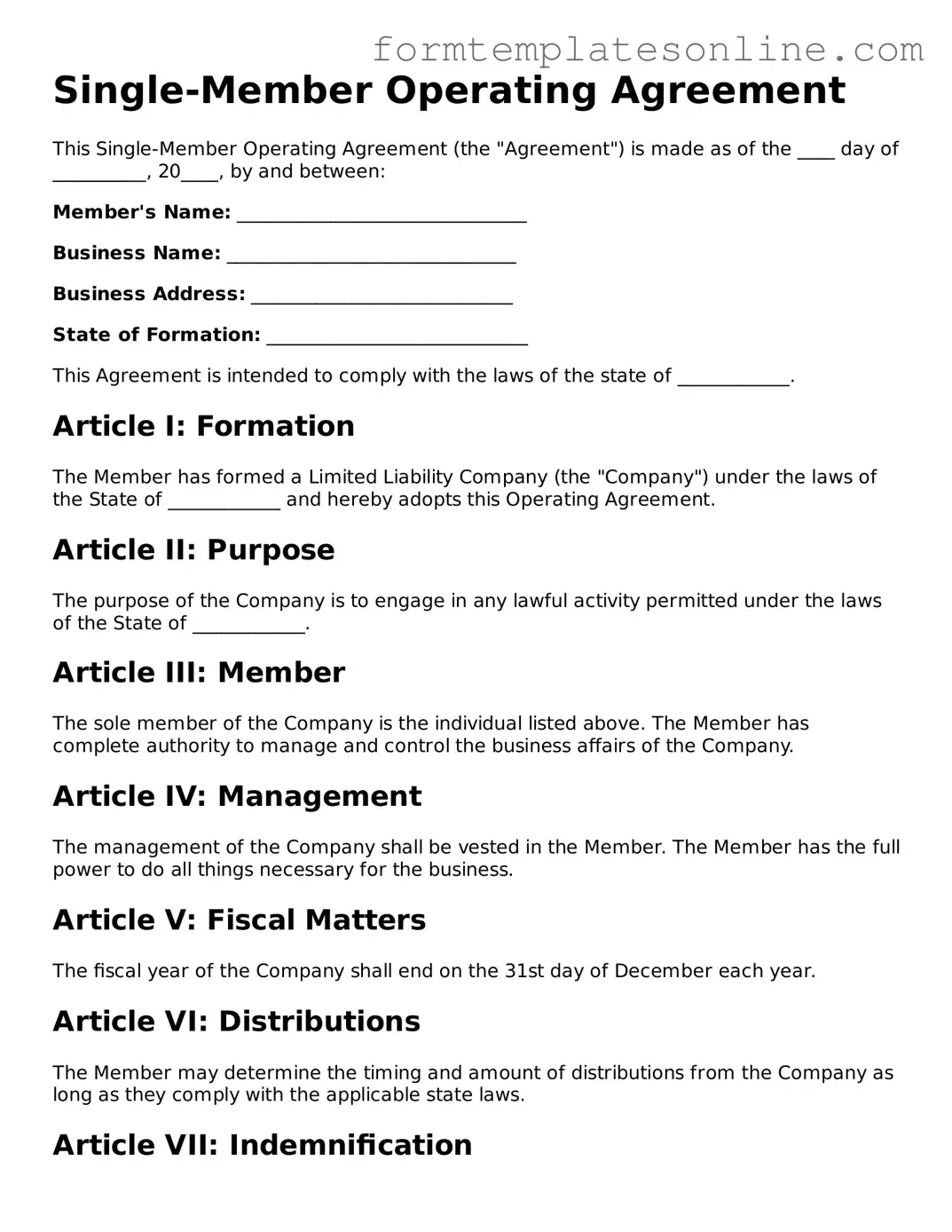

Example - Single-Member Operating Agreement Form

Single-Member Operating Agreement

This Single-Member Operating Agreement (the "Agreement") is made as of the ____ day of __________, 20____, by and between:

Member's Name: _______________________________

Business Name: _______________________________

Business Address: ____________________________

State of Formation: ____________________________

This Agreement is intended to comply with the laws of the state of ____________.

Article I: Formation

The Member has formed a Limited Liability Company (the "Company") under the laws of the State of ____________ and hereby adopts this Operating Agreement.

Article II: Purpose

The purpose of the Company is to engage in any lawful activity permitted under the laws of the State of ____________.

Article III: Member

The sole member of the Company is the individual listed above. The Member has complete authority to manage and control the business affairs of the Company.

Article IV: Management

The management of the Company shall be vested in the Member. The Member has the full power to do all things necessary for the business.

Article V: Fiscal Matters

The fiscal year of the Company shall end on the 31st day of December each year.

Article VI: Distributions

The Member may determine the timing and amount of distributions from the Company as long as they comply with the applicable state laws.

Article VII: Indemnification

The Company shall indemnify the Member against any and all expenses and liabilities incurred in connection with the business of the Company, except in cases of willful misconduct or gross negligence.

Article VIII: Amendments

This Agreement may be amended or modified only by a written agreement signed by the Member.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of ____________.

IN WITNESS WHEREOF, the Member has executed this Agreement as of the date first above written.

Member's Signature: ___________________________

Date: ___________________________

More About Single-Member Operating Agreement

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the management structure and operating procedures of a single-member limited liability company (LLC). This agreement serves as an internal guideline for the owner, detailing how the business will be run, how profits and losses will be handled, and the responsibilities of the owner. Although it is not always required by law, having this document can help protect the owner's personal assets and provide clarity in business operations.

Why is a Single-Member Operating Agreement important?

This agreement is crucial for several reasons. Firstly, it helps establish the LLC as a separate legal entity, which can shield personal assets from business liabilities. Secondly, it provides a clear framework for decision-making and operational processes, reducing potential conflicts in the future. Additionally, it can be beneficial for tax purposes and may be required by banks or investors when opening a business account or applying for loans.

What should be included in a Single-Member Operating Agreement?

A comprehensive Single-Member Operating Agreement typically includes several key components. These may consist of the business name and address, the purpose of the LLC, the ownership structure, and how profits and losses will be distributed. It may also outline the management structure, procedures for amending the agreement, and the process for dissolving the LLC if necessary. While the owner can customize these elements, clarity and detail are essential for effective governance.

Can I create a Single-Member Operating Agreement on my own?

Yes, it is possible to create a Single-Member Operating Agreement independently. There are various templates and resources available online that can guide you through the process. However, it is advisable to consult with a legal professional to ensure that the agreement complies with state laws and adequately addresses your specific business needs. This step can help prevent potential legal issues down the road.

Do I need to file the Single-Member Operating Agreement with the state?

Generally, a Single-Member Operating Agreement does not need to be filed with the state. It is an internal document meant for the owner’s records. However, some states may have specific requirements or recommendations regarding operating agreements. It is important to check your state’s regulations to ensure compliance and to understand any documentation that may need to be submitted to maintain the LLC's good standing.

Key takeaways

Here are key takeaways about filling out and using the Single-Member Operating Agreement form:

- Identify the Owner: Clearly state the name of the single member who owns the business.

- Business Purpose: Define the purpose of the business. This helps clarify the goals and operations.

- Management Structure: Specify how the business will be managed. As a single member, you have full control.

- Capital Contributions: Document any initial investments made by the member. This includes cash, property, or services.

- Profit Distribution: Outline how profits will be distributed. This can be done regularly or at the member's discretion.

- Liability Protection: Understand that this agreement helps protect personal assets from business liabilities.

- Amendments: Include a section on how changes to the agreement can be made in the future.

- Sign and Date: Ensure the agreement is signed and dated by the single member to validate it.

Using this form correctly can help establish clear guidelines for the business and protect the owner's interests.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management structure and operational guidelines for a single-member limited liability company (LLC). |

| Legal Requirement | While not always legally required, having an operating agreement is highly recommended to clarify ownership and operational procedures. |

| State-Specific Laws | Each state has its own laws governing LLCs. For example, in California, the California Corporations Code governs LLCs. |

| Ownership Clarity | This agreement helps establish clear ownership rights, ensuring that the single member has definitive control over the LLC. |

| Liability Protection | By creating an operating agreement, the member reinforces the limited liability protection of the LLC, separating personal and business assets. |

| Tax Implications | The agreement can specify how the LLC will be taxed, which may include options for pass-through taxation or corporate taxation. |

| Amendments | The operating agreement can include provisions for how changes to the agreement can be made, allowing flexibility as the business evolves. |

| Dispute Resolution | It can outline procedures for resolving disputes, which can help avoid costly legal battles in the future. |

Dos and Don'ts

When filling out the Single-Member Operating Agreement form, it’s important to follow certain guidelines. Here’s a list of what you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Do provide accurate information about your business.

- Do include your name and address clearly.

- Do specify the purpose of your business.

- Do outline the management structure, even if you are the sole member.

- Don't leave any required fields blank.

- Don't use vague language or ambiguous terms.

- Don't forget to date and sign the document.

- Don't ignore local laws that may affect your agreement.

Following these guidelines will help ensure that your Single-Member Operating Agreement is complete and effective.