Attorney-Approved Release of Promissory Note Template

When it comes to managing loans and financial agreements, clarity and proper documentation are essential. One crucial document in this realm is the Release of Promissory Note form. This form serves as a formal acknowledgment that a borrower has fulfilled their obligation to repay a loan, allowing the lender to officially release any claims against the borrower. By using this form, both parties can ensure that the terms of the loan are settled, providing peace of mind and legal protection. The document typically includes key details such as the names of the borrower and lender, the original amount of the loan, and the date of repayment. It's designed to be straightforward, making it easy for individuals to navigate the process of closing out a loan agreement. Additionally, this form can help prevent future disputes by clearly documenting that the debt has been satisfied. Understanding the importance and function of the Release of Promissory Note form is vital for anyone involved in lending or borrowing money, as it solidifies the end of a financial relationship and paves the way for new beginnings.

Common mistakes

-

Not Including All Necessary Information: One common mistake is failing to provide complete details about the parties involved. This includes names, addresses, and contact information. Omitting any of this information can lead to confusion or disputes later on.

-

Incorrectly Filling Out the Date: It's essential to ensure that the date on the form is accurate. A wrong date can affect the validity of the release. Always double-check that the date reflects when the release is actually being signed.

-

Neglecting Signatures: Forgetting to sign the form is a frequent oversight. Both parties must sign the Release of Promissory Note. Without signatures, the document may not be legally binding.

-

Not Keeping Copies: After filling out the form, some people fail to make copies for their records. Keeping a copy of the signed release is crucial in case any issues arise in the future.

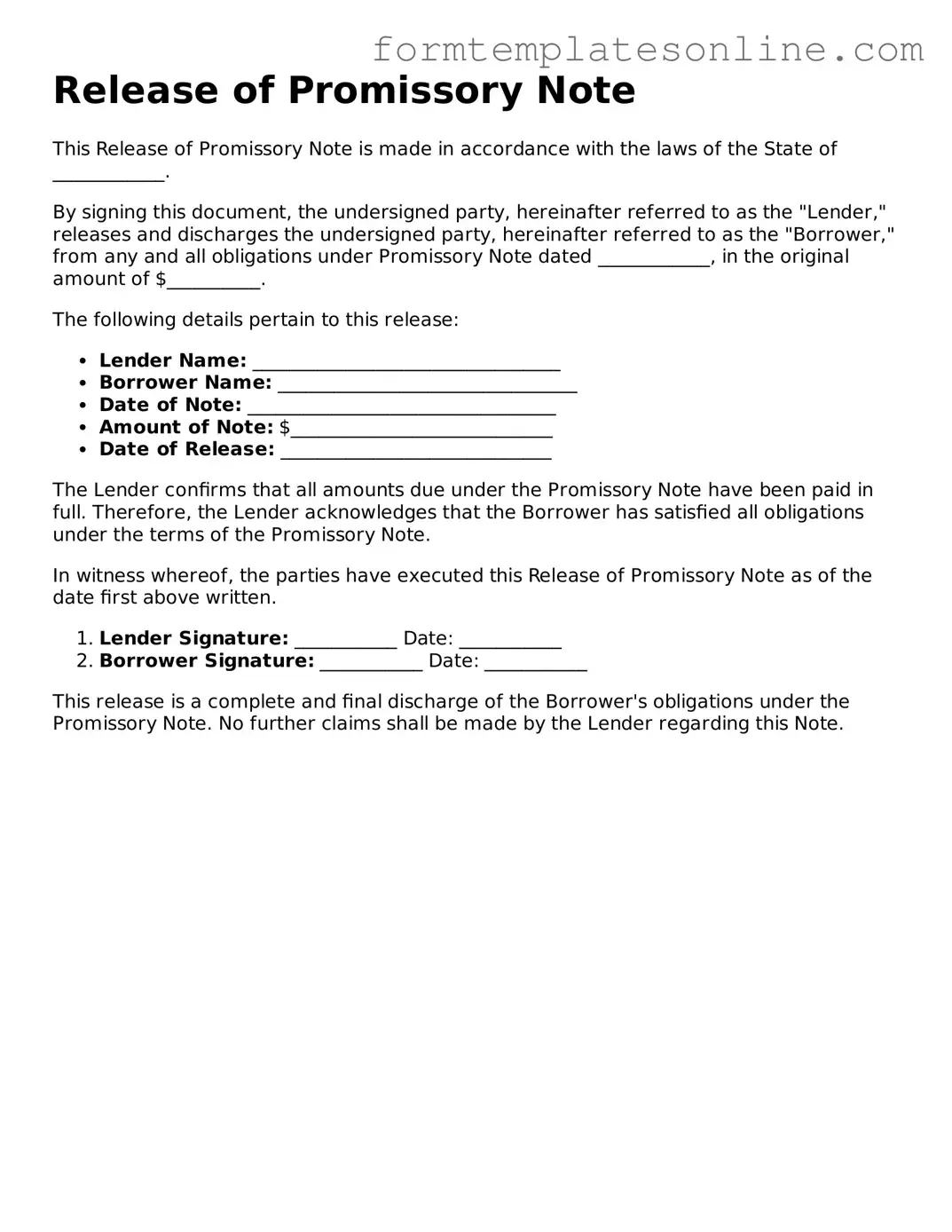

Example - Release of Promissory Note Form

Release of Promissory Note

This Release of Promissory Note is made in accordance with the laws of the State of ____________.

By signing this document, the undersigned party, hereinafter referred to as the "Lender," releases and discharges the undersigned party, hereinafter referred to as the "Borrower," from any and all obligations under Promissory Note dated ____________, in the original amount of $__________.

The following details pertain to this release:

- Lender Name: _________________________________

- Borrower Name: ________________________________

- Date of Note: _________________________________

- Amount of Note: $____________________________

- Date of Release: _____________________________

The Lender confirms that all amounts due under the Promissory Note have been paid in full. Therefore, the Lender acknowledges that the Borrower has satisfied all obligations under the terms of the Promissory Note.

In witness whereof, the parties have executed this Release of Promissory Note as of the date first above written.

- Lender Signature: ___________ Date: ___________

- Borrower Signature: ___________ Date: ___________

This release is a complete and final discharge of the Borrower's obligations under the Promissory Note. No further claims shall be made by the Lender regarding this Note.

More About Release of Promissory Note

What is a Release of Promissory Note form?

The Release of Promissory Note form is a document that formally acknowledges the repayment of a loan or debt that was secured by a promissory note. By signing this form, the lender confirms that the borrower has fulfilled their financial obligation. This release is important for the borrower as it provides proof that they no longer owe any money related to the promissory note.

When should I use the Release of Promissory Note form?

You should use the Release of Promissory Note form once the borrower has fully repaid the loan. It is crucial to complete this form to ensure that both parties have a clear understanding that the debt has been settled. This is particularly important if the borrower plans to apply for additional credit or loans in the future, as it helps to clear their financial record regarding that specific debt.

What information is required to complete the form?

To complete the Release of Promissory Note form, you will need to include the names and addresses of both the lender and the borrower. Additionally, you must provide details about the original promissory note, such as the date it was issued and the amount of the loan. Finally, both parties should sign and date the document to validate the release.

Is the Release of Promissory Note form legally binding?

Yes, the Release of Promissory Note form is legally binding once it is signed by both parties. This means that it can be used as evidence in court if any disputes arise in the future regarding the repayment of the loan. It is advisable to keep a copy of the signed form for your records, as it serves as official proof that the debt has been satisfied.

Key takeaways

When filling out and using the Release of Promissory Note form, several important points should be considered to ensure accuracy and compliance.

- The form must be completed in full, including all required signatures and dates.

- Ensure that the original promissory note is referenced correctly to avoid confusion.

- Both the borrower and lender should retain a copy of the completed form for their records.

- Filing the release with the appropriate entity, such as a county recorder's office, may be necessary.

- Review the terms of the original agreement to confirm that all obligations have been fulfilled.

- Consider having the form notarized to add an extra layer of authenticity.

- Timely submission of the release can prevent potential disputes regarding the debt status.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Release of Promissory Note form is a document that confirms the repayment of a loan and releases the borrower from further obligations. |

| Purpose | The form serves to officially document that a debt has been satisfied and the lender relinquishes any claims against the borrower. |

| Governing Law | The laws governing promissory notes vary by state. For example, in California, the relevant statutes can be found in the California Commercial Code. |

| Required Information | Typically, the form requires details such as the names of the borrower and lender, the date of the original note, and the amount paid. |

| Signatures | The release must be signed by the lender to be valid. This signature indicates the lender's agreement to release the borrower from the debt. |

| Filing | While not always required, filing the release with the appropriate state office can provide additional legal protection for the borrower. |

| Effectiveness | The release is effective immediately upon signing unless otherwise specified in the document. |

| Record Keeping | Both parties should keep a copy of the signed release for their records, as it serves as proof of the debt's satisfaction. |

More Release of Promissory Note Types:

Loan Note Template - Helps clarify both parties' rights and responsibilities in the transaction.

For individuals seeking clarity in financial agreements, the Florida Promissory Note form is crucial for accurately establishing the terms of a loan. This legal document includes necessary elements such as the repayment schedule and interest specifics, ensuring both parties are well-informed. For more information, you can refer to the essential guide on the Promissory Note form.

Dos and Don'ts

When filling out the Release of Promissory Note form, it is important to follow certain guidelines to ensure accuracy and compliance. Below are nine things to do and avoid during this process.

- Do read the form carefully before starting to fill it out.

- Do provide accurate information as required in the form.

- Do sign and date the form in the appropriate sections.

- Do keep a copy of the completed form for your records.

- Do seek assistance if you have questions about the form.

- Don't leave any required fields blank.

- Don't use white-out or make alterations to the form.

- Don't submit the form without double-checking for errors.

- Don't forget to notify the other party once the form is submitted.