Attorney-Approved Quitclaim Deed Template

A Quitclaim Deed is a legal document that plays a crucial role in real estate transactions, particularly when transferring property rights. Unlike a warranty deed, which guarantees a clear title, a quitclaim deed offers no such assurances. It simply allows the person transferring the property, known as the grantor, to relinquish any claim they may have to the property. This form is commonly used among family members, in divorce settlements, or in situations where the grantor does not want to provide warranties regarding the title. It’s important to note that while a quitclaim deed can effectively transfer ownership, it does not clear any liens or encumbrances on the property. Therefore, both parties should understand the implications of using this form. The quitclaim deed must be properly executed and recorded to be legally effective, ensuring that the new owner’s claim is recognized in public records. Understanding these key aspects will help individuals make informed decisions when considering the use of a quitclaim deed in their property transactions.

State-specific Quitclaim Deed Documents

Common mistakes

-

Incomplete Information: Failing to provide all required information, such as names, addresses, and legal descriptions of the property, can render the deed invalid.

-

Incorrect Property Description: Using vague or incorrect descriptions of the property can lead to disputes over ownership.

-

Not Notarizing the Document: A quitclaim deed must be notarized to be legally binding. Omitting this step can invalidate the deed.

-

Missing Signatures: All parties involved must sign the document. A missing signature can cause delays or complications in the transfer process.

-

Improper Execution: The deed must be executed in accordance with state laws. Failure to follow these laws can lead to legal challenges.

-

Not Recording the Deed: After completing the deed, it should be recorded with the appropriate county office. Neglecting to do so can affect the enforceability of the deed.

-

Using Outdated Forms: Utilizing outdated or incorrect forms can lead to errors. Always ensure that the latest version of the quitclaim deed is being used.

-

Ignoring Tax Implications: Failing to consider potential tax consequences of the property transfer can result in unexpected financial obligations.

-

Not Consulting Legal Advice: Skipping professional legal advice can lead to mistakes that may have been avoided with proper guidance.

-

Assuming All Quitclaim Deeds Are the Same: Each state may have different requirements and implications for quitclaim deeds. Assuming uniformity can lead to errors.

Example - Quitclaim Deed Form

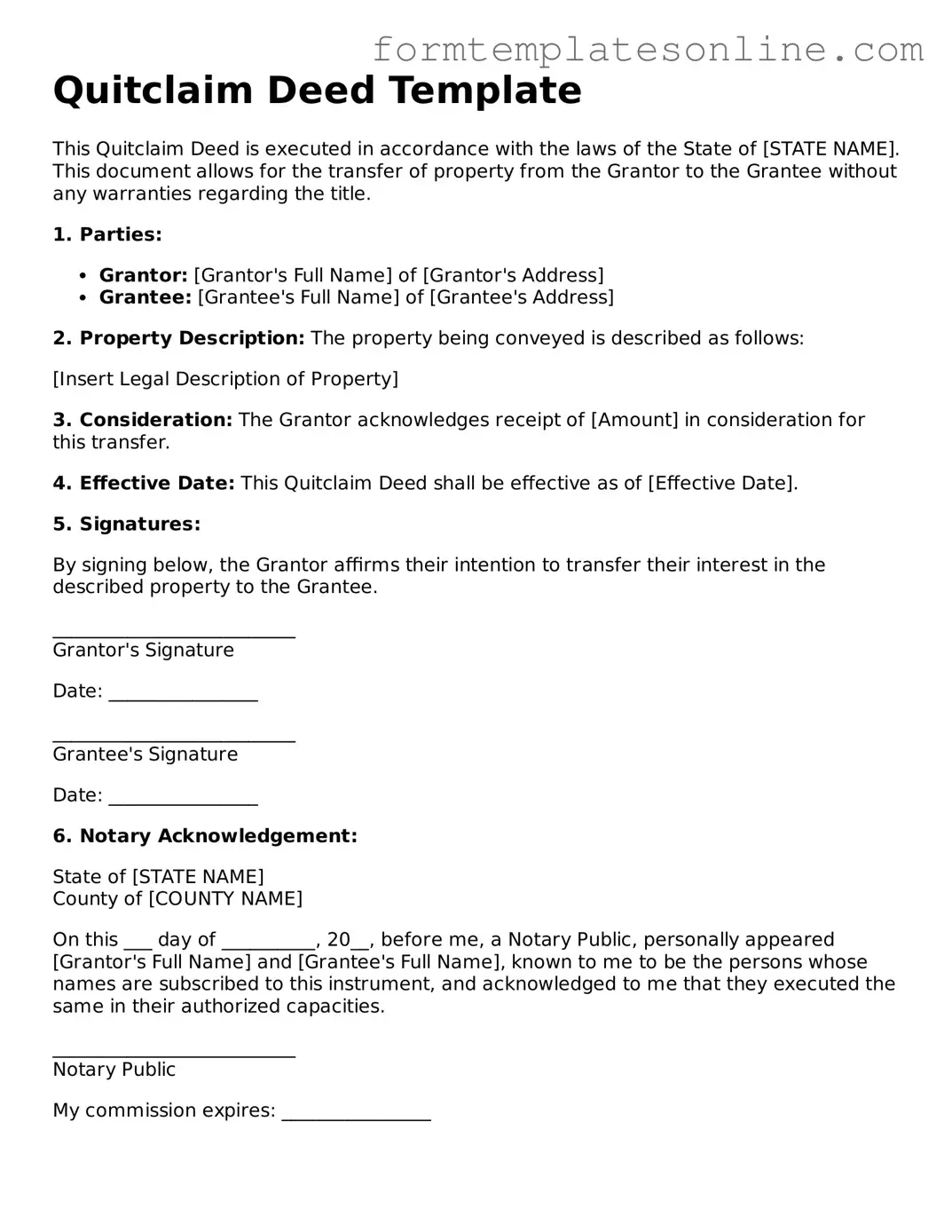

Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with the laws of the State of [STATE NAME]. This document allows for the transfer of property from the Grantor to the Grantee without any warranties regarding the title.

1. Parties:

- Grantor: [Grantor's Full Name] of [Grantor's Address]

- Grantee: [Grantee's Full Name] of [Grantee's Address]

2. Property Description: The property being conveyed is described as follows:

[Insert Legal Description of Property]

3. Consideration: The Grantor acknowledges receipt of [Amount] in consideration for this transfer.

4. Effective Date: This Quitclaim Deed shall be effective as of [Effective Date].

5. Signatures:

By signing below, the Grantor affirms their intention to transfer their interest in the described property to the Grantee.

__________________________

Grantor's Signature

Date: ________________

__________________________

Grantee's Signature

Date: ________________

6. Notary Acknowledgement:

State of [STATE NAME]

County of [COUNTY NAME]

On this ___ day of __________, 20__, before me, a Notary Public, personally appeared [Grantor's Full Name] and [Grantee's Full Name], known to me to be the persons whose names are subscribed to this instrument, and acknowledged to me that they executed the same in their authorized capacities.

__________________________

Notary Public

My commission expires: ________________

More About Quitclaim Deed

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the grantor has in the property, if any. This makes it a common choice for transferring property between family members or in divorce settlements.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in situations where the parties know each other and trust one another, such as transferring property between family members, resolving estate issues, or when one spouse is relinquishing their interest in a property during a divorce. They are also useful for clearing up title issues, such as when a person wants to remove their name from a property title.

What are the risks associated with a Quitclaim Deed?

The primary risk of using a Quitclaim Deed is the lack of warranty. The grantor does not guarantee that they own the property or that there are no liens or other claims against it. If the grantor does not actually have clear title, the grantee may end up with no legal rights to the property. It is advisable to conduct a title search or consult with a real estate attorney before executing a Quitclaim Deed.

Do I need to have the Quitclaim Deed notarized?

Yes, a Quitclaim Deed typically needs to be notarized to be legally valid. Notarization helps verify the identities of the parties involved and confirms that the document was signed willingly. Additionally, some states may have specific requirements regarding the execution and recording of the deed, so it's essential to check local laws.

How do I file a Quitclaim Deed?

To file a Quitclaim Deed, you must first complete the document accurately, ensuring all necessary information is included. After notarization, you will need to file the deed with the appropriate county recorder's office where the property is located. There may be a filing fee, so it’s wise to check with the local office for specific procedures and costs.

Can I revoke a Quitclaim Deed once it has been executed?

Once a Quitclaim Deed is executed and filed, it cannot be unilaterally revoked. However, the grantor can execute a new deed to transfer the property back or to another party. If there are concerns about the transaction, it is advisable to consult with a legal professional to explore options for addressing any issues that may arise.

Key takeaways

When filling out and using a Quitclaim Deed form, it is essential to keep several key points in mind:

- Understand the purpose: A Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear.

- Identify the parties: Clearly state the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide accurate property details: Include the property's legal description, which can usually be found in the original deed or tax records.

- Signatures are crucial: Ensure that the grantor signs the deed in front of a notary public to validate the document.

- Consider tax implications: Be aware that transferring property may have tax consequences for both parties involved.

- File with the county: After completion, the Quitclaim Deed should be filed with the local county recorder's office to make it official.

- Keep a copy: Retain a copy of the executed Quitclaim Deed for personal records and future reference.

File Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of real property from one party to another without any warranties or guarantees. |

| Usage | This type of deed is commonly used in situations such as transferring property between family members or clearing up title issues. |

| State-Specific Forms | Each state may have its own specific quitclaim deed form, which must be used to comply with local laws. |

| Governing Law | In the United States, quitclaim deeds are governed by state property laws, which can vary significantly from one state to another. |

| Consideration | While a quitclaim deed can be executed without monetary exchange, some states require a nominal consideration, such as $1, to validate the transfer. |

| Liabilities | The grantor of a quitclaim deed is not liable for any issues related to the property after the transfer is complete. |

| Recording | To protect the interests of the grantee, it is advisable to record the quitclaim deed with the local county recorder's office. |

| Tax Implications | Property transfers via quitclaim deeds may have tax implications, including potential gift taxes if the transfer is not for fair market value. |

| Title Insurance | Obtaining title insurance is generally not possible with a quitclaim deed since it does not guarantee clear title. |

| Revocation | A quitclaim deed cannot be revoked once it has been executed and recorded, making it a permanent transfer of ownership. |

More Quitclaim Deed Types:

What Is a Deed in Lieu of Foreclosure - Potential tax implications may arise from accepting or surrendering a property via Deed in Lieu, requiring careful consideration.

For those looking to navigate firearm transactions smoothly, the Florida Firearm Bill of Sale is invaluable in facilitating ownership transfer. It is crucial to use a legal Florida firearm bill of sale document to ensure all necessary details are accurately captured and legally acknowledged.

Title Companies and Transfer on Death Deeds - There is often a simple process for filing this deed with the appropriate county office.

Dos and Don'ts

When filling out a Quitclaim Deed form, it is essential to ensure accuracy and compliance with legal requirements. Here are four important dos and don'ts to consider:

- Do provide complete and accurate information about the property and the parties involved.

- Do ensure that the form is signed in the presence of a notary public.

- Don't leave any sections blank; incomplete forms may be rejected.

- Don't forget to check local laws for any specific requirements regarding Quitclaim Deeds.