Attorney-Approved Promissory Note for a Car Template

When purchasing a car, understanding the financial agreements involved is crucial for both buyers and sellers. One key document that often comes into play is the Promissory Note for a Car. This form serves as a written promise from the buyer to repay a specified amount of money to the seller, typically over a set period. It outlines important details such as the purchase price, interest rate, payment schedule, and consequences of defaulting on payments. By clearly defining the terms of the loan, this note helps protect the interests of both parties involved in the transaction. Additionally, it may include provisions for late fees, prepayment options, and what happens in the event of a dispute. Understanding these components can empower buyers to make informed decisions while ensuring sellers receive the compensation they are owed. With the right knowledge, navigating the complexities of car financing becomes a more straightforward process.

Common mistakes

-

Incomplete Information: One common mistake is leaving out essential details, such as the names of the borrower and lender. Ensure that all parties are clearly identified.

-

Incorrect Loan Amount: Some individuals mistakenly write down the wrong loan amount. Double-check that the figure matches the agreed-upon sum.

-

Missing Interest Rate: Failing to include an interest rate can lead to confusion. Specify whether the loan is interest-free or state the agreed rate.

-

Vague Repayment Terms: Not outlining clear repayment terms can cause misunderstandings. Detail the payment schedule, including due dates and amounts.

-

Not Including a Late Fee Clause: Omitting a late fee clause may lead to difficulties if payments are missed. Consider specifying penalties for late payments.

-

Ignoring Signatures: A promissory note is not valid without the signatures of both parties. Ensure all necessary signatures are present before finalizing the document.

-

Neglecting to Date the Document: Forgetting to include the date can create ambiguity. Always date the note to establish when the agreement was made.

-

Not Keeping Copies: Failing to make copies of the signed document can lead to disputes later. Retain copies for both the borrower and lender.

-

Forgetting to Review State Laws: Each state has specific requirements for promissory notes. It’s crucial to be aware of local laws to ensure compliance.

-

Relying on Oral Agreements: Assuming that verbal agreements suffice can be a mistake. Always put the terms in writing to avoid future conflicts.

Example - Promissory Note for a Car Form

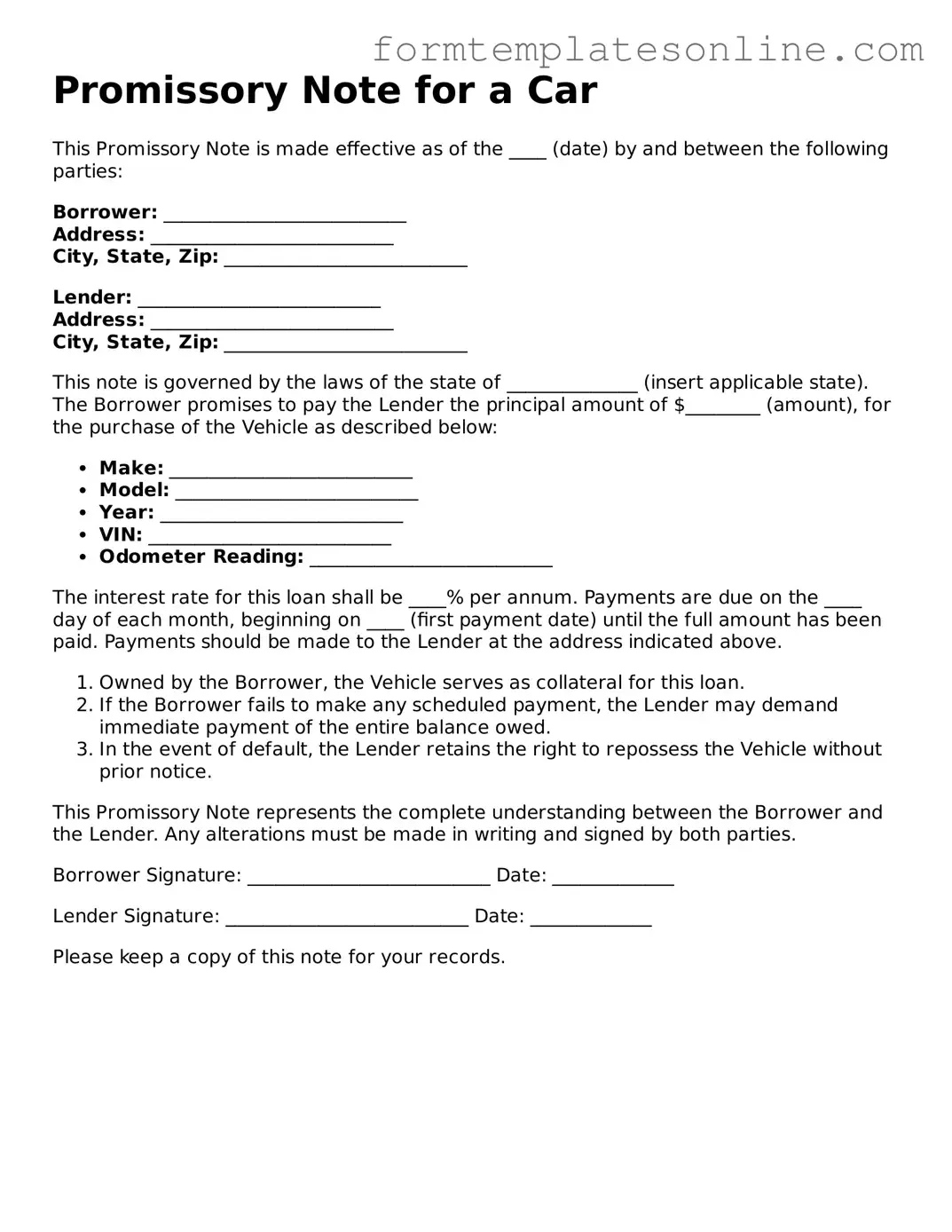

Promissory Note for a Car

This Promissory Note is made effective as of the ____ (date) by and between the following parties:

Borrower: __________________________

Address: __________________________

City, State, Zip: __________________________

Lender: __________________________

Address: __________________________

City, State, Zip: __________________________

This note is governed by the laws of the state of ______________ (insert applicable state). The Borrower promises to pay the Lender the principal amount of $________ (amount), for the purchase of the Vehicle as described below:

- Make: __________________________

- Model: __________________________

- Year: __________________________

- VIN: __________________________

- Odometer Reading: __________________________

The interest rate for this loan shall be ____% per annum. Payments are due on the ____ day of each month, beginning on ____ (first payment date) until the full amount has been paid. Payments should be made to the Lender at the address indicated above.

- Owned by the Borrower, the Vehicle serves as collateral for this loan.

- If the Borrower fails to make any scheduled payment, the Lender may demand immediate payment of the entire balance owed.

- In the event of default, the Lender retains the right to repossess the Vehicle without prior notice.

This Promissory Note represents the complete understanding between the Borrower and the Lender. Any alterations must be made in writing and signed by both parties.

Borrower Signature: __________________________ Date: _____________

Lender Signature: __________________________ Date: _____________

Please keep a copy of this note for your records.

More About Promissory Note for a Car

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines the borrower's promise to repay a loan used to purchase a vehicle. This note details the loan amount, interest rate, repayment schedule, and any consequences for late payments or default. It serves as a binding agreement between the lender and borrower, ensuring both parties understand their obligations.

Who needs a Promissory Note for a Car?

If you are financing the purchase of a car through a private seller or individual, a Promissory Note is essential. It protects both the buyer and seller by clearly stating the terms of the loan. Even if you are purchasing from a dealership, you may still want a Promissory Note to formalize any additional financing arrangements outside of the dealership's financing options.

What information should be included in the Promissory Note?

The Promissory Note should include the following key information: the names and addresses of both the borrower and lender, the total loan amount, the interest rate, the repayment schedule (including due dates), and any penalties for late payments. It should also specify whether the loan is secured or unsecured, and if secured, details about the collateral (the car itself).

What happens if I default on the Promissory Note?

If you default on the Promissory Note, the lender has the right to take action to recover the owed amount. This may include repossessing the vehicle if it is secured by the loan. Additionally, defaulting can negatively impact your credit score, making it harder to obtain future loans. It is crucial to communicate with the lender if you anticipate any issues with repayment.

Can I modify the terms of the Promissory Note after it is signed?

Key takeaways

When it comes to financing a vehicle, understanding the Promissory Note for a Car is essential. This document outlines the terms of a loan agreement between the borrower and the lender. Here are some key takeaways to consider:

- Define the Loan Amount: Clearly state the total amount being borrowed. This figure is crucial as it sets the foundation for the agreement.

- Interest Rate: Specify the interest rate applicable to the loan. This rate determines how much extra you will pay over time.

- Repayment Schedule: Outline when payments are due. A clear schedule helps both parties understand their obligations.

- Late Payment Penalties: Include any penalties for late payments. Knowing the consequences can encourage timely payments.

- Collateral Description: Describe the car being financed. This identifies what is at stake should the borrower default on the loan.

- Signatures Required: Ensure that both parties sign the document. Signatures signify agreement and commitment to the terms outlined.

- Legal Considerations: Be aware that this document is a legally binding contract. Understanding its implications is vital for both parties.

- Keep Copies: After filling out the form, make copies for both the lender and borrower. This ensures that both parties have access to the same information.

- Consult a Professional: If unsure about any terms or conditions, seek advice from a legal professional. This can prevent misunderstandings down the line.

By keeping these points in mind, you can navigate the process of filling out and using a Promissory Note for a Car with confidence. Understanding your responsibilities and rights will help ensure a smoother transaction.

File Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount of money to the lender in exchange for financing the purchase of a vehicle. |

| Purpose | This document serves as a legal agreement between the buyer and the lender, detailing the terms of the loan. |

| Interest Rate | The note typically specifies an interest rate, which can be fixed or variable, affecting the total amount repaid. |

| Payment Schedule | It outlines the payment schedule, including the frequency of payments (monthly, bi-weekly, etc.) and the total duration of the loan. |

| State-Specific Forms | Each state may have specific requirements for promissory notes, so it's essential to use the correct form according to local laws. |

| Governing Laws | In the U.S., the Uniform Commercial Code (UCC) governs promissory notes, but state laws can also apply. |

| Default Terms | The note should include terms that define what happens in the event of a default, including late fees or repossession of the vehicle. |

| Signatures | Both the borrower and lender must sign the note for it to be legally binding, indicating their agreement to the terms. |

| Amendments | Any changes to the original terms must be documented and agreed upon by both parties to remain valid. |

More Promissory Note for a Car Types:

Satisfaction and Release Form - Protects against potential future claims on the same debt.

The Florida Promissory Note is a key document that ensures both parties have a clear understanding of their agreement. For those interested in crafting this essential document, our guide on the process of creating a comprehensive Promissory Note form is invaluable. You can find more information at crafting a comprehensive Promissory Note.

Dos and Don'ts

When filling out the Promissory Note for a Car form, it is important to follow specific guidelines to ensure accuracy and clarity. Below are some dos and don'ts to consider.

- Do provide accurate personal information, including your full name and address.

- Do clearly state the loan amount and the interest rate.

- Do include the repayment schedule, specifying due dates and amounts.

- Do read the entire document carefully before signing.

- Don't leave any sections blank; fill in all required fields.

- Don't use unclear language or abbreviations that may cause confusion.

- Don't forget to keep a copy of the signed note for your records.