Attorney-Approved Promissory Note Template

The Promissory Note form serves as a crucial document in financial transactions, facilitating agreements between lenders and borrowers. This form outlines the borrower's commitment to repay a specified sum of money to the lender, detailing the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments. It provides clarity on the obligations of both parties, ensuring that expectations are aligned from the outset. Additionally, the Promissory Note may include provisions for collateral, which offers the lender security in case of default. Understanding the essential elements of this form is vital for anyone involved in lending or borrowing, as it protects the rights of both parties and helps to prevent misunderstandings. By clearly stating the terms and conditions, the Promissory Note fosters trust and accountability, making it an indispensable tool in personal and business finance.

State-specific Promissory Note Documents

Promissory Note Document Types

Common mistakes

-

Incomplete Information: One common mistake is leaving out essential details. Borrowers often forget to include their full name, address, or the date. Each piece of information is crucial for identifying the parties involved.

-

Incorrect Loan Amount: It's important to double-check the loan amount. Some individuals miswrite the figure, which can lead to confusion and disputes later on.

-

Missing Signatures: A promissory note must be signed by all parties. Neglecting to sign can render the document invalid, making it difficult to enforce the agreement.

-

Vague Terms: Clarity is key. Some people use vague language when describing repayment terms or interest rates. This can create misunderstandings about the obligations of each party.

-

Ignoring State Laws: Each state has specific laws governing promissory notes. Failing to comply with these regulations can lead to legal issues down the line.

-

Not Keeping Copies: After filling out the form, it's essential to keep copies for both the lender and borrower. Without proper documentation, tracking payments or resolving disputes can become complicated.

Example - Promissory Note Form

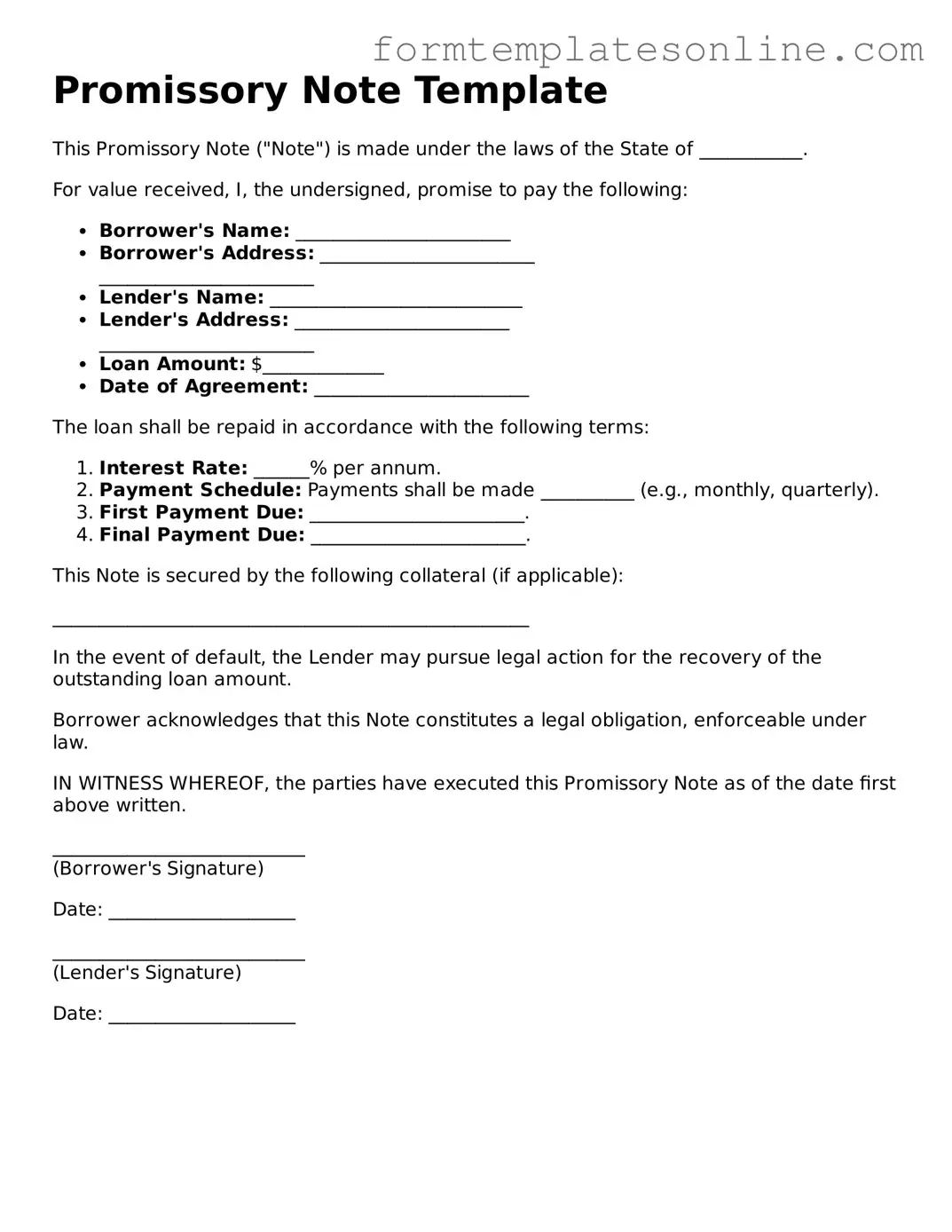

Promissory Note Template

This Promissory Note ("Note") is made under the laws of the State of ___________.

For value received, I, the undersigned, promise to pay the following:

- Borrower's Name: _______________________

- Borrower's Address: _______________________

_______________________ - Lender's Name: ___________________________

- Lender's Address: _______________________

_______________________ - Loan Amount: $_____________

- Date of Agreement: _______________________

The loan shall be repaid in accordance with the following terms:

- Interest Rate: ______% per annum.

- Payment Schedule: Payments shall be made __________ (e.g., monthly, quarterly).

- First Payment Due: _______________________.

- Final Payment Due: _______________________.

This Note is secured by the following collateral (if applicable):

___________________________________________________

In the event of default, the Lender may pursue legal action for the recovery of the outstanding loan amount.

Borrower acknowledges that this Note constitutes a legal obligation, enforceable under law.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

___________________________

(Borrower's Signature)

Date: ____________________

___________________________

(Lender's Signature)

Date: ____________________

More About Promissory Note

What is a Promissory Note?

A Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a defined time or on demand. It outlines the terms of the loan, including the interest rate, repayment schedule, and any penalties for late payments. This document serves as a legal record of the agreement between the borrower and the lender.

Who uses a Promissory Note?

Individuals and businesses often use Promissory Notes when borrowing or lending money. For example, a person might use one when taking out a personal loan from a friend or family member. Similarly, businesses may issue Promissory Notes to secure financing from investors or banks. It is a versatile tool that can be tailored to fit various lending situations.

What are the key components of a Promissory Note?

A typical Promissory Note includes several essential components. These are the names of the borrower and lender, the principal amount borrowed, the interest rate, the repayment terms, and the maturity date. Additionally, it may specify any collateral securing the loan and outline the rights of both parties in case of default. Each of these elements plays a crucial role in ensuring clarity and protecting the interests of both parties involved.

What happens if the borrower defaults on the Promissory Note?

If the borrower fails to make payments as agreed, the lender has the right to take certain actions. This may include charging late fees, pursuing legal action to recover the owed amount, or seizing any collateral specified in the note. It is important for both parties to understand their rights and responsibilities to avoid misunderstandings and potential disputes.

Key takeaways

When filling out and using a Promissory Note form, keep these key takeaways in mind:

- Clearly define the loan terms. Specify the amount borrowed, interest rate, and repayment schedule. Ambiguity can lead to disputes.

- Include both parties' information. Ensure that the names and addresses of the borrower and lender are accurate and complete.

- Consider legal requirements. Some states may have specific laws governing promissory notes, including required disclosures or formalities.

- Keep a copy for your records. After signing, both parties should retain a signed copy of the note for future reference.

File Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Parties Involved | Typically, a promissory note involves two parties: the maker (borrower) and the payee (lender). |

| Governing Law | In the U.S., the Uniform Commercial Code (UCC) governs promissory notes, with specific state laws applying. |

| Essential Elements | A valid promissory note must include the amount, interest rate, payment schedule, and signatures of the parties. |

| Types | Promissory notes can be secured (backed by collateral) or unsecured (not backed by any asset). |

| Transferability | Promissory notes are generally negotiable, meaning they can be transferred to another party through endorsement. |

| Enforceability | A promissory note is legally enforceable, provided it meets the necessary legal requirements. |

| Default Consequences | If the maker defaults, the payee may have the right to pursue legal action to recover the owed amount. |

| State Variations | Each state may have unique requirements and forms for promissory notes, influenced by local laws. |

Other Templates:

Western Union Receipt Generator - Look out for updates regarding the status of your transfer.

A Michigan Non-disclosure Agreement form is a legal document used to protect sensitive information. When signed, it prevents parties from sharing any confidential details specified in the agreement. It's a critical tool for businesses and individuals in Michigan looking to safeguard their proprietary information or trade secrets. For more information on this topic, you can visit OnlineLawDocs.com.

Bill of Sale Mobile Home - Promotes transparency in the buying and selling process of mobile homes.

Dos and Don'ts

When filling out a Promissory Note form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do include the full names and addresses of both the borrower and the lender.

- Do specify the loan amount clearly and accurately.

- Do state the interest rate, if applicable, and whether it is fixed or variable.

- Do outline the repayment schedule, including due dates and payment amounts.

- Do ensure that all parties sign and date the document.

- Don't leave any blank spaces on the form; fill in all required information.

- Don't use ambiguous language; be clear and specific in your terms.

- Don't forget to keep a copy of the signed Promissory Note for your records.

- Don't ignore local laws that may affect the terms of the note.