Attorney-Approved Prenuptial Agreement Template

When couples decide to marry, they often consider a variety of factors that will influence their future together. One important aspect that can help clarify financial expectations and responsibilities is the prenuptial agreement, commonly referred to as a prenup. This legal document outlines the distribution of assets and debts in the event of a divorce or separation, providing a framework for both parties. It typically addresses issues such as property ownership, spousal support, and the handling of joint debts. By discussing these matters before marriage, couples can foster open communication and reduce potential conflicts down the road. Additionally, a prenup can protect individual assets acquired before the marriage and ensure that both partners understand their rights and obligations. While some may view prenuptial agreements as unromantic, they can serve as a practical tool for establishing a solid foundation for a lasting partnership.

State-specific Prenuptial Agreement Documents

Common mistakes

-

Not Disclosing All Assets: One common mistake is failing to fully disclose all assets. Transparency is crucial. Hiding or omitting property can lead to disputes later.

-

Using Ambiguous Language: Vague terms can create confusion. Clear and specific language is essential to ensure both parties understand their rights and obligations.

-

Neglecting to Update the Agreement: Life changes, such as new assets or children, may require updates. Regularly reviewing the agreement can prevent future issues.

-

Not Seeking Legal Advice: Skipping professional guidance can lead to mistakes. Each party should consult an attorney to ensure the agreement is fair and enforceable.

-

Rushing the Process: Taking time is important. Hurrying through the process can result in overlooked details and potential conflicts.

-

Ignoring State Laws: Each state has different laws regarding prenuptial agreements. Understanding local regulations is vital for creating a valid document.

Example - Prenuptial Agreement Form

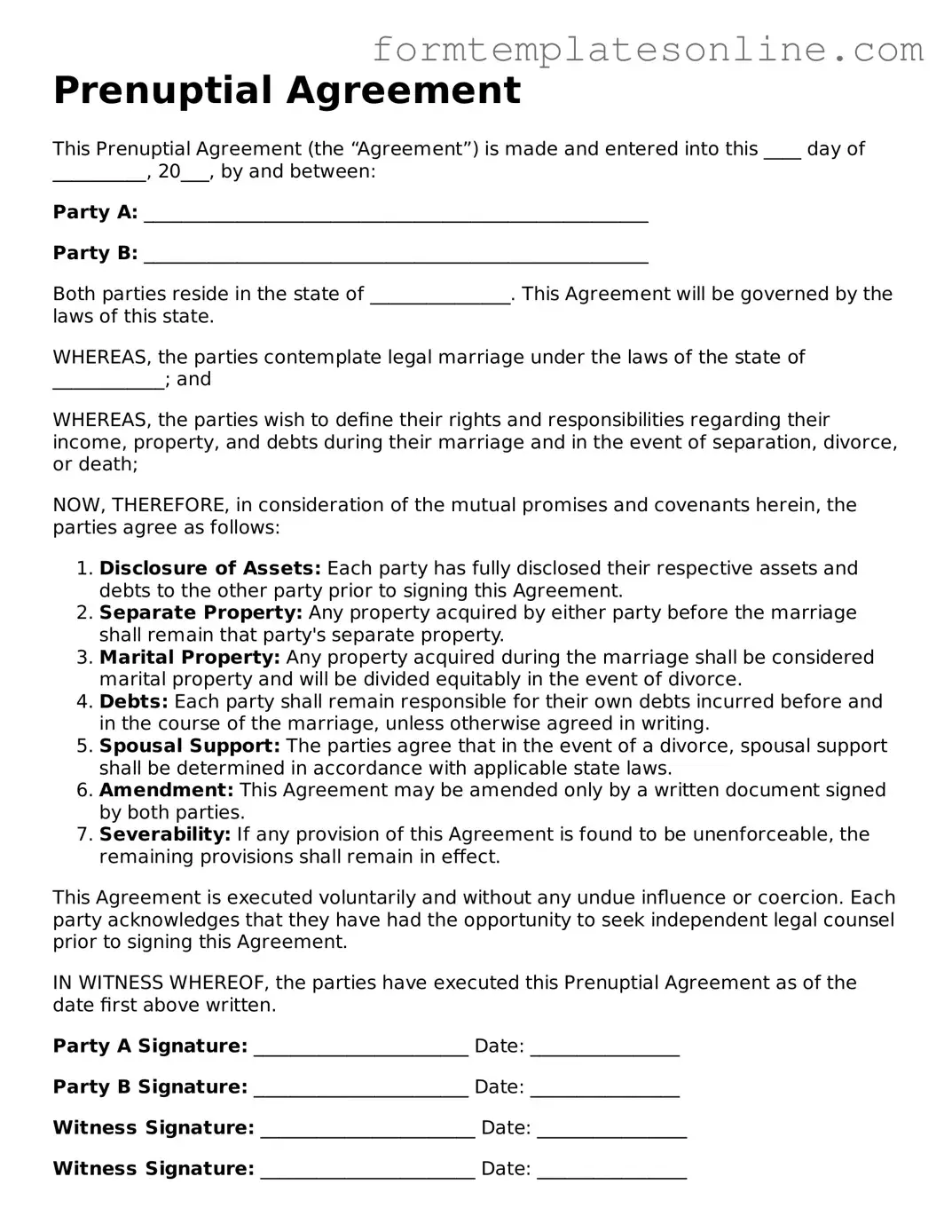

Prenuptial Agreement

This Prenuptial Agreement (the “Agreement”) is made and entered into this ____ day of __________, 20___, by and between:

Party A: ______________________________________________________

Party B: ______________________________________________________

Both parties reside in the state of _______________. This Agreement will be governed by the laws of this state.

WHEREAS, the parties contemplate legal marriage under the laws of the state of ____________; and

WHEREAS, the parties wish to define their rights and responsibilities regarding their income, property, and debts during their marriage and in the event of separation, divorce, or death;

NOW, THEREFORE, in consideration of the mutual promises and covenants herein, the parties agree as follows:

- Disclosure of Assets: Each party has fully disclosed their respective assets and debts to the other party prior to signing this Agreement.

- Separate Property: Any property acquired by either party before the marriage shall remain that party's separate property.

- Marital Property: Any property acquired during the marriage shall be considered marital property and will be divided equitably in the event of divorce.

- Debts: Each party shall remain responsible for their own debts incurred before and in the course of the marriage, unless otherwise agreed in writing.

- Spousal Support: The parties agree that in the event of a divorce, spousal support shall be determined in accordance with applicable state laws.

- Amendment: This Agreement may be amended only by a written document signed by both parties.

- Severability: If any provision of this Agreement is found to be unenforceable, the remaining provisions shall remain in effect.

This Agreement is executed voluntarily and without any undue influence or coercion. Each party acknowledges that they have had the opportunity to seek independent legal counsel prior to signing this Agreement.

IN WITNESS WHEREOF, the parties have executed this Prenuptial Agreement as of the date first above written.

Party A Signature: _______________________ Date: ________________

Party B Signature: _______________________ Date: ________________

Witness Signature: _______________________ Date: ________________

Witness Signature: _______________________ Date: ________________

More About Prenuptial Agreement

What is a prenuptial agreement?

A prenuptial agreement, often referred to as a "prenup," is a legal document that couples create before they get married. It outlines how assets and debts will be divided in the event of a divorce or separation. This agreement can provide clarity and protection for both parties, ensuring that individual financial interests are safeguarded.

Who should consider a prenuptial agreement?

Anyone entering into marriage may want to consider a prenuptial agreement, especially those with significant assets, business interests, or children from previous relationships. It can be particularly beneficial for individuals who wish to protect their wealth or ensure that their financial responsibilities are clearly defined.

What can be included in a prenuptial agreement?

Many aspects can be addressed in a prenup. Common provisions include the division of property, debt responsibilities, spousal support, and the handling of assets acquired during the marriage. Couples can also include clauses regarding the management of joint finances and how to address future financial situations.

Is a prenuptial agreement legally binding?

Yes, a prenuptial agreement can be legally binding if it meets certain requirements. Both parties must enter into the agreement voluntarily, and it should be fair and reasonable at the time of signing. Additionally, full financial disclosure is essential. It’s advisable to have the agreement reviewed by legal professionals to ensure its enforceability.

Can a prenuptial agreement be changed after marriage?

Yes, a prenuptial agreement can be modified after marriage, but both parties must agree to the changes. This typically involves drafting a new document or an amendment to the existing prenup. Just like the original agreement, any changes should be made voluntarily and with full disclosure of financial information.

What happens if a couple does not have a prenuptial agreement?

If a couple does not have a prenuptial agreement and later divorces, state laws will govern the division of assets and debts. This can lead to uncertainty and disputes, as the court will determine how to split property based on various factors, including the length of the marriage and each spouse's financial contributions.

How do I create a prenuptial agreement?

Creating a prenuptial agreement typically involves several steps. First, both parties should discuss their financial goals and concerns. Next, it is wise to consult with separate attorneys who can provide guidance and ensure that each person's interests are represented. Finally, the agreement should be drafted, reviewed, and signed well before the wedding to avoid any claims of coercion.

Are prenuptial agreements only for wealthy individuals?

No, prenuptial agreements are not solely for the wealthy. They can benefit anyone who wants to clarify financial responsibilities and protect individual assets. Regardless of financial status, a prenup can help couples navigate potential conflicts and promote open communication about money matters.

How can a prenuptial agreement help in case of divorce?

A prenuptial agreement can significantly streamline the divorce process. By clearly outlining how assets and debts will be divided, it can reduce disputes and lengthy court battles. This clarity can lead to a more amicable separation, allowing both parties to move forward with less stress and uncertainty.

Key takeaways

Filling out and using a Prenuptial Agreement form can be a significant step for couples planning to marry. Here are some key takeaways to consider:

- Understanding Purpose: A prenuptial agreement outlines how assets will be divided in the event of a divorce. It can provide clarity and peace of mind for both partners.

- Open Communication: Discussing the terms of the agreement openly can strengthen the relationship. Both partners should feel comfortable expressing their needs and concerns.

- Full Disclosure: It is essential for both parties to fully disclose their financial situations. This transparency helps ensure that the agreement is fair and legally binding.

- Legal Guidance: Consulting with a lawyer is advisable. A legal professional can help draft the agreement and ensure it complies with state laws.

- Timing Matters: It’s best to finalize the agreement well before the wedding. Rushing through this process can lead to misunderstandings or disputes later on.

- Review Regularly: Life circumstances change, so reviewing the agreement periodically is wise. This can help ensure that it remains relevant as financial situations evolve.

- Consider Emotional Aspects: A prenuptial agreement can feel uncomfortable. Acknowledging the emotional side of this process is important for both partners.

- State Variations: Laws regarding prenuptial agreements can vary by state. Understanding local regulations can help in drafting a valid agreement.

By keeping these key points in mind, couples can navigate the process of creating a prenuptial agreement with greater ease and confidence.

File Details

| Fact Name | Description |

|---|---|

| Definition | A prenuptial agreement is a legal contract created by two individuals before they marry, outlining the division of assets and financial responsibilities in the event of divorce or separation. |

| Governing Law | The laws governing prenuptial agreements vary by state. For example, in California, the Family Code governs these agreements, while in New York, the Domestic Relations Law applies. |

| Enforceability | For a prenuptial agreement to be enforceable, it must be in writing, signed by both parties, and executed voluntarily without coercion or fraud. |

| Disclosure Requirements | Full financial disclosure is typically required. Both parties should provide complete information about their assets and debts to ensure fairness and transparency. |

Other Templates:

Who Can Write Esa Letters - Written by a licensed professional, the letter is a straightforward way to communicate the need for emotional support in housing applications.

A West Virginia Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date. This legal document outlines the terms of the loan, including interest rates and payment schedules, ensuring clarity and protection for both the borrower and lender. If you're ready to formalize a loan agreement, consider filling out the Promissory Note form by clicking the button below.

Load Calculation for House - Fosters collaboration among building professionals and tradespeople.

Broker Price Opinion Letter Pdf - Assess how local developments may affect property value over time.

Dos and Don'ts

When preparing to fill out a Prenuptial Agreement form, there are important guidelines to follow to ensure clarity and fairness. Here’s a list of things you should and shouldn't do:

- Do communicate openly with your partner about your expectations and concerns.

- Do seek legal advice to understand the implications of the agreement.

- Do be honest about your assets and debts to promote transparency.

- Do ensure that both parties have adequate time to review the agreement before signing.

- Don't rush the process; take the time needed to discuss all terms thoroughly.

- Don't hide any financial information or assets, as this can lead to disputes later.

- Don't use overly complex language that may confuse either party.

- Don't forget to revisit the agreement periodically, especially if circumstances change.