Valid Transfer-on-Death Deed Form for Pennsylvania

The Pennsylvania Transfer-on-Death Deed form is a valuable estate planning tool that allows property owners to transfer real estate to their chosen beneficiaries upon their death, without the need for probate. This form simplifies the transfer process, ensuring that your loved ones receive your property directly, thus avoiding the complexities and delays often associated with probate proceedings. By utilizing this deed, you maintain full control of your property during your lifetime; you can sell, mortgage, or change your mind about the beneficiaries at any time. Importantly, the Transfer-on-Death Deed must be properly executed and recorded to be effective, ensuring that your intentions are clearly documented and legally binding. Understanding the nuances of this form can help you make informed decisions about your estate and provide peace of mind knowing that your wishes will be honored after you pass away.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to accurately describe the property. The legal description must be precise. Omitting details can lead to confusion or disputes later.

-

Not Including All Owners: If there are multiple owners of the property, all must be included on the deed. Leaving someone out can invalidate the transfer.

-

Failure to Sign: The deed must be signed by the owner. Forgetting to sign or having the wrong person sign can render the deed ineffective.

-

Not Having Witnesses: Pennsylvania requires that the deed be witnessed. Skipping this step can lead to issues with the deed's validity.

-

Improper Notarization: The deed must be notarized correctly. If the notary does not follow proper procedures, the deed may not be accepted.

-

Failing to Record the Deed: After completing the deed, it must be recorded with the county. Neglecting this step means the transfer may not be recognized by the state.

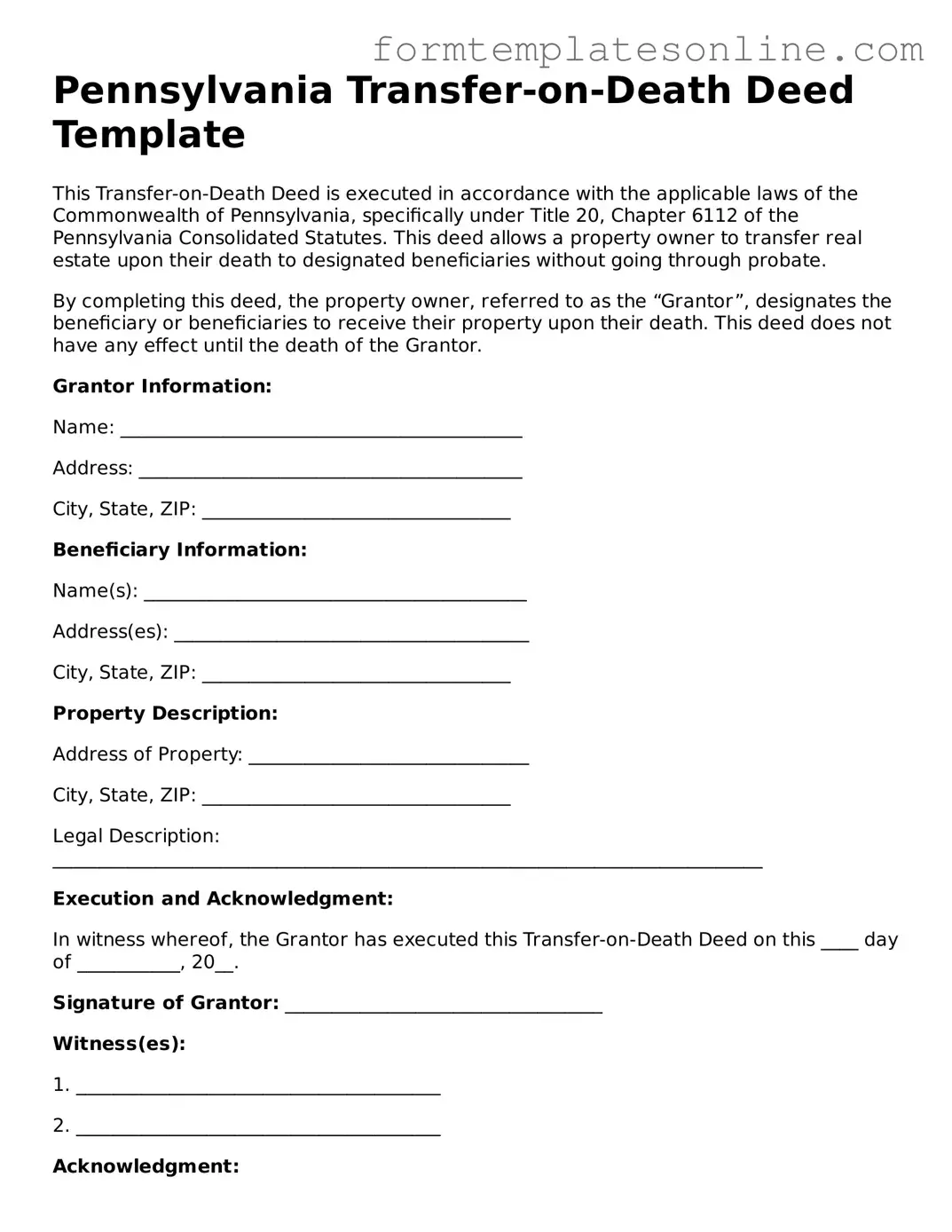

Example - Pennsylvania Transfer-on-Death Deed Form

Pennsylvania Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed in accordance with the applicable laws of the Commonwealth of Pennsylvania, specifically under Title 20, Chapter 6112 of the Pennsylvania Consolidated Statutes. This deed allows a property owner to transfer real estate upon their death to designated beneficiaries without going through probate.

By completing this deed, the property owner, referred to as the “Grantor”, designates the beneficiary or beneficiaries to receive their property upon their death. This deed does not have any effect until the death of the Grantor.

Grantor Information:

Name: ___________________________________________

Address: _________________________________________

City, State, ZIP: _________________________________

Beneficiary Information:

Name(s): _________________________________________

Address(es): ______________________________________

City, State, ZIP: _________________________________

Property Description:

Address of Property: ______________________________

City, State, ZIP: _________________________________

Legal Description: ____________________________________________________________________________

Execution and Acknowledgment:

In witness whereof, the Grantor has executed this Transfer-on-Death Deed on this ____ day of ___________, 20__.

Signature of Grantor: __________________________________

Witness(es):

1. _______________________________________

2. _______________________________________

Acknowledgment:

State of Pennsylvania, County of _______________:

On this ____ day of ___________, 20__, before me, a Notary Public, personally appeared the Grantor, known to me (or satisfactorily proven) to be the person whose name is subscribed to this instrument, and acknowledged that he/she executed the same for the purposes therein contained.

Notary Signature: _______________________________

My Commission Expires: _______________________________

More About Pennsylvania Transfer-on-Death Deed

What is a Pennsylvania Transfer-on-Death Deed?

A Pennsylvania Transfer-on-Death Deed is a legal document that allows a property owner to designate one or more beneficiaries to receive their real estate upon their death. This deed allows the owner to retain full control of the property during their lifetime, and it does not require probate when the owner passes away. It is an effective way to transfer property without the complexities often associated with traditional wills or trusts.

Who can create a Transfer-on-Death Deed in Pennsylvania?

Any individual who is the sole owner or a co-owner of real estate in Pennsylvania can create a Transfer-on-Death Deed. It is important to ensure that the property is titled in the individual's name and that they have the legal capacity to make decisions regarding the property. If there are multiple owners, all must agree to the transfer for it to be valid.

How does a Transfer-on-Death Deed work?

Once the Transfer-on-Death Deed is executed and recorded with the county recorder of deeds, it becomes effective immediately. The property owner retains full ownership and control of the property during their lifetime. Upon the owner's death, the designated beneficiaries automatically receive ownership of the property without the need for probate. This seamless transfer simplifies the process for heirs and can save time and costs associated with estate administration.

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be changed or revoked at any time before the property owner's death. To do this, the owner must create a new deed that explicitly revokes the previous one or file a revocation form with the county recorder of deeds. It is advisable to ensure that any changes are properly documented and recorded to avoid confusion in the future.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger any immediate tax consequences for the property owner. However, the beneficiaries may be subject to inheritance taxes based on the value of the property at the time of the owner's death. It is wise to consult with a tax professional to understand any potential tax obligations that may arise from the transfer.

Is legal assistance necessary to create a Transfer-on-Death Deed?

Key takeaways

When considering the Pennsylvania Transfer-on-Death Deed, it’s important to understand its implications and requirements. Here are some key takeaways:

- Eligibility: Only certain types of property can be transferred using this deed. Ensure that the property in question qualifies under Pennsylvania law.

- Filling Out the Form: Complete the form accurately, including all necessary information about the property and the beneficiaries. Any errors can lead to complications in the transfer process.

- Signing Requirements: The deed must be signed in front of a notary public. This step is crucial to ensure that the deed is legally binding.

- Recording the Deed: After signing, the deed must be recorded with the county recorder of deeds. This action makes the transfer effective upon the death of the property owner.

By keeping these points in mind, you can navigate the process of using a Transfer-on-Death Deed in Pennsylvania more effectively.

File Details

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in Pennsylvania to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Pennsylvania Consolidated Statutes, Title 20, Section 6111.2. |

| Execution Requirements | The deed must be signed by the property owner and acknowledged before a notary public to be valid. |

| Revocation | Property owners can revoke or change the Transfer-on-Death Deed at any time before their death by executing a new deed. |

Consider Some Other Transfer-on-Death Deed Forms for US States

House Deed Transfer - This deed enables efficient transfer of real estate to named beneficiaries immediately upon the owner's passing.

Free Printable Transfer on Death Deed Form Florida - This legal tool ensures that property does not become part of the estate for probate, streamlining the transfer process.

Beneficiary Deed Georgia - The Transfer-on-Death Deed is often regarded as a straightforward estate planning tool.

To ensure you have the right documentation, it's vital to understand the importance of the Florida Affidavit of Residency form, which can often be a part of essential procedures. For more information, visit this link for the necessary helpful guidance on the Affidavit of Residency requirements.

Texas Life Estate Deed Form - Creating a Transfer-on-Death Deed requires the property owner to complete and file the form with the relevant county office.

Dos and Don'ts

When filling out the Pennsylvania Transfer-on-Death Deed form, it is essential to follow specific guidelines to ensure that the document is valid and reflects your intentions. Below are important dos and don'ts to consider.

- Do ensure that you are the sole owner of the property or have the legal authority to transfer it.

- Do clearly identify the property by providing a complete legal description.

- Do include the names and addresses of the beneficiaries who will receive the property upon your passing.

- Do sign the deed in the presence of a notary public to validate the document.

- Don't forget to check for any outstanding liens or debts on the property before transferring it.

- Don't use vague language or abbreviations that could lead to confusion about the property or beneficiaries.

- Don't neglect to file the completed deed with the county recorder's office to make it legally effective.

- Don't assume that verbal agreements or informal arrangements will suffice; always document your intentions formally.