Valid Promissory Note Form for Pennsylvania

The Pennsylvania Promissory Note form serves as a critical financial instrument that outlines the terms of a loan agreement between a borrower and a lender. This legally binding document specifies the amount borrowed, the interest rate, and the repayment schedule, ensuring that both parties have a clear understanding of their obligations. In Pennsylvania, the form must include essential details such as the names and addresses of the involved parties, the date of the agreement, and any collateral that may secure the loan. Additionally, it is important for the note to outline the consequences of default, which can include late fees or legal action. By utilizing this form, individuals and businesses can protect their interests and establish a transparent framework for financial transactions. Understanding the components of the Pennsylvania Promissory Note is essential for anyone considering borrowing or lending money, as it provides clarity and security in financial dealings.

Common mistakes

-

Incorrect Names: Many individuals mistakenly enter the wrong names for the borrower and lender. It's crucial to ensure that the full legal names are used. Abbreviations or nicknames can lead to confusion and potential legal issues.

-

Missing Signatures: A common oversight is failing to sign the document. Both parties must provide their signatures for the note to be legally binding. Without these signatures, the document may not hold up in court.

-

Improper Amounts: Errors in the loan amount are frequent. Double-check the numerical figure and the written amount to ensure they match. Discrepancies can create disputes later on.

-

Omitting Terms: Some individuals overlook including important terms, such as the interest rate or repayment schedule. Clearly defining these terms is essential to avoid misunderstandings between the parties involved.

Example - Pennsylvania Promissory Note Form

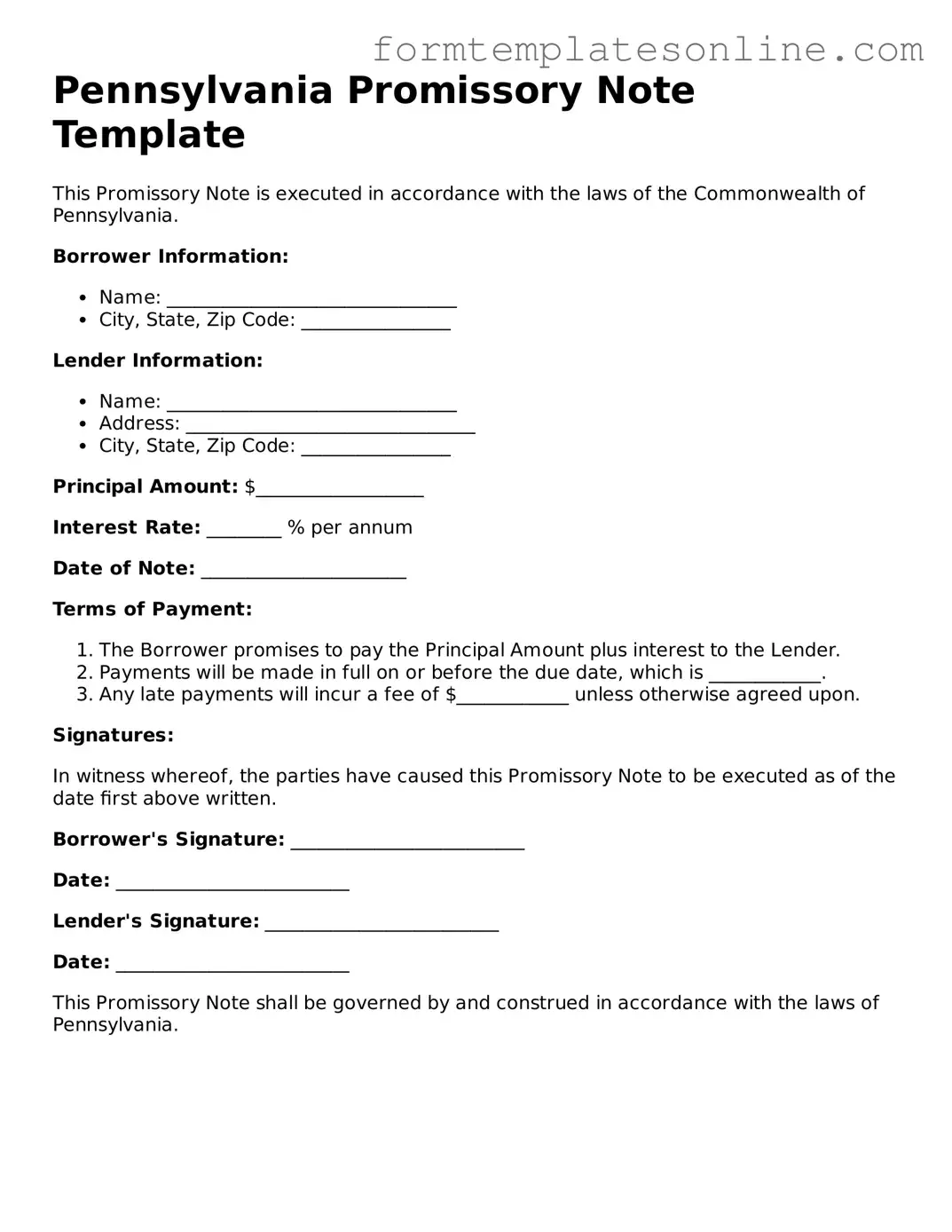

Pennsylvania Promissory Note Template

This Promissory Note is executed in accordance with the laws of the Commonwealth of Pennsylvania.

Borrower Information:

- Name: _______________________________

- City, State, Zip Code: ________________

Lender Information:

- Name: _______________________________

- Address: _______________________________

- City, State, Zip Code: ________________

Principal Amount: $__________________

Interest Rate: ________ % per annum

Date of Note: ______________________

Terms of Payment:

- The Borrower promises to pay the Principal Amount plus interest to the Lender.

- Payments will be made in full on or before the due date, which is ____________.

- Any late payments will incur a fee of $____________ unless otherwise agreed upon.

Signatures:

In witness whereof, the parties have caused this Promissory Note to be executed as of the date first above written.

Borrower's Signature: _________________________

Date: _________________________

Lender's Signature: _________________________

Date: _________________________

This Promissory Note shall be governed by and construed in accordance with the laws of Pennsylvania.

More About Pennsylvania Promissory Note

What is a Pennsylvania Promissory Note?

A Pennsylvania Promissory Note is a legal document in which one party, the borrower, promises to pay a specified sum of money to another party, the lender, under agreed-upon terms. This note outlines the amount borrowed, the interest rate, repayment schedule, and any consequences for defaulting on the loan.

Who can use a Promissory Note in Pennsylvania?

Any individual or business can use a Promissory Note in Pennsylvania. It is commonly used between friends, family members, or business partners. However, both parties should ensure that they understand the terms and conditions before signing.

What information is required in a Pennsylvania Promissory Note?

A valid Promissory Note should include the names and addresses of both the borrower and lender, the principal amount, the interest rate, the repayment schedule, and any specific terms regarding late payments or default. It may also include clauses about prepayment or collateral if applicable.

Is a Promissory Note legally binding?

Yes, a properly executed Promissory Note is legally binding in Pennsylvania. Once both parties sign the document, it creates an enforceable obligation for the borrower to repay the loan according to the agreed terms. If the borrower defaults, the lender has the right to take legal action to recover the owed amount.

Does a Promissory Note need to be notarized in Pennsylvania?

While notarization is not strictly required for a Promissory Note to be valid in Pennsylvania, having the document notarized can provide an additional layer of security. It serves as proof of the identities of the parties involved and the authenticity of the signatures, which can be helpful in case of disputes.

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as outlined in the Promissory Note, the lender can pursue legal action to recover the owed amount. This may involve filing a lawsuit or seeking a judgment against the borrower. The lender may also be able to collect any collateral specified in the note.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note to avoid future disputes.

What is the difference between a secured and unsecured Promissory Note?

A secured Promissory Note is backed by collateral, meaning the lender has a claim on specific assets if the borrower defaults. An unsecured Promissory Note does not have collateral backing it, making it riskier for the lender, as they must rely solely on the borrower's promise to repay.

Are there any tax implications for using a Promissory Note?

Yes, there can be tax implications for both the borrower and the lender. Interest paid on the loan may be tax-deductible for the borrower, while the lender may need to report the interest income on their tax return. Consulting with a tax professional is advisable to understand the specific implications.

Where can I find a Pennsylvania Promissory Note template?

Templates for Pennsylvania Promissory Notes can be found online through legal websites, or you may consult with an attorney to draft a customized note that meets your specific needs. Ensure that any template you use complies with Pennsylvania laws and adequately protects your interests.

Key takeaways

When filling out and using the Pennsylvania Promissory Note form, it is essential to understand the following key points:

- Identification of Parties: Clearly identify the borrower and lender by including their full names and addresses.

- Loan Amount: Specify the exact amount being borrowed. This should be a clear figure to avoid any confusion.

- Interest Rate: Indicate the interest rate applicable to the loan. Ensure it complies with Pennsylvania's legal limits.

- Payment Terms: Outline the payment schedule, including due dates and frequency of payments (e.g., monthly, quarterly).

- Maturity Date: State the date by which the loan must be fully repaid.

- Default Clauses: Include terms that define what constitutes a default and the consequences of defaulting on the loan.

- Signatures: Both parties must sign the document to validate the agreement. Consider having it notarized for added legal assurance.

- State Law Compliance: Ensure the note adheres to Pennsylvania laws regarding promissory notes to avoid legal issues.

- Record Keeping: Maintain a copy of the signed promissory note for both parties' records. This is crucial for future reference.

By following these guidelines, individuals can effectively create and utilize a Pennsylvania Promissory Note, ensuring clarity and legal compliance in their financial agreements.

File Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a certain time or on demand. |

| Governing Law | The Pennsylvania Uniform Commercial Code (UCC) governs promissory notes in Pennsylvania, specifically under Title 13 Pa.C.S. § 3101 et seq. |

| Parties Involved | The document involves two primary parties: the maker (the person promising to pay) and the payee (the person receiving the payment). |

| Requirements | A valid promissory note must include the date, amount, interest rate (if applicable), payment terms, and signatures of the parties involved. |

| Interest Rates | Interest rates on promissory notes in Pennsylvania must comply with state usury laws, which limit the maximum rate that can be charged. |

| Enforceability | For a promissory note to be enforceable, it must be clear and unambiguous, leaving no room for doubt about the terms. |

| Transferability | Promissory notes can be transferred to another party through endorsement, making them negotiable instruments under UCC guidelines. |

| Default Consequences | If the maker defaults on the payment, the payee has the right to pursue legal action to recover the owed amount, along with any applicable interest and fees. |

| Record Keeping | It is advisable for both parties to keep a copy of the signed promissory note and any related correspondence for their records. |

Consider Some Other Promissory Note Forms for US States

Promissory Note Template California Word - This form can be customized to meet the specific needs of both parties involved.

For those looking to make a smooth transaction, the essential document for any sale is the Golf Cart Bill of Sale form, which outlines the necessary information to facilitate clear ownership transfer in Florida.

Promissory Note Illinois - They can be an important tool for managing personal and business finances.

Dos and Don'ts

When filling out the Pennsylvania Promissory Note form, it's essential to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting.

- Don't leave any required fields blank.

- Do use clear and legible handwriting or type the information.

- Don't use abbreviations unless specified.

- Do double-check all numbers and dates for accuracy.

- Don't sign the form until all parties are present.

- Do keep a copy of the completed form for your records.

- Don't forget to include the interest rate, if applicable.

- Do ensure that all parties involved understand the terms.

- Don't rush through the process; take your time to ensure everything is correct.