Valid Deed in Lieu of Foreclosure Form for Pennsylvania

The Pennsylvania Deed in Lieu of Foreclosure form serves as a crucial tool for homeowners facing the possibility of foreclosure. This legal document allows a homeowner to voluntarily transfer ownership of their property to the lender, thereby avoiding the lengthy and often costly foreclosure process. By opting for this route, homeowners can mitigate the negative impacts on their credit scores and may be able to negotiate terms that are more favorable than those typically associated with foreclosure. The form outlines essential details, including the names of the parties involved, a description of the property, and any existing liens or encumbrances. Additionally, it may contain provisions regarding the release of liability for the homeowner, which can provide peace of mind during a difficult financial situation. Understanding the implications and benefits of this form is vital for homeowners considering this option as a means to resolve their mortgage challenges.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary information. This includes not filling out the names of all parties involved, property address, and legal descriptions. Omitting details can lead to delays or rejection of the deed.

-

Incorrect Signatures: Ensure that all required parties sign the form. If a spouse or co-owner is not included in the signature, the deed may not be valid. Double-check that signatures match the names listed on the document.

-

Not Notarizing the Document: Many people overlook the requirement for notarization. A deed in lieu of foreclosure must be notarized to be legally binding. Failing to do this can invalidate the entire process.

-

Ignoring Local Requirements: Each county may have specific requirements for submitting a deed in lieu of foreclosure. Not adhering to local regulations can cause complications. It’s wise to check with local authorities or a legal professional.

-

Failing to Understand Tax Implications: Some individuals do not consider the potential tax consequences of transferring property through a deed in lieu of foreclosure. Consulting a tax advisor can help clarify any obligations or benefits that may arise from this action.

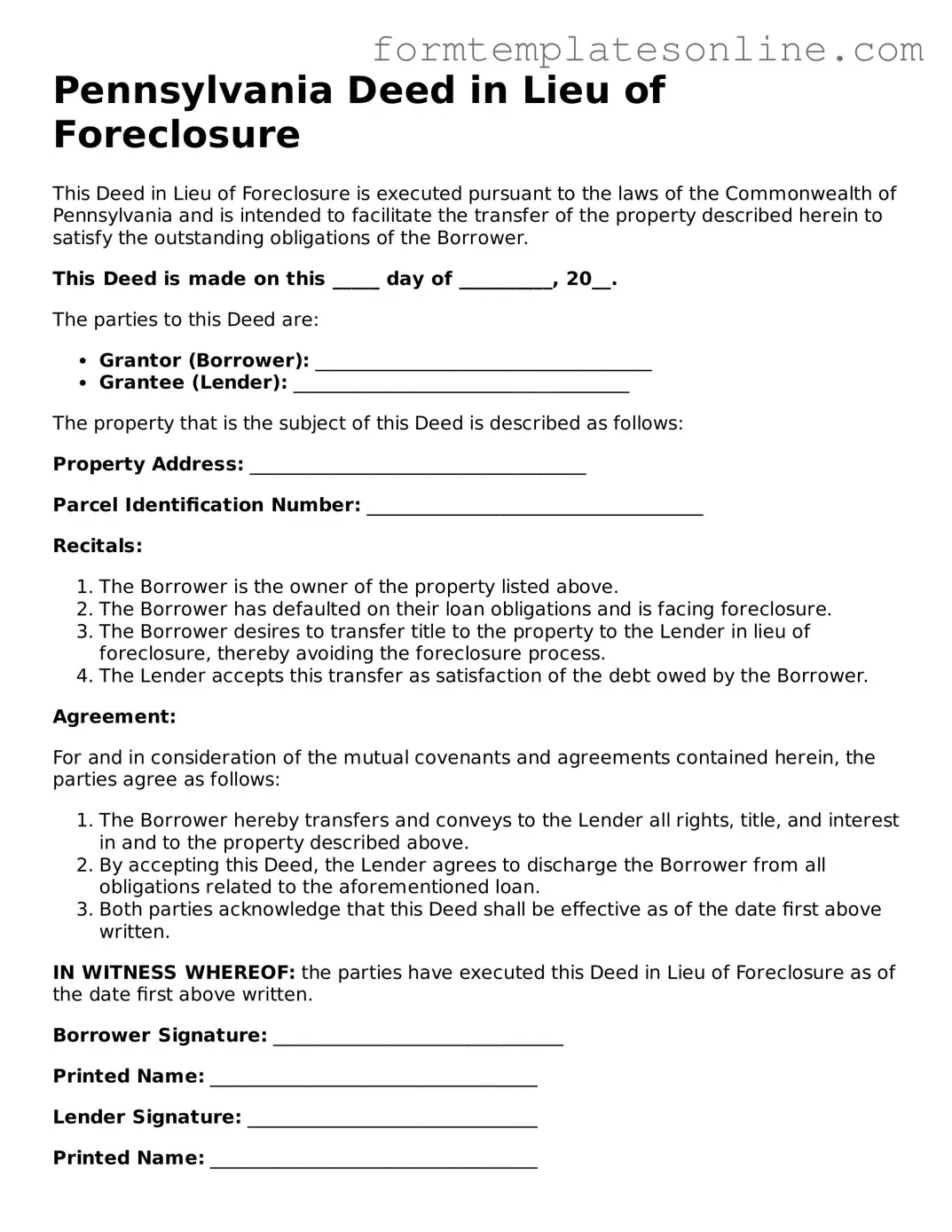

Example - Pennsylvania Deed in Lieu of Foreclosure Form

Pennsylvania Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is executed pursuant to the laws of the Commonwealth of Pennsylvania and is intended to facilitate the transfer of the property described herein to satisfy the outstanding obligations of the Borrower.

This Deed is made on this _____ day of __________, 20__.

The parties to this Deed are:

- Grantor (Borrower): ____________________________________

- Grantee (Lender): ____________________________________

The property that is the subject of this Deed is described as follows:

Property Address: ____________________________________

Parcel Identification Number: ____________________________________

Recitals:

- The Borrower is the owner of the property listed above.

- The Borrower has defaulted on their loan obligations and is facing foreclosure.

- The Borrower desires to transfer title to the property to the Lender in lieu of foreclosure, thereby avoiding the foreclosure process.

- The Lender accepts this transfer as satisfaction of the debt owed by the Borrower.

Agreement:

For and in consideration of the mutual covenants and agreements contained herein, the parties agree as follows:

- The Borrower hereby transfers and conveys to the Lender all rights, title, and interest in and to the property described above.

- By accepting this Deed, the Lender agrees to discharge the Borrower from all obligations related to the aforementioned loan.

- Both parties acknowledge that this Deed shall be effective as of the date first above written.

IN WITNESS WHEREOF: the parties have executed this Deed in Lieu of Foreclosure as of the date first above written.

Borrower Signature: _______________________________

Printed Name: ___________________________________

Lender Signature: _______________________________

Printed Name: ___________________________________

Witness Signature: _______________________________

Printed Name: ___________________________________

Notary Public:

State of Pennsylvania, County of ______________________, ss:

This document was acknowledged before me on this _____ day of __________, 20__ by ______________________________________, the Borrower.

Notary Signature: _______________________________

My Commission Expires: _______________________

More About Pennsylvania Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure in Pennsylvania?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid the foreclosure process. This option is typically considered when the homeowner is unable to keep up with mortgage payments and wants to prevent the negative consequences of foreclosure on their credit. By voluntarily giving the property back to the lender, the homeowner can often settle their mortgage debt more amicably.

What are the benefits of using a Deed in Lieu of Foreclosure?

One of the primary benefits is that it can help the homeowner avoid the lengthy and stressful foreclosure process. Additionally, it may have less of an impact on the homeowner's credit score compared to a foreclosure. The process can also be quicker, allowing the homeowner to move on sooner. Furthermore, in some cases, lenders may agree to forgive any remaining mortgage debt, providing financial relief to the homeowner.

What are the requirements to qualify for a Deed in Lieu of Foreclosure?

To qualify, homeowners typically need to demonstrate financial hardship, such as job loss, medical expenses, or other significant financial challenges. Lenders often require that the homeowner has tried to sell the property and that it is not currently in foreclosure. Homeowners must also be current on their mortgage payments or have a good reason for their delinquency. Each lender may have specific requirements, so it is essential to communicate directly with them.

How does the process of completing a Deed in Lieu of Foreclosure work?

The process usually begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. After reviewing the homeowner's financial situation, the lender will assess whether they are willing to accept the deed. If approved, the homeowner will need to sign the deed, transferring ownership of the property to the lender. The lender may also require the homeowner to sign a release of liability, which can help protect them from future claims regarding the mortgage debt.

Are there any risks associated with a Deed in Lieu of Foreclosure?

Yes, there are potential risks. Homeowners should be aware that they may still face tax implications if the lender forgives any part of the mortgage debt, as this could be considered taxable income. Additionally, if the property has a second mortgage or other liens, the homeowner may still be responsible for those debts unless specifically addressed in the agreement with the lender. It is advisable to consult with a financial advisor or attorney to understand all implications before proceeding.

Key takeaways

Filling out and using the Pennsylvania Deed in Lieu of Foreclosure form is a critical step for homeowners facing foreclosure. Understanding the implications and requirements of this process can significantly impact the outcome. Here are four key takeaways:

- Voluntary Agreement: A deed in lieu of foreclosure is a voluntary agreement between the homeowner and the lender. It allows the homeowner to transfer the property title to the lender, thereby avoiding the lengthy foreclosure process.

- Clear Communication: It is essential to communicate clearly with the lender. Ensure that both parties understand the terms of the agreement, including any potential tax implications or remaining debts.

- Legal Review: Consider having a legal professional review the deed before signing. This step can help identify any unfavorable terms and protect your rights during the transaction.

- Impact on Credit: Be aware that a deed in lieu of foreclosure will still affect your credit score, though it may be less damaging than a formal foreclosure. Understanding the long-term consequences is vital for future financial planning.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Purpose | This form helps borrowers mitigate the negative impact of foreclosure on their credit history. |

| Governing Law | The process is governed by Pennsylvania state law, specifically under the Pennsylvania Uniform Commercial Code. |

| Eligibility | Borrowers must be facing financial hardship and unable to continue mortgage payments to qualify. |

| Mutual Agreement | Both the borrower and lender must agree to the terms outlined in the Deed in Lieu of Foreclosure. |

| Property Condition | The property must be free of any liens or encumbrances for the deed to be accepted. |

| Documentation | Borrowers need to provide necessary documentation, including financial statements and proof of hardship. |

| Impact on Credit | While less damaging than foreclosure, a Deed in Lieu of Foreclosure can still negatively affect a borrower’s credit score. |

| Tax Implications | Borrowers may face tax consequences due to potential cancellation of debt income. |

| Finality | Once executed, the Deed in Lieu of Foreclosure is generally considered final and cannot be reversed. |

Consider Some Other Deed in Lieu of Foreclosure Forms for US States

Foreclosure Deed - The process might involve negotiation regarding the outstanding mortgage balance.

To navigate the intricacies of vehicle transactions, understanding the Florida ATV Bill of Sale form is crucial for every buyer and seller involved in the process. For a thorough guide, refer to the essential information about the ATV Bill of Sale document requirements, which highlights key aspects necessary for a successful transfer of ownership.

Georgia Foreclosure Laws - A Deed in Lieu is not a guaranteed solution and depends on lender approval.

Dos and Don'ts

When filling out the Pennsylvania Deed in Lieu of Foreclosure form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are six important dos and don'ts:

- Do ensure all property information is accurate, including the address and legal description.

- Do include the names of all parties involved in the transaction, including the grantor and grantee.

- Do have the form notarized to validate the signatures of all parties.

- Do review the form for completeness before submitting it to avoid delays.

- Don't leave any required fields blank, as this may lead to rejection of the form.

- Don't forget to check local regulations or consult a professional for any specific requirements that may apply.