Valid Deed Form for Pennsylvania

When it comes to transferring property ownership in Pennsylvania, understanding the Pennsylvania Deed form is essential. This legal document serves as a formal record of the transfer, ensuring that the new owner has clear title to the property. It includes crucial information such as the names of the grantor (the person selling or giving away the property) and the grantee (the person receiving the property), a detailed description of the property itself, and any conditions or restrictions that may apply. Additionally, the deed must be signed and notarized to be legally binding. Different types of deeds, such as warranty deeds and quitclaim deeds, offer varying levels of protection and assurance regarding the property title. Knowing which type of deed to use is vital for both parties involved in the transaction. By familiarizing yourself with the Pennsylvania Deed form and its requirements, you can navigate the property transfer process with confidence and clarity.

Common mistakes

-

Incorrect Property Description: One common mistake is failing to provide a complete and accurate description of the property. This includes not specifying the lot number, block number, or any relevant boundaries.

-

Missing Signatures: All required parties must sign the deed. Often, individuals overlook the necessity of having both the grantor and grantee sign the document.

-

Improper Notarization: Notarization is crucial. Some people forget to have the deed properly notarized, which can lead to issues in validating the document.

-

Incorrect Date: The date on the deed must be accurate. Errors in dating can create confusion regarding the timeline of the transaction.

-

Failure to Include Consideration: The deed should state the consideration, or the amount paid for the property. Omitting this information can lead to complications.

-

Not Checking for Liens: Before finalizing the deed, it is essential to ensure there are no existing liens on the property. Failing to do so can result in legal issues later.

-

Inaccurate Grantee Information: Providing incorrect information about the grantee, such as the name or address, can cause delays or disputes in ownership.

-

Ignoring Local Requirements: Each county may have specific requirements for deeds. Not adhering to these local regulations can lead to rejection of the deed.

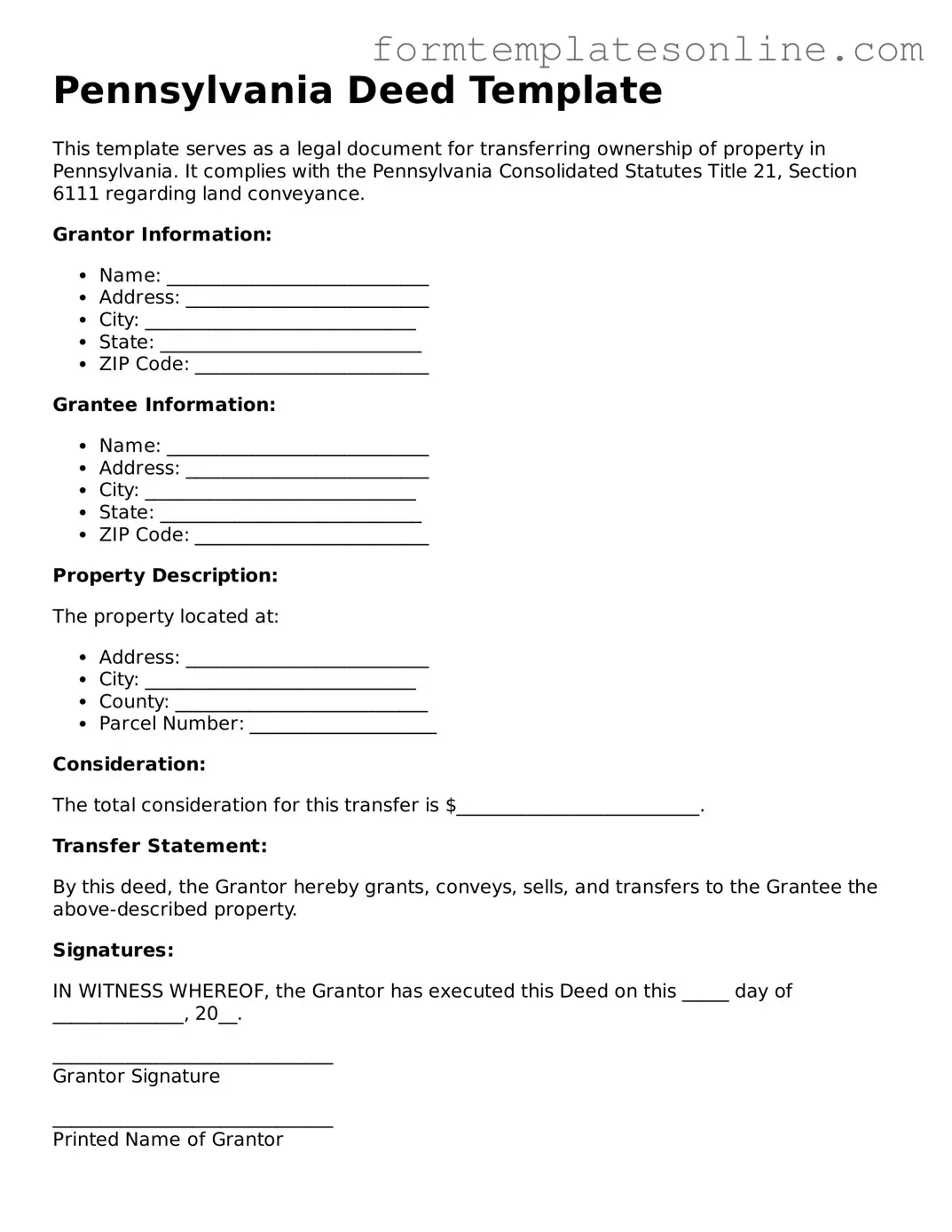

Example - Pennsylvania Deed Form

Pennsylvania Deed Template

This template serves as a legal document for transferring ownership of property in Pennsylvania. It complies with the Pennsylvania Consolidated Statutes Title 21, Section 6111 regarding land conveyance.

Grantor Information:

- Name: ____________________________

- Address: __________________________

- City: _____________________________

- State: ____________________________

- ZIP Code: _________________________

Grantee Information:

- Name: ____________________________

- Address: __________________________

- City: _____________________________

- State: ____________________________

- ZIP Code: _________________________

Property Description:

The property located at:

- Address: __________________________

- City: _____________________________

- County: ___________________________

- Parcel Number: ____________________

Consideration:

The total consideration for this transfer is $__________________________.

Transfer Statement:

By this deed, the Grantor hereby grants, conveys, sells, and transfers to the Grantee the above-described property.

Signatures:

IN WITNESS WHEREOF, the Grantor has executed this Deed on this _____ day of ______________, 20__.

______________________________

Grantor Signature

______________________________

Printed Name of Grantor

Notary Acknowledgment:

State of Pennsylvania, County of _______________:

On this _____ day of _______________, 20__, before me, a Notary Public, personally appeared ______________________, known to me (or satisfactorily proven) to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

IN WITNESS WHEREOF, I have hereunto set my hand and affixed my notarial seal.

______________________________

Notary Public

More About Pennsylvania Deed

What is a Pennsylvania Deed form?

A Pennsylvania Deed form is a legal document used to transfer ownership of real estate from one party to another within the state of Pennsylvania. This form must be completed accurately and filed with the appropriate county office to ensure that the transfer of title is legally recognized.

What types of deeds are available in Pennsylvania?

In Pennsylvania, several types of deeds can be used, including Warranty Deeds, Quitclaim Deeds, and Special Warranty Deeds. A Warranty Deed provides the highest level of protection to the buyer, guaranteeing that the seller holds clear title to the property. A Quitclaim Deed transfers whatever interest the seller has in the property without any guarantees. A Special Warranty Deed offers some protection but only for the time the seller owned the property.

How do I complete a Pennsylvania Deed form?

To complete a Pennsylvania Deed form, you will need to provide specific information, including the names of the grantor (seller) and grantee (buyer), a legal description of the property, and the consideration (purchase price). It is crucial to ensure that all information is accurate and that the form is signed in front of a notary public.

Is a notary required for a Pennsylvania Deed?

Yes, a notary public is required to witness the signatures on a Pennsylvania Deed. This requirement helps to prevent fraud and ensures that the parties involved are entering into the agreement willingly and knowingly. The notary will also affix their seal to the document, which is necessary for recording.

How do I record a Pennsylvania Deed?

To record a Pennsylvania Deed, the completed and notarized document must be submitted to the Recorder of Deeds in the county where the property is located. There may be a recording fee, and it is advisable to check with the local office for specific requirements. Once recorded, the deed becomes part of the public record.

Are there any taxes associated with transferring a deed in Pennsylvania?

Yes, when transferring a deed in Pennsylvania, the seller may be subject to a real estate transfer tax. This tax is typically calculated as a percentage of the sale price and varies by county. Both the buyer and seller should be aware of their potential tax obligations and may negotiate who will pay the transfer tax as part of the sale agreement.

Can I use a Pennsylvania Deed form for any type of property?

A Pennsylvania Deed form can generally be used for various types of real estate, including residential, commercial, and vacant land. However, specific considerations may apply depending on the type of property and the nature of the transaction. It is advisable to consult with a legal expert or real estate professional to ensure compliance with all applicable laws and regulations.

Key takeaways

When filling out and using the Pennsylvania Deed form, there are several important points to keep in mind:

- Accuracy is crucial. Ensure that all names, addresses, and property descriptions are correct. Mistakes can lead to delays or legal issues.

- Signatures must be notarized. The deed requires the signatures of all parties involved to be witnessed and notarized, which adds a layer of legitimacy to the document.

- Understand the type of deed. Different types of deeds, such as warranty deeds or quitclaim deeds, serve different purposes. Choose the one that best fits your needs.

- File the deed promptly. After completing the form, it must be filed with the county recorder of deeds in Pennsylvania. Delays in filing can affect ownership rights.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Pennsylvania Deed form is used to transfer ownership of real property from one party to another. |

| Types of Deeds | Common types include Warranty Deeds, Quitclaim Deeds, and Special Purpose Deeds. |

| Governing Law | The Pennsylvania Uniform Conveyancing Act governs the use of deed forms in the state. |

| Execution Requirements | The deed must be signed by the grantor in the presence of a notary public to be valid. |

| Recording | To protect the interests of the new owner, the deed should be recorded at the county's Recorder of Deeds office. |

Consider Some Other Deed Forms for US States

What Does a Deed Look Like in Florida - The Deed form can serve as proof of ownership in legal matters.

The New York Boat Bill of Sale form is a crucial document used to transfer ownership of a boat from one party to another. This form provides essential details about the vessel, including its make, model, and hull identification number. For those looking to ensure a smooth transaction and establish clear ownership records, additional information can be found at https://documentonline.org/blank-new-york-boat-bill-of-sale/.

Property Deed Form - The transfer process outlined in the deed should align with both parties’ intentions.

Dos and Don'ts

When filling out the Pennsylvania Deed form, it's important to be careful and thorough. Here are some guidelines to help you navigate the process.

- Do: Double-check all names and addresses for accuracy.

- Do: Clearly describe the property being transferred.

- Do: Sign the form in the presence of a notary public.

- Do: Include the correct date of the transaction.

- Do: Review the form for any missing information before submission.

- Don't: Use abbreviations for names or addresses.

- Don't: Leave any sections blank unless specified.

- Don't: Forget to provide the required payment for filing fees.

- Don't: Submit the form without verifying that it meets all local requirements.

Following these guidelines will help ensure that your deed is completed correctly and processed without unnecessary delays.