Valid Articles of Incorporation Form for Pennsylvania

The Pennsylvania Articles of Incorporation form serves as a crucial document for individuals and groups seeking to establish a corporation within the state. This form outlines essential information about the corporation, including its name, purpose, and the address of its registered office. Additionally, it requires details about the incorporators, who are the individuals responsible for filing the paperwork and initiating the corporate structure. The Articles of Incorporation also specify the number of shares the corporation is authorized to issue, along with any relevant provisions regarding the management and operation of the business. Understanding the components of this form is vital for ensuring compliance with state regulations and for laying a solid foundation for the corporation’s future operations. By accurately completing this form, aspiring business owners can effectively navigate the initial steps of corporate formation and set the stage for their enterprise's success.

Common mistakes

-

Incorrect Business Name: One of the most common mistakes is failing to choose a unique business name. The name must not only reflect the nature of the business but also be distinguishable from existing entities in Pennsylvania. It’s crucial to check the availability of the name through the Pennsylvania Department of State’s online database.

-

Missing or Incorrect Registered Office Address: Every corporation must provide a registered office address in Pennsylvania. Some people overlook this requirement or provide an address that does not meet the state’s criteria. Ensure that the address is valid and that it can receive legal documents.

-

Improperly Designating the Incorporators: The Articles of Incorporation require the names and addresses of the incorporators. Failing to include all necessary information or listing individuals who are not eligible can lead to delays. Make sure to include accurate details for each incorporator.

-

Neglecting to Specify the Purpose of the Corporation: The form asks for a brief description of the corporation's purpose. Some individuals either leave this section blank or provide vague descriptions. A clear and concise purpose statement is essential, as it informs the state and the public about your business activities.

Example - Pennsylvania Articles of Incorporation Form

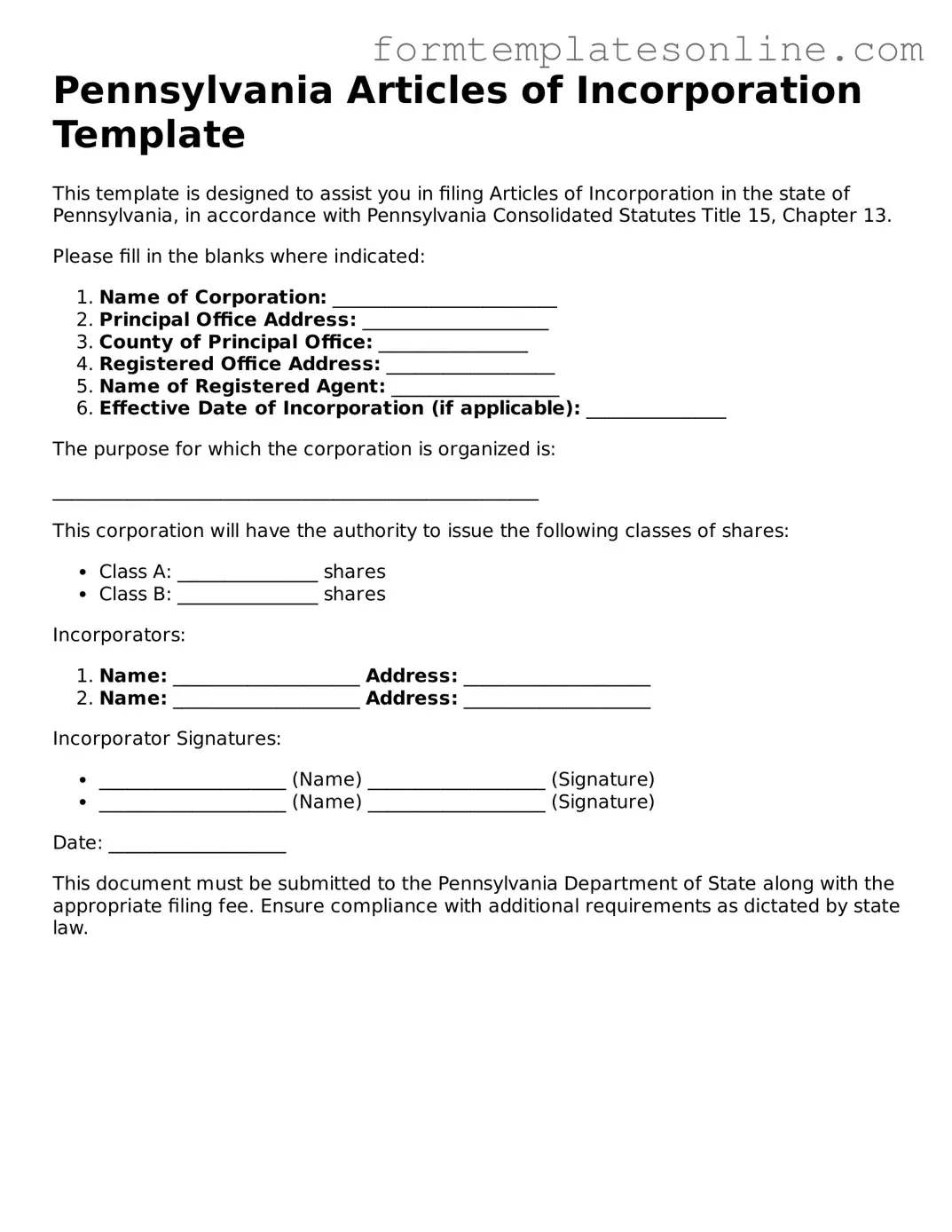

Pennsylvania Articles of Incorporation Template

This template is designed to assist you in filing Articles of Incorporation in the state of Pennsylvania, in accordance with Pennsylvania Consolidated Statutes Title 15, Chapter 13.

Please fill in the blanks where indicated:

- Name of Corporation: ________________________

- Principal Office Address: ____________________

- County of Principal Office: ________________

- Registered Office Address: __________________

- Name of Registered Agent: __________________

- Effective Date of Incorporation (if applicable): _______________

The purpose for which the corporation is organized is:

____________________________________________________

This corporation will have the authority to issue the following classes of shares:

- Class A: _______________ shares

- Class B: _______________ shares

Incorporators:

- Name: ____________________ Address: ____________________

- Name: ____________________ Address: ____________________

Incorporator Signatures:

- ____________________ (Name) ___________________ (Signature)

- ____________________ (Name) ___________________ (Signature)

Date: ___________________

This document must be submitted to the Pennsylvania Department of State along with the appropriate filing fee. Ensure compliance with additional requirements as dictated by state law.

More About Pennsylvania Articles of Incorporation

What are the Pennsylvania Articles of Incorporation?

The Articles of Incorporation are a legal document that establishes a corporation in Pennsylvania. This document outlines essential details about the corporation, such as its name, purpose, registered office address, and the number of shares it is authorized to issue. Filing this document is a crucial step in forming a corporation in the state.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Pennsylvania must file the Articles of Incorporation. This includes businesses of various types, such as for-profit corporations, non-profit organizations, and professional corporations. It is the first step in formalizing the business structure.

What information is required on the Articles of Incorporation form?

The form typically requires the corporation's name, the purpose of the corporation, the address of the registered office, the name and address of the incorporators, and the number of shares the corporation is authorized to issue. Additional information may be required depending on the type of corporation being formed.

How do I file the Articles of Incorporation in Pennsylvania?

To file the Articles of Incorporation, you can submit the completed form to the Pennsylvania Department of State. This can be done online, by mail, or in person. There is a filing fee that varies depending on the type of corporation. Make sure to keep a copy of the filed document for your records.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Pennsylvania varies based on the type of corporation. Generally, the fee ranges from $125 to $250. It is important to check the latest fee schedule on the Pennsylvania Department of State's website for the most accurate information.

How long does it take to process the Articles of Incorporation?

The processing time for the Articles of Incorporation can vary. Typically, it takes about 7 to 10 business days for the Pennsylvania Department of State to process the filing. However, expedited services may be available for an additional fee, which can significantly reduce the processing time.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If there are changes to the corporation's name, purpose, or other key details, an amendment must be filed with the Pennsylvania Department of State. This process also involves submitting a specific form and paying a fee.

What happens if I do not file the Articles of Incorporation?

If you do not file the Articles of Incorporation, your business cannot legally operate as a corporation in Pennsylvania. This means you would not have the legal protections that come with incorporation, such as limited liability for debts and obligations. Additionally, operating without proper registration can lead to fines and legal issues.

Do I need a lawyer to file the Articles of Incorporation?

While it is not legally required to have a lawyer to file the Articles of Incorporation, it can be beneficial. A legal professional can help ensure that the document is filled out correctly and that all necessary information is included. This can help avoid delays or issues with the filing process.

Key takeaways

When filling out and using the Pennsylvania Articles of Incorporation form, several important points should be considered:

- The form must be completed accurately to ensure proper registration of the business entity.

- All required information, such as the name of the corporation and the registered office address, must be provided.

- A filing fee is required when submitting the Articles of Incorporation; payment methods should be verified beforehand.

- Once filed, the corporation will be recognized as a legal entity, allowing it to conduct business in Pennsylvania.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Pennsylvania Articles of Incorporation form is used to legally create a corporation in the state of Pennsylvania. |

| Governing Law | This form is governed by the Pennsylvania Business Corporation Law of 1988, as amended. |

| Filing Requirements | To file the Articles of Incorporation, applicants must submit the form to the Pennsylvania Department of State along with the required filing fee. |

| Information Required | The form requires basic information, including the corporation's name, registered office address, and the names of the incorporators. |

Consider Some Other Articles of Incorporation Forms for US States

Florida Corporation - Specifies the number of directors needed for a quorum.

Filing the IRS 2553 form is essential for small business owners who wish to benefit from S corporation status, a choice that can significantly impact their tax obligations. For detailed guidance on this process, potential filers can consult resources such as OnlineLawDocs.com, which provides valuable information on completing the form and understanding the implications of this election.

How Much Is Llc in Texas - These documents provide a formal declaration to the government about the corporation's existence.

Where Can I Find Articles of Incorporation - The articles may outline procedures for shareholder conflicts.

Dos and Don'ts

When filling out the Pennsylvania Articles of Incorporation form, consider the following guidelines:

- Do: Provide accurate and complete information to ensure the application is processed without delays.

- Do: Include the name of the corporation as it will appear in official records.

- Do: Specify the purpose of the corporation clearly to avoid confusion.

- Do: Sign the form in the appropriate section to validate the submission.

- Don't: Leave any required fields blank, as this may result in rejection of the application.

- Don't: Use a name that is already registered by another corporation in Pennsylvania.

- Don't: Forget to include the registered office address, as this is a legal requirement.

- Don't: Submit the form without reviewing it for errors or inconsistencies.