Payroll Check PDF Form

The Payroll Check form serves as a critical document in the realm of employee compensation, facilitating the accurate and timely payment of wages. This form typically includes essential information such as the employee's name, identification number, and the pay period for which the wages are being disbursed. Additionally, it outlines the gross pay, deductions for taxes and benefits, and the net pay that the employee will ultimately receive. Employers must ensure that the form is completed correctly to comply with federal and state regulations, which can vary significantly. Moreover, the Payroll Check form plays a vital role in maintaining transparent financial records for both the employer and the employee. Its significance extends beyond mere payment; it is a key component of the overall payroll process, impacting tax reporting and employee satisfaction. Given the complexities involved in payroll management, understanding the nuances of this form is imperative for both employers and employees alike.

Common mistakes

-

Not providing accurate personal information. This includes the employee's full name, address, and Social Security number. Errors in this section can lead to delays in processing.

-

Failing to indicate the correct pay period. Each payroll check corresponds to a specific time frame. If this is not clearly stated, it can cause confusion and payment issues.

-

Incorrectly calculating hours worked. Employees should double-check their reported hours. Mistakes in this area can result in underpayment or overpayment.

-

Omitting deductions. It is essential to list all applicable deductions, such as taxes and benefits. Missing these can affect the net pay and lead to compliance issues.

-

Not signing the form. A signature is often required to validate the document. Without it, the payroll check may not be processed.

-

Using outdated forms. Payroll check forms can change. Always ensure that the most current version is being used to avoid any discrepancies.

-

Ignoring submission deadlines. Payroll forms typically have specific due dates. Late submissions can delay payment and create financial stress.

Example - Payroll Check Form

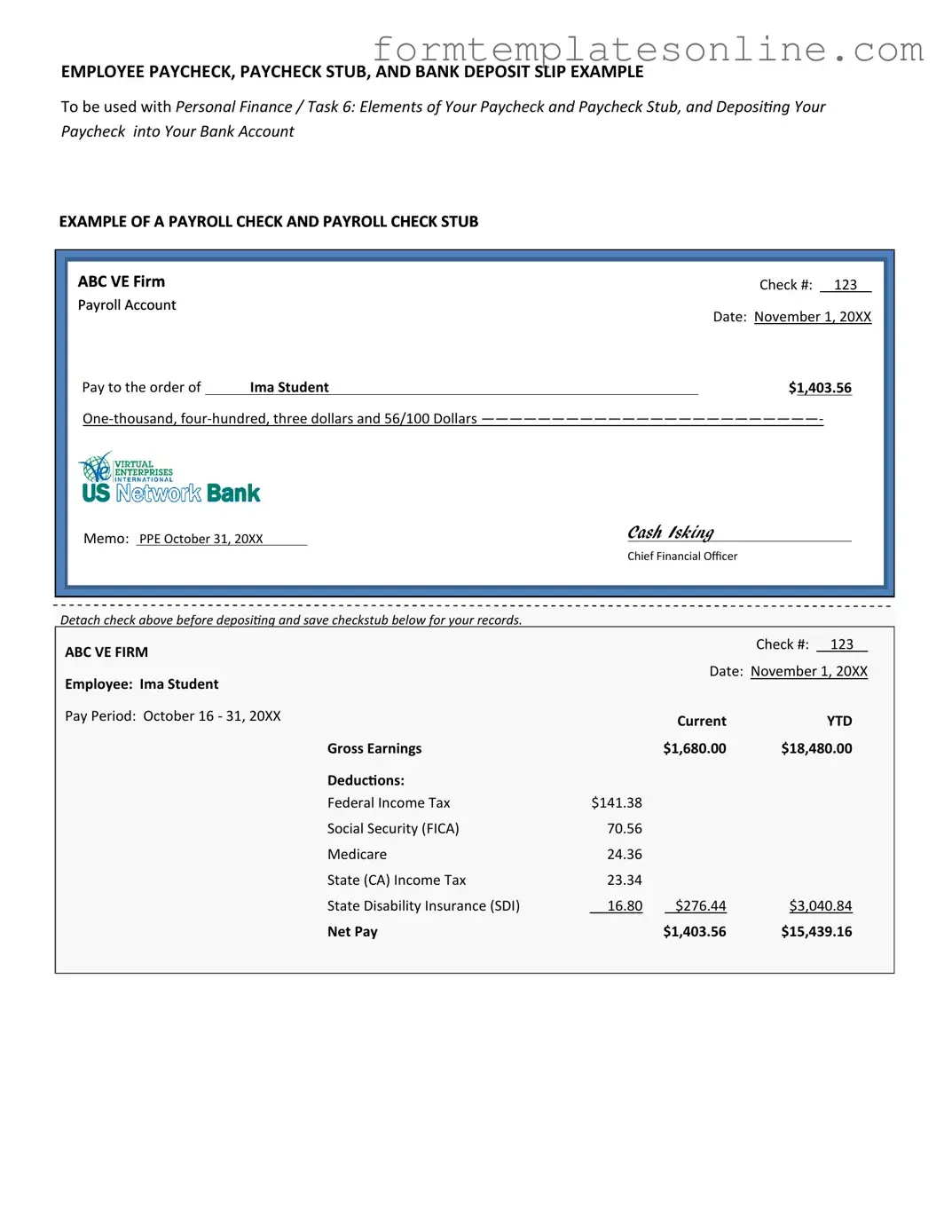

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account

More About Payroll Check

What is a Payroll Check form?

A Payroll Check form is a document used by employers to process and issue payments to employees for their work. This form typically includes details such as the employee's name, the amount to be paid, the pay period, and any deductions that may apply. It serves as a record of payment and ensures that employees receive their wages accurately and on time.

How do I fill out a Payroll Check form?

To complete a Payroll Check form, start by entering the employee's full name and any identification number required by your organization. Next, specify the payment amount and the pay period for which the employee is being compensated. Be sure to include any necessary deductions, such as taxes or benefits. Finally, sign and date the form to validate it before processing the payment.

What should I do if I make a mistake on the Payroll Check form?

If a mistake is made on the Payroll Check form, it is important to correct it promptly. Cross out the incorrect information and write the correct details clearly next to it. Initial the correction to indicate it was made intentionally. In some cases, it may be necessary to complete a new form altogether, especially if the error affects the payment amount or employee information significantly.

How can I ensure timely processing of the Payroll Check form?

To ensure timely processing, submit the Payroll Check form as early as possible, ideally before the payroll deadline set by your employer. Make sure all information is accurate and complete to avoid delays. If your organization uses an electronic system, follow the submission guidelines carefully. Regular communication with the payroll department can also help to confirm that the form has been received and processed on time.

Key takeaways

When filling out and using the Payroll Check form, there are several important points to keep in mind. Understanding these can help ensure accuracy and compliance in your payroll processes.

- Complete All Required Fields: Make sure to fill in every necessary section of the form. This typically includes employee details, pay period dates, and the total amount to be paid. Incomplete forms can lead to payment delays.

- Double-Check Calculations: Always verify the calculations for hours worked and any deductions. Errors in math can result in overpayments or underpayments, which can complicate payroll records.

- Use Clear and Legible Writing: If you are filling out the form by hand, ensure that your handwriting is clear. Illegible forms may lead to misinterpretation of important information.

- Maintain Records: Keep a copy of each Payroll Check form for your records. This practice not only helps in tracking payments but also serves as a reference for any future discrepancies.

Form Attributes

| Fact Name | Description |

|---|---|

| Purpose | The Payroll Check form is used to document the payment of wages to employees, ensuring accurate record-keeping for both the employer and employee. |

| Components | This form typically includes the employee's name, address, Social Security number, pay period, and the amount paid. |

| Frequency of Use | Employers often use this form on a regular basis, such as weekly, bi-weekly, or monthly, depending on their payroll schedule. |

| State-Specific Requirements | Different states may have specific laws governing payroll documentation. For example, California requires employers to provide a pay stub detailing deductions. |

| Record Retention | Employers are generally required to keep payroll records, including the Payroll Check form, for a minimum of three years for tax purposes. |

| Tax Implications | Accurate completion of the Payroll Check form is crucial for calculating and withholding federal, state, and local taxes from employee wages. |

Other PDF Forms

Asurion Wireless - Claimants submit this form to potentially receive reimbursement.

The Oregon Homeschool Letter of Intent form is a crucial document that parents or guardians must submit to officially notify the state of their decision to homeschool their children. This form outlines the intent to provide an educational experience outside the traditional school system. For those interested in homeschooling in Oregon, it is important to adequately complete the required documentation, including the Homeschool Letter of Intent form, to ensure compliance with state regulations.

Wage and Tax Statement - Employers are required to file W-2 forms with the Social Security Administration.

Dos and Don'ts

When filling out the Payroll Check form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do: Double-check all personal information for accuracy.

- Do: Use clear and legible handwriting or type the information.

- Do: Ensure that all necessary signatures are included.

- Do: Keep a copy of the completed form for your records.

- Don't: Leave any required fields blank.

- Don't: Use correction fluid or tape on the form.

- Don't: Submit the form without verifying the payment amount.

Following these guidelines can help prevent issues and ensure that your payroll check is processed smoothly.