Attorney-Approved Owner Financing Contract Template

When navigating the world of real estate transactions, the Owner Financing Contract form emerges as a vital tool for both buyers and sellers. This agreement allows a seller to provide financing directly to the buyer, bypassing traditional lenders and their often stringent requirements. It outlines key elements such as the purchase price, interest rate, repayment schedule, and any down payment. Additionally, it specifies the responsibilities of both parties, including maintenance and property taxes, ensuring clarity and mutual understanding. By utilizing this form, sellers can attract more buyers and close deals faster, while buyers gain access to financing options that may not be available through conventional means. The Owner Financing Contract not only facilitates a smoother transaction but also fosters a sense of partnership between the buyer and seller, making it an attractive option in today’s real estate market.

Common mistakes

-

Not Including Complete Buyer and Seller Information: One common mistake is failing to provide full names and contact details for both parties. This information is crucial for clarity and future communication.

-

Skipping Property Description: Some individuals forget to include a detailed description of the property being financed. This should encompass the address, legal description, and any specific features of the property.

-

Omitting Payment Terms: It’s essential to clearly outline the payment structure. This includes the amount of the down payment, interest rate, and payment schedule. Ambiguities can lead to misunderstandings later.

-

Not Specifying Default Terms: Many overlook the importance of detailing what happens in case of default. Clear terms regarding late fees, grace periods, and foreclosure processes protect both parties.

-

Ignoring Legal Requirements: Each state has its own laws regarding owner financing. Failing to comply with these regulations can render the contract invalid or unenforceable.

-

Forgetting to Include Contingencies: Life is unpredictable. Not including contingencies for inspections, appraisals, or financing can lead to complications if circumstances change.

-

Neglecting Signatures: A contract without signatures is just a piece of paper. Ensure that both parties sign and date the document to make it legally binding.

-

Failing to Keep Copies: After filling out the contract, it’s vital to keep copies for both parties. This ensures everyone has access to the terms agreed upon, should any disputes arise.

Example - Owner Financing Contract Form

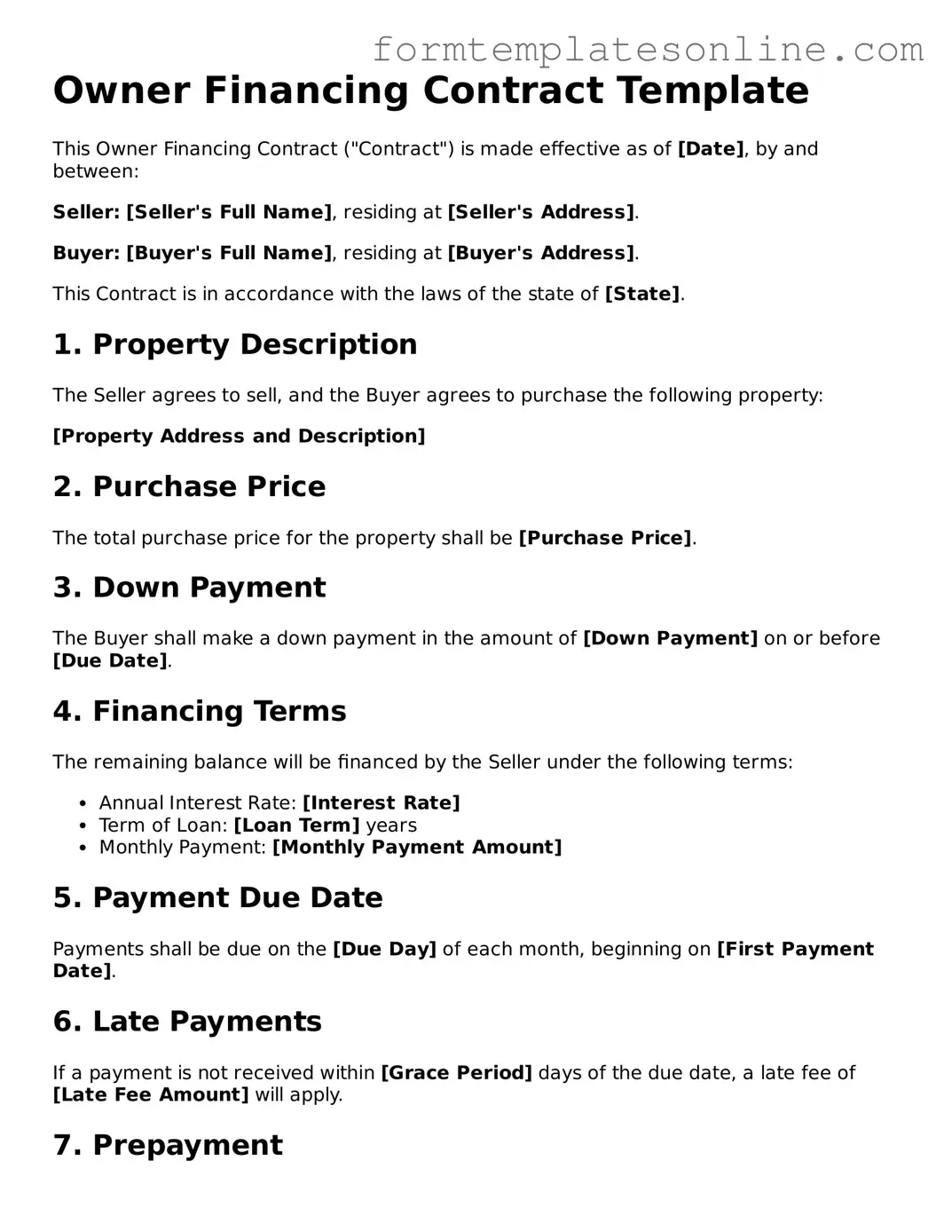

Owner Financing Contract Template

This Owner Financing Contract ("Contract") is made effective as of [Date], by and between:

Seller: [Seller's Full Name], residing at [Seller's Address].

Buyer: [Buyer's Full Name], residing at [Buyer's Address].

This Contract is in accordance with the laws of the state of [State].

1. Property Description

The Seller agrees to sell, and the Buyer agrees to purchase the following property:

[Property Address and Description]

2. Purchase Price

The total purchase price for the property shall be [Purchase Price].

3. Down Payment

The Buyer shall make a down payment in the amount of [Down Payment] on or before [Due Date].

4. Financing Terms

The remaining balance will be financed by the Seller under the following terms:

- Annual Interest Rate: [Interest Rate]

- Term of Loan: [Loan Term] years

- Monthly Payment: [Monthly Payment Amount]

5. Payment Due Date

Payments shall be due on the [Due Day] of each month, beginning on [First Payment Date].

6. Late Payments

If a payment is not received within [Grace Period] days of the due date, a late fee of [Late Fee Amount] will apply.

7. Prepayment

The Buyer may prepay the total outstanding balance at any time without a penalty.

8. Default

In the event of default, the Seller may pursue remedies as provided under state law, including but not limited to:

- Acceleration of the remaining balance.

- Foreclosure as permitted under the applicable law.

9. Governing Law

This Contract shall be governed by the laws of the State of [State].

10. Signatures

By signing below, both parties acknowledge their agreement to the terms outlined in this Contract.

______________________________

Seller’s Signature

Date: _________________________

______________________________

Buyer's Signature

Date: _________________________

This template serves as a guide. It is recommended to consult with a legal professional before finalizing any contract.

More About Owner Financing Contract

What is an Owner Financing Contract?

An Owner Financing Contract is a legal agreement between a seller and a buyer, where the seller provides financing directly to the buyer to purchase the property. This arrangement allows the buyer to make payments over time, rather than obtaining a traditional mortgage from a bank or financial institution. It can be beneficial for buyers who may have difficulty securing conventional financing due to credit issues or other factors.

Who benefits from an Owner Financing Contract?

Both buyers and sellers can benefit from this type of contract. Buyers gain access to properties that they might not otherwise be able to afford or finance through traditional means. Sellers can attract a wider range of potential buyers and may receive a steady stream of income through monthly payments. Additionally, sellers can often sell their property faster and may receive a higher selling price.

What are the typical terms included in an Owner Financing Contract?

Typical terms in an Owner Financing Contract include the purchase price, down payment amount, interest rate, payment schedule, and the duration of the loan. The contract should also outline any penalties for late payments, the process for handling defaults, and whether the buyer can prepay the loan without penalties. Clarity in these terms helps both parties understand their obligations and rights.

Is a down payment required in an Owner Financing Contract?

Yes, a down payment is usually required. The amount can vary based on the agreement between the buyer and seller but is often between 5% to 20% of the purchase price. A larger down payment may help secure better terms for the buyer, such as a lower interest rate or more favorable repayment schedule.

What happens if the buyer defaults on the contract?

If the buyer defaults on the contract, the seller typically has the right to reclaim the property. The specific process for handling defaults should be clearly outlined in the contract. In many cases, the seller may also retain any payments made up to that point, which can serve as compensation for the time and resources invested in the sale.

Can an Owner Financing Contract be used for any type of property?

Yes, an Owner Financing Contract can be used for various types of properties, including residential homes, commercial properties, and vacant land. However, the terms and conditions may vary depending on the type of property and the specific circumstances surrounding the sale.

Should I consult a professional before entering into an Owner Financing Contract?

It is highly advisable to consult with a real estate attorney or a qualified professional before entering into an Owner Financing Contract. They can help ensure that the terms are fair and legally binding, protecting both the buyer's and seller's interests. Understanding the implications of the agreement can prevent potential disputes in the future.

Key takeaways

Understanding the Owner Financing Contract form is crucial for both buyers and sellers in real estate transactions. Here are some key takeaways to keep in mind:

- Clear Terms: Ensure that all terms are clearly defined in the contract. This includes the purchase price, interest rate, and repayment schedule.

- Legal Compliance: Verify that the contract complies with local and state laws. This helps avoid potential legal issues down the line.

- Disclosure Requirements: Both parties should be aware of any disclosure requirements. Transparency can prevent misunderstandings and disputes.

- Default Provisions: Include provisions for default. This outlines what happens if either party fails to meet their obligations.

- Title and Ownership: Confirm that the seller has clear title to the property. This protects the buyer from future claims against the property.

- Seek Legal Advice: It is wise to consult with a real estate attorney before finalizing the contract. Professional guidance can help ensure all aspects are covered.

By keeping these points in mind, both buyers and sellers can navigate the owner financing process more effectively.

File Details

| Fact Name | Description |

|---|---|

| Definition | An Owner Financing Contract allows a buyer to purchase property directly from the seller, who finances the purchase instead of a traditional lender. |

| Down Payment | Typically, the buyer makes a down payment, which is often a percentage of the purchase price. This amount is negotiated between the buyer and seller. |

| Interest Rate | The interest rate is set by the seller and can be higher or lower than conventional mortgage rates. This rate is crucial as it affects monthly payments. |

| Governing Law | The contract is governed by state-specific laws. For example, in California, the California Civil Code applies, while in Texas, it follows the Texas Property Code. |

| Payment Terms | Payment terms are flexible and can include monthly payments, balloon payments, or a combination. These terms should be clearly outlined in the contract. |

| Default Consequences | If the buyer defaults, the seller can initiate foreclosure proceedings, similar to traditional mortgages. This risk should be understood by both parties. |

| Legal Considerations | Both parties should seek legal advice before signing. Owner financing contracts can be complex, and understanding the terms is essential to avoid disputes. |

More Owner Financing Contract Types:

Purchase Agreement Addendum - The addendum is an essential tool for documenting any agreed-upon changes to the deal.

The New York Real Estate Purchase Agreement form is a legally binding document that outlines the terms and conditions under which a piece of real estate will be sold and purchased. It details everything from the price to the responsibilities of both the buyer and the seller. Understanding this form is essential for anyone looking to navigate the complexities of buying or selling property in New York, and for further assistance, you can refer to NY PDF Forms.

Dos and Don'ts

When filling out an Owner Financing Contract form, attention to detail is crucial. Here’s a list of things to do and avoid:

- Do: Read the entire contract thoroughly before starting.

- Do: Clearly state the purchase price and financing terms.

- Do: Include all necessary personal information, such as names and addresses.

- Do: Specify the down payment amount and due date.

- Do: Outline the repayment schedule, including interest rates.

- Do: Consult with a real estate professional if unsure about any terms.

- Do: Keep a copy of the completed contract for your records.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any sections blank; fill in all required fields.

- Don't: Ignore state-specific laws that may affect the contract.