Attorney-Approved Operating Agreement Template

An Operating Agreement is a crucial document for any Limited Liability Company (LLC) as it outlines the internal workings and governance of the business. This form serves multiple purposes, including defining the roles and responsibilities of members, establishing procedures for decision-making, and detailing the distribution of profits and losses. Additionally, it addresses important aspects such as member contributions, ownership percentages, and the process for adding or removing members. By laying out these foundational elements, the Operating Agreement helps prevent disputes among members and provides a clear framework for the company's operations. Furthermore, it can specify procedures for handling various situations, such as the dissolution of the LLC or the transfer of ownership interests. Having a well-drafted Operating Agreement not only protects the interests of the members but also enhances the credibility of the business in the eyes of potential investors and partners.

State-specific Operating Agreement Documents

Operating Agreement Document Types

Common mistakes

-

Inaccurate Member Information: People often forget to include accurate names and addresses of all members. This can lead to confusion and legal complications later.

-

Undefined Roles and Responsibilities: Not clearly outlining each member's roles can create misunderstandings. It's essential to specify who does what within the company.

-

Omitting Capital Contributions: Failing to detail each member's financial contributions can result in disputes. Clearly stating how much each member invests is crucial.

-

Neglecting Profit and Loss Distribution: Not specifying how profits and losses will be divided can lead to disagreements. This section should reflect the agreement among members.

-

Ignoring Decision-Making Processes: A lack of clarity about how decisions are made can cause chaos. Define whether decisions require a majority vote or unanimous consent.

-

Not Including a Buyout Clause: Without a buyout clause, exiting members may face difficulties. It's important to outline how a member can sell their interest in the company.

-

Forgetting to Address Dispute Resolution: Failing to include a method for resolving disputes can lead to prolonged conflicts. Consider mediation or arbitration options.

-

Skipping Amendments Procedure: Not specifying how to amend the Operating Agreement can complicate future changes. Outline the process for making amendments clearly.

-

Overlooking State-Specific Requirements: Each state has unique laws governing Operating Agreements. Ignoring these can result in an invalid document.

-

Not Seeking Legal Advice: Many individuals attempt to draft their own agreements without professional guidance. Consulting with a legal expert can prevent costly mistakes.

Example - Operating Agreement Form

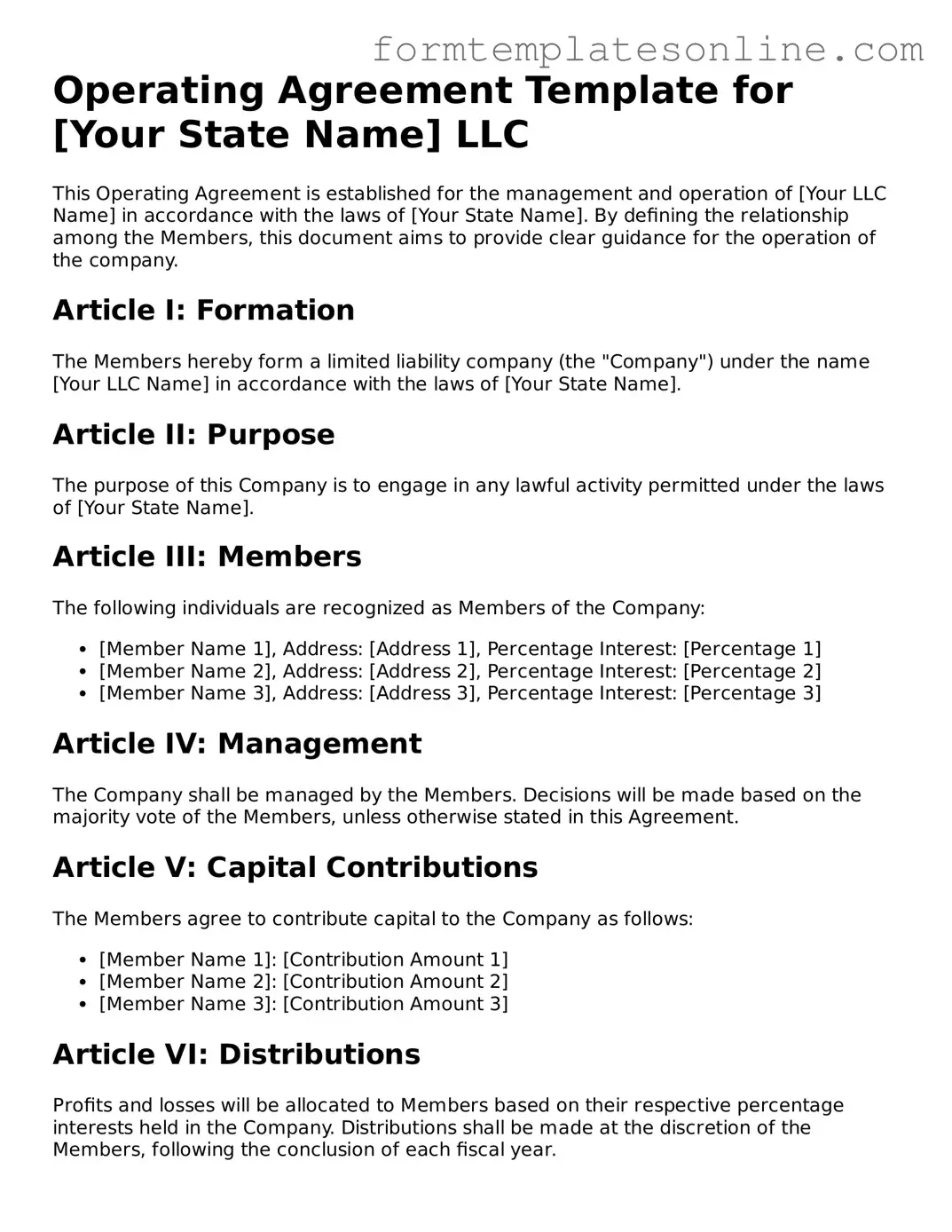

Operating Agreement Template for [Your State Name] LLC

This Operating Agreement is established for the management and operation of [Your LLC Name] in accordance with the laws of [Your State Name]. By defining the relationship among the Members, this document aims to provide clear guidance for the operation of the company.

Article I: Formation

The Members hereby form a limited liability company (the "Company") under the name [Your LLC Name] in accordance with the laws of [Your State Name].

Article II: Purpose

The purpose of this Company is to engage in any lawful activity permitted under the laws of [Your State Name].

Article III: Members

The following individuals are recognized as Members of the Company:

- [Member Name 1], Address: [Address 1], Percentage Interest: [Percentage 1]

- [Member Name 2], Address: [Address 2], Percentage Interest: [Percentage 2]

- [Member Name 3], Address: [Address 3], Percentage Interest: [Percentage 3]

Article IV: Management

The Company shall be managed by the Members. Decisions will be made based on the majority vote of the Members, unless otherwise stated in this Agreement.

Article V: Capital Contributions

The Members agree to contribute capital to the Company as follows:

- [Member Name 1]: [Contribution Amount 1]

- [Member Name 2]: [Contribution Amount 2]

- [Member Name 3]: [Contribution Amount 3]

Article VI: Distributions

Profits and losses will be allocated to Members based on their respective percentage interests held in the Company. Distributions shall be made at the discretion of the Members, following the conclusion of each fiscal year.

Article VII: Withdrawal or Addition of Members

If a Member wishes to withdraw from the Company, the remaining Members may admit a new Member by unanimous consent. Any withdrawal must be conducted in compliance with the laws of [Your State Name].

Article VIII: Indemnification

The Company agrees to indemnify any Member against losses arising from their role in the Company, provided such Member acted in good faith and in the best interest of the Company.

Article IX: Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members. Any changes must align with the laws of [Your State Name].

Article X: Governing Law

This Agreement shall be governed by the laws of [Your State Name].

In witness whereof, the Members have executed this Operating Agreement as of the ___ day of __________, 20__.

Signatures:

- _____________________________ [Member Name 1]

- _____________________________ [Member Name 2]

- _____________________________ [Member Name 3]

More About Operating Agreement

What is an Operating Agreement?

An Operating Agreement is a legal document that outlines the ownership and operating procedures of a Limited Liability Company (LLC). It serves as a blueprint for how the business will be run, detailing the roles of members, decision-making processes, and distribution of profits. While not always required by law, having one is crucial for clarity and protection among members.

Why do I need an Operating Agreement?

An Operating Agreement is essential for several reasons. First, it helps prevent misunderstandings among members by clearly defining roles and responsibilities. Second, it can protect your limited liability status by demonstrating that your LLC is a separate entity. Additionally, it provides a framework for resolving disputes and making decisions, which can save time and money in the long run.

Who should create the Operating Agreement?

What should be included in the Operating Agreement?

Is an Operating Agreement legally binding?

Can I change my Operating Agreement after it’s created?

What happens if I don’t have an Operating Agreement?

Key takeaways

Filling out an Operating Agreement is an important step for any business. Here are some key takeaways to keep in mind:

- Clarify Roles and Responsibilities: Clearly define the roles of each member. This helps prevent misunderstandings and ensures everyone knows their duties.

- Outline Profit Distribution: Specify how profits and losses will be shared among members. This can avoid disputes later on.

- Establish Decision-Making Processes: Detail how decisions will be made within the company. This includes voting rights and procedures.

- Include Buyout Provisions: Plan for potential future changes. Outline what happens if a member wants to leave or if new members join.

- Review and Update Regularly: Treat the Operating Agreement as a living document. Regular reviews ensure it stays relevant as the business evolves.

File Details

| Fact Name | Description |

|---|---|

| Definition | An Operating Agreement is a document that outlines the management structure and operating procedures of a Limited Liability Company (LLC). |

| Importance | This agreement helps protect the owners' personal assets and clarifies the roles and responsibilities of each member. |

| State-Specific Forms | Each state may have specific requirements for Operating Agreements, and it's essential to comply with local laws. |

| Governing Law | In states like Delaware, the governing law for Operating Agreements is found in Title 6, Chapter 18 of the Delaware Code. |

| Flexibility | Operating Agreements can be customized to fit the unique needs of the LLC, allowing for flexibility in management and profit distribution. |

Other Templates:

Dog Contract - This form can assist in registering the dog with local authorities.

Sample Employee Handbook - The Employee Handbook outlines benefits and compensation policies.

Employment Status Change Form - This form serves to manage changes by employee requests.

Dos and Don'ts

When filling out the Operating Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Here are six things to do and avoid:

- Do read the entire form carefully before starting.

- Do provide accurate and up-to-date information.

- Do consult with a legal professional if unsure about any section.

- Do keep a copy of the completed form for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank; fill in all necessary information.