Valid Transfer-on-Death Deed Form for Ohio

In Ohio, the Transfer-on-Death Deed (TOD) serves as a vital estate planning tool that allows property owners to transfer their real estate assets directly to beneficiaries upon their death, bypassing the often lengthy and costly probate process. This straightforward legal document can simplify the transfer of property, ensuring that your loved ones receive their inheritance quickly and efficiently. The form must be properly executed and recorded to be valid, and it provides flexibility, as property owners retain full control over their assets during their lifetime. Additionally, the TOD deed can be revoked or amended at any time before the owner’s death, offering peace of mind in an ever-changing world. Understanding the nuances of the Transfer-on-Death Deed is essential for anyone looking to secure their estate and provide for their family in a seamless manner.

Common mistakes

-

Incorrect Property Description: People often fail to provide a complete and accurate description of the property. This can lead to confusion or disputes about which property is being transferred. Always include the full address and legal description.

-

Not Naming Beneficiaries: Some individuals forget to name a beneficiary or mistakenly name someone who is not eligible to receive the property. It’s crucial to clearly identify the person or people who will inherit the property.

-

Improper Signatures: The deed must be signed by the property owner(s). A common mistake is not having all required signatures or failing to have the signatures notarized. Ensure that all necessary parties sign the document in the presence of a notary public.

-

Failure to Record the Deed: After filling out the form, some people neglect to file it with the county recorder's office. Without this step, the transfer does not take effect. Always ensure that the deed is properly recorded to make it legally binding.

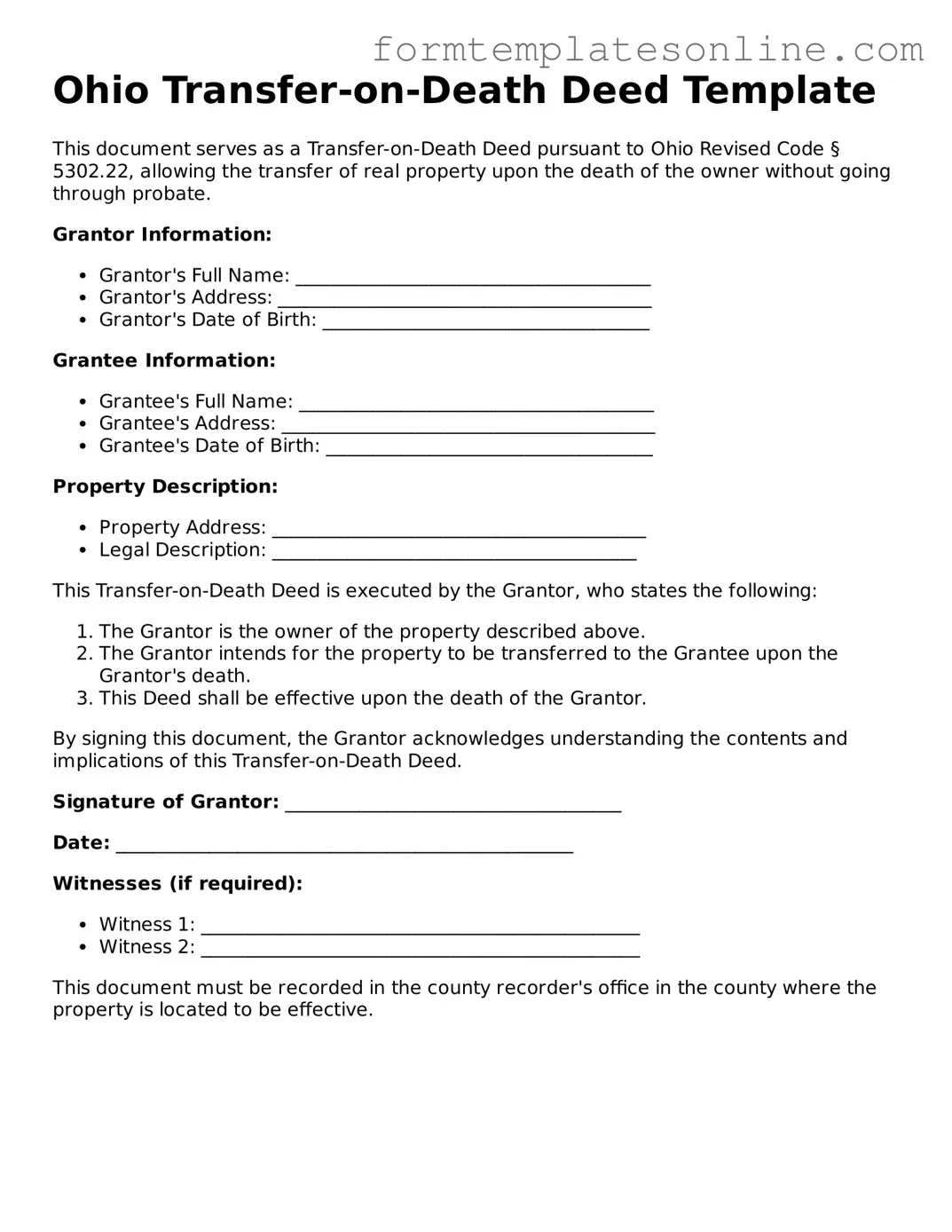

Example - Ohio Transfer-on-Death Deed Form

Ohio Transfer-on-Death Deed Template

This document serves as a Transfer-on-Death Deed pursuant to Ohio Revised Code § 5302.22, allowing the transfer of real property upon the death of the owner without going through probate.

Grantor Information:

- Grantor's Full Name: ______________________________________

- Grantor's Address: ________________________________________

- Grantor's Date of Birth: ___________________________________

Grantee Information:

- Grantee's Full Name: ______________________________________

- Grantee's Address: ________________________________________

- Grantee's Date of Birth: ___________________________________

Property Description:

- Property Address: ________________________________________

- Legal Description: _______________________________________

This Transfer-on-Death Deed is executed by the Grantor, who states the following:

- The Grantor is the owner of the property described above.

- The Grantor intends for the property to be transferred to the Grantee upon the Grantor's death.

- This Deed shall be effective upon the death of the Grantor.

By signing this document, the Grantor acknowledges understanding the contents and implications of this Transfer-on-Death Deed.

Signature of Grantor: ____________________________________

Date: _________________________________________________

Witnesses (if required):

- Witness 1: _______________________________________________

- Witness 2: _______________________________________________

This document must be recorded in the county recorder's office in the county where the property is located to be effective.

More About Ohio Transfer-on-Death Deed

What is a Transfer-on-Death Deed in Ohio?

A Transfer-on-Death Deed (TODD) in Ohio is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death. This deed enables the property owner to retain full control over the property during their lifetime. It avoids the probate process, making it a straightforward option for transferring property to heirs without the complexities often associated with wills and trusts.

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed in Ohio, you must fill out the appropriate form, which includes details about the property and the beneficiaries. It is important to ensure that the deed is signed in front of a notary public. After signing, the deed must be filed with the county recorder’s office in the county where the property is located. This filing officially records the deed and makes it effective upon the property owner's death.

Can I revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked. The property owner may revoke the deed at any time before their death. This can be done by executing a new deed that explicitly states the revocation or by filing a revocation form with the county recorder’s office. It’s essential to follow the proper legal procedures to ensure that the revocation is valid and recognized.

What types of property can be transferred using a Transfer-on-Death Deed?

In Ohio, a Transfer-on-Death Deed can be used to transfer various types of real estate, including residential homes, commercial properties, and vacant land. However, it is important to note that this deed cannot be used for personal property, such as vehicles or bank accounts. Only real estate that is titled in the owner’s name can be transferred using this method.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications when executing a Transfer-on-Death Deed. The property remains part of the owner's estate until their death, so the owner continues to be responsible for property taxes and any income generated by the property. However, beneficiaries may be subject to taxes upon inheriting the property, depending on the property’s value and local tax laws. Consulting a tax professional can provide clarity on specific situations.

Who can be a beneficiary on a Transfer-on-Death Deed?

Beneficiaries on a Transfer-on-Death Deed can be individuals, such as family members or friends, or entities, like trusts or charities. There is no limit to the number of beneficiaries you can designate. However, it’s essential to ensure that the beneficiaries are clearly identified in the deed to avoid any confusion or disputes after the property owner’s death.

Key takeaways

When considering the Ohio Transfer-on-Death Deed form, it's important to understand its key aspects. Here are some essential takeaways:

- Purpose of the Deed: The Transfer-on-Death Deed allows property owners to designate beneficiaries who will receive their property automatically upon their death, avoiding probate.

- Eligibility: Only individuals who own real estate in Ohio can use this deed. It’s essential to ensure that the property is eligible for transfer.

- Filling Out the Form: Complete the form accurately, including the property description and the names of beneficiaries. Mistakes can lead to complications later.

- Signing Requirements: The deed must be signed in front of a notary public. This step is crucial for the deed to be valid and enforceable.

- Recording the Deed: After signing, the deed must be recorded with the county recorder's office where the property is located. This step finalizes the transfer arrangement.

Understanding these points can help ensure a smooth process when using the Ohio Transfer-on-Death Deed form.

File Details

| Fact Name | Details |

|---|---|

| Definition | The Ohio Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The use of Transfer-on-Death Deeds in Ohio is governed by Ohio Revised Code Section 5302.22. |

| Eligibility | Any individual who owns real estate in Ohio can create a Transfer-on-Death Deed, provided they are of sound mind and legal age. |

| Revocation | Property owners can revoke a Transfer-on-Death Deed at any time before their death, allowing for flexibility in estate planning. |

| Filing Requirements | To be valid, the deed must be signed, notarized, and recorded with the county recorder's office where the property is located. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes during the property owner's lifetime, but beneficiaries may face capital gains taxes upon sale. |

Consider Some Other Transfer-on-Death Deed Forms for US States

Does a Living Trust Avoid Probate in California - A Transfer-on-Death Deed does not affect the owner’s taxes or debts while they are alive.

The New York Boat Bill of Sale form is a crucial document used to transfer ownership of a boat from one party to another. This form provides essential details about the vessel, including its make, model, and hull identification number. Properly completing this document ensures a smooth transaction and establishes clear ownership records. For a convenient template, you can refer to documentonline.org/blank-new-york-boat-bill-of-sale/.

Disadvantages of Transfer on Death Deed Illinois - A Transfer-on-Death Deed can help you manage your estate while ensuring specific property goes to the right individuals after your death.

Beneficiary Deed Georgia - If multiple owners exist, all must agree to the deed’s terms.

How to Avoid Probate in Pa - With a Transfer-on-Death Deed, property ownership can change hands directly after the owner's passing.

Dos and Don'ts

When filling out the Ohio Transfer-on-Death Deed form, it is essential to approach the process with care and attention to detail. Here are five important guidelines to follow, including actions to take and those to avoid.

- Do ensure you understand the purpose of the deed. Familiarize yourself with how a Transfer-on-Death Deed works and its implications for your estate.

- Do provide accurate property descriptions. Clearly describe the property you wish to transfer, including its address and legal description.

- Do sign the deed in the presence of a notary. Ensure that your signature is notarized to validate the document.

- Do keep a copy of the completed deed. Retain a copy for your records and inform your beneficiaries about its existence.

- Do consult with an estate planning attorney. Seek professional advice to ensure that your intentions are correctly reflected in the deed.

- Don’t rush through the process. Take your time to carefully fill out each section of the form to avoid mistakes.

- Don’t leave any sections blank. Ensure that all required information is provided to prevent delays or complications.

- Don’t forget to revoke any previous deeds. If you have existing Transfer-on-Death Deeds, make sure to revoke them if necessary.

- Don’t ignore state-specific requirements. Be aware of Ohio's specific rules regarding the Transfer-on-Death Deed.

- Don’t underestimate the importance of clear communication. Discuss your plans with your beneficiaries to avoid confusion later on.