Valid Real Estate Purchase Agreement Form for Ohio

When embarking on the journey of buying or selling property in Ohio, understanding the Ohio Real Estate Purchase Agreement form is essential. This document serves as the backbone of any real estate transaction, outlining the terms and conditions agreed upon by both the buyer and the seller. It typically includes critical elements such as the purchase price, the legal description of the property, and the closing date. Additionally, the agreement addresses contingencies, which are conditions that must be met for the sale to proceed, such as financing or inspections. Both parties must also be aware of their respective responsibilities, including earnest money deposits and disclosures regarding the property’s condition. By grasping these key components, individuals can navigate the complexities of real estate transactions with greater confidence and clarity.

Common mistakes

-

Incomplete Information: Buyers often forget to fill in all required fields. Missing information can delay the process or lead to misunderstandings. Always double-check that every section is complete.

-

Incorrect Property Description: It's crucial to accurately describe the property being purchased. Errors in the address or legal description can create significant issues down the line. Verify the details before submission.

-

Ignoring Contingencies: Many buyers overlook the importance of contingencies. These are conditions that must be met for the sale to proceed. Not including them can leave buyers vulnerable to unexpected situations.

-

Failure to Specify Closing Costs: Buyers sometimes neglect to clarify who will pay closing costs. This can lead to disputes later on. Clearly outline these costs in the agreement to avoid confusion.

-

Not Seeking Professional Help: Some individuals attempt to fill out the form without guidance. Real estate transactions can be complex. Consulting a professional can prevent costly mistakes and ensure compliance with local laws.

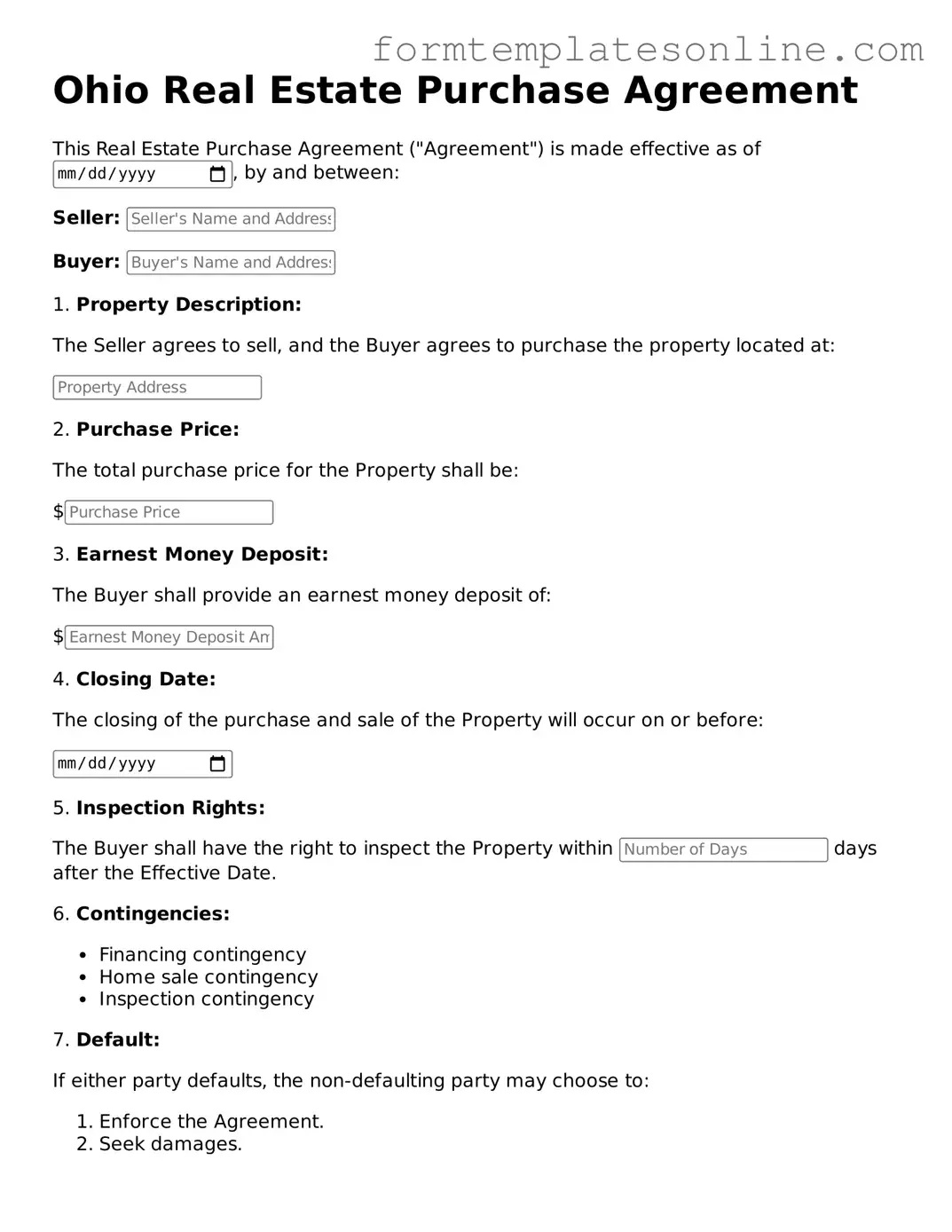

Example - Ohio Real Estate Purchase Agreement Form

Ohio Real Estate Purchase Agreement

This Real Estate Purchase Agreement ("Agreement") is made effective as of , by and between:

Seller:

Buyer:

1. Property Description:

The Seller agrees to sell, and the Buyer agrees to purchase the property located at:

2. Purchase Price:

The total purchase price for the Property shall be:

$

3. Earnest Money Deposit:

The Buyer shall provide an earnest money deposit of:

$

4. Closing Date:

The closing of the purchase and sale of the Property will occur on or before:

5. Inspection Rights:

The Buyer shall have the right to inspect the Property within days after the Effective Date.

6. Contingencies:

- Financing contingency

- Home sale contingency

- Inspection contingency

7. Default:

If either party defaults, the non-defaulting party may choose to:

- Enforce the Agreement.

- Seek damages.

8. Governing Law:

This Agreement shall be governed by and construed in accordance with the laws of the State of Ohio.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Seller's Signature: ______________________ Date: ______________

Buyer's Signature: ______________________ Date: ______________

More About Ohio Real Estate Purchase Agreement

What is the Ohio Real Estate Purchase Agreement?

The Ohio Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a property is bought and sold in the state of Ohio. It serves as a binding contract between the buyer and the seller, detailing aspects such as the purchase price, property description, and any contingencies that must be met before the sale can be finalized.

Who typically uses the Ohio Real Estate Purchase Agreement?

This agreement is commonly used by buyers and sellers of residential properties, including single-family homes, condominiums, and multi-family units. Real estate agents and brokers also utilize this form to facilitate transactions on behalf of their clients, ensuring that all parties are aware of their rights and obligations.

What key elements are included in the agreement?

Essential components of the Ohio Real Estate Purchase Agreement include the names of the buyer and seller, the legal description of the property, the purchase price, earnest money deposit details, and timelines for inspections and closing. Additionally, it may address contingencies such as financing approval and home inspections, which protect both parties during the transaction.

Is the Ohio Real Estate Purchase Agreement legally binding?

Yes, once both parties sign the agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to adhere to the terms outlined in the document. Failure to comply with the agreement could lead to legal consequences, including potential lawsuits or financial penalties.

Can the Ohio Real Estate Purchase Agreement be modified?

Modifications to the agreement can be made, but they must be documented in writing and signed by both parties. It is important to ensure that any changes are clearly stated to avoid misunderstandings later on. This may include adjustments to the purchase price, closing date, or any contingencies that were initially agreed upon.

What happens if a buyer wants to back out of the agreement?

If a buyer wishes to withdraw from the agreement, they must review the contingencies outlined in the contract. If they are within the timeframe specified for contingencies, such as failing to secure financing, they may be able to back out without penalty. However, if they attempt to withdraw without valid reasons, they could risk losing their earnest money deposit or facing legal action from the seller.

How does earnest money work in the Ohio Real Estate Purchase Agreement?

Earnest money is a deposit made by the buyer to demonstrate their serious intent to purchase the property. This amount is typically held in escrow until the closing of the sale. If the transaction proceeds as planned, the earnest money is applied to the purchase price. However, if the buyer backs out without a valid reason, the seller may be entitled to keep the earnest money as compensation for their time and effort.

What are common contingencies in the Ohio Real Estate Purchase Agreement?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies in Ohio include financing contingencies, which allow the buyer to secure a mortgage, and inspection contingencies, which enable the buyer to have the property inspected for any issues. These contingencies provide a safety net for buyers and help ensure that they do not enter into a purchase without adequate protections.

Where can I obtain the Ohio Real Estate Purchase Agreement form?

The Ohio Real Estate Purchase Agreement form can typically be obtained through real estate agents, brokers, or legal professionals. Additionally, various online resources provide templates for the agreement. It is advisable to consult with a qualified real estate professional or attorney to ensure that the form is filled out correctly and meets all legal requirements.

Key takeaways

When filling out and using the Ohio Real Estate Purchase Agreement form, it is crucial to understand several key aspects to ensure a smooth transaction.

- Accuracy is Essential: Every detail in the form must be filled out accurately. Errors can lead to misunderstandings or legal complications.

- Understand the Terms: Familiarize yourself with the terms and conditions outlined in the agreement. Know what you are agreeing to before signing.

- Include Contingencies: Consider including contingencies, such as financing or inspection clauses, to protect your interests in the transaction.

- Seek Professional Guidance: Consult with a real estate agent or attorney if you have questions or uncertainties about the form or the process.

- Keep Copies: Always keep a copy of the signed agreement for your records. This documentation is vital for future reference.

By following these guidelines, you can navigate the Ohio Real Estate Purchase Agreement process more effectively.

File Details

| Fact Name | Description |

|---|---|

| Governing Law | The Ohio Real Estate Purchase Agreement is governed by Ohio state law. |

| Parties Involved | The agreement involves a buyer and a seller, both of whom must be clearly identified. |

| Property Description | A detailed description of the property being sold is required, including the address and legal description. |

| Purchase Price | The total purchase price must be clearly stated, along with any deposit amounts. |

| Contingencies | Buyers may include contingencies, such as financing or inspection, which must be outlined in the agreement. |

| Closing Date | The agreement should specify a closing date, which is when the ownership of the property is transferred. |

| Disclosures | Sellers are required to provide certain disclosures about the property, such as known defects or issues. |

| Signatures | Both parties must sign the agreement for it to be legally binding. |

| Default and Remedies | The agreement should outline what happens in the event of a default by either party, including potential remedies. |

Consider Some Other Real Estate Purchase Agreement Forms for US States

Illinois Real Estate Contract for Sale by Owner - Includes a section on handling earnest money in the event of cancellation.

The New York Boat Bill of Sale form is a crucial document used to transfer ownership of a boat from one party to another. This form provides essential details about the vessel, including its make, model, and hull identification number. Properly completing this document ensures a smooth transaction and establishes clear ownership records. For those looking to obtain this document, you can find it at documentonline.org/blank-new-york-boat-bill-of-sale.

Purchasing Agreement - Includes provisions for repairs or credits from the seller.

Dos and Don'ts

When filling out the Ohio Real Estate Purchase Agreement form, it is essential to approach the process with care and attention to detail. Here are ten things to keep in mind:

- Do read the entire form thoroughly before starting to fill it out.

- Do provide accurate and complete information about the property and parties involved.

- Do include all necessary contingencies, such as financing or inspection clauses.

- Do ensure that all signatures are obtained from all parties involved in the transaction.

- Do double-check the dates, especially the closing date and any deadlines for contingencies.

- Don't leave any sections blank; if a section does not apply, indicate that clearly.

- Don't use vague language; be specific about terms and conditions.

- Don't rush through the process; take your time to avoid mistakes.

- Don't forget to consult with a real estate professional if you have questions.

- Don't assume that verbal agreements will be honored; everything should be documented in writing.