Valid Quitclaim Deed Form for Ohio

The Ohio Quitclaim Deed form is a crucial document for anyone looking to transfer property rights in the state of Ohio. This form allows a property owner, known as the grantor, to convey their interest in a property to another party, referred to as the grantee, without making any guarantees about the title's validity. It’s often used in situations like transferring property between family members or clearing up title issues. The form requires specific information, including the names of both parties, a description of the property, and the date of the transfer. While it’s generally simpler than other types of deeds, such as warranty deeds, it’s important to understand that a quitclaim deed does not protect the grantee from any claims against the property. Therefore, individuals should consider conducting a title search or obtaining title insurance before proceeding with the transfer. Properly completing and filing the quitclaim deed with the county recorder’s office is essential to ensure that the transfer is legally recognized. Understanding these key aspects can help facilitate a smooth property transfer process in Ohio.

Common mistakes

-

Incomplete Information: One of the most common mistakes is leaving out essential details. Make sure to include the full names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Missing even one name can invalidate the deed.

-

Incorrect Property Description: A precise description of the property is crucial. Failing to provide an accurate legal description can lead to confusion or disputes later on. Always verify that the property description matches the information in public records.

-

Not Notarizing the Document: A quitclaim deed must be notarized to be legally binding. Forgetting to have the document signed in front of a notary public can render it ineffective. Ensure that both parties sign the deed in the presence of the notary.

-

Improper Filing: After completing the quitclaim deed, it must be filed with the appropriate county recorder’s office. Neglecting this step means that the transfer of ownership is not officially recognized. Always check the local requirements for filing.

-

Ignoring Tax Implications: Many people overlook the potential tax consequences of transferring property. It’s essential to understand how this transfer may affect property taxes or capital gains taxes. Consulting with a tax professional can provide clarity.

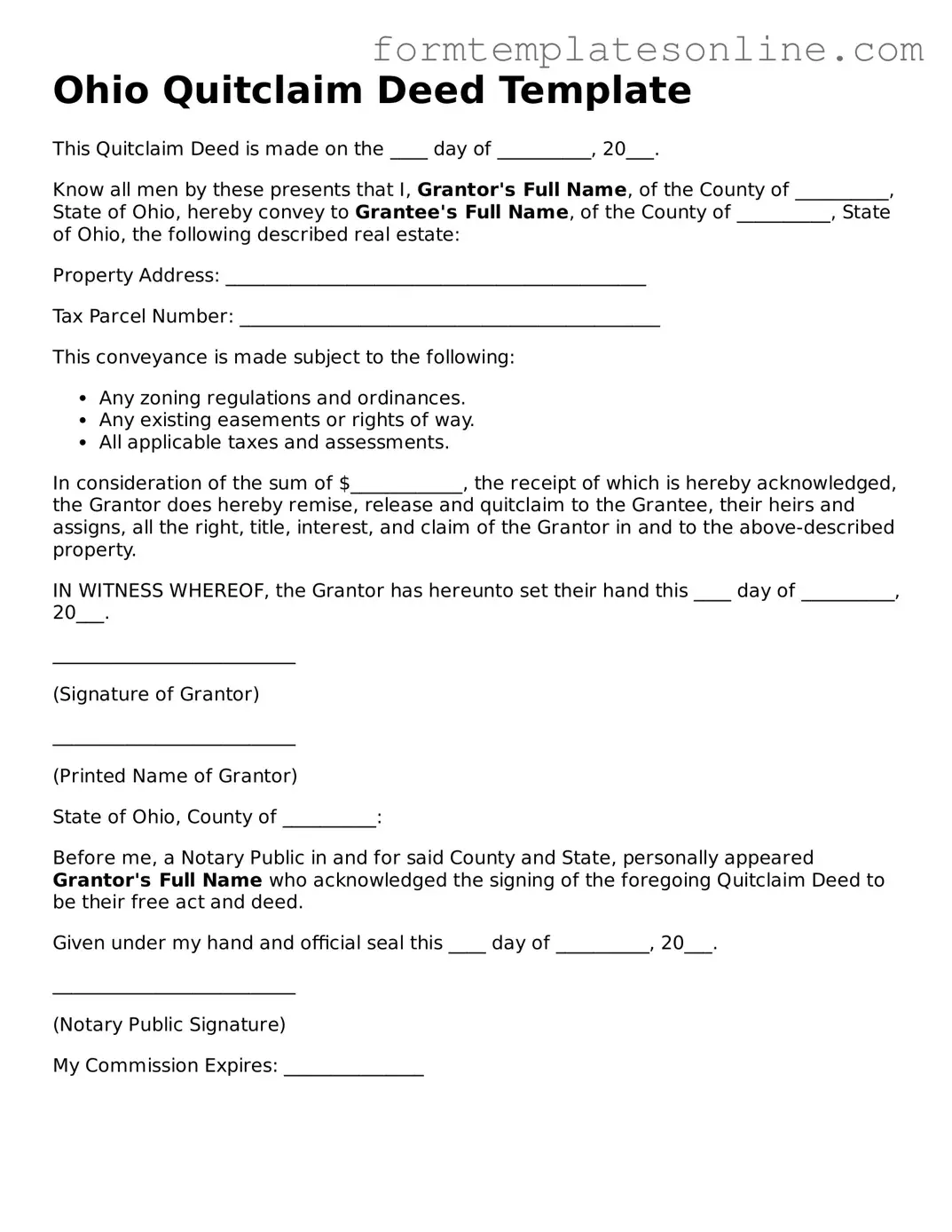

Example - Ohio Quitclaim Deed Form

Ohio Quitclaim Deed Template

This Quitclaim Deed is made on the ____ day of __________, 20___.

Know all men by these presents that I, Grantor's Full Name, of the County of __________, State of Ohio, hereby convey to Grantee's Full Name, of the County of __________, State of Ohio, the following described real estate:

Property Address: _____________________________________________

Tax Parcel Number: _____________________________________________

This conveyance is made subject to the following:

- Any zoning regulations and ordinances.

- Any existing easements or rights of way.

- All applicable taxes and assessments.

In consideration of the sum of $____________, the receipt of which is hereby acknowledged, the Grantor does hereby remise, release and quitclaim to the Grantee, their heirs and assigns, all the right, title, interest, and claim of the Grantor in and to the above-described property.

IN WITNESS WHEREOF, the Grantor has hereunto set their hand this ____ day of __________, 20___.

__________________________

(Signature of Grantor)

__________________________

(Printed Name of Grantor)

State of Ohio, County of __________:

Before me, a Notary Public in and for said County and State, personally appeared Grantor's Full Name who acknowledged the signing of the foregoing Quitclaim Deed to be their free act and deed.

Given under my hand and official seal this ____ day of __________, 20___.

__________________________

(Notary Public Signature)

My Commission Expires: _______________

More About Ohio Quitclaim Deed

What is a Quitclaim Deed in Ohio?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another in Ohio. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property has clear title to it. Instead, it simply conveys whatever interest the grantor has in the property, if any. This means that if there are any issues with the title, the grantee may not have legal recourse against the grantor. Quitclaim Deeds are often used between family members or in situations where the parties know each other well and trust one another.

How do I complete a Quitclaim Deed form in Ohio?

To complete a Quitclaim Deed in Ohio, you'll need to gather specific information. Start by identifying the grantor (the person giving up their interest) and the grantee (the person receiving the interest). Include their full names and addresses. Next, describe the property being transferred, including the legal description, which can usually be found on the property’s deed or tax records. After filling out the form, both parties must sign it in the presence of a notary public. Finally, the completed Quitclaim Deed should be filed with the county recorder's office where the property is located to make the transfer official.

Are there any fees associated with filing a Quitclaim Deed in Ohio?

Yes, there are typically fees associated with filing a Quitclaim Deed in Ohio. The fees can vary by county, so it’s a good idea to check with your local county recorder’s office for the exact amount. Generally, the fee may include a base filing fee, plus additional charges based on the number of pages in the document. It's also important to note that while there may not be a fee for the Quitclaim Deed itself, you might incur costs for notarization and obtaining copies of the deed.

Can a Quitclaim Deed be revoked in Ohio?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. The transfer of property is considered final. However, the grantor and grantee can agree to reverse the transaction by creating a new deed that transfers the property back to the original owner. This new deed would also need to be completed, signed, notarized, and recorded to be legally effective. It’s essential to consult with a legal professional if you’re considering reversing a Quitclaim Deed to understand the implications fully.

Key takeaways

- Understanding the purpose of a quitclaim deed is essential. This type of deed transfers ownership without guaranteeing the title's validity.

- Ensure all parties involved in the transaction are clearly identified. Full names and addresses should be included to avoid confusion.

- Provide a complete legal description of the property. This description should be accurate and match what is recorded in public records.

- Signatures are crucial. All grantors must sign the deed in front of a notary public to make the document legally binding.

- Consider recording the quitclaim deed with the county recorder’s office. This step protects the new owner's interest and provides public notice of the transfer.

- Be aware of potential tax implications. The transfer of property may trigger tax responsibilities that need to be addressed.

- Consulting with a real estate attorney can be beneficial. Professional guidance can help navigate any complexities in the property transfer process.

File Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate from one party to another without any warranties regarding the title. |

| Governing Law | The use of quitclaim deeds in Ohio is governed by Ohio Revised Code § 5302.01 et seq. |

| No Guarantees | Unlike warranty deeds, quitclaim deeds do not guarantee that the property title is clear of liens or encumbrances. |

| Common Uses | Quitclaim deeds are often used among family members, in divorce settlements, or to clear up title issues. |

| Filing Requirements | In Ohio, a quitclaim deed must be signed, notarized, and filed with the county recorder’s office to be effective. |

| Tax Implications | Transfer taxes may apply when using a quitclaim deed in Ohio, depending on the county and the value of the property. |

| Revocation | Once a quitclaim deed is executed and recorded, it cannot be revoked unless the grantee agrees to return the property. |

Consider Some Other Quitclaim Deed Forms for US States

Michigan Quit Claim Deed Pdf - Quitclaim Deeds play a significant role in property title clearing and management.

When engaging in a firearm transaction, having the proper documentation is crucial. Utilizing the Florida Firearm Bill of Sale form aids in the legal transfer of firearms, establishing a clear chain of ownership. For those interested, a comprehensive guide on this is available at the link: detailed Florida Firearm Bill of Sale documentation.

Pennsylvania Quit Claim Deed Form - The process is typically faster than traditional property sales.

Dos and Don'ts

When filling out the Ohio Quitclaim Deed form, it's important to know what to do and what to avoid. Here’s a simple list to help you navigate the process.

- Do ensure that all names are spelled correctly.

- Do include the correct legal description of the property.

- Do sign the form in front of a notary public.

- Do provide the date of the transfer.

- Do check for any outstanding liens or mortgages on the property.

- Don't leave any sections blank.

- Don't use nicknames or informal names.

- Don't forget to include the grantee's address.

- Don't rush the process; take your time to review everything.

- Don't assume that the form is valid without proper notarization.

Following these guidelines will help ensure a smoother process when completing your Quitclaim Deed in Ohio.