Valid Promissory Note Form for Ohio

In Ohio, a promissory note serves as a critical financial instrument that outlines a borrower's promise to repay a specified amount of money to a lender under agreed-upon terms. This document typically includes essential details such as the principal amount, interest rate, repayment schedule, and any applicable penalties for late payments. Additionally, the note may specify whether it is secured or unsecured, indicating whether the borrower has pledged any collateral to back the loan. It is important to note that the terms of the promissory note can vary significantly depending on the agreement between the parties involved. Understanding the components of this form is vital for both lenders and borrowers, as it establishes the legal obligations and rights of each party. Properly executed, a promissory note can provide clarity and protection in financial transactions, making it a fundamental tool in both personal and commercial lending scenarios.

Common mistakes

-

Incomplete Information: Failing to fill out all required fields can lead to issues. Make sure to provide all necessary details, including names, addresses, and amounts.

-

Incorrect Dates: Entering the wrong date for the loan or repayment can create confusion. Double-check that all dates are accurate and correspond to the terms agreed upon.

-

Missing Signatures: A promissory note must be signed by all parties involved. Neglecting to include signatures can render the document invalid.

-

Unclear Terms: Vague language regarding repayment terms can lead to misunderstandings. Be specific about payment amounts, due dates, and any interest rates.

-

Failure to Include Witnesses or Notary: Depending on the situation, some notes may require a witness or notary. Check local requirements to ensure compliance.

-

Not Keeping Copies: Always retain a copy of the signed promissory note for your records. Losing the original can complicate future enforcement of the agreement.

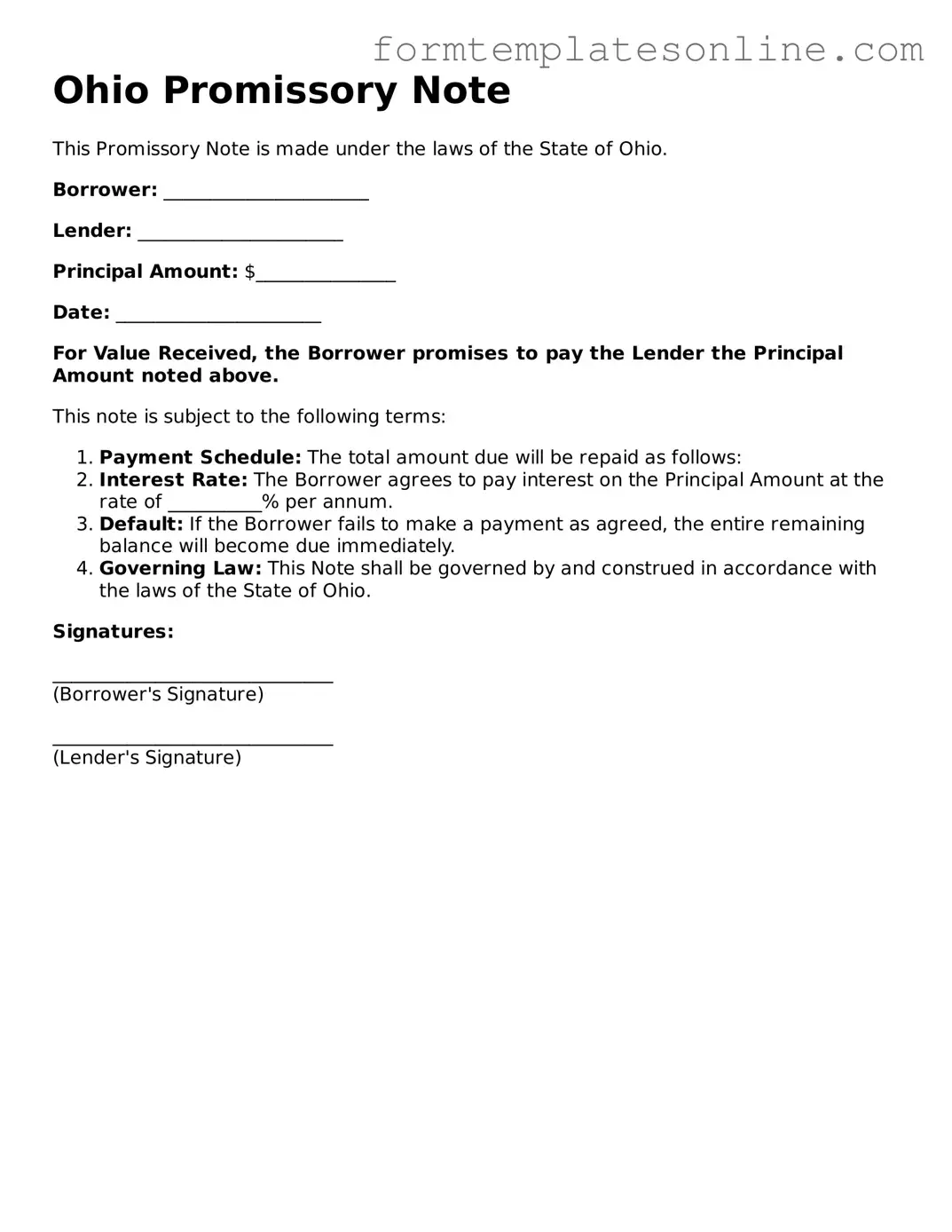

Example - Ohio Promissory Note Form

Ohio Promissory Note

This Promissory Note is made under the laws of the State of Ohio.

Borrower: ______________________

Lender: ______________________

Principal Amount: $_______________

Date: ______________________

For Value Received, the Borrower promises to pay the Lender the Principal Amount noted above.

This note is subject to the following terms:

- Payment Schedule: The total amount due will be repaid as follows:

- Interest Rate: The Borrower agrees to pay interest on the Principal Amount at the rate of __________% per annum.

- Default: If the Borrower fails to make a payment as agreed, the entire remaining balance will become due immediately.

- Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of Ohio.

Signatures:

______________________________

(Borrower's Signature)

______________________________

(Lender's Signature)

More About Ohio Promissory Note

What is a Promissory Note in Ohio?

A Promissory Note is a written promise to pay a specified amount of money to a designated party at a certain time or on demand. In Ohio, this document serves as a legal instrument that outlines the terms of the loan, including the interest rate, payment schedule, and any collateral involved. It is essential for establishing the obligations of both the borrower and the lender.

What are the essential components of an Ohio Promissory Note?

An Ohio Promissory Note typically includes several key components: the names and addresses of the borrower and lender, the principal amount being borrowed, the interest rate, the repayment schedule, and any terms regarding late payments or default. Additionally, it may specify whether the note is secured or unsecured, meaning whether it is backed by collateral.

Is a Promissory Note legally binding in Ohio?

Yes, a Promissory Note is legally binding in Ohio as long as it meets certain criteria. Both parties must agree to the terms, and the note must be signed by the borrower. If the borrower fails to repay the loan as agreed, the lender has the right to pursue legal action to recover the owed amount.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but both parties must agree to the changes. It is advisable to document any modifications in writing and have both parties sign the amended note to ensure clarity and enforceability.

What happens if a borrower defaults on a Promissory Note in Ohio?

If a borrower defaults on a Promissory Note, the lender may take several actions. This can include demanding immediate payment of the entire loan amount, pursuing legal action to recover the debt, or initiating foreclosure proceedings if the note is secured by collateral. The specific actions taken will depend on the terms outlined in the Promissory Note and applicable Ohio laws.

Are there any specific laws governing Promissory Notes in Ohio?

Yes, Promissory Notes in Ohio are governed by both state laws and the Uniform Commercial Code (UCC). The UCC provides a framework for commercial transactions, including the creation and enforcement of Promissory Notes. It is important for both borrowers and lenders to understand these laws to ensure compliance and protect their rights.

Do I need a lawyer to create a Promissory Note in Ohio?

While it is not legally required to have a lawyer draft a Promissory Note, seeking legal advice can be beneficial. A lawyer can help ensure that the note is properly structured, compliant with Ohio laws, and tailored to meet the specific needs of both parties. This can prevent potential disputes and misunderstandings in the future.

Key takeaways

When considering the Ohio Promissory Note form, it is essential to understand several key aspects to ensure proper use and compliance with state laws. Below are important takeaways regarding the form:

- Understand the Purpose: A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This clarity helps avoid confusion later.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This figure should match any verbal agreements made prior to filling out the form.

- Detail the Interest Rate: If applicable, include the interest rate. This rate should comply with Ohio laws regarding usury, which limit how much interest can be charged.

- Outline Repayment Terms: Clearly define the repayment schedule, including due dates and the method of payment. This can help prevent misunderstandings.

- Include Default Terms: Specify what constitutes a default and the consequences of defaulting on the loan. This can protect the lender's interests.

- Consider Witnesses or Notarization: While not always required, having a witness or notarizing the document can add an extra layer of validity and protection.

- Keep Copies: After signing, both parties should retain copies of the promissory note. This ensures that both sides have access to the agreed-upon terms.

- Consult Legal Advice: If there are any uncertainties about the terms or implications of the note, seeking legal advice can provide clarity and ensure compliance with Ohio law.

File Details

| Fact Name | Description |

|---|---|

| Definition | An Ohio Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Ohio Promissory Note is governed by Ohio Revised Code Section 1303.01 et seq. |

| Parties Involved | Typically, there are two main parties: the borrower (maker) who promises to pay, and the lender (payee) who receives the payment. |

| Interest Rate | The note may specify an interest rate. If not stated, Ohio law allows for a reasonable rate to be applied. |

| Payment Terms | Payment terms can vary. They may include a lump sum payment or installments over time, as agreed upon by both parties. |

| Enforceability | For a promissory note to be enforceable, it must be signed by the maker and include essential terms like amount, interest rate, and payment schedule. |

Consider Some Other Promissory Note Forms for US States

Create a Promissory Note - The document is typically straightforward, focusing on payment obligations.

The importance of the Georgia Motor Vehicle Bill of Sale form cannot be overstated, as it not only documents the sale and transfer of ownership of a motor vehicle but also provides legal security for both the buyer and the seller. For those needing further assistance or resources related to this process, OnlineLawDocs.com offers valuable information to ensure a smooth transaction.

Promissory Note Template Georgia - Interest rates on the note can be fixed or variable, depending on the agreement reached.

Dos and Don'ts

When filling out the Ohio Promissory Note form, it is important to approach the process with care. Here are some guidelines to help you navigate this task effectively.

- Do: Read the entire form carefully before you start filling it out.

- Do: Provide accurate information about the borrower and lender.

- Do: Clearly state the loan amount and repayment terms.

- Do: Sign and date the document in the appropriate places.

- Do: Keep a copy for your records after completing the form.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any sections blank unless instructed to do so.

- Don't: Use vague language; be specific in your terms.

- Don't: Forget to review the completed form for errors.

- Don't: Assume verbal agreements are enough; everything should be in writing.