Valid Operating Agreement Form for Ohio

In the realm of business formation, particularly for limited liability companies (LLCs) in Ohio, the Operating Agreement plays a crucial role in defining the internal workings and governance of the entity. This document serves as a foundational blueprint, outlining the rights and responsibilities of members, management structures, and operational procedures. Key aspects often included in the agreement encompass member contributions, profit distribution, and decision-making processes, which collectively ensure clarity and minimize disputes among members. Additionally, the Operating Agreement addresses the procedures for adding or removing members, handling member disputes, and outlining the dissolution process, should that become necessary. By establishing these guidelines, the Operating Agreement not only aids in compliance with state regulations but also fosters a sense of security and professionalism within the business structure. Understanding the significance of this document is essential for anyone looking to navigate the complexities of LLC management in Ohio.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. This can include missing names, addresses, or signatures. Each section must be filled out completely to avoid delays.

-

Incorrect Member Designations: It's crucial to accurately identify all members of the LLC. Some people mistakenly list non-members or fail to include all members, leading to confusion about ownership and responsibilities.

-

Omitting Operating Procedures: The agreement should outline how the LLC will operate. Some individuals overlook this section, which can create issues down the line regarding decision-making and management.

-

Not Addressing Profit Distribution: Clearly stating how profits and losses will be shared among members is essential. Failing to do so can lead to disputes later, especially if expectations are not aligned.

-

Ignoring State Requirements: Each state has specific rules regarding LLCs. Some people neglect to review Ohio's requirements, which can result in non-compliance and potential legal issues.

-

Not Seeking Legal Advice: While it may seem straightforward, many individuals skip consulting with a legal professional. This can lead to mistakes that could have been easily avoided with expert guidance.

Example - Ohio Operating Agreement Form

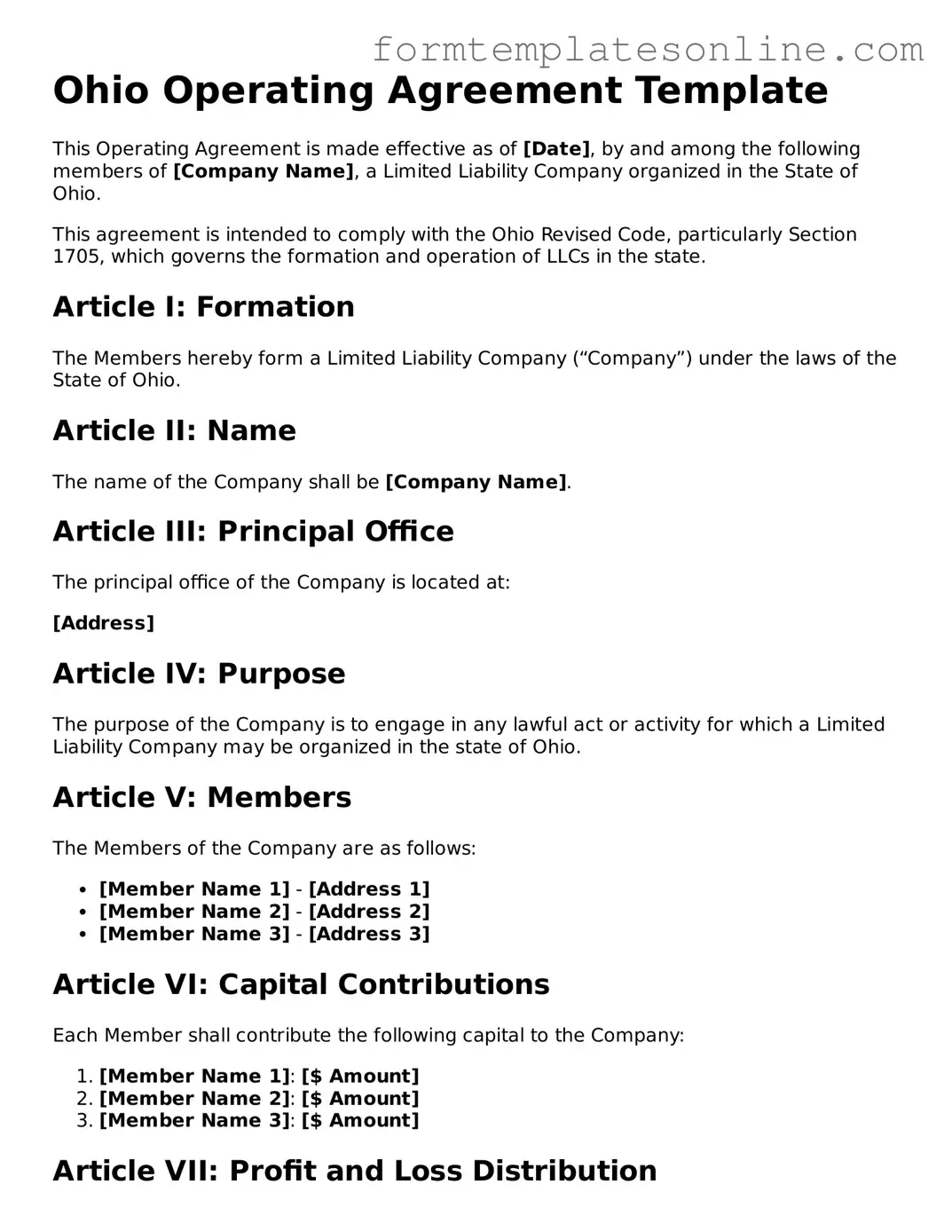

Ohio Operating Agreement Template

This Operating Agreement is made effective as of [Date], by and among the following members of [Company Name], a Limited Liability Company organized in the State of Ohio.

This agreement is intended to comply with the Ohio Revised Code, particularly Section 1705, which governs the formation and operation of LLCs in the state.

Article I: Formation

The Members hereby form a Limited Liability Company (“Company”) under the laws of the State of Ohio.

Article II: Name

The name of the Company shall be [Company Name].

Article III: Principal Office

The principal office of the Company is located at:

[Address]

Article IV: Purpose

The purpose of the Company is to engage in any lawful act or activity for which a Limited Liability Company may be organized in the state of Ohio.

Article V: Members

The Members of the Company are as follows:

- [Member Name 1] - [Address 1]

- [Member Name 2] - [Address 2]

- [Member Name 3] - [Address 3]

Article VI: Capital Contributions

Each Member shall contribute the following capital to the Company:

- [Member Name 1]: [$ Amount]

- [Member Name 2]: [$ Amount]

- [Member Name 3]: [$ Amount]

Article VII: Profit and Loss Distribution

Profits and losses shall be allocated to the Members as follows:

- [Member Name 1]: [%]

- [Member Name 2]: [%]

- [Member Name 3]: [%]

Article VIII: Management

The management of the Company shall be vested in:

- [Member Name/Manager]

Article IX: Indemnification

The Company shall indemnify any Member or Manager to the full extent permitted under the laws of the State of Ohio.

Article X: Amendments

This Operating Agreement may be amended only by a written agreement signed by all Members.

Article XI: Dissolution

The Company may be dissolved upon the occurrence of any of the following:

- Unanimous agreement of the Members.

- As required by law.

IN WITNESS WHEREOF:

The undersigned have executed this Operating Agreement as of the effective date first above written.

_______________________________

[Member Name 1]

_______________________________

[Member Name 2]

_______________________________

[Member Name 3]

More About Ohio Operating Agreement

What is an Ohio Operating Agreement?

An Ohio Operating Agreement is a legal document that outlines the ownership and operating procedures of a Limited Liability Company (LLC) in Ohio. It serves as a foundational agreement among the members, detailing how the company will be managed, how profits and losses will be distributed, and the responsibilities of each member. Having this document in place helps prevent misunderstandings and disputes among members.

Is an Operating Agreement required in Ohio?

No, an Operating Agreement is not legally required in Ohio. However, it is highly recommended. Without it, your LLC will be governed by default state laws, which may not align with your intentions or the specific needs of your business. An Operating Agreement provides clarity and can protect your personal assets by reinforcing the limited liability status of your LLC.

What should be included in an Ohio Operating Agreement?

An effective Operating Agreement should include several key elements: the names and addresses of the members, the purpose of the LLC, the management structure, how profits and losses will be allocated, the process for adding new members, and the procedures for handling disputes. You might also want to include provisions for dissolution and any other specific rules that govern your LLC.

Can I change my Operating Agreement after it is created?

Yes, you can change your Operating Agreement. It’s essential to review and update it regularly to reflect any changes in the business, such as new members joining or changes in management. Make sure that all members agree to the changes and document them properly to maintain clarity and legal standing.

How do I create an Ohio Operating Agreement?

Creating an Ohio Operating Agreement can be done through various methods. You can draft one yourself using templates available online, hire an attorney for personalized assistance, or use online legal services that specialize in business formation. Ensure that the agreement is tailored to your specific business needs and complies with Ohio laws.

What happens if we don’t have an Operating Agreement?

If your LLC does not have an Operating Agreement, you will be subject to Ohio's default LLC laws. This can lead to unintended consequences, such as disputes over profit sharing and management decisions. Without clear guidelines, members may find themselves in conflict, which could jeopardize the stability of the business.

Can a single-member LLC have an Operating Agreement?

Absolutely! A single-member LLC can and should have an Operating Agreement. This document helps establish the business as a separate legal entity, reinforces limited liability protection, and outlines how the business will operate. It also provides a clear record of your business structure and intentions, which can be beneficial for banking and tax purposes.

Key takeaways

Filling out and using the Ohio Operating Agreement form is essential for members of a limited liability company (LLC) in Ohio. Here are seven key takeaways to consider:

- Purpose of the Agreement: The Operating Agreement outlines the management structure and operating procedures of the LLC, ensuring all members are on the same page.

- Member Details: It is crucial to include accurate information about each member, such as names, addresses, and ownership percentages.

- Management Structure: The agreement should specify whether the LLC will be member-managed or manager-managed, affecting how decisions are made.

- Capital Contributions: Clearly outline each member’s initial capital contributions and any future contributions required to maintain the LLC.

- Distribution of Profits and Losses: The Operating Agreement must detail how profits and losses will be distributed among members, which can be based on ownership percentages or other agreed-upon methods.

- Amendment Procedures: Include a process for amending the Operating Agreement, allowing flexibility as the business evolves.

- Legal Compliance: Ensure that the agreement complies with Ohio laws and regulations, as this will help protect the members and the LLC’s status.

Understanding these key aspects can facilitate a smoother operation and management of the LLC in Ohio.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Operating Agreement outlines the management structure and operational procedures for a limited liability company (LLC) in Ohio. |

| Governing Law | This agreement is governed by the Ohio Revised Code, specifically Chapter 1705, which pertains to limited liability companies. |

| Member Rights | It defines the rights and responsibilities of the members, including voting rights, profit distribution, and decision-making processes. |

| Flexibility | The Ohio Operating Agreement allows for flexibility in structuring the LLC, accommodating various management styles and member contributions. |

| Importance | Having an Operating Agreement is crucial for protecting members' interests and preventing disputes, even if not required by law. |

Consider Some Other Operating Agreement Forms for US States

Llc Operating Agreement Georgia - An Operating Agreement can outline responsibilities for tax filings.

How to Write an Operating Agreement - An Operating Agreement details how new members can join the LLC.

A Michigan Non-disclosure Agreement form is a legal document used to protect sensitive information. When signed, it prevents parties from sharing any confidential details specified in the agreement. It's a critical tool for businesses and individuals in Michigan looking to safeguard their proprietary information or trade secrets. For more information on this topic, you can visit OnlineLawDocs.com.

California Llc Operating Agreement Requirements - The form can outline member contributions, both financial and in kind.

Dos and Don'ts

When filling out the Ohio Operating Agreement form, it’s important to be thorough and accurate. Here are ten things to keep in mind:

- Do read the instructions carefully before starting.

- Do provide accurate information about your business structure.

- Do include all members' names and addresses.

- Do specify the management structure clearly.

- Do outline the profit and loss distribution among members.

- Don't leave any sections blank unless instructed.

- Don't use vague language; be specific in your descriptions.

- Don't forget to sign and date the form.

- Don't submit the form without reviewing it for errors.

- Don't ignore state-specific requirements that may apply.