Valid Motor Vehicle Bill of Sale Form for Ohio

The Ohio Motor Vehicle Bill of Sale form serves as a crucial document in the process of buying or selling a vehicle in the state. This form captures essential details such as the names and addresses of both the buyer and the seller, ensuring that both parties are clearly identified. It also includes information about the vehicle itself, such as the make, model, year, and Vehicle Identification Number (VIN), which helps prevent any confusion regarding the specific vehicle being transferred. The sale price is another key component, as it reflects the agreed-upon amount for the transaction. Additionally, the form may require the seller's signature, which confirms their intent to transfer ownership, and the buyer's signature, indicating their acceptance of the vehicle. Properly completing this form not only facilitates a smooth transaction but also serves as a record for both parties, providing legal protection and clarity in the event of future disputes. Understanding the importance of this document can help ensure that both buyers and sellers navigate the vehicle transfer process with confidence.

Common mistakes

-

Incorrect Vehicle Information: One common mistake is failing to accurately provide the vehicle's make, model, year, and VIN. This information is crucial for identification and must match official records.

-

Missing Signatures: Both the buyer and seller must sign the form. A lack of signatures can render the document invalid, leading to complications in the transfer of ownership.

-

Inaccurate Sale Price: Listing an incorrect sale price can create issues with taxes and registration. It is essential to report the true amount agreed upon by both parties.

-

Omitting Date of Sale: Not including the date of sale can lead to confusion regarding the timeline of ownership transfer. Always ensure this date is clearly stated.

-

Failure to Include Buyer and Seller Information: Both parties' names and addresses must be clearly written. Omitting this information can complicate future ownership verification.

-

Not Providing a Notarized Signature: While notarization is not always required, some transactions may benefit from it. Notarizing can add an extra layer of legitimacy to the document.

-

Using an Outdated Form: Always ensure you are using the most current version of the Bill of Sale form. Using an outdated form may lead to unnecessary legal issues.

-

Ignoring State-Specific Requirements: Each state may have different requirements for a Bill of Sale. Failing to adhere to Ohio's specific regulations can invalidate the transaction.

-

Not Keeping Copies: After filling out the form, both parties should retain copies for their records. Not having documentation can create problems if disputes arise later.

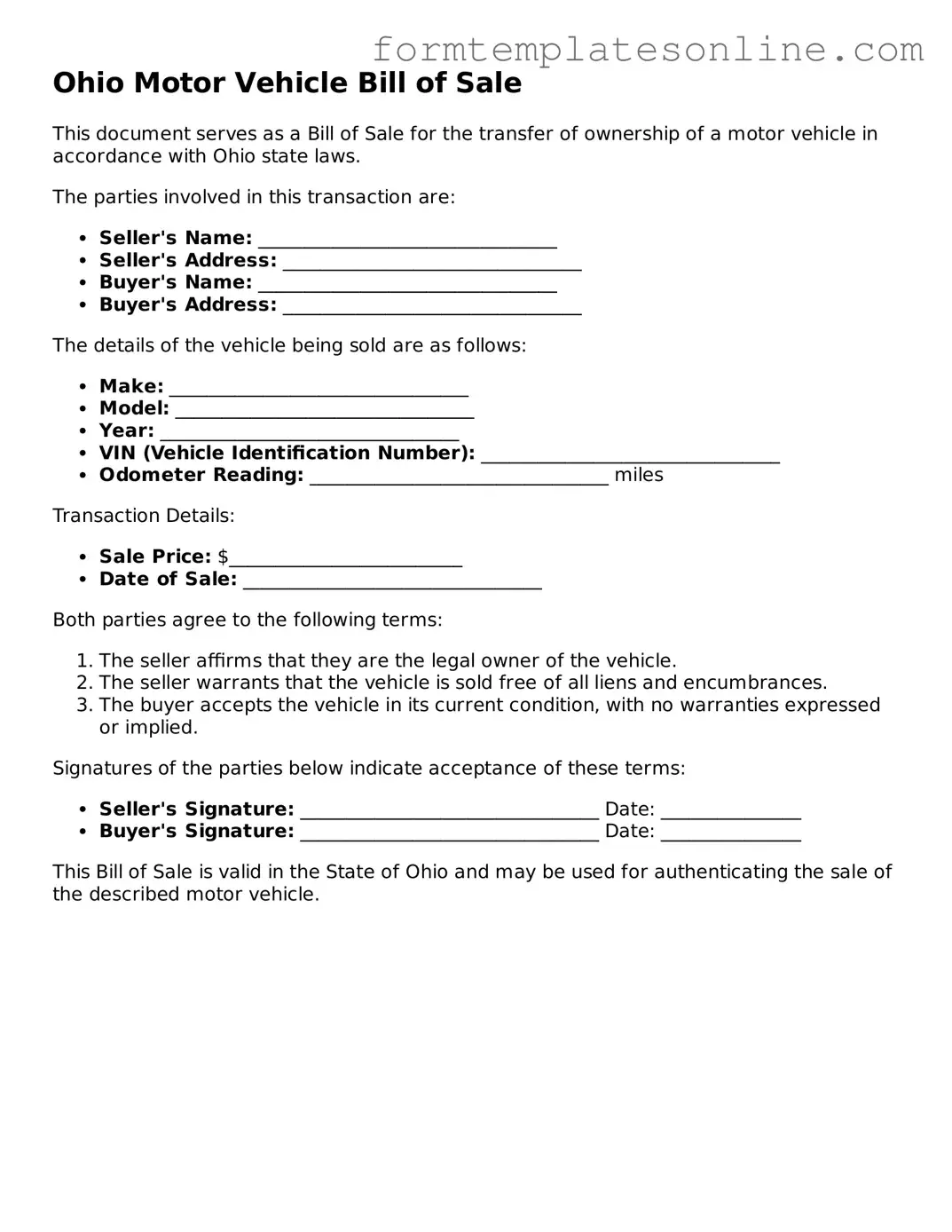

Example - Ohio Motor Vehicle Bill of Sale Form

Ohio Motor Vehicle Bill of Sale

This document serves as a Bill of Sale for the transfer of ownership of a motor vehicle in accordance with Ohio state laws.

The parties involved in this transaction are:

- Seller's Name: ________________________________

- Seller's Address: ________________________________

- Buyer's Name: ________________________________

- Buyer's Address: ________________________________

The details of the vehicle being sold are as follows:

- Make: ________________________________

- Model: ________________________________

- Year: ________________________________

- VIN (Vehicle Identification Number): ________________________________

- Odometer Reading: ________________________________ miles

Transaction Details:

- Sale Price: $_________________________

- Date of Sale: ________________________________

Both parties agree to the following terms:

- The seller affirms that they are the legal owner of the vehicle.

- The seller warrants that the vehicle is sold free of all liens and encumbrances.

- The buyer accepts the vehicle in its current condition, with no warranties expressed or implied.

Signatures of the parties below indicate acceptance of these terms:

- Seller's Signature: ________________________________ Date: _______________

- Buyer's Signature: ________________________________ Date: _______________

This Bill of Sale is valid in the State of Ohio and may be used for authenticating the sale of the described motor vehicle.

More About Ohio Motor Vehicle Bill of Sale

What is the Ohio Motor Vehicle Bill of Sale form?

The Ohio Motor Vehicle Bill of Sale form is a legal document that records the sale of a vehicle from one party to another. It serves as proof of the transaction and includes important details such as the buyer's and seller's names, addresses, vehicle identification number (VIN), make, model, year, and the sale price. This form is essential for both the buyer and seller to protect their rights and ensure a smooth transfer of ownership.

Do I need to have the Bill of Sale notarized?

In Ohio, it is not mandatory for the Motor Vehicle Bill of Sale to be notarized. However, having it notarized can provide an additional layer of security and authenticity. It may also help if there are any disputes regarding the sale in the future. While notarization is optional, it is a good practice to consider, especially for higher-value transactions.

How do I complete the Ohio Motor Vehicle Bill of Sale form?

To complete the form, both the seller and buyer need to fill in their personal information, including names and addresses. Next, provide the vehicle details, such as the VIN, make, model, and year. The sale price must also be clearly stated. Both parties should sign and date the document. It’s advisable for each party to keep a copy for their records after the transaction is finalized.

Is the Bill of Sale required for vehicle registration in Ohio?

Yes, the Bill of Sale is often required when registering a vehicle in Ohio. The buyer must present the completed Bill of Sale to the Ohio Bureau of Motor Vehicles (BMV) along with other necessary documents, such as the title and proof of identification. The Bill of Sale helps verify the transaction and supports the transfer of ownership in the state's records.

Key takeaways

When filling out and using the Ohio Motor Vehicle Bill of Sale form, it is important to consider the following key points:

- The form serves as a legal document that records the sale of a vehicle between a buyer and a seller.

- Both the buyer and seller must provide their names, addresses, and signatures on the form.

- Accurate vehicle information, including the make, model, year, and Vehicle Identification Number (VIN), is required.

- The sale price of the vehicle must be clearly stated on the form.

- The date of the sale should be included to establish when the transaction occurred.

- The form can be used to document both private sales and dealership transactions.

- It is advisable for both parties to keep a copy of the completed bill of sale for their records.

- In Ohio, a bill of sale is not mandatory for vehicle registration, but it is highly recommended.

- Using the form can help protect both parties in case of disputes regarding the sale.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Motor Vehicle Bill of Sale form is used to document the sale of a motor vehicle between a buyer and a seller. |

| Governing Law | The form is governed by Ohio Revised Code Section 4505.04. |

| Required Information | The form requires details such as the vehicle identification number (VIN), make, model, year, and odometer reading. |

| Seller's Information | It must include the seller's name, address, and signature to validate the sale. |

| Buyer's Information | The buyer's name and address must also be provided on the form. |

| Date of Sale | The date when the transaction occurs must be indicated on the form. |

| Notarization | While notarization is not mandatory, it is recommended for additional security and authenticity. |

| Use for Title Transfer | This bill of sale is often used as proof of ownership when transferring the title to the buyer. |

| Record Keeping | Both parties should retain a copy of the completed bill of sale for their records. |

| Availability | The Ohio Motor Vehicle Bill of Sale form can typically be obtained online or at local Bureau of Motor Vehicles (BMV) offices. |

Consider Some Other Motor Vehicle Bill of Sale Forms for US States

Bill of Sale Dmv Ca - Helps document the vehicle’s history with accurate information.

Vehicle Bill of Sale Illinois Pdf - The form can help protect against claims from third parties after the sale.

Florida Motorcycle Bill of Sale - The Bill of Sale is not just a form; it represents an agreement between parties.

Dos and Don'ts

When completing the Ohio Motor Vehicle Bill of Sale form, it's important to ensure that all information is accurate and complete. Here are some guidelines to help you through the process:

- Do ensure all fields are filled out accurately. Double-check the vehicle identification number (VIN), make, model, and year to avoid any discrepancies.

- Do include the purchase price. Clearly state the amount paid for the vehicle, as this is essential for tax purposes.

- Do sign and date the form. Both the buyer and seller should sign and date the document to validate the transaction.

- Do keep a copy for your records. Retain a copy of the completed Bill of Sale for your personal records and for any future reference.

- Don't leave any fields blank. Incomplete forms can lead to issues with registration and title transfer.

- Don't use incorrect or misleading information. Providing false information can result in legal complications down the line.

- Don't forget to check local requirements. Some counties may have specific regulations regarding the Bill of Sale.

- Don't rush through the process. Take your time to ensure everything is filled out correctly to avoid any mistakes.