Valid Durable Power of Attorney Form for Ohio

The Ohio Durable Power of Attorney form serves as a crucial legal instrument that empowers individuals to designate a trusted person to make financial and legal decisions on their behalf, particularly in the event of incapacitation. This form is not merely a document; it represents a proactive approach to managing one’s affairs and ensuring that personal wishes are respected when one is unable to communicate or make decisions. The form covers a broad range of powers, allowing the appointed agent to handle tasks such as managing bank accounts, paying bills, and making investment decisions. Importantly, the durable aspect of this power of attorney means that the authority granted to the agent remains effective even if the principal becomes mentally incapacitated. This feature distinguishes it from other types of power of attorney, which may become void under similar circumstances. Furthermore, the Ohio Durable Power of Attorney form requires specific language and signatures to ensure its validity, thus emphasizing the importance of adhering to legal standards. By understanding the nuances of this form, individuals can better prepare for unforeseen circumstances, safeguarding their financial interests and personal preferences.

Common mistakes

-

Failing to clearly identify the principal. It is crucial to provide the full legal name and address of the person granting the power of attorney.

-

Not specifying the powers granted. The form should detail the specific powers that the agent will have. General terms can lead to confusion.

-

Neglecting to date the document. A date is essential to establish when the power of attorney becomes effective and to avoid disputes.

-

Overlooking the need for witness signatures. In Ohio, having at least one witness is necessary to validate the document.

-

Not having the document notarized. While not always required, notarization can provide additional legal protection and credibility.

-

Choosing an unsuitable agent. It is vital to select someone trustworthy and capable of making decisions on your behalf.

-

Failing to communicate with the agent. Discussing your wishes and expectations with the appointed agent helps ensure they understand your preferences.

-

Using outdated forms. Laws can change, so it is important to use the most current version of the Durable Power of Attorney form.

-

Not reviewing the document regularly. Life circumstances change, and it is wise to revisit the power of attorney periodically to ensure it still reflects your wishes.

-

Ignoring state-specific requirements. Each state has its own rules regarding powers of attorney, so it is essential to comply with Ohio's specific regulations.

Example - Ohio Durable Power of Attorney Form

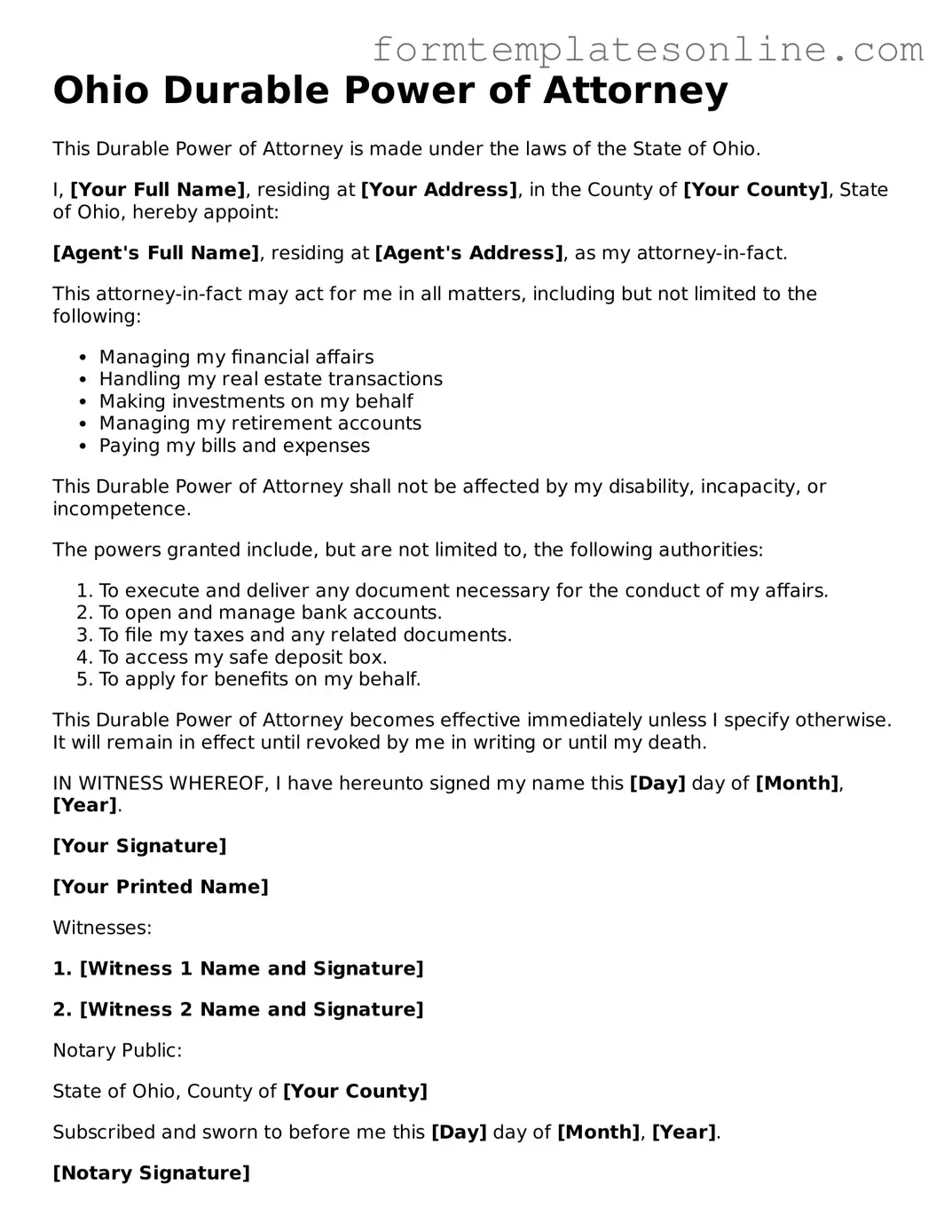

Ohio Durable Power of Attorney

This Durable Power of Attorney is made under the laws of the State of Ohio.

I, [Your Full Name], residing at [Your Address], in the County of [Your County], State of Ohio, hereby appoint:

[Agent's Full Name], residing at [Agent's Address], as my attorney-in-fact.

This attorney-in-fact may act for me in all matters, including but not limited to the following:

- Managing my financial affairs

- Handling my real estate transactions

- Making investments on my behalf

- Managing my retirement accounts

- Paying my bills and expenses

This Durable Power of Attorney shall not be affected by my disability, incapacity, or incompetence.

The powers granted include, but are not limited to, the following authorities:

- To execute and deliver any document necessary for the conduct of my affairs.

- To open and manage bank accounts.

- To file my taxes and any related documents.

- To access my safe deposit box.

- To apply for benefits on my behalf.

This Durable Power of Attorney becomes effective immediately unless I specify otherwise. It will remain in effect until revoked by me in writing or until my death.

IN WITNESS WHEREOF, I have hereunto signed my name this [Day] day of [Month], [Year].

[Your Signature]

[Your Printed Name]

Witnesses:

1. [Witness 1 Name and Signature]

2. [Witness 2 Name and Signature]

Notary Public:

State of Ohio, County of [Your County]

Subscribed and sworn to before me this [Day] day of [Month], [Year].

[Notary Signature]

More About Ohio Durable Power of Attorney

What is a Durable Power of Attorney in Ohio?

A Durable Power of Attorney (DPOA) in Ohio is a legal document that allows you to appoint someone else to make decisions on your behalf. This can include financial decisions, medical choices, or other personal matters. The term "durable" means that the authority granted to your agent continues even if you become incapacitated. This ensures that your affairs can be managed without interruption when you are unable to act for yourself.

Who can be appointed as my agent in a Durable Power of Attorney?

In Ohio, you can choose any competent adult to serve as your agent. This can be a family member, friend, or a trusted advisor. It is important to select someone who you believe will act in your best interest and who understands your wishes. Additionally, your agent should be someone who is reliable and capable of handling the responsibilities that come with this role.

How do I create a Durable Power of Attorney in Ohio?

To create a Durable Power of Attorney in Ohio, you need to complete a specific form that outlines your wishes and the powers you are granting to your agent. This form must be signed by you and witnessed by at least one person, or notarized. It is advisable to consult with a legal professional to ensure that the document meets all legal requirements and accurately reflects your intentions.

Can I revoke or change my Durable Power of Attorney?

Yes, you have the right to revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent. To revoke the document, you should create a written notice stating your intention to revoke it and notify your agent and any institutions that may have a copy of the original DPOA. If you wish to make changes, you can create a new Durable Power of Attorney that supersedes the previous one.

What happens if I become incapacitated and do not have a Durable Power of Attorney?

If you become incapacitated without a Durable Power of Attorney in place, your loved ones may need to go through a legal process called guardianship to make decisions on your behalf. This process can be lengthy, costly, and may not reflect your personal wishes. Having a DPOA ensures that someone you trust can step in and manage your affairs without the need for court intervention.

Is a Durable Power of Attorney valid in other states?

Generally, a Durable Power of Attorney created in Ohio is recognized in other states, but laws can vary. It is important to check the specific requirements of the state where you intend to use the document. If you move to another state or plan to conduct business there, consider consulting with a local attorney to ensure your DPOA remains valid and meets any additional requirements.

Key takeaways

Filling out and using the Ohio Durable Power of Attorney form is an important step in ensuring that your financial and medical decisions are handled according to your wishes in the event that you become unable to make those decisions yourself. Here are some key takeaways to consider:

- Understand the Purpose: The Durable Power of Attorney allows you to appoint someone to manage your financial and legal affairs when you are unable to do so.

- Choose Your Agent Wisely: Select someone you trust to act in your best interest. This person will have significant authority over your financial matters.

- Be Specific: Clearly outline the powers you are granting to your agent. You can limit their authority to specific tasks or grant them broad powers.

- Consider Multiple Agents: You may choose to appoint more than one agent. This can provide checks and balances in decision-making.

- Sign and Date the Document: Ensure that you sign and date the Durable Power of Attorney in the presence of a notary public or witnesses, as required by Ohio law.

- Review Regularly: Revisit your Durable Power of Attorney periodically, especially after significant life changes, to ensure it still reflects your wishes.

- Communicate with Your Agent: Discuss your values and preferences with your agent. Open communication can help them make decisions that align with your wishes.

- Understand Revocation: You have the right to revoke the Durable Power of Attorney at any time, as long as you are mentally competent to do so.

File Details

| Fact Name | Description |

|---|---|

| Definition | The Ohio Durable Power of Attorney is a legal document that allows an individual to appoint someone else to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | The form is governed by Ohio Revised Code Section 1337.22 through 1337.64. |

| Durability | This power of attorney remains effective even if the principal becomes mentally incompetent. |

| Principal and Agent | The person creating the document is referred to as the principal, while the person designated to act on their behalf is called the agent or attorney-in-fact. |

| Scope of Authority | The agent can be granted broad or limited powers, including financial, legal, and healthcare decisions, depending on the principal's wishes. |

| Execution Requirements | The form must be signed by the principal in the presence of a notary public or two witnesses, who must also sign the document. |

| Revocation | The principal can revoke the durable power of attorney at any time, provided they are mentally competent. |

| Agent's Duties | The agent is legally obligated to act in the best interest of the principal and must keep accurate records of transactions. |

| Legal Advice | It is advisable for individuals to seek legal counsel when creating a durable power of attorney to ensure that their specific needs are met. |

Consider Some Other Durable Power of Attorney Forms for US States

Michigan Power of Attorney - Legal authority is granted to your agent to act in your best interests.

A Michigan Non-disclosure Agreement form is a legal document used to protect sensitive information. When signed, it prevents parties from sharing any confidential details specified in the agreement. It's a critical tool for businesses and individuals in Michigan looking to safeguard their proprietary information or trade secrets, as highlighted by resources like OnlineLawDocs.com.

Pa Durable Power of Attorney Form - Clearly defining your agent's authority helps ensure they act within your wishes.

How Do I Get Power of Attorney in Florida - The form can specify the time when it takes effect, whether immediately or in the event of incapacitation.

Poa Form Illinois - This form can be used for specific tasks, or you can grant broad powers to your agent.

Dos and Don'ts

When filling out the Ohio Durable Power of Attorney form, it is essential to approach the process with care. Here are some important dos and don'ts to consider:

- Do clearly identify the person you are appointing as your agent. Make sure their full name and contact information are accurate.

- Do specify the powers you wish to grant your agent. Be clear about what decisions they can make on your behalf.

- Do sign the form in the presence of a notary public. This step adds an important layer of validity to the document.

- Do keep a copy of the completed form for your records. This ensures you have access to it when needed.

- Don't rush through the form. Take your time to ensure all information is correct and complete.

- Don't overlook the importance of discussing your wishes with your agent. They should understand your preferences and values.