Valid Deed in Lieu of Foreclosure Form for Ohio

In Ohio, homeowners facing financial difficulties may find themselves exploring various options to avoid foreclosure. One such option is the Deed in Lieu of Foreclosure, a legal process that allows property owners to voluntarily transfer their property title back to the lender. This arrangement can provide a way to relieve the burden of mortgage payments while minimizing the impact on the homeowner's credit score. By completing the Deed in Lieu of Foreclosure form, the homeowner essentially agrees to hand over the property in exchange for the lender canceling the mortgage debt. This process can be less stressful and quicker than going through a lengthy foreclosure process. However, it's essential to understand the implications of this decision, including potential tax consequences and the lender's willingness to accept the deed. Homeowners should also be aware of the specific requirements and documentation needed to complete the form correctly, ensuring a smoother transition during a challenging time.

Common mistakes

-

Not Reading the Instructions Carefully: Many individuals rush through the process and overlook crucial details in the instructions. Taking time to understand each section can prevent errors.

-

Incorrect Property Description: Failing to provide an accurate legal description of the property can lead to complications. Always ensure that the description matches what is on the original deed.

-

Missing Signatures: A common mistake is neglecting to sign the document. All required parties must sign for the deed to be valid.

-

Not Notarizing the Document: Some people forget that a notarized signature is often necessary. Without notarization, the deed may not be legally enforceable.

-

Failing to Include All Necessary Parties: If there are multiple owners or parties involved, all must be included in the deed. Omitting anyone can create legal issues down the line.

-

Inaccurate Date: Entering the wrong date can lead to confusion about the transaction timeline. It’s essential to ensure the date is correct and clearly written.

-

Not Consulting with Legal Counsel: Some individuals attempt to fill out the form without seeking advice from a legal expert. This can lead to costly mistakes that could have been avoided.

-

Overlooking Local Requirements: Different counties may have specific requirements for the deed. Failing to check local regulations can result in a rejected submission.

-

Assuming the Deed is Final: Many believe that signing the deed in lieu of foreclosure immediately resolves their mortgage issues. In reality, there may be additional steps to complete the process.

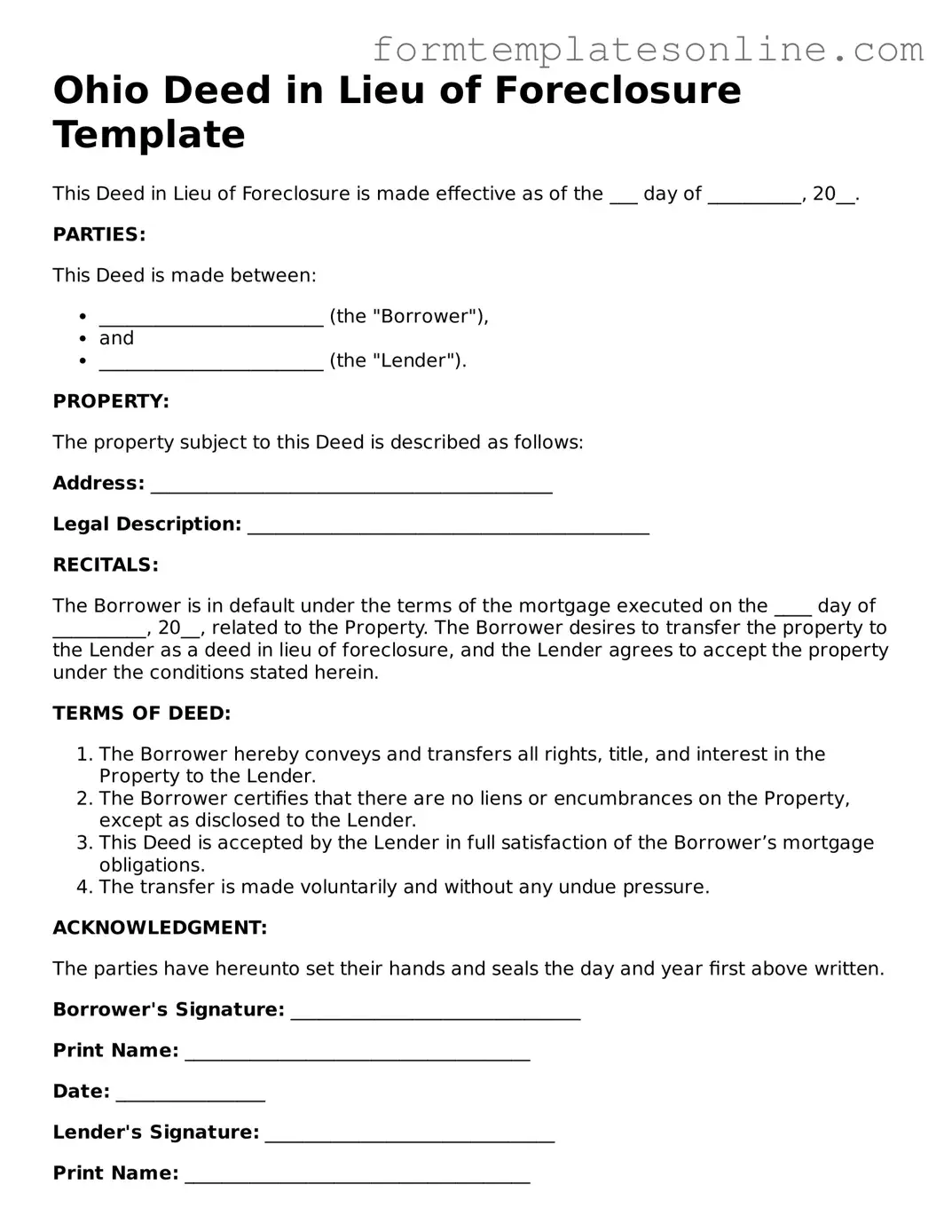

Example - Ohio Deed in Lieu of Foreclosure Form

Ohio Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made effective as of the ___ day of __________, 20__.

PARTIES:

This Deed is made between:

- ________________________ (the "Borrower"),

- and

- ________________________ (the "Lender").

PROPERTY:

The property subject to this Deed is described as follows:

Address: ___________________________________________

Legal Description: ___________________________________________

RECITALS:

The Borrower is in default under the terms of the mortgage executed on the ____ day of __________, 20__, related to the Property. The Borrower desires to transfer the property to the Lender as a deed in lieu of foreclosure, and the Lender agrees to accept the property under the conditions stated herein.

TERMS OF DEED:

- The Borrower hereby conveys and transfers all rights, title, and interest in the Property to the Lender.

- The Borrower certifies that there are no liens or encumbrances on the Property, except as disclosed to the Lender.

- This Deed is accepted by the Lender in full satisfaction of the Borrower’s mortgage obligations.

- The transfer is made voluntarily and without any undue pressure.

ACKNOWLEDGMENT:

The parties have hereunto set their hands and seals the day and year first above written.

Borrower's Signature: _______________________________

Print Name: _____________________________________

Date: ________________

Lender's Signature: _______________________________

Print Name: _____________________________________

Date: ________________

More About Ohio Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement in which a homeowner voluntarily transfers the ownership of their property to the lender to avoid foreclosure. This process allows the homeowner to relinquish their property and potentially reduce the negative impact on their credit score compared to a foreclosure proceeding.

Who is eligible for a Deed in Lieu of Foreclosure in Ohio?

Eligibility typically depends on the lender’s policies and the homeowner's financial situation. Generally, homeowners who are experiencing financial hardship and cannot keep up with mortgage payments may qualify. It is essential to demonstrate that foreclosure is unavoidable and that the homeowner has made efforts to resolve the situation, such as trying to sell the property or obtain a loan modification.

What are the benefits of choosing a Deed in Lieu of Foreclosure?

One significant benefit is the potential for a less damaging effect on the homeowner's credit score compared to a foreclosure. Additionally, the process can be quicker and less costly than a traditional foreclosure. Homeowners may also avoid the stress and uncertainty associated with a lengthy foreclosure process.

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also drawbacks. Homeowners may still face tax implications, as forgiven mortgage debt may be considered taxable income. Furthermore, not all lenders accept a Deed in Lieu of Foreclosure, which could limit options. It is crucial for homeowners to understand these factors before proceeding.

How does the process work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu of Foreclosure. The lender will then evaluate the homeowner's financial situation and the property's value. If approved, the homeowner will sign the deed, transferring ownership to the lender, and may receive a release from the mortgage obligation.

Will I need to vacate the property immediately?

Not necessarily. The timeline for vacating the property can vary. Some lenders may allow homeowners to remain in the home for a short period after the deed is signed, while others may require immediate vacating. It is essential to discuss this aspect with the lender to understand their specific policies.

Can I negotiate terms with my lender?

Yes, homeowners can negotiate terms with their lender. This may include discussing the timeline for vacating the property, any potential financial assistance, or the possibility of remaining in the home as a renter. Open communication with the lender is key to finding a mutually agreeable solution.

What should I do if my lender denies my request for a Deed in Lieu of Foreclosure?

If a request is denied, homeowners should ask for specific reasons and explore alternative options. This may include pursuing a short sale, loan modification, or other foreclosure alternatives. Seeking advice from a housing counselor or legal professional can also provide guidance tailored to individual circumstances.

Key takeaways

When considering the Ohio Deed in Lieu of Foreclosure form, it’s important to understand the implications and process involved. Here are some key takeaways to keep in mind:

- Voluntary Process: A deed in lieu of foreclosure is a voluntary agreement between the borrower and the lender. This means both parties must agree to the transfer of property to avoid foreclosure.

- Property Condition: Ensure the property is in good condition before submitting the deed. Lenders may be less inclined to accept a deed in lieu if the property requires significant repairs.

- Clear Title: The borrower must provide a clear title to the property. Any liens or encumbrances must be resolved prior to the transfer to avoid complications.

- Impact on Credit: While a deed in lieu may be less damaging than a foreclosure, it can still negatively impact your credit score. Understanding this can help you make an informed decision.

- Consultation Recommended: It’s advisable to consult with a legal or financial advisor before proceeding. They can help navigate the process and ensure all necessary steps are taken correctly.

File Details

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure proceedings. |

| Governing Law | In Ohio, the deed in lieu of foreclosure is governed by the Ohio Revised Code, particularly sections related to property and foreclosure. |

| Voluntary Process | This process is initiated voluntarily by the borrower, making it a less adversarial option compared to traditional foreclosure. |

| Eligibility | Homeowners facing financial difficulties may qualify for a deed in lieu of foreclosure, provided they have not filed for bankruptcy. |

| Benefits | Borrowers can avoid the lengthy foreclosure process, potentially reducing damage to their credit score. |

| Title Transfer | Upon signing the deed, ownership of the property is transferred to the lender, relieving the borrower of mortgage obligations. |

| Deficiency Judgments | In Ohio, lenders may still pursue deficiency judgments unless specifically waived in the deed in lieu agreement. |

| Impact on Credit | While a deed in lieu of foreclosure is less damaging than a foreclosure, it can still negatively affect a borrower's credit score. |

Consider Some Other Deed in Lieu of Foreclosure Forms for US States

Foreclosure Deed - This can be a practical choice for properties with little or no equity left.

California Property Surrender Deed - Consultation with a real estate attorney can provide clarity on the Deed in Lieu process.

When engaging in a vehicle sale, it's essential to utilize the Georgia Motor Vehicle Bill of Sale form, which not only serves to formalize the transaction but also provides vital legal documentation. By completing this form, buyers and sellers ensure clarity and protect their interests. For further information and resources related to this document, you can visit OnlineLawDocs.com, which offers comprehensive guidance.

Will I Owe Money After a Deed in Lieu of Foreclosure - This option may be faster and less cumbersome than a foreclosure auction process.

Dos and Don'ts

When filling out the Ohio Deed in Lieu of Foreclosure form, it is important to follow certain guidelines to ensure the process goes smoothly. Here are some essential dos and don'ts to consider:

- Do provide accurate property information, including the legal description.

- Do ensure all parties involved sign the document.

- Do check for any outstanding liens or claims against the property.

- Do consult with a legal professional if you have any questions.

- Don't leave any sections of the form blank.

- Don't rush through the process; take your time to review everything.

- Don't forget to make copies of the signed document for your records.

- Don't ignore deadlines related to the foreclosure process.