Valid Bill of Sale Form for Ohio

The Ohio Bill of Sale form serves as a crucial document in the transfer of ownership for personal property, ensuring both parties have a clear record of the transaction. This form typically includes essential details such as the names and addresses of the buyer and seller, a description of the item being sold, and the sale price. It may also specify any warranties or guarantees, outlining the condition of the item at the time of sale. While not always required by law, having a Bill of Sale can protect both parties by providing proof of the transaction, which can be vital for future reference or in case of disputes. Additionally, this document can help facilitate the registration of vehicles and other items that require formal ownership transfer. Understanding the components and importance of the Ohio Bill of Sale form can simplify the buying and selling process, ensuring a smooth transaction for all involved.

Common mistakes

-

Incorrect Information About the Seller: One common mistake is providing inaccurate or incomplete details about the seller. This includes missing the seller's full name, address, or contact information. Always ensure that this information is clear and correct.

-

Missing Buyer Information: Just like the seller, the buyer's information must be accurate. Omitting the buyer's name or address can lead to confusion later on. Double-check that all necessary details are included.

-

Failure to Describe the Item: A vague description of the item being sold can cause issues. It’s essential to include specific details such as the make, model, year, and any unique identifiers like a Vehicle Identification Number (VIN) for vehicles.

-

Not Including the Sale Price: Forgetting to state the sale price is another frequent error. This information is crucial for both parties and may be needed for tax purposes. Clearly state the agreed-upon price in the designated section.

-

Ignoring Signatures: The document is not valid without the signatures of both the buyer and the seller. Some people overlook this requirement, thinking it’s unnecessary. Always ensure both parties sign and date the form.

-

Not Keeping a Copy: After completing the Bill of Sale, it’s important to keep a copy for your records. Many individuals fail to do this, which can lead to complications if disputes arise later. Make sure to store a copy in a safe place.

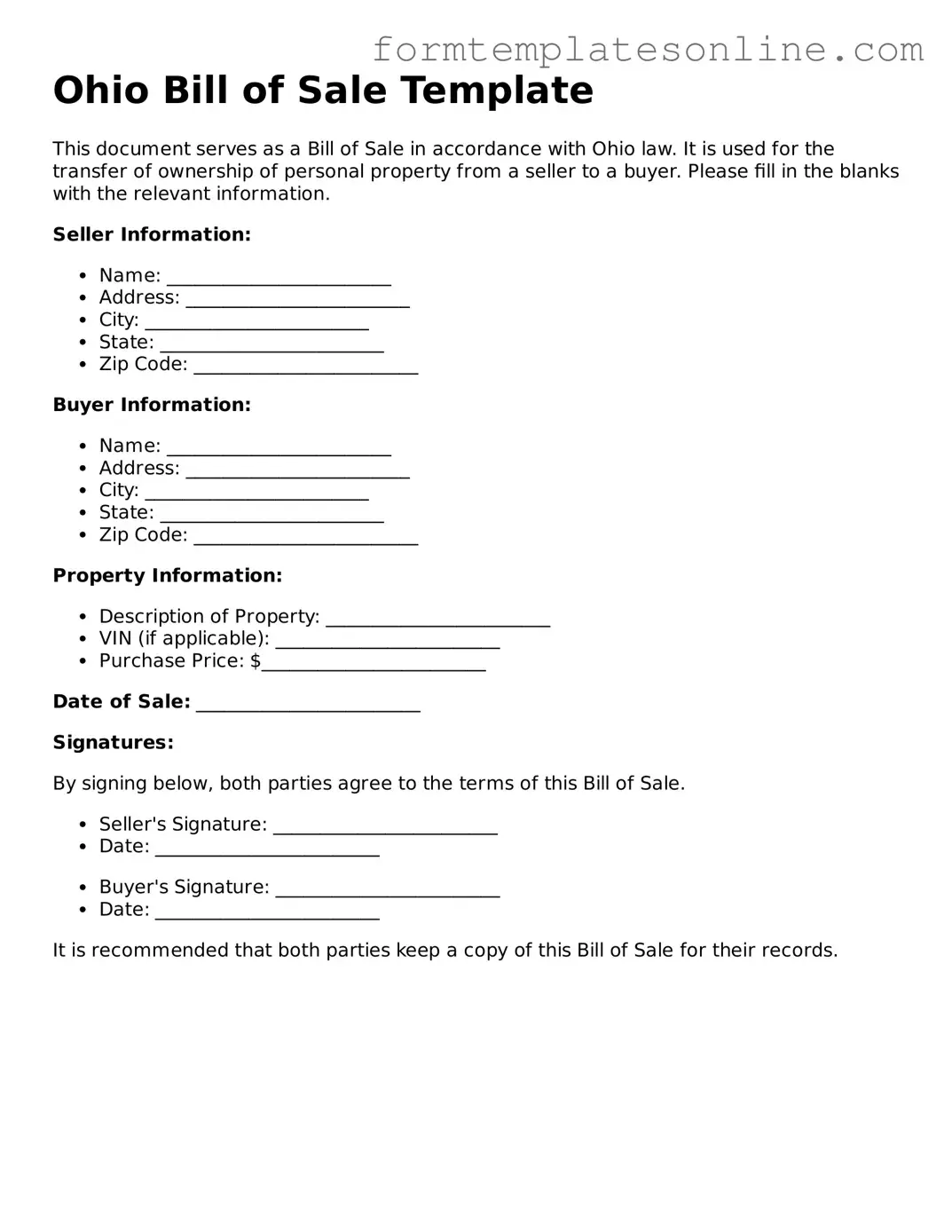

Example - Ohio Bill of Sale Form

Ohio Bill of Sale Template

This document serves as a Bill of Sale in accordance with Ohio law. It is used for the transfer of ownership of personal property from a seller to a buyer. Please fill in the blanks with the relevant information.

Seller Information:

- Name: ________________________

- Address: ________________________

- City: ________________________

- State: ________________________

- Zip Code: ________________________

Buyer Information:

- Name: ________________________

- Address: ________________________

- City: ________________________

- State: ________________________

- Zip Code: ________________________

Property Information:

- Description of Property: ________________________

- VIN (if applicable): ________________________

- Purchase Price: $________________________

Date of Sale: ________________________

Signatures:

By signing below, both parties agree to the terms of this Bill of Sale.

- Seller's Signature: ________________________

- Date: ________________________

- Buyer's Signature: ________________________

- Date: ________________________

It is recommended that both parties keep a copy of this Bill of Sale for their records.

More About Ohio Bill of Sale

What is a Bill of Sale in Ohio?

A Bill of Sale is a legal document that records the transfer of ownership of personal property from one person to another. In Ohio, this document is often used for transactions involving vehicles, boats, and other valuable items. It serves as proof of the sale and can be essential for both the buyer and seller to protect their rights and interests.

Is a Bill of Sale required in Ohio?

While a Bill of Sale is not legally required for all transactions in Ohio, it is highly recommended, especially for significant purchases like vehicles or trailers. Having a Bill of Sale provides a clear record of the transaction, which can help resolve disputes and clarify ownership if questions arise later.

What information should be included in an Ohio Bill of Sale?

An effective Bill of Sale should include several key pieces of information. This includes the names and addresses of both the buyer and seller, a description of the item being sold (including make, model, and VIN for vehicles), the purchase price, and the date of the transaction. Additionally, both parties should sign the document to validate the sale.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale in Ohio. There are no specific state forms mandated for this purpose. However, it is important to ensure that your document includes all necessary details to make it legally binding. Many templates are available online that can guide you in drafting a comprehensive Bill of Sale.

Do I need to have the Bill of Sale notarized?

In Ohio, notarization of a Bill of Sale is not required, but it can add an extra layer of legitimacy to the document. If you choose to have it notarized, it can help verify the identities of both parties and the authenticity of their signatures, which may be beneficial if disputes arise later.

What if the item sold is a vehicle?

When selling a vehicle in Ohio, the Bill of Sale should include specific information such as the Vehicle Identification Number (VIN), the make and model of the vehicle, and the odometer reading at the time of sale. Additionally, the seller must provide the buyer with the vehicle title, which must be signed over to the new owner. This ensures that the buyer can register the vehicle in their name.

How does a Bill of Sale affect taxes?

A Bill of Sale can have tax implications for both the buyer and the seller. For the buyer, the document serves as proof of purchase, which may be required when registering the item and paying sales tax. For the seller, it can be useful for record-keeping and reporting income from the sale on tax returns. It's wise to keep a copy of the Bill of Sale for future reference.

What should I do if I lose my Bill of Sale?

If you lose your Bill of Sale, it can be challenging, but not impossible to recover. If you have a copy of the document or any evidence of the transaction, such as emails or payment receipts, you can use those to create a new Bill of Sale. It’s advisable to keep multiple copies of important documents like this in the future.

Can a Bill of Sale be used in court?

Yes, a Bill of Sale can be used in court as evidence of a transaction. If a dispute arises regarding the sale, this document can help establish the terms agreed upon by both parties. However, its effectiveness may depend on how well it was drafted and whether it includes all necessary details and signatures.

Key takeaways

When dealing with the Ohio Bill of Sale form, understanding its nuances can streamline the transaction process. Here are some key takeaways to consider:

- Purpose of the Bill of Sale: This document serves as a legal record of the sale of personal property, providing proof of ownership transfer from the seller to the buyer.

- Required Information: Ensure that all necessary details are included, such as the names and addresses of both parties, a description of the item being sold, and the sale price.

- Signatures: Both the buyer and seller must sign the Bill of Sale. This signifies their agreement to the terms outlined in the document.

- Notarization: While notarization is not mandatory in Ohio, having the document notarized can add an extra layer of authenticity and protection for both parties.

- Use for Various Transactions: The Bill of Sale can be used for various types of transactions, including vehicles, boats, and other personal property, making it a versatile tool.

- Record Keeping: Keep a copy of the Bill of Sale for your records. This can be crucial for future reference, especially in case of disputes or for tax purposes.

- State-Specific Requirements: Be aware that some items may have specific requirements under Ohio law, such as additional documentation for vehicle sales.

- Consulting Professionals: If uncertain about any aspect of the transaction or the Bill of Sale, consider seeking advice from a legal professional to ensure compliance with state laws.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Ohio Bill of Sale serves as a legal document to transfer ownership of personal property from one individual to another. |

| Governing Law | The Bill of Sale in Ohio is governed by the Ohio Revised Code, specifically sections related to the sale and transfer of personal property. |

| Types of Property | This form can be used for various types of personal property, including vehicles, boats, and equipment. |

| Notarization | While notarization is not mandatory for all Bill of Sale forms in Ohio, it is recommended to enhance the document's validity. |

| Required Information | The form typically requires details such as the buyer's and seller's names, addresses, the description of the property, and the sale price. |

| Use in Vehicle Transactions | For vehicle transactions, the Ohio Bill of Sale is often required for registration and title transfer with the Ohio Bureau of Motor Vehicles. |

| As-Is Clause | Many Bills of Sale include an "as-is" clause, indicating that the buyer accepts the property in its current condition without warranties. |

| Record Keeping | Both parties should retain a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

Consider Some Other Bill of Sale Forms for US States

Print Bill of Sale - This document can be used to establish that no verbal agreements exist outside the sale.

Bill of Sale Michigan - A Bill of Sale can be incorporated into other contracts as a supplementary document.

Dmv Family Transfer - Information about the item, such as its serial number or VIN, is important to document.

North Carolina Vehicle Title - A Bill of Sale may include the description of the item, sale price, and date of the transaction.

Dos and Don'ts

When filling out the Ohio Bill of Sale form, there are important guidelines to follow. Here’s a helpful list of things you should and shouldn’t do:

- Do provide accurate information about the buyer and seller.

- Do include a detailed description of the item being sold.

- Do sign and date the form to make it valid.

- Do keep a copy for your records after completion.

- Do check for any state-specific requirements that may apply.

- Don’t leave any blank spaces on the form.

- Don’t use vague terms when describing the item.

- Don’t forget to include the purchase price.

- Don’t rush through the process; take your time to ensure accuracy.