Valid Articles of Incorporation Form for Ohio

Starting a business in Ohio involves several important steps, one of which is completing the Articles of Incorporation form. This document serves as the foundation for your corporation, outlining essential details such as the corporation's name, its purpose, and the address of its principal office. Additionally, the form requires information about the registered agent, who will be responsible for receiving legal documents on behalf of the corporation. You will also need to specify the number of shares the corporation is authorized to issue, which is crucial for determining ownership structure. By filing the Articles of Incorporation with the Ohio Secretary of State, you not only establish your business as a legal entity but also gain access to various protections and benefits that come with incorporation. Understanding the components of this form is vital for anyone looking to embark on the journey of entrepreneurship in Ohio, as it sets the stage for your business’s future success.

Common mistakes

-

Incorrect Entity Name: The name of the corporation must be unique and not similar to existing businesses. Failing to check name availability can lead to rejection.

-

Missing Purpose Statement: A clear and specific purpose for the corporation is required. Vague or overly broad descriptions may cause issues.

-

Inaccurate Registered Agent Information: The registered agent must have a physical address in Ohio. Providing incorrect details can delay the process.

-

Omitting Incorporator Details: All incorporators must be listed with their names and addresses. Leaving out any incorporators can result in incomplete forms.

-

Failure to Include the Correct Number of Shares: Specify the number of shares the corporation is authorized to issue. Not including this information can lead to rejection.

-

Not Signing the Document: The Articles of Incorporation must be signed by the incorporator(s). A missing signature will invalidate the submission.

-

Incorrect Filing Fee: Ensure the correct fee is submitted with the form. Underpaying or overpaying can cause delays in processing.

-

Inadequate Contact Information: Providing a phone number or email is essential for communication. Lack of contact details can hinder follow-up.

-

Ignoring State-Specific Requirements: Each state may have unique requirements. Failing to adhere to Ohio’s specific regulations can lead to complications.

Example - Ohio Articles of Incorporation Form

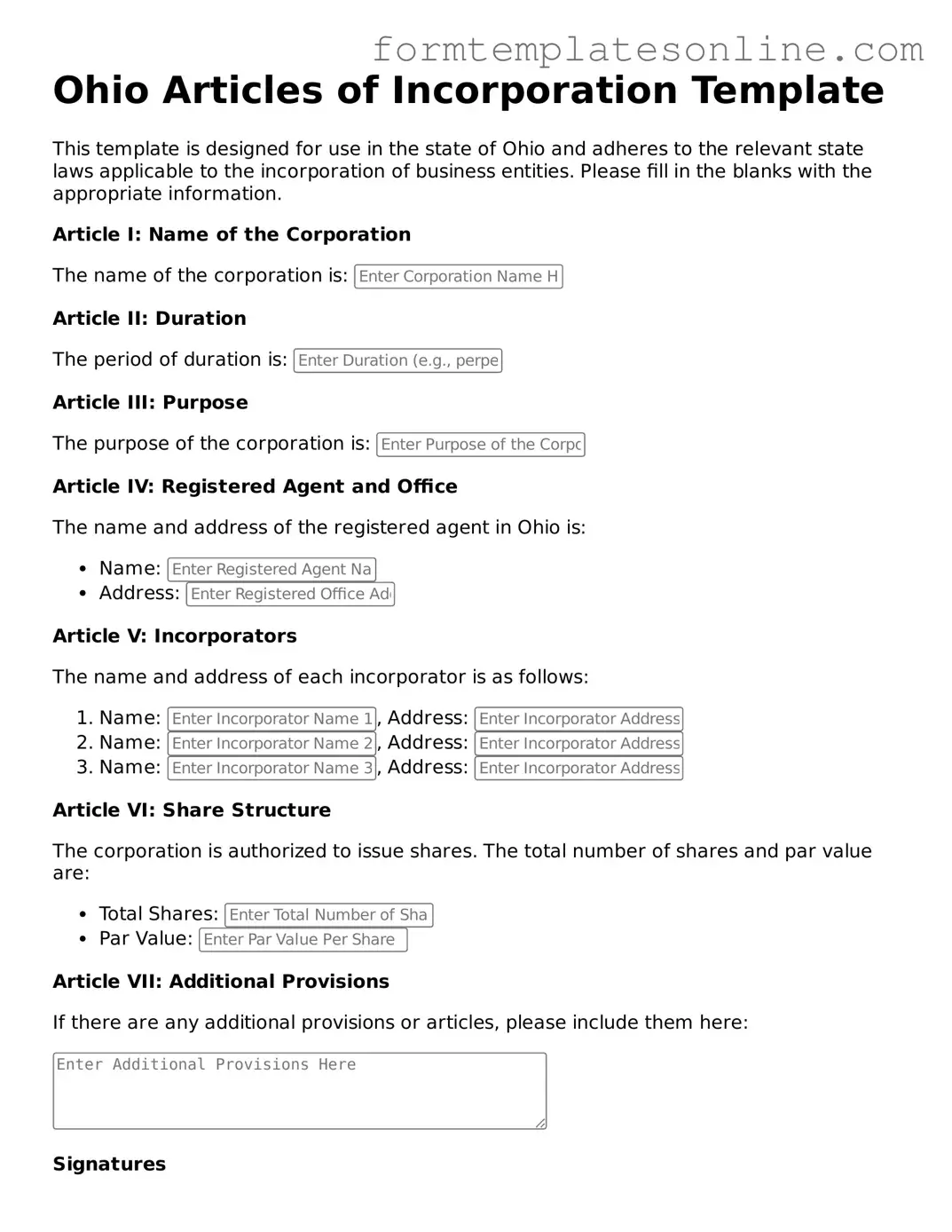

Ohio Articles of Incorporation Template

This template is designed for use in the state of Ohio and adheres to the relevant state laws applicable to the incorporation of business entities. Please fill in the blanks with the appropriate information.

Article I: Name of the Corporation

The name of the corporation is:

Article II: Duration

The period of duration is:

Article III: Purpose

The purpose of the corporation is:

Article IV: Registered Agent and Office

The name and address of the registered agent in Ohio is:

- Name:

- Address:

Article V: Incorporators

The name and address of each incorporator is as follows:

- Name: , Address:

- Name: , Address:

- Name: , Address:

Article VI: Share Structure

The corporation is authorized to issue shares. The total number of shares and par value are:

- Total Shares:

- Par Value:

Article VII: Additional Provisions

If there are any additional provisions or articles, please include them here:

Signatures

The undersigned hereby declare that the information provided is true and correct.

- Signature of Incorporator 1:

- Signature of Incorporator 2:

- Signature of Incorporator 3:

Date of Incorporation:

By completing and submitting these articles, you ensure compliance with Ohio law and may establish your corporation effectively.

More About Ohio Articles of Incorporation

What is the Ohio Articles of Incorporation form?

The Ohio Articles of Incorporation form is a legal document that establishes a corporation in the state of Ohio. It includes essential information about the corporation, such as its name, purpose, and the address of its principal office. Filing this form is the first step to creating a legal entity that can conduct business in Ohio.

Who needs to file the Articles of Incorporation?

What information is required on the form?

How do I file the Articles of Incorporation?

What is the filing fee for the Articles of Incorporation?

How long does it take to process the Articles of Incorporation?

What happens after I file the Articles of Incorporation?

Can I amend the Articles of Incorporation later?

Do I need a lawyer to file the Articles of Incorporation?

Key takeaways

Filing the Articles of Incorporation in Ohio is a crucial step for anyone looking to establish a corporation. Understanding the process can save time and ensure compliance. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for your corporation, establishing its existence in the eyes of the law.

- Choose a Unique Name: Your corporation's name must be distinguishable from existing entities in Ohio. Conduct a name search to ensure availability.

- Designate a Registered Agent: A registered agent is required for every corporation. This person or entity will receive legal documents on behalf of your corporation.

- Specify the Business Purpose: Clearly outline the nature of your business. A broad statement is acceptable, but it should reflect your intended activities.

- Include the Number of Shares: If your corporation will issue stock, specify the number of shares and their par value. This is essential for potential investors.

- File with the Secretary of State: Submit your completed Articles of Incorporation to the Ohio Secretary of State. This can typically be done online or via mail.

- Understand the Fees: There are filing fees associated with submitting the Articles of Incorporation. Ensure you are aware of the current fees to avoid delays.

Taking the time to carefully complete the Articles of Incorporation can pave the way for a successful business venture in Ohio. Make sure you pay attention to each detail, as this document is foundational to your corporation's legitimacy and future operations.

File Details

| Fact Name | Description |

|---|---|

| Governing Law | The Ohio Articles of Incorporation are governed by the Ohio Revised Code, specifically Chapter 1701. |

| Purpose | The form is used to legally establish a corporation in Ohio. |

| Filing Requirement | Filing with the Ohio Secretary of State is required to create a corporation. |

| Information Needed | Key information includes the corporation's name, principal office address, and registered agent details. |

| Fees | A filing fee must be paid when submitting the Articles of Incorporation. |

| Type of Corporation | The form can be used for both profit and nonprofit corporations. |

| Effective Date | The corporation can specify an effective date for the Articles, which may differ from the filing date. |

| Amendments | Changes to the Articles of Incorporation can be made through a formal amendment process. |

Consider Some Other Articles of Incorporation Forms for US States

Where Can I Find Articles of Incorporation - The articles outline the corporate structure and governance.

The Arizona Mobile Home Bill of Sale form is a legal document used to transfer ownership of a mobile home from one party to another. This form serves as proof of the transaction and outlines the terms agreed upon by the buyer and seller. For those involved in this process, accessing the Mobile Home Bill of Sale form is essential to ensure all legal requirements are met.

Form California Llc - Provides information for initial financing of the corporation.

Dos and Don'ts

When filling out the Ohio Articles of Incorporation form, it's important to follow certain guidelines to ensure a smooth process. Here are four things you should do and four things you shouldn't do:

- Do provide accurate information about your business name and address.

- Do include the purpose of your corporation clearly and concisely.

- Do ensure that the names and addresses of the initial directors are correct.

- Do double-check the form for completeness before submission.

- Don't use a name that is already taken or too similar to an existing corporation.

- Don't forget to sign and date the form before submitting it.

- Don't leave out any required information, as this can delay processing.

- Don't underestimate the importance of reviewing the form for errors.