Valid Transfer-on-Death Deed Form for North Carolina

In North Carolina, the Transfer-on-Death Deed (TODD) serves as a valuable tool for individuals looking to simplify the transfer of real estate upon their passing. This legal document allows property owners to designate one or more beneficiaries who will automatically receive the property without the need for probate. By completing and recording a TODD, you can ensure that your loved ones inherit your property seamlessly, minimizing potential disputes and delays. Importantly, the deed remains revocable during your lifetime, meaning you can change your mind or alter the beneficiaries at any time. The process of executing a Transfer-on-Death Deed is straightforward, yet it requires careful attention to detail to ensure that all legal requirements are met. Understanding the implications of this deed, as well as its benefits, can provide peace of mind for both you and your family, helping to secure your legacy while alleviating the burdens often associated with property transfer after death.

Common mistakes

-

Failing to include all necessary information about the property. Ensure that the legal description of the property is accurate and complete.

-

Not properly identifying the beneficiaries. Clearly list the names and addresses of all individuals who will receive the property.

-

Neglecting to sign the deed in the presence of a notary. A signature without notarization may invalidate the deed.

-

Overlooking the need to record the deed. Failing to file the deed with the county register of deeds can lead to complications in transferring ownership.

-

Using incorrect or outdated forms. Always ensure that you are using the most current version of the Transfer-on-Death Deed form.

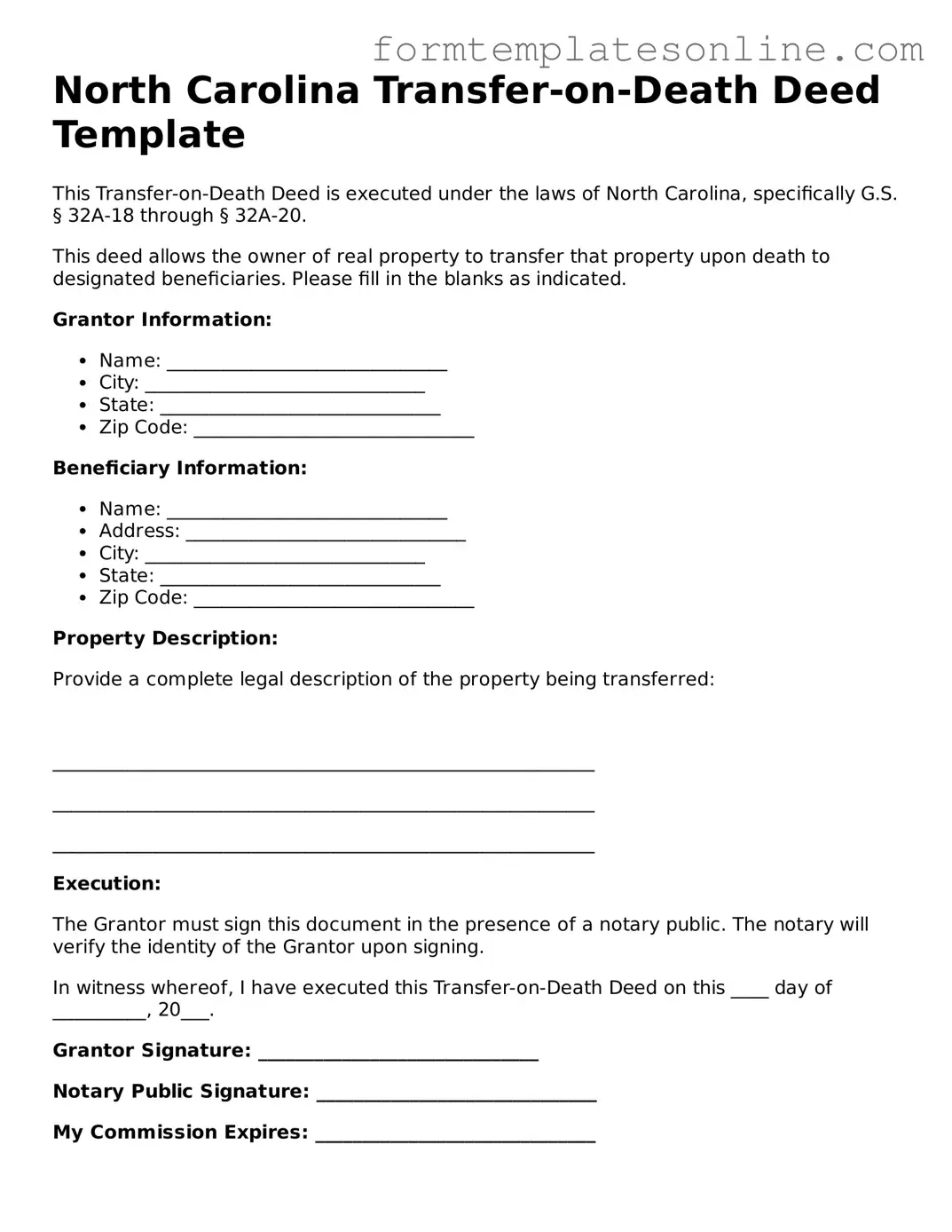

Example - North Carolina Transfer-on-Death Deed Form

North Carolina Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed under the laws of North Carolina, specifically G.S. § 32A-18 through § 32A-20.

This deed allows the owner of real property to transfer that property upon death to designated beneficiaries. Please fill in the blanks as indicated.

Grantor Information:

- Name: ______________________________

- City: ______________________________

- State: ______________________________

- Zip Code: ______________________________

Beneficiary Information:

- Name: ______________________________

- Address: ______________________________

- City: ______________________________

- State: ______________________________

- Zip Code: ______________________________

Property Description:

Provide a complete legal description of the property being transferred:

__________________________________________________________

__________________________________________________________

__________________________________________________________

Execution:

The Grantor must sign this document in the presence of a notary public. The notary will verify the identity of the Grantor upon signing.

In witness whereof, I have executed this Transfer-on-Death Deed on this ____ day of __________, 20___.

Grantor Signature: ______________________________

Notary Public Signature: ______________________________

My Commission Expires: ______________________________

More About North Carolina Transfer-on-Death Deed

What is a Transfer-on-Death Deed in North Carolina?

A Transfer-on-Death Deed (TODD) allows property owners in North Carolina to designate a beneficiary who will receive their real estate upon their death. This deed provides a way to transfer property outside of probate, simplifying the process for heirs. The property remains under the owner's control during their lifetime, and they can revoke or modify the deed at any time before death.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in North Carolina can use a Transfer-on-Death Deed. This includes single individuals, married couples, and even certain types of trusts. However, it is important to ensure that the property is not subject to any liens or other encumbrances that could affect the transfer.

How do I create a Transfer-on-Death Deed?

To create a TODD, you must complete the appropriate form, which includes information about the property and the designated beneficiary. The deed must be signed and notarized. After that, it needs to be recorded with the county register of deeds where the property is located. This recording is crucial for the deed to be effective.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed that explicitly revokes the previous one or modify the existing deed. The new or modified deed must also be signed, notarized, and recorded to take effect.

What happens if I sell the property after creating a Transfer-on-Death Deed?

If you sell the property after creating a TODD, the deed becomes void. The transfer will not take place upon your death because the property is no longer owned by you. If you wish to transfer a different property after the sale, you will need to create a new Transfer-on-Death Deed for that property.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, transferring property via a TODD does not trigger immediate tax consequences. The beneficiary will inherit the property at its fair market value at the time of your death, which may help avoid capital gains tax issues. However, it’s advisable to consult with a tax professional to understand any potential implications specific to your situation.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. A will goes into effect only after your death and must go through probate, while a TODD transfers property directly to the beneficiary without probate. This can save time and costs associated with the probate process.

Can I designate multiple beneficiaries in a Transfer-on-Death Deed?

Yes, you can designate multiple beneficiaries in a Transfer-on-Death Deed. You can specify how the property will be divided among them, whether equally or in different proportions. It’s important to be clear in the deed to avoid confusion or disputes later on.

Key takeaways

Filling out and using the North Carolina Transfer-on-Death Deed form can be a straightforward process if you keep a few key points in mind. Here are some essential takeaways to help you navigate this important legal document:

- Understand the Purpose: A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate.

- Eligibility Requirements: Only certain types of property can be transferred using this deed, typically residential real estate. Ensure your property qualifies.

- Complete the Form Accurately: Fill out the form with precise information, including the names and addresses of both the owner and the beneficiaries. Any errors could lead to complications later.

- Sign in Front of Witnesses: The deed must be signed in the presence of two witnesses. This step is crucial for the validity of the document.

- File with the Register of Deeds: After signing, you must record the deed with the local Register of Deeds office. This step officially documents the transfer and protects your beneficiaries’ rights.

- Revocation is Possible: If you change your mind, you can revoke the Transfer-on-Death Deed at any time before your death. This flexibility allows you to adjust your plans as needed.

By keeping these points in mind, you can ensure that your Transfer-on-Death Deed serves its intended purpose effectively and efficiently.

File Details

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners in North Carolina to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by North Carolina General Statutes, specifically § 32A-1.1. |

| Execution Requirements | The deed must be signed by the property owner and notarized. Additionally, it must be recorded in the county where the property is located. |

| Revocation | A property owner can revoke a Transfer-on-Death Deed at any time before their death by executing a new deed or a formal revocation document. |

Consider Some Other Transfer-on-Death Deed Forms for US States

Texas Life Estate Deed Form - Ultimately, a Transfer-on-Death Deed is a proactive step in estate planning, ensuring one's wishes regarding property are upheld.

When buying or selling a mobile home, it is essential to use a proper legal document to ensure the transaction is valid and secure. A Mobile Home Bill of Sale is a legal document that records the transfer of ownership of a mobile home from one party to another. This form serves as proof of the sale and outlines important details such as the purchase price, the date of sale, and the identities of both the buyer and seller. For a hassle-free process, you can download a Mobile Home Bill of Sale form which will help you complete this vital step accurately and efficiently.

Where Can I Get a Tod Form - The Transfer-on-Death Deed aligns with modern estate planning needs, allowing for direct property transfer at death.

Dos and Don'ts

When completing the North Carolina Transfer-on-Death Deed form, it is important to follow specific guidelines to ensure accuracy and compliance. Below is a list of dos and don'ts that can help you navigate this process effectively.

- Do ensure that the property description is clear and accurate.

- Do include the names of all beneficiaries who will receive the property.

- Do sign the deed in the presence of a notary public.

- Do file the deed with the appropriate county register of deeds office.

- Do keep a copy of the completed deed for your records.

- Don't forget to check for any outstanding liens or mortgages on the property.

- Don't use vague language when describing the property.

- Don't neglect to inform beneficiaries about the deed and their rights.

- Don't attempt to fill out the form without proper identification and documentation.