Valid Quitclaim Deed Form for North Carolina

In North Carolina, the Quitclaim Deed serves as a crucial tool for transferring property rights between individuals. This form allows one party, known as the grantor, to relinquish any claim they may have to a property, effectively passing it to another party, the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property. Instead, it conveys whatever interest the grantor has, if any. This makes it particularly useful in situations such as divorce settlements, estate transfers, or when property is given as a gift. The process of executing a Quitclaim Deed requires careful attention to detail, including the proper identification of the parties involved and the property description. Once completed, the deed must be signed and notarized before it can be recorded with the local register of deeds. Understanding the implications and proper use of this form can help individuals navigate property transfers smoothly and avoid potential disputes in the future.

Common mistakes

-

Failing to provide the correct names of the grantor and grantee. It is essential that the names are spelled correctly and match official identification.

-

Not including the legal description of the property. This description should be precise and can often be found in previous deeds or property tax records.

-

Leaving out the date of the transfer. A quitclaim deed must clearly state when the transfer takes place.

-

Neglecting to sign the document. Both the grantor and grantee must sign the deed for it to be valid.

-

Using incorrect notary information. The deed must be notarized by a qualified notary public, and the notary's signature and seal must be present.

-

Failing to check for existing liens or encumbrances on the property. This oversight can lead to complications later on.

-

Not providing sufficient consideration. While a quitclaim deed can be executed without monetary exchange, it should still state the consideration, even if it is nominal.

-

Omitting the property’s tax identification number. Including this number can help clarify the specific property being transferred.

-

Not filing the deed with the appropriate county office. After completion, the deed must be recorded to be legally recognized.

-

Overlooking state-specific requirements. Each state may have unique rules regarding quitclaim deeds, and it is important to ensure compliance with North Carolina laws.

Example - North Carolina Quitclaim Deed Form

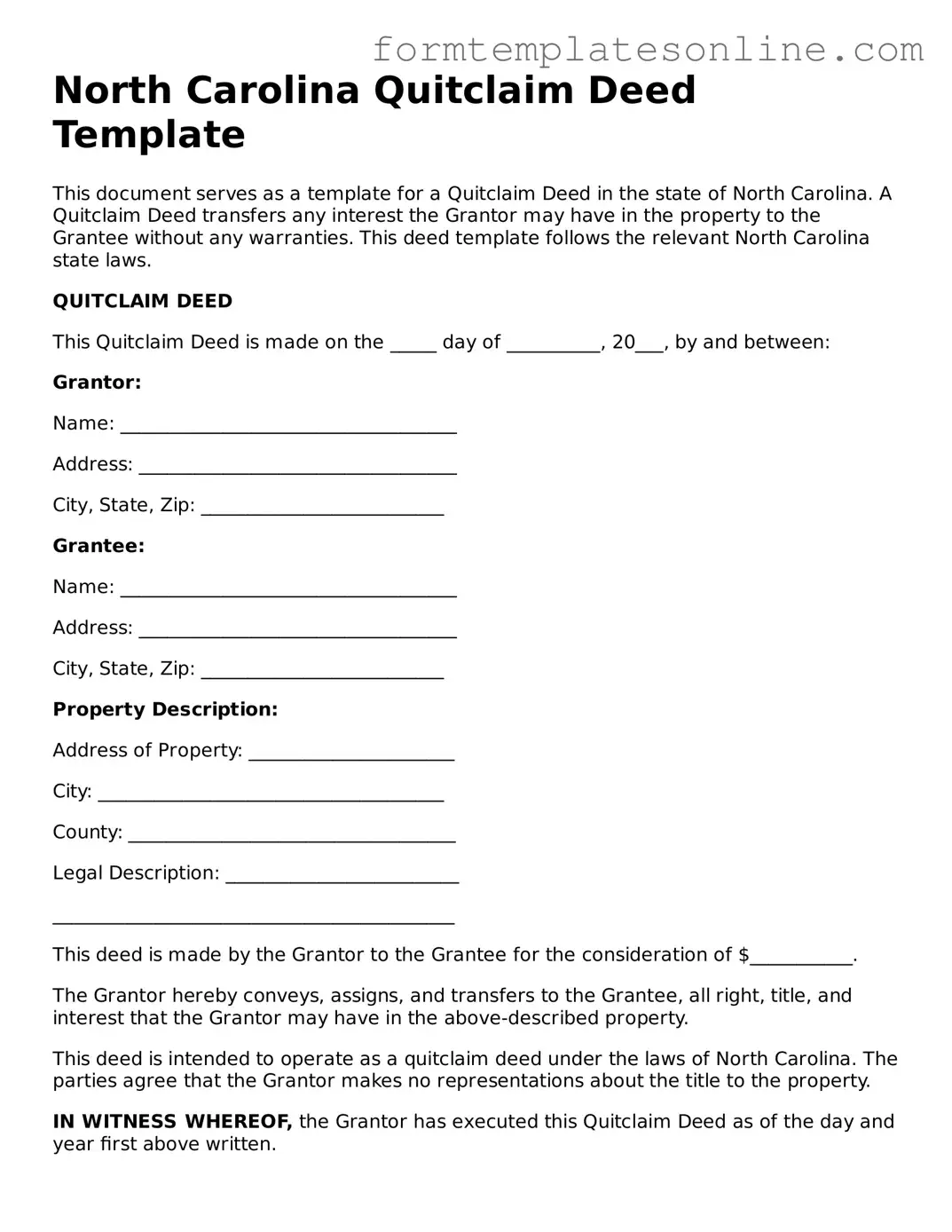

North Carolina Quitclaim Deed Template

This document serves as a template for a Quitclaim Deed in the state of North Carolina. A Quitclaim Deed transfers any interest the Grantor may have in the property to the Grantee without any warranties. This deed template follows the relevant North Carolina state laws.

QUITCLAIM DEED

This Quitclaim Deed is made on the _____ day of __________, 20___, by and between:

Grantor:

Name: ____________________________________

Address: __________________________________

City, State, Zip: __________________________

Grantee:

Name: ____________________________________

Address: __________________________________

City, State, Zip: __________________________

Property Description:

Address of Property: ______________________

City: _____________________________________

County: ___________________________________

Legal Description: _________________________

___________________________________________

This deed is made by the Grantor to the Grantee for the consideration of $___________.

The Grantor hereby conveys, assigns, and transfers to the Grantee, all right, title, and interest that the Grantor may have in the above-described property.

This deed is intended to operate as a quitclaim deed under the laws of North Carolina. The parties agree that the Grantor makes no representations about the title to the property.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

_______________________________

Signature of Grantor

_______________________________

Printed Name of Grantor

STATE OF NORTH CAROLINA

COUNTY OF _______________

Before me, a Notary Public, personally appeared _____________________ (Grantor's Name) who acknowledged the due execution of the foregoing Quitclaim Deed.

In witness whereof, I have hereunto set my hand and official seal this ___ day of __________, 20__.

_______________________________

Notary Public

My Commission Expires: _______________

More About North Carolina Quitclaim Deed

What is a Quitclaim Deed in North Carolina?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another in North Carolina. This type of deed conveys whatever interest the grantor has in the property, without guaranteeing that the title is clear. It is often used in situations such as transferring property between family members, resolving disputes, or clearing up title issues. The Quitclaim Deed does not provide any warranties or assurances regarding the property’s title, which means that the grantee takes on any potential risks associated with the property’s ownership.

How do I complete a Quitclaim Deed in North Carolina?

To complete a Quitclaim Deed in North Carolina, the grantor must provide certain information. This includes the names and addresses of both the grantor and grantee, a legal description of the property, and the date of the transfer. The document must be signed by the grantor in the presence of a notary public. After signing, the Quitclaim Deed should be filed with the local county register of deeds to ensure that the transfer is officially recorded. It is advisable to check with local authorities for any specific requirements or forms that may be needed.

Are there any tax implications associated with a Quitclaim Deed in North Carolina?

In North Carolina, transferring property through a Quitclaim Deed may have tax implications. While the transfer itself may not incur a sales tax, it could affect property tax assessments. Additionally, if the property is transferred as a gift, the grantor may need to consider federal gift tax regulations. It is important for both grantors and grantees to consult with a tax professional or attorney to understand any potential tax consequences related to the transfer of property.

Can a Quitclaim Deed be revoked in North Carolina?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked unilaterally. The transfer of property is considered final unless the parties involved agree to reverse the transaction through another legal instrument, such as a new deed. If the grantee wishes to return the property to the grantor, both parties must execute a new deed to effectuate that change. It is advisable to seek legal counsel when considering reversing a property transfer to ensure compliance with applicable laws and to address any potential complications.

Key takeaways

Filling out and using the North Carolina Quitclaim Deed form requires attention to detail and understanding of the process. Here are some key takeaways to consider:

- Purpose of the Quitclaim Deed: This document transfers ownership of property from one party to another without guaranteeing that the title is free of claims.

- Completing the Form: Ensure that all sections of the form are filled out accurately, including the names of the grantor (seller) and grantee (buyer), property description, and signatures.

- Notarization Requirement: The Quitclaim Deed must be signed in the presence of a notary public to be legally valid.

- Recording the Deed: After completion, the deed should be recorded at the local county register of deeds to provide public notice of the property transfer.

- Tax Implications: Be aware of any potential tax consequences that may arise from the transfer of property, including transfer taxes.

- Legal Advice: It is advisable to consult with a real estate attorney to ensure that the Quitclaim Deed meets all legal requirements and protects your interests.

File Details

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document used to transfer ownership of real estate without any warranties or guarantees regarding the property title. |

| Governing Law | In North Carolina, the quitclaim deed is governed by the North Carolina General Statutes, specifically Chapter 47. |

| Use Cases | Commonly used among family members or in situations where the property title is clear, quitclaim deeds simplify the transfer process. |

| Signature Requirements | The deed must be signed by the grantor (the person transferring the property) and typically requires notarization for validity. |

| Limitations | Unlike warranty deeds, quitclaim deeds do not protect the grantee (the person receiving the property) from potential title issues or claims. |

Consider Some Other Quitclaim Deed Forms for US States

Pennsylvania Quit Claim Deed Form - No formal appraisal is needed when completing a Quitclaim Deed.

A Michigan Non-disclosure Agreement form is a legal document used to protect sensitive information. When signed, it prevents parties from sharing any confidential details specified in the agreement. It's a critical tool for businesses and individuals in Michigan looking to safeguard their proprietary information or trade secrets. For more information, you can visit OnlineLawDocs.com.

Quick Claim Deed Form - Individuals considering a Quitclaim Deed should make sure all parties involved fully understand the terms.

Quit Claim Deed Georgia - A quitclaim deed is also a method for legally changing property ownership after marriage or divorce.

Michigan Quit Claim Deed Pdf - They are less formal than other deed types, requiring minimal legal language.

Dos and Don'ts

When filling out the North Carolina Quitclaim Deed form, it is important to follow specific guidelines to ensure the document is valid and effective. Here are six key dos and don'ts to consider:

- Do clearly identify the property being transferred. Include the full legal description.

- Do include the names of both the grantor and grantee accurately.

- Do sign the form in front of a notary public to ensure its legality.

- Do check for any local requirements that may apply to your specific situation.

- Don't leave any required fields blank. Incomplete forms can lead to issues later.

- Don't use outdated versions of the form. Always use the most current version available.

By following these guidelines, you can help ensure that your Quitclaim Deed is properly executed and recognized by the appropriate authorities.