Valid Promissory Note Form for North Carolina

In the realm of financial transactions, the North Carolina Promissory Note serves as a crucial instrument for facilitating loans and establishing repayment obligations between parties. This legally binding document outlines the terms of the loan, including the principal amount borrowed, the interest rate, and the repayment schedule. It provides clarity on the responsibilities of both the borrower and the lender, ensuring that expectations are clearly defined. Additionally, the form addresses potential contingencies, such as default and the applicable remedies, which can protect the lender's interests. By incorporating essential elements such as signatures, dates, and any required disclosures, the North Carolina Promissory Note not only formalizes the agreement but also serves as a safeguard for both parties involved. Understanding its components is vital for anyone engaging in lending or borrowing, as it lays the groundwork for a transparent and fair financial relationship.

Common mistakes

-

Incorrect Borrower Information: People often fail to provide accurate details about the borrower. This includes the full name, address, and contact information. Any errors can lead to confusion or delays in the process.

-

Missing Loan Amount: It is crucial to clearly state the amount of the loan. Leaving this blank or writing it incorrectly can create disputes later on. Double-check the figures to ensure accuracy.

-

Omitting Interest Rate: The interest rate should be specified in the note. Some individuals neglect to include this vital information, which can lead to misunderstandings regarding payment expectations.

-

Failure to Sign and Date: A common oversight is not signing or dating the document. Without these, the note may not be legally binding. Always ensure that both parties have signed and dated the form before finalizing it.

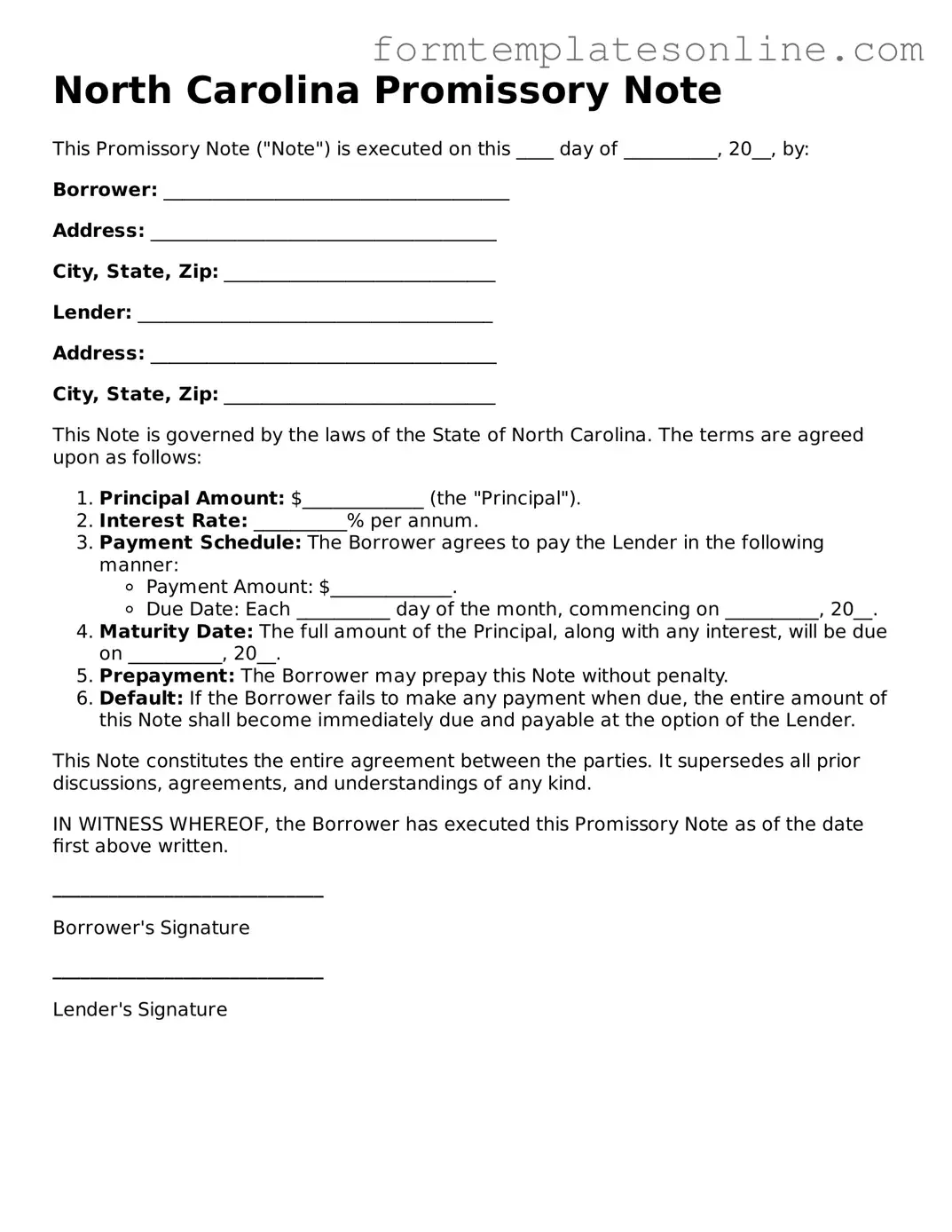

Example - North Carolina Promissory Note Form

North Carolina Promissory Note

This Promissory Note ("Note") is executed on this ____ day of __________, 20__, by:

Borrower: _____________________________________

Address: _____________________________________

City, State, Zip: _____________________________

Lender: ______________________________________

Address: _____________________________________

City, State, Zip: _____________________________

This Note is governed by the laws of the State of North Carolina. The terms are agreed upon as follows:

- Principal Amount: $_____________ (the "Principal").

- Interest Rate: __________% per annum.

- Payment Schedule: The Borrower agrees to pay the Lender in the following manner:

- Payment Amount: $_____________.

- Due Date: Each __________ day of the month, commencing on __________, 20__.

- Maturity Date: The full amount of the Principal, along with any interest, will be due on __________, 20__.

- Prepayment: The Borrower may prepay this Note without penalty.

- Default: If the Borrower fails to make any payment when due, the entire amount of this Note shall become immediately due and payable at the option of the Lender.

This Note constitutes the entire agreement between the parties. It supersedes all prior discussions, agreements, and understandings of any kind.

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the date first above written.

_____________________________

Borrower's Signature

_____________________________

Lender's Signature

More About North Carolina Promissory Note

What is a North Carolina Promissory Note?

A North Carolina Promissory Note is a legal document in which one party, the borrower, agrees to pay a specific sum of money to another party, the lender, under agreed-upon terms. This note outlines the amount borrowed, the interest rate, the repayment schedule, and any penalties for late payment. It serves as a written record of the debt and can be enforced in court if necessary. In North Carolina, these notes can be used for personal loans, business loans, or any situation where money is borrowed with the intent to repay.

What are the essential components of a Promissory Note in North Carolina?

To create a valid Promissory Note in North Carolina, several key components must be included. First, the names and addresses of both the borrower and lender should be clearly stated. Next, the principal amount of the loan must be specified, along with the interest rate, if applicable. The repayment terms, including the due date and payment schedule, are crucial for clarity. Additionally, any provisions regarding default, late fees, and the governing law should be included. By covering these aspects, the note becomes a comprehensive agreement that protects both parties.

Is a Promissory Note legally binding in North Carolina?

Yes, a Promissory Note is legally binding in North Carolina, provided it meets certain criteria. The document must be signed by the borrower, and both parties must have the legal capacity to enter into a contract. If the terms of the note are clear and unambiguous, it can be enforced in a court of law. This means that if the borrower fails to repay the loan as agreed, the lender has the right to pursue legal action to recover the owed amount. However, it is advisable for both parties to seek legal advice to ensure the note complies with state laws and adequately protects their interests.

Can a Promissory Note be modified after it is signed?

Yes, a Promissory Note can be modified after it is signed, but any changes must be made in writing and agreed upon by both parties. This could involve altering the repayment schedule, changing the interest rate, or adjusting other terms of the agreement. It is essential to document these modifications properly to avoid any disputes in the future. Both parties should sign the amended note to confirm their agreement to the new terms. Keeping clear records of any changes helps maintain transparency and can prevent misunderstandings later on.

Key takeaways

When filling out and using the North Carolina Promissory Note form, it is essential to understand its structure and requirements. Here are five key takeaways:

- Clear Identification of Parties: The form must clearly identify both the borrower and the lender. Full names and contact information should be included to avoid confusion.

- Loan Amount Specification: The total loan amount should be explicitly stated. This figure is critical for both parties to understand their financial obligations.

- Interest Rate Details: If applicable, the interest rate must be included. Clearly defining whether the rate is fixed or variable can help prevent disputes later.

- Payment Terms: Outline the repayment schedule, including due dates and the method of payment. This ensures both parties are aware of when payments are expected.

- Signatures Required: Both the borrower and lender must sign the document for it to be legally binding. Ensure that the date of signing is also noted.

These key points can help facilitate a smooth transaction and ensure that all parties are on the same page regarding the terms of the loan.

File Details

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated party at a defined time or on demand. |

| Governing Law | North Carolina General Statutes Chapter 25 governs promissory notes in North Carolina. |

| Parties Involved | The note involves two main parties: the maker (borrower) and the payee (lender). |

| Essential Elements | A valid promissory note must include the amount owed, the interest rate (if applicable), and the repayment terms. |

| Signature Requirement | The maker must sign the promissory note to indicate their agreement to the terms outlined. |

| Enforceability | If properly executed, a promissory note is legally enforceable in a court of law. |

| Default Consequences | Failure to repay as agreed may result in legal action by the payee to recover the owed amount. |

Consider Some Other Promissory Note Forms for US States

Promissory Note Florida Pdf - Finalizing a promissory note can provide peace of mind for both the lender and the borrower.

For those seeking clarity in appointing a trusted individual, understanding the importance of a general power of attorney in Florida is vital. This document enables someone to act on your behalf in financial or legal matters. Explore how to properly complete this form by reviewing the comprehensive details provided in the general power of attorney guide.

Promissory Note Template California Word - Interest rates on the note can be fixed or variable, as stated in the terms.

Loan Agreement Template Texas - The note can be transferred to another party, making it a negotiable instrument.

Promissory Note Illinois - A well-crafted Promissory Note protects both the lender's and borrower's interests.

Dos and Don'ts

When filling out the North Carolina Promissory Note form, it's important to follow certain guidelines. Here are six things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate and complete information.

- Do sign and date the form where indicated.

- Do keep a copy for your records.

- Don't leave any required fields blank.

- Don't use unclear language or abbreviations.