Valid Operating Agreement Form for North Carolina

The North Carolina Operating Agreement form serves as a foundational document for limited liability companies (LLCs) in the state, outlining essential elements that govern the company’s operations and management. This agreement typically addresses key aspects such as the ownership structure, the roles and responsibilities of members, and the procedures for decision-making and profit distribution. It also lays out the process for adding or removing members, thereby ensuring clarity in membership transitions. Furthermore, the form often includes provisions for resolving disputes among members, which can help prevent conflicts from escalating. By establishing these guidelines, the Operating Agreement not only protects the interests of its members but also enhances the overall stability and credibility of the LLC. Understanding the significance of this document is crucial for anyone looking to form or manage an LLC in North Carolina, as it can significantly influence the company’s success and compliance with state laws.

Common mistakes

-

Neglecting to Include Member Information: One common mistake is failing to provide complete details about all members of the LLC. Each member’s name, address, and percentage of ownership should be clearly stated.

-

Omitting Purpose of the LLC: The operating agreement should specify the business purpose of the LLC. A vague or missing description can lead to confusion and potential legal issues down the line.

-

Ignoring Voting Rights: Members often overlook detailing voting rights. It’s essential to clarify how decisions will be made, including the voting process and what constitutes a quorum.

-

Failing to Address Profit Distribution: Not specifying how profits and losses will be allocated among members can lead to disputes. Clearly outline the distribution method to avoid misunderstandings.

-

Not Including a Buy-Sell Agreement: A buy-sell agreement is crucial for managing the exit of a member. Omitting this can create complications if a member wants to sell their interest or passes away.

-

Overlooking Amendment Procedures: It’s important to include a process for making changes to the operating agreement. Without this, members may find it difficult to adapt to future needs.

-

Skipping Signatures: Finally, failing to have all members sign the agreement can invalidate it. Ensure that every member acknowledges and agrees to the terms by signing the document.

Example - North Carolina Operating Agreement Form

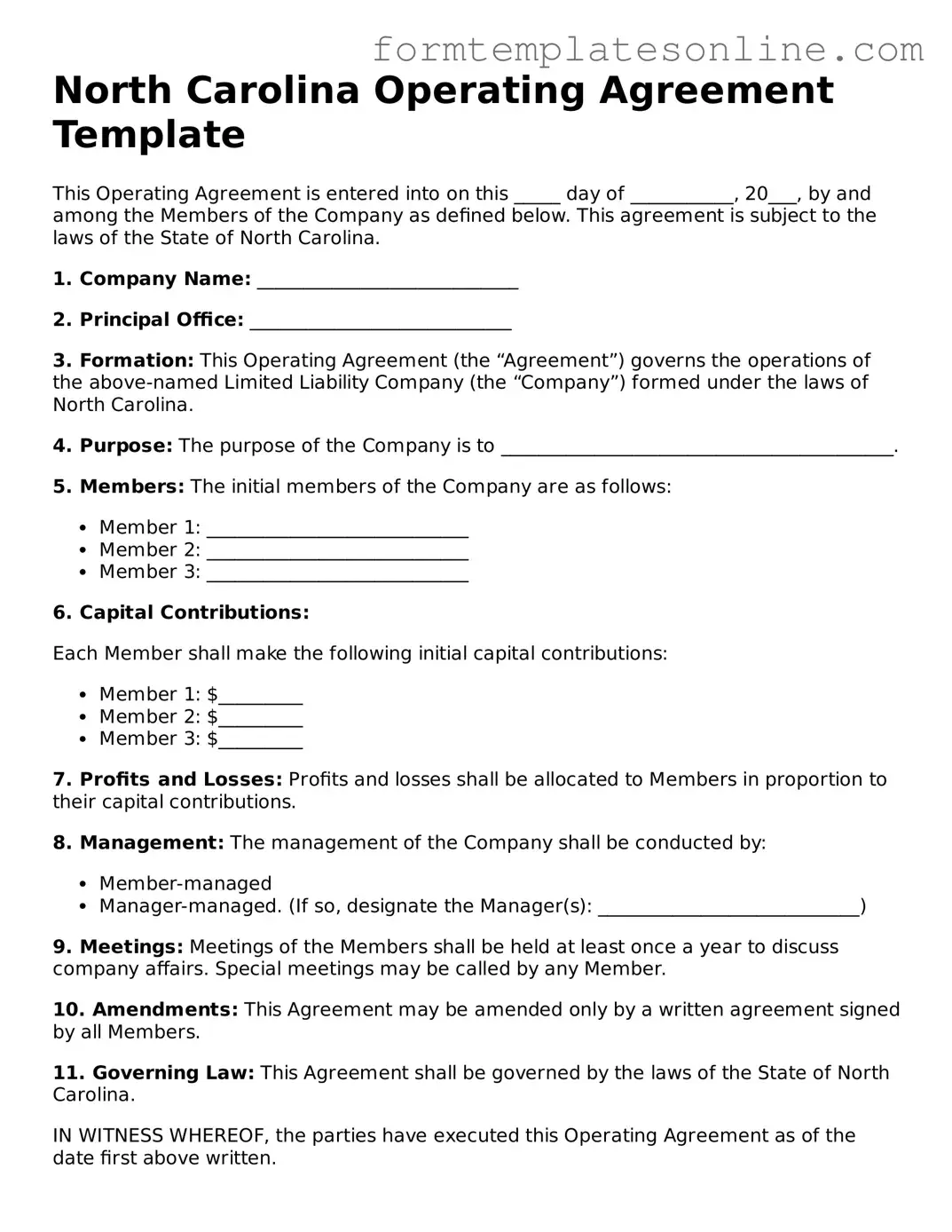

North Carolina Operating Agreement Template

This Operating Agreement is entered into on this _____ day of ___________, 20___, by and among the Members of the Company as defined below. This agreement is subject to the laws of the State of North Carolina.

1. Company Name: ____________________________

2. Principal Office: ____________________________

3. Formation: This Operating Agreement (the “Agreement”) governs the operations of the above-named Limited Liability Company (the “Company”) formed under the laws of North Carolina.

4. Purpose: The purpose of the Company is to __________________________________________.

5. Members: The initial members of the Company are as follows:

- Member 1: ____________________________

- Member 2: ____________________________

- Member 3: ____________________________

6. Capital Contributions:

Each Member shall make the following initial capital contributions:

- Member 1: $_________

- Member 2: $_________

- Member 3: $_________

7. Profits and Losses: Profits and losses shall be allocated to Members in proportion to their capital contributions.

8. Management: The management of the Company shall be conducted by:

- Member-managed

- Manager-managed. (If so, designate the Manager(s): ____________________________)

9. Meetings: Meetings of the Members shall be held at least once a year to discuss company affairs. Special meetings may be called by any Member.

10. Amendments: This Agreement may be amended only by a written agreement signed by all Members.

11. Governing Law: This Agreement shall be governed by the laws of the State of North Carolina.

IN WITNESS WHEREOF, the parties have executed this Operating Agreement as of the date first above written.

Members:

- ____________________________ (Signature)

- ____________________________ (Signature)

- ____________________________ (Signature)

More About North Carolina Operating Agreement

What is a North Carolina Operating Agreement?

An Operating Agreement in North Carolina is a crucial document for Limited Liability Companies (LLCs). It outlines the management structure, operational procedures, and financial arrangements of the LLC. While not required by law, having an Operating Agreement can help clarify the roles and responsibilities of members, thereby reducing potential conflicts in the future.

Why should I create an Operating Agreement for my LLC?

Creating an Operating Agreement is beneficial for several reasons. It provides a clear framework for how the LLC will operate, which can prevent misunderstandings among members. Additionally, it can help protect your limited liability status by demonstrating that your LLC is a separate entity from its owners. This document can also be instrumental in securing financing or attracting investors, as it reflects a well-organized business structure.

What should be included in a North Carolina Operating Agreement?

A comprehensive Operating Agreement typically includes several key components. These may consist of the LLC's name and purpose, the names of its members, the management structure, procedures for adding or removing members, and how profits and losses will be distributed. Additionally, it should outline the process for resolving disputes and any rules regarding meetings and voting. Each section should be tailored to fit the specific needs of the LLC.

Do I need a lawyer to draft my Operating Agreement?

While it is not mandatory to hire a lawyer to draft an Operating Agreement, consulting with one can be beneficial. A legal professional can ensure that the document complies with North Carolina laws and adequately reflects the intentions of the members. However, many resources are available online that can assist in creating a basic Operating Agreement if you choose to draft it independently.

Can the Operating Agreement be amended later?

Yes, an Operating Agreement can be amended as needed. It is advisable to include a specific procedure for making amendments within the document itself. This could involve requiring a certain percentage of member approval or setting a timeline for proposed changes. Keeping the Operating Agreement up to date ensures that it continues to meet the needs of the LLC as it evolves.

Is the Operating Agreement a public document?

No, the Operating Agreement is generally not a public document in North Carolina. Unlike the Articles of Organization, which must be filed with the state and are accessible to the public, the Operating Agreement is an internal document. This confidentiality allows members to maintain control over their business operations without disclosing sensitive information to outsiders.

How often should I review my Operating Agreement?

It is wise to review your Operating Agreement regularly, especially when significant changes occur within the LLC, such as adding new members or altering the business structure. Annual reviews can help ensure that the document remains relevant and effective in guiding the LLC's operations. Keeping it current can also help prevent disputes and misunderstandings among members.

Key takeaways

Filling out and using the North Carolina Operating Agreement form is an essential step for any business owner looking to establish a limited liability company (LLC). Here are some key takeaways to consider:

- Purpose of the Agreement: The Operating Agreement outlines the ownership and operating procedures of your LLC. It serves as a foundational document that helps prevent misunderstandings among members.

- Customization is Key: While templates are available, customizing your agreement to reflect your unique business needs is crucial. This ensures that all members are on the same page.

- Member Roles: Clearly define each member's role and responsibilities within the LLC. This clarity can help avoid conflicts and streamline operations.

- Profit Distribution: Specify how profits and losses will be distributed among members. This section should reflect the contributions made by each member.

- Decision-Making Process: Establish a decision-making process that outlines how major business decisions will be made. This can include voting rights and procedures.

- Amendments: Include a process for amending the Operating Agreement. Businesses evolve, and having a clear method for updates can save time and confusion later.

- Dispute Resolution: Consider adding a section on how disputes will be resolved. This can help manage conflicts in a constructive manner, potentially avoiding costly litigation.

- Legal Compliance: Ensure that your Operating Agreement complies with North Carolina state laws. This helps protect your LLC's status and provides legal backing for your operations.

Taking the time to fill out the North Carolina Operating Agreement form thoughtfully can set your LLC on a path to success. It’s not just a formality; it’s a roadmap for your business journey.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Operating Agreement outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | The agreement is governed by the North Carolina General Statutes, specifically Chapter 57D. |

| Member Rights | It defines the rights and responsibilities of the members, including profit distribution and decision-making processes. |

| Flexibility | The Operating Agreement allows for customization to meet the specific needs of the LLC and its members. |

Consider Some Other Operating Agreement Forms for US States

How to Write an Operating Agreement - It can help expedite the process if the LLC faces legal scrutiny.

The process of initiating a homeschooling program in Kansas starts with the completion of the Homeschool Letter of Intent form, which allows parents or guardians to formally inform the state of their intent to educate their children at home. This document is crucial for ensuring adherence to state regulations and helps families navigate the necessary steps in setting up a compliant educational environment.

Llc Operating Agreement Georgia - A clear Operating Agreement can provide clarity during audits.

Dos and Don'ts

When filling out the North Carolina Operating Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below are four recommendations, including both actions to take and those to avoid.

- Do: Review the form thoroughly before starting to fill it out to understand all required sections.

- Do: Provide accurate and complete information about the members and the business structure.

- Don't: Rush through the process; take your time to ensure that all details are correct.

- Don't: Leave any sections blank unless instructed to do so, as this may lead to delays or complications.