Valid Lady Bird Deed Form for North Carolina

In the realm of estate planning, the North Carolina Lady Bird Deed has gained popularity for its unique approach to property transfer. This legal instrument allows property owners to retain control over their real estate during their lifetime while ensuring a smooth transition to their chosen beneficiaries upon death. One of the standout features of the Lady Bird Deed is its ability to bypass the often lengthy and costly probate process, making it an attractive option for many. Additionally, this deed provides the grantor with the flexibility to sell, mortgage, or change the beneficiaries at any time, offering peace of mind and control. Unlike traditional life estate deeds, which can impose restrictions on the property, the Lady Bird Deed allows for greater freedom and adaptability. As individuals consider their estate planning options, understanding the nuances of the North Carolina Lady Bird Deed can empower them to make informed decisions that align with their wishes and financial goals.

Common mistakes

Filling out the North Carolina Lady Bird Deed form can be a straightforward process, but several common mistakes can lead to complications. Below is a list of nine mistakes to avoid:

-

Incorrect Property Description:

Ensure the property description is accurate and matches public records. A vague or incorrect description can create issues in the future.

-

Missing Signatures:

All required parties must sign the deed. Missing signatures can invalidate the document.

-

Not Including a Notary:

The deed must be notarized. Failing to have a notary can prevent the deed from being recorded.

-

Incorrect Names:

Names should be spelled correctly and match legal identification. Any discrepancies can lead to legal challenges.

-

Failing to Specify Beneficiaries:

Clearly identify who will receive the property upon the owner’s passing. Ambiguity can lead to disputes among heirs.

-

Not Understanding the Implications:

It's important to understand how a Lady Bird Deed affects property ownership and Medicaid eligibility. Misunderstanding can lead to unintended consequences.

-

Not Recording the Deed:

After completing the form, it must be recorded with the county register of deeds. Failing to do so can render the deed ineffective.

-

Omitting Additional Provisions:

If there are specific instructions or conditions, make sure to include them. Omitting these can lead to confusion later on.

-

Not Seeking Legal Advice:

Consulting with a legal professional can help ensure the deed is completed correctly. Neglecting this step can result in costly mistakes.

By being aware of these common mistakes, individuals can take steps to ensure their Lady Bird Deed is completed accurately and effectively. This proactive approach can help avoid future complications and provide peace of mind.

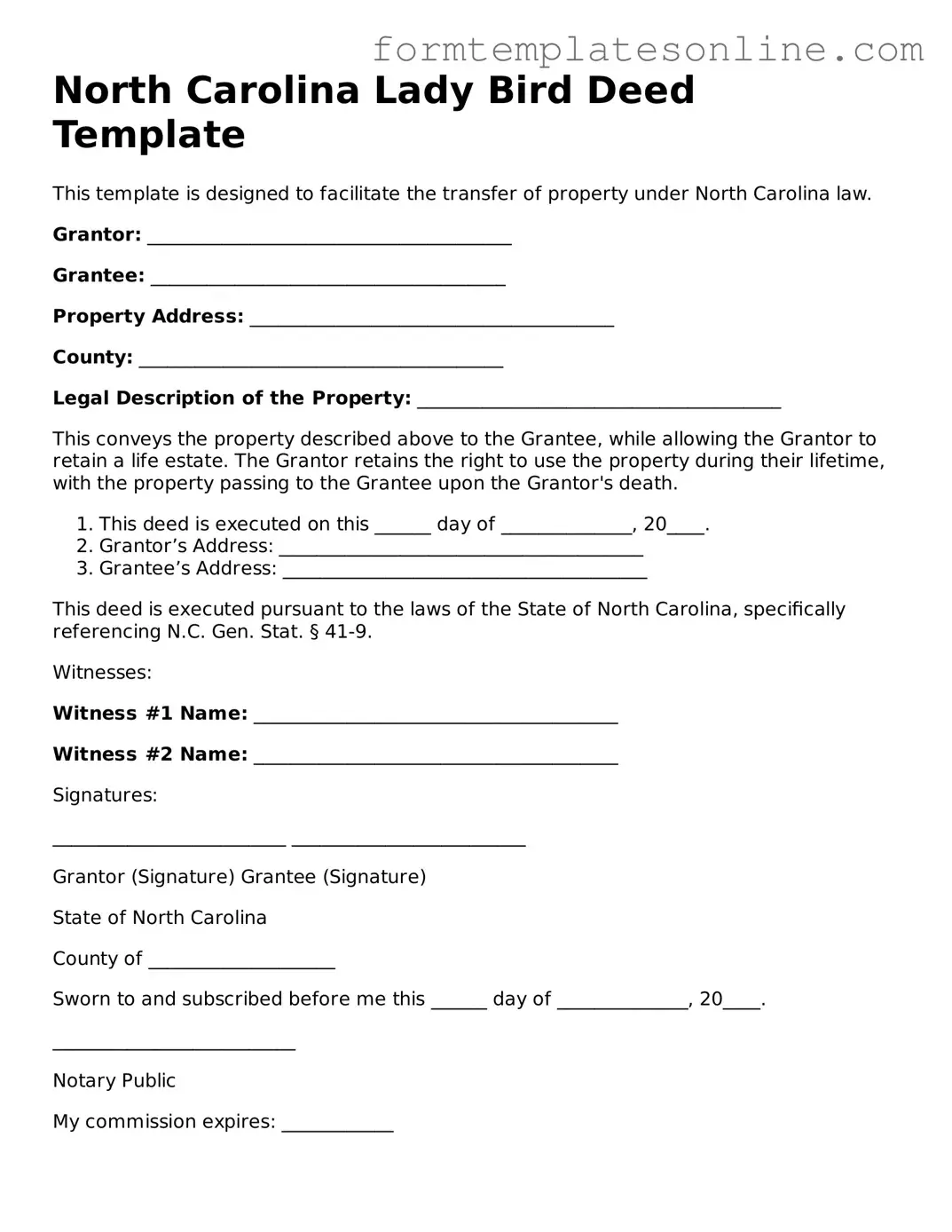

Example - North Carolina Lady Bird Deed Form

North Carolina Lady Bird Deed Template

This template is designed to facilitate the transfer of property under North Carolina law.

Grantor: _______________________________________

Grantee: ______________________________________

Property Address: _______________________________________

County: _______________________________________

Legal Description of the Property: _______________________________________

This conveys the property described above to the Grantee, while allowing the Grantor to retain a life estate. The Grantor retains the right to use the property during their lifetime, with the property passing to the Grantee upon the Grantor's death.

- This deed is executed on this ______ day of ______________, 20____.

- Grantor’s Address: _______________________________________

- Grantee’s Address: _______________________________________

This deed is executed pursuant to the laws of the State of North Carolina, specifically referencing N.C. Gen. Stat. § 41-9.

Witnesses:

Witness #1 Name: _______________________________________

Witness #2 Name: _______________________________________

Signatures:

_________________________ _________________________

Grantor (Signature) Grantee (Signature)

State of North Carolina

County of ____________________

Sworn to and subscribed before me this ______ day of ______________, 20____.

__________________________

Notary Public

My commission expires: ____________

More About North Carolina Lady Bird Deed

What is a Lady Bird Deed in North Carolina?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners to transfer their real estate to beneficiaries while retaining certain rights. In North Carolina, this type of deed enables the property owner to maintain control over the property during their lifetime, including the right to sell, mortgage, or change the beneficiaries. Upon the owner’s death, the property automatically transfers to the designated beneficiaries without going through probate.

Who can use a Lady Bird Deed in North Carolina?

Any property owner in North Carolina can use a Lady Bird Deed to transfer real estate. This includes individuals, married couples, or joint owners. It is particularly beneficial for those who wish to avoid probate and retain control over their property during their lifetime. However, it is essential to consult with a legal professional to ensure that this option aligns with individual estate planning goals.

What are the advantages of using a Lady Bird Deed?

One of the primary advantages of a Lady Bird Deed is the ability to avoid probate, which can be a lengthy and costly process. Additionally, the property owner retains control over the property, allowing for flexibility in managing their assets. The deed also provides potential tax benefits, as the property may receive a stepped-up basis upon the owner's death, which can reduce capital gains taxes for beneficiaries.

Are there any disadvantages to using a Lady Bird Deed?

While a Lady Bird Deed offers several benefits, it also has potential drawbacks. For instance, the property may still be subject to creditors' claims during the owner's lifetime. Furthermore, if the owner decides to sell the property, the beneficiaries will lose their interest in it. Additionally, this type of deed may not be recognized in all states, so it is crucial to consider the specific laws in North Carolina.

How do you create a Lady Bird Deed in North Carolina?

To create a Lady Bird Deed in North Carolina, the property owner must draft the deed, clearly stating the intent to create an enhanced life estate. The deed should include the legal description of the property and the names of the beneficiaries. After drafting, the deed must be signed, notarized, and recorded with the county register of deeds. It is advisable to work with a legal professional to ensure compliance with all legal requirements.

Can a Lady Bird Deed be revoked or changed?

Yes, a Lady Bird Deed can be revoked or changed by the property owner at any time during their lifetime. The owner retains the right to modify the deed, change beneficiaries, or even sell the property. To revoke the deed, the owner must execute a new deed or a revocation document, which should also be recorded to ensure clarity regarding the property’s ownership.

Is a Lady Bird Deed the right choice for everyone?

A Lady Bird Deed may not be suitable for everyone. Individuals with complex estate planning needs or those who have specific concerns about asset protection should consider alternative options. It is essential to evaluate personal circumstances and consult with an estate planning attorney to determine the most appropriate strategy for transferring property and managing assets.

Key takeaways

Filling out and using the North Carolina Lady Bird Deed form can be straightforward if you keep a few key points in mind. Here are some important takeaways:

- Understand the Purpose: The Lady Bird Deed allows property owners to transfer their property to beneficiaries while retaining control during their lifetime.

- Retain Control: You can sell, mortgage, or change the property without needing consent from the beneficiaries.

- Avoid Probate: This deed helps your property bypass the probate process upon your death, simplifying the transfer to your beneficiaries.

- Tax Implications: Consult with a tax advisor to understand any potential tax consequences for you and your beneficiaries.

- Complete the Form Accurately: Ensure all names, addresses, and legal descriptions of the property are correct to avoid complications later.

- Sign and Notarize: The deed must be signed in the presence of a notary public to be legally valid.

- Record the Deed: File the completed deed with the local register of deeds to ensure it is legally recognized.

- Review Regularly: Periodically review the deed to ensure it still aligns with your wishes and estate planning goals.

By keeping these points in mind, you can navigate the process of using the Lady Bird Deed effectively and with confidence.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The North Carolina Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | This deed is governed by North Carolina General Statutes, specifically under Chapter 31A. |

| Retained Rights | Property owners can retain the right to live in and use the property for their lifetime. |

| Transfer on Death | The deed enables automatic transfer of property to named beneficiaries upon the owner's death. |

| Exemption from Probate | Property transferred via a Lady Bird Deed does not go through probate, simplifying the process for heirs. |

| Revocability | The owner can revoke or change the deed at any time before their death. |

| Tax Implications | There may be tax benefits, as the property is not considered a gift until the owner's death. |

| Eligibility | Only real property, such as land and buildings, can be transferred using this deed. |

| Execution Requirements | The deed must be signed by the property owner and notarized to be valid. |

| Beneficiary Designation | Multiple beneficiaries can be named, and they can inherit equal or unequal shares as specified in the deed. |

Consider Some Other Lady Bird Deed Forms for US States

Free Michigan Lady Bird Deed Pdf - This deed type is often preferred for its straightforwardness compared to other estate planning tools.

A Georgia Power of Attorney form is a legal document that gives one person the authority to act on behalf of another. This authority can cover a wide range of activities, from managing finances to making healthcare decisions. It's a crucial tool for planning and managing personal affairs, especially in unforeseen circumstances. For more information, you can visit OnlineLawDocs.com.

Ladybird Deed Florida - It allows property owners to remain living in their home during their lifetime while designating recipients for the property.

Dos and Don'ts

When filling out the North Carolina Lady Bird Deed form, it’s important to follow certain guidelines to ensure everything is completed correctly. Here’s a list of what to do and what to avoid:

- Do ensure that all property details are accurate and up to date.

- Do clearly identify all parties involved, including the grantor and grantee.

- Do consult with a legal professional if you have any questions about the process.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank; incomplete forms can lead to issues.

- Don't use outdated information; always verify your details before submission.

- Don't forget to sign and date the form where required.

- Don't rush the process; take your time to ensure everything is correct.