Valid Transfer-on-Death Deed Form for New York

The New York Transfer-on-Death Deed form provides a streamlined method for property owners to transfer real estate to beneficiaries upon their passing, effectively bypassing the lengthy probate process. This legal instrument allows individuals to retain full ownership and control of their property during their lifetime while designating one or more beneficiaries to receive the property automatically after death. Importantly, the deed must be executed in accordance with specific state requirements to ensure its validity, including notarization and proper filing with the county clerk's office. Additionally, the form allows property owners to change or revoke the deed at any time before their death, offering flexibility in estate planning. Understanding the nuances of this form can empower property owners to make informed decisions about their assets and provide peace of mind regarding their heirs' future. In New York, this approach to property transfer is gaining popularity as it simplifies the transition of ownership and minimizes potential conflicts among heirs.

Common mistakes

-

Not Including All Required Information: Many individuals forget to provide essential details such as the legal description of the property. This omission can lead to delays or even invalidate the deed.

-

Failing to Sign the Deed: A common mistake is neglecting to sign the Transfer-on-Death Deed. Without a signature, the document is not legally binding, and the transfer will not occur as intended.

-

Improper Witness or Notary Requirements: Some people overlook the necessity of having the deed witnessed or notarized. In New York, failing to meet these requirements can result in the deed being rejected.

-

Not Recording the Deed: After completing the form, individuals often forget to file it with the county clerk’s office. This step is crucial for ensuring the transfer is recognized legally upon death.

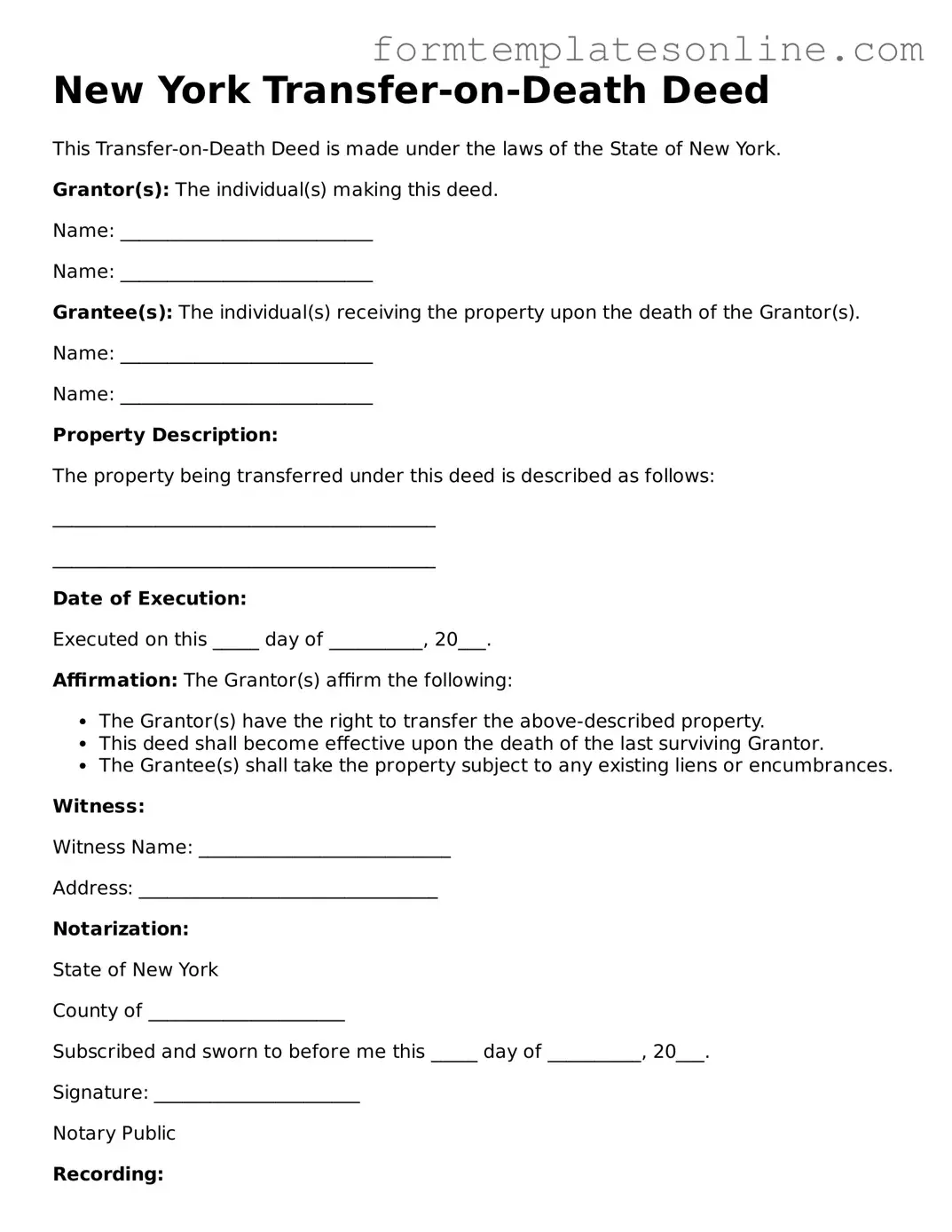

Example - New York Transfer-on-Death Deed Form

New York Transfer-on-Death Deed

This Transfer-on-Death Deed is made under the laws of the State of New York.

Grantor(s): The individual(s) making this deed.

Name: ___________________________

Name: ___________________________

Grantee(s): The individual(s) receiving the property upon the death of the Grantor(s).

Name: ___________________________

Name: ___________________________

Property Description:

The property being transferred under this deed is described as follows:

_________________________________________

_________________________________________

Date of Execution:

Executed on this _____ day of __________, 20___.

Affirmation: The Grantor(s) affirm the following:

- The Grantor(s) have the right to transfer the above-described property.

- This deed shall become effective upon the death of the last surviving Grantor.

- The Grantee(s) shall take the property subject to any existing liens or encumbrances.

Witness:

Witness Name: ___________________________

Address: ________________________________

Notarization:

State of New York

County of _____________________

Subscribed and sworn to before me this _____ day of __________, 20___.

Signature: ______________________

Notary Public

Recording:

This deed must be recorded in accordance with New York law for it to be effective.

More About New York Transfer-on-Death Deed

What is a Transfer-on-Death Deed in New York?

A Transfer-on-Death Deed (TOD Deed) allows an individual to transfer real estate to a beneficiary upon their death, without going through probate. This form is beneficial for individuals looking to simplify the transfer of their property and avoid lengthy legal processes after their passing.

Who can use a Transfer-on-Death Deed?

Any individual who owns real property in New York can utilize a Transfer-on-Death Deed. This includes homeowners, property investors, and anyone else with title to real estate. However, the deed must be executed correctly to be valid.

How do I create a Transfer-on-Death Deed?

To create a TOD Deed, you must fill out the appropriate form, which includes details about the property and the beneficiary. After completing the form, it must be signed in the presence of a notary public. Finally, the deed must be recorded with the county clerk where the property is located to ensure its effectiveness.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time before your death. To do this, you must create a new deed or a revocation form and follow the same recording process. It is essential to ensure that the new or revoked deed is properly executed and recorded to avoid any confusion regarding your intentions.

What happens if the beneficiary predeceases me?

If the designated beneficiary dies before you, the Transfer-on-Death Deed will not transfer the property to that individual. Instead, the property will become part of your estate and will be distributed according to your will or New York state intestacy laws if you do not have a will.

Are there any tax implications with a Transfer-on-Death Deed?

Generally, transferring property through a TOD Deed does not trigger immediate tax consequences. However, the beneficiary may be responsible for property taxes after the transfer occurs. It is advisable to consult a tax professional to understand any potential implications fully.

Is a Transfer-on-Death Deed the same as a will?

No, a Transfer-on-Death Deed is not the same as a will. While both documents deal with the distribution of property after death, a TOD Deed specifically transfers real estate outside of probate. A will, on the other hand, outlines how all assets, including real estate, should be distributed and must go through the probate process.

Can I use a Transfer-on-Death Deed for all types of property?

A Transfer-on-Death Deed is specifically designed for real property, such as land and buildings. It cannot be used for personal property, bank accounts, or other types of assets. For those assets, different estate planning tools may be necessary.

Do I need an attorney to create a Transfer-on-Death Deed?

While it is not legally required to have an attorney assist you in creating a Transfer-on-Death Deed, it is often recommended. An attorney can help ensure that the deed is properly executed and recorded, minimizing the risk of future disputes or complications.

Key takeaways

Filling out and using the New York Transfer-on-Death Deed form can be a straightforward process if you understand the key elements involved. Here are some important takeaways to consider:

- The Transfer-on-Death Deed allows you to designate a beneficiary who will receive your property upon your death, avoiding probate.

- To be valid, the deed must be signed by the property owner in the presence of a notary public.

- Ensure that the beneficiary's name is clearly stated and that they are identifiable to avoid confusion later.

- It is crucial to record the deed with the county clerk's office where the property is located to make it effective.

- Once the deed is recorded, it cannot be revoked unless you complete a formal revocation process.

- Consider consulting with a legal professional to ensure that your deed complies with all state laws and requirements.

- Review your deed periodically, especially if there are changes in your life or your beneficiary's situation.

- Remember that the Transfer-on-Death Deed only applies to real property and does not cover personal assets or bank accounts.

By keeping these points in mind, you can effectively navigate the process of creating and using a Transfer-on-Death Deed in New York.

File Details

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed in New York is governed by New York Estates, Powers and Trusts Law (EPTL) § 2-1.11. |

| Eligibility | Any individual who owns real property in New York can create a Transfer-on-Death Deed. |

| Beneficiary Designation | The deed allows the owner to name one or more beneficiaries who will receive the property upon the owner's death. |

| Revocation | The Transfer-on-Death Deed can be revoked by the owner at any time before their death, as long as the revocation is executed properly. |

| Filing Requirements | The deed must be signed, notarized, and filed with the county clerk's office where the property is located. |

| Impact on Creditors | The property transferred via a Transfer-on-Death Deed may still be subject to the owner's debts and creditors during their lifetime. |

| Tax Implications | There are no immediate tax implications for the owner when executing a Transfer-on-Death Deed, but beneficiaries may face tax liabilities upon inheritance. |

| Effect on Estate Planning | This deed can be a useful tool in estate planning, allowing for a smooth transfer of property without the complexities of probate. |

| Limitations | Transfer-on-Death Deeds cannot be used for all types of property, such as certain types of jointly-owned property or property held in trust. |

Consider Some Other Transfer-on-Death Deed Forms for US States

House Deed Transfer - This type of deed can simplify estate planning by bypassing lengthy legal proceedings traditionally associated with inheritance.

Texas Life Estate Deed Form - A Transfer-on-Death Deed allows property owners to designate beneficiaries for their real estate upon death without going through probate.

A Georgia Hold Harmless Agreement form is a legal document where one party agrees not to hold the other party liable for any injuries, damages, or losses. This agreement is commonly used in situations where there is a potential for risk, such as property use or construction projects. It serves to protect individuals or businesses by explicitly outlining responsibilities and liabilities. For more information, you can visit OnlineLawDocs.com.

Free Printable Transfer on Death Deed Form Florida - A Transfer-on-Death Deed allows an individual to designate a beneficiary to receive property at their death without the need for probate.

Dos and Don'ts

When filling out the New York Transfer-on-Death Deed form, careful attention is essential to ensure that the document is completed correctly. Below are some guidelines to follow and avoid during this process.

- Do ensure that you clearly identify the property being transferred, including the correct address and legal description.

- Do include the full names of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Do sign the deed in the presence of a notary public to validate the document.

- Do check for any specific state requirements that may apply to the Transfer-on-Death Deed.

- Don't leave any sections of the form blank, as this may lead to confusion or rejection.

- Don't forget to file the deed with the appropriate county clerk's office after it has been completed and notarized.

- Don't use outdated forms; always ensure that you are using the most current version of the Transfer-on-Death Deed form.

- Don't assume that verbal agreements or informal arrangements will suffice; the deed must be properly executed to be legally effective.

By following these guidelines, you can help ensure that the Transfer-on-Death Deed is filled out accurately and effectively, providing peace of mind for all parties involved.