Valid Real Estate Purchase Agreement Form for New York

The New York Real Estate Purchase Agreement form is a crucial document for anyone involved in buying or selling property in the state. This form outlines the essential terms and conditions of the transaction, ensuring that both parties are clear on their obligations and rights. Key components include the purchase price, deposit details, and financing contingencies, which provide clarity on how the transaction will be funded. Additionally, the agreement specifies the closing date and any conditions that must be met prior to finalizing the sale. It also addresses property disclosures, ensuring that buyers are informed about the property's condition and any potential issues. By covering these major aspects, the New York Real Estate Purchase Agreement serves as a foundational tool that protects the interests of both buyers and sellers, facilitating a smoother transaction process.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details, such as the buyer's and seller's full names and contact information, can lead to confusion and delays.

-

Incorrect Property Description: Not accurately describing the property, including its address and legal description, can create issues during the closing process.

-

Missing Signatures: Both parties must sign the agreement. Omitting a signature can render the contract unenforceable.

-

Ignoring Contingencies: Failing to include important contingencies, such as financing or inspection contingencies, can expose buyers to unnecessary risk.

-

Improper Dates: Entering incorrect dates for the closing or other important deadlines can lead to misunderstandings and missed opportunities.

-

Neglecting Earnest Money Details: Not specifying the amount of earnest money or the terms for its return can cause disputes later on.

-

Overlooking Title Issues: Failing to address title insurance and any potential title issues can leave buyers vulnerable to legal complications.

-

Vague Terms: Using ambiguous language regarding the sale terms, such as payment structure or included fixtures, can lead to disagreements.

-

Forgetting to Review Local Laws: Not considering local real estate laws and regulations can result in non-compliance and potential legal issues.

-

Skipping Professional Assistance: Attempting to fill out the form without consulting a real estate attorney or agent can lead to costly mistakes.

Example - New York Real Estate Purchase Agreement Form

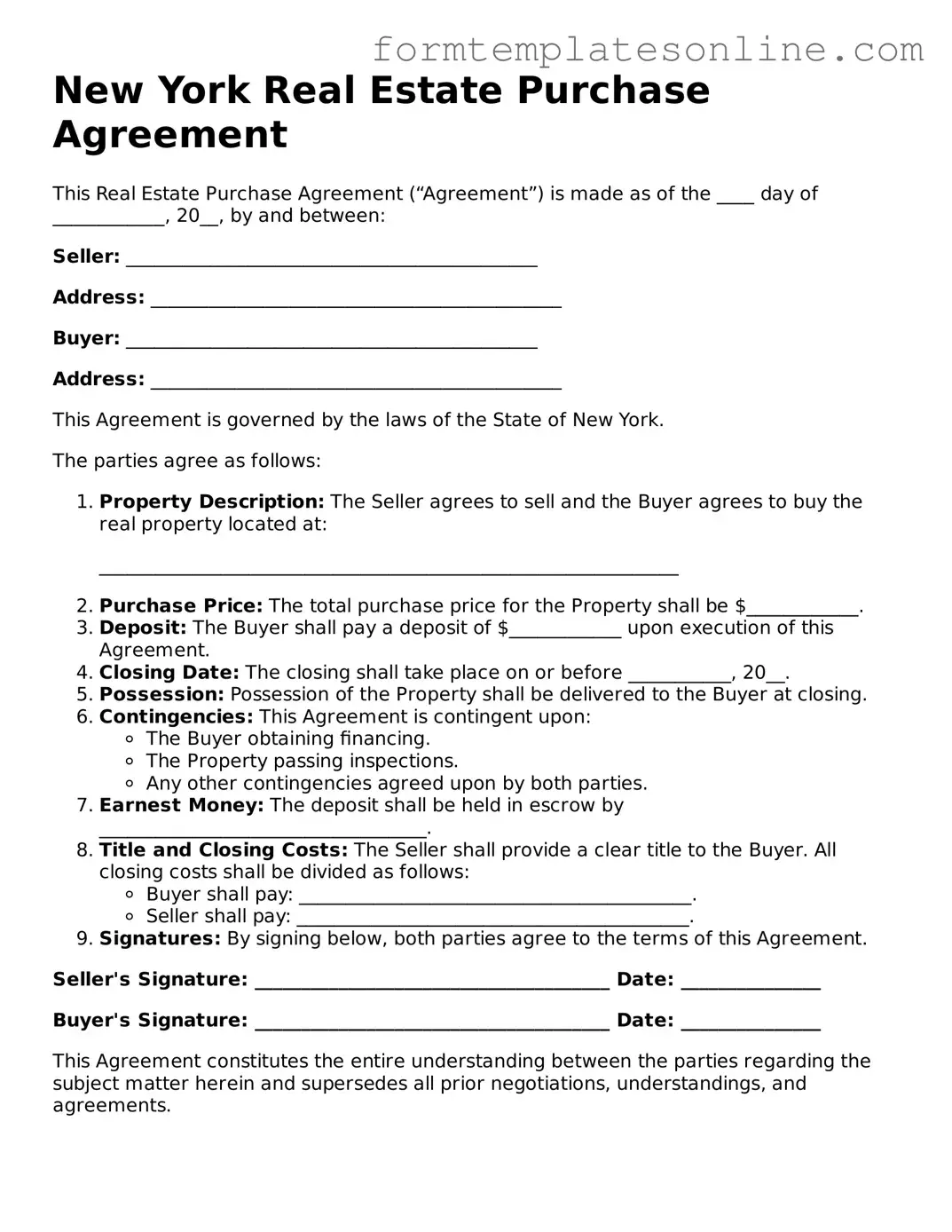

New York Real Estate Purchase Agreement

This Real Estate Purchase Agreement (“Agreement”) is made as of the ____ day of ____________, 20__, by and between:

Seller: ____________________________________________

Address: ____________________________________________

Buyer: ____________________________________________

Address: ____________________________________________

This Agreement is governed by the laws of the State of New York.

The parties agree as follows:

- Property Description: The Seller agrees to sell and the Buyer agrees to buy the real property located at:

- Purchase Price: The total purchase price for the Property shall be $____________.

- Deposit: The Buyer shall pay a deposit of $____________ upon execution of this Agreement.

- Closing Date: The closing shall take place on or before ___________, 20__.

- Possession: Possession of the Property shall be delivered to the Buyer at closing.

- Contingencies: This Agreement is contingent upon:

- The Buyer obtaining financing.

- The Property passing inspections.

- Any other contingencies agreed upon by both parties.

- Earnest Money: The deposit shall be held in escrow by ___________________________________.

- Title and Closing Costs: The Seller shall provide a clear title to the Buyer. All closing costs shall be divided as follows:

- Buyer shall pay: __________________________________________.

- Seller shall pay: __________________________________________.

- Signatures: By signing below, both parties agree to the terms of this Agreement.

______________________________________________________________

Seller's Signature: ______________________________________ Date: _______________

Buyer's Signature: ______________________________________ Date: _______________

This Agreement constitutes the entire understanding between the parties regarding the subject matter herein and supersedes all prior negotiations, understandings, and agreements.

More About New York Real Estate Purchase Agreement

What is a New York Real Estate Purchase Agreement?

A New York Real Estate Purchase Agreement is a legally binding contract between a buyer and a seller for the purchase of real estate. This document outlines the terms of the sale, including the purchase price, closing date, and any contingencies that must be met before the transaction is finalized. It serves to protect both parties by clearly stating their rights and obligations.

What key elements should be included in the agreement?

Several important elements should be included in the agreement. These include the names of the buyer and seller, a description of the property, the purchase price, the earnest money deposit, contingencies such as financing or inspection, and the closing date. Additionally, any special conditions or agreements should be clearly stated to avoid misunderstandings later on.

Are there any contingencies I should consider?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include financing, home inspections, and the sale of the buyer's current home. Including these provisions can protect you from unexpected issues that may arise during the transaction process.

What happens if either party breaches the agreement?

If either party fails to fulfill their obligations as outlined in the agreement, it may be considered a breach of contract. The non-breaching party may have several options, including seeking damages, specific performance, or terminating the contract. It's essential to understand your rights and potential remedies in such situations.

Is it necessary to have a lawyer review the agreement?

While it is not legally required to have a lawyer review the agreement, it is highly recommended. A knowledgeable attorney can help ensure that your interests are protected, clarify any confusing terms, and provide guidance on local laws and regulations that may affect the transaction.

How is the purchase price determined?

The purchase price is typically negotiated between the buyer and seller based on various factors, including the property's market value, comparable sales in the area, and the condition of the property. It’s essential for both parties to conduct thorough research and consider obtaining an appraisal to support their position.

What is an earnest money deposit?

An earnest money deposit is a sum of money provided by the buyer to demonstrate their commitment to purchasing the property. This deposit is typically held in escrow and applied toward the purchase price at closing. If the buyer fails to fulfill the terms of the agreement, the seller may be entitled to keep the earnest money as compensation.

When is the closing date set?

The closing date is usually set during the negotiation process and is included in the purchase agreement. It is the date when the ownership of the property is officially transferred from the seller to the buyer. Both parties should agree on a date that allows sufficient time for all contingencies to be met and necessary paperwork to be completed.

What should I do if I have questions about the agreement?

If you have questions about the Real Estate Purchase Agreement, it’s important to seek clarification before signing. You can consult with your real estate agent or a qualified attorney who can provide insights specific to your situation. Ensuring you fully understand the terms will help you make informed decisions throughout the process.

Key takeaways

When filling out and using the New York Real Estate Purchase Agreement form, keep these key takeaways in mind:

- Understand the Parties Involved: Clearly identify the buyer and seller. Make sure their names and contact information are accurate.

- Property Description: Provide a detailed description of the property. Include the address and any specific features that define the property.

- Purchase Price and Payment Terms: Clearly state the purchase price. Outline how the payment will be made, including any deposits and financing details.

- Contingencies: Include any contingencies that must be met for the sale to proceed. This could involve financing, inspections, or other conditions.

- Signatures: Ensure that both parties sign and date the agreement. This makes the document legally binding.

Taking these steps can help ensure a smoother transaction and protect the interests of both parties involved.

File Details

| Fact Name | Description |

|---|---|

| Governing Law | The New York Real Estate Purchase Agreement is governed by New York State law. |

| Parties Involved | The agreement typically involves a buyer and a seller, both of whom must be legally capable of entering into a contract. |

| Property Description | A detailed description of the property being sold is required, including its address and legal description. |

| Purchase Price | The total purchase price must be clearly stated, along with any deposit amounts and payment terms. |

| Contingencies | Common contingencies may include financing, inspections, and appraisals, allowing buyers to back out under certain conditions. |

| Closing Date | The agreement should specify a closing date, which is the date when the property transfer is finalized. |

| Default Provisions | Provisions addressing default by either party are included, outlining remedies and consequences for breach of contract. |

| Signatures | Both parties must sign the agreement for it to be legally binding, indicating their acceptance of the terms. |

Consider Some Other Real Estate Purchase Agreement Forms for US States

North Carolina Realtors - The form may specify financing details to ensure clarity in payment expectations.

In order to ensure that sensitive information remains confidential and is not shared without consent, parties can utilize a Georgia Non-disclosure Agreement (NDA). This legal document acts as a protective measure for trade secrets and proprietary data, especially for businesses operating within Georgia. By entering into this agreement, both parties agree to uphold confidentiality and secure sensitive information. For more details on crafting an effective NDA, you can refer to OnlineLawDocs.com.

Pa Standard Agreement of Sale - This document can be used for various property types, including residential and commercial.

Dos and Don'ts

When filling out the New York Real Estate Purchase Agreement form, there are important guidelines to follow. Here’s a list of things you should and shouldn’t do:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate information about the property and parties involved.

- Do specify the purchase price clearly.

- Do include any contingencies, such as financing or inspection.

- Do sign and date the agreement in the appropriate places.

- Don't leave any blank spaces; if a section does not apply, write "N/A."

- Don't rush through the process; take your time to ensure accuracy.

- Don't forget to include any necessary addendums or disclosures.

- Don't ignore local laws or regulations that may affect the agreement.

- Don't hesitate to seek legal advice if you have questions.

Following these guidelines can help ensure that your Real Estate Purchase Agreement is filled out correctly and protects your interests in the transaction.