Valid Quitclaim Deed Form for New York

The New York Quitclaim Deed is a crucial legal instrument used in real estate transactions, particularly when transferring property ownership. This form allows one party, known as the grantor, to transfer their interest in a property to another party, the grantee, without making any guarantees about the title's validity. Unlike warranty deeds, which provide assurances regarding the title, quitclaim deeds are often utilized in situations where the parties know each other well, such as family transfers or divorce settlements. This simplicity makes it an appealing option for many, but it also means that the grantee assumes the risk associated with any potential title issues. The form requires specific information, including the names of both parties, a description of the property, and the signatures of the grantor. Additionally, it must be notarized and filed with the appropriate county clerk's office to be legally effective. Understanding the nuances of the New York Quitclaim Deed is essential for anyone looking to navigate property transfers smoothly and securely.

Common mistakes

-

Incorrect Property Description: Many people fail to provide a complete and accurate description of the property. This includes not specifying the correct address, lot number, or boundaries. A vague description can lead to confusion and potential legal issues.

-

Missing Signatures: It’s essential that all parties involved in the transfer sign the Quitclaim Deed. Sometimes, individuals overlook the requirement for both the grantor (the person transferring the property) and the grantee (the person receiving the property) to sign the document. Without these signatures, the deed may not be valid.

-

Not Notarizing the Document: A Quitclaim Deed typically needs to be notarized to be legally binding. Failing to have the document notarized can lead to challenges in proving its authenticity. This step is crucial for ensuring the deed is recognized by the county clerk.

-

Improper Filing: After completing the Quitclaim Deed, it must be filed with the appropriate county office. Some individuals neglect this step or file it incorrectly. This can result in the deed not being recorded, which may affect ownership rights and future property transactions.

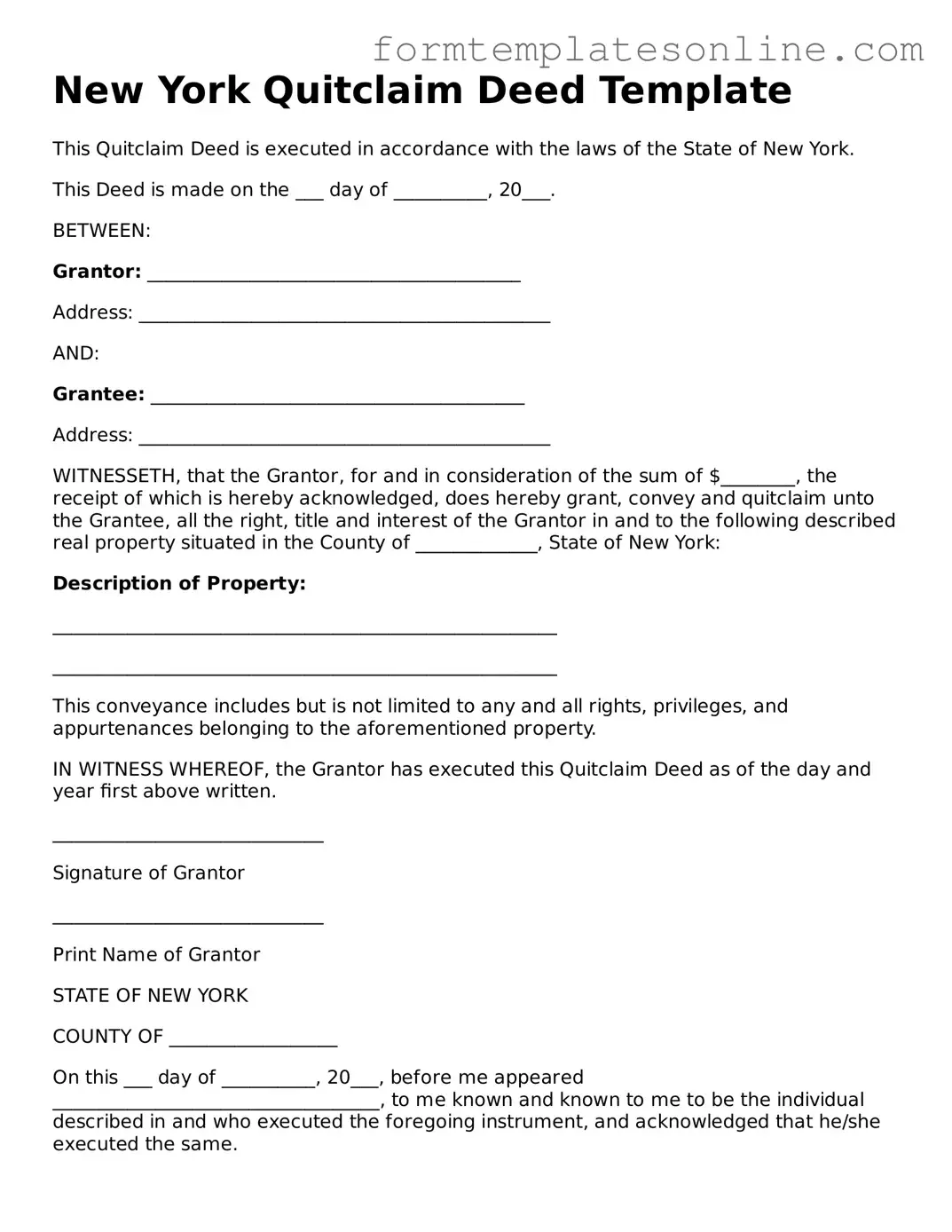

Example - New York Quitclaim Deed Form

New York Quitclaim Deed Template

This Quitclaim Deed is executed in accordance with the laws of the State of New York.

This Deed is made on the ___ day of __________, 20___.

BETWEEN:

Grantor: ________________________________________

Address: ____________________________________________

AND:

Grantee: ________________________________________

Address: ____________________________________________

WITNESSETH, that the Grantor, for and in consideration of the sum of $________, the receipt of which is hereby acknowledged, does hereby grant, convey and quitclaim unto the Grantee, all the right, title and interest of the Grantor in and to the following described real property situated in the County of _____________, State of New York:

Description of Property:

______________________________________________________

______________________________________________________

This conveyance includes but is not limited to any and all rights, privileges, and appurtenances belonging to the aforementioned property.

IN WITNESS WHEREOF, the Grantor has executed this Quitclaim Deed as of the day and year first above written.

_____________________________

Signature of Grantor

_____________________________

Print Name of Grantor

STATE OF NEW YORK

COUNTY OF __________________

On this ___ day of __________, 20___, before me appeared ___________________________________, to me known and known to me to be the individual described in and who executed the foregoing instrument, and acknowledged that he/she executed the same.

_____________________________

Notary Public

More About New York Quitclaim Deed

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. Unlike a warranty deed, a quitclaim deed does not guarantee that the property title is clear or free from claims. Instead, it simply conveys whatever interest the grantor has in the property at the time of the transfer. This type of deed is often used between family members or in situations where the parties know each other well, as it offers a straightforward way to transfer property without extensive legal protections.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed in various situations. For instance, if you are transferring property to a family member, such as a spouse or child, a quitclaim deed can simplify the process. It is also commonly used in divorce settlements when one spouse relinquishes their interest in a property to the other. However, it's important to note that using a quitclaim deed does not eliminate any existing liens or debts associated with the property, so it’s wise to be aware of any financial obligations tied to the real estate before proceeding.

How do I complete a Quitclaim Deed in New York?

Completing a Quitclaim Deed in New York involves several steps. First, you will need to obtain the form, which can often be found online or at a local office supply store. Fill out the form with the necessary information, including the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), as well as a description of the property. After filling it out, the deed must be signed in the presence of a notary public. Finally, you will need to file the completed deed with the county clerk’s office where the property is located to make the transfer official.

Are there any fees associated with filing a Quitclaim Deed?

Yes, there are fees associated with filing a Quitclaim Deed in New York. These fees can vary by county, so it’s important to check with your local county clerk’s office for the exact amount. In addition to filing fees, you may also incur costs for obtaining a notary public’s services, which can vary based on their rates. Always budget for these expenses when planning to execute a property transfer using a quitclaim deed.

Does a Quitclaim Deed affect property taxes?

A Quitclaim Deed itself does not directly affect property taxes. However, transferring property ownership can lead to reassessment by local tax authorities, which may change the property’s tax valuation. In New York, property tax assessments are generally based on the current market value, and a change in ownership can trigger a review. It’s advisable to check with your local tax assessor’s office to understand how the transfer might impact your property taxes.

Key takeaways

When dealing with property transfers in New York, the Quitclaim Deed form serves as a straightforward tool. Understanding its nuances can make the process smoother and ensure clarity in ownership. Here are some key takeaways to keep in mind:

- Purpose: A Quitclaim Deed is primarily used to transfer ownership interest in a property without guaranteeing that the title is clear. This means the grantor is not promising that they own the property free and clear of any claims.

- Parties Involved: The form requires the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Ensure that the names are spelled correctly to avoid future disputes.

- Property Description: A clear and complete description of the property is essential. This typically includes the address and, if applicable, the lot number or parcel identification number.

- Signature Requirement: The grantor must sign the Quitclaim Deed in front of a notary public. This signature authenticates the document and is a critical step in the process.

- Recording the Deed: After the Quitclaim Deed is completed and signed, it should be filed with the county clerk's office where the property is located. This step is vital for making the transfer public and legally binding.

- Potential Tax Implications: Transferring property can have tax consequences. It’s advisable to consult a tax professional to understand any potential implications related to property taxes or capital gains.

- Limitations: A Quitclaim Deed does not provide warranties or guarantees about the property. If you are looking for a more secure transfer, consider other types of deeds, like a Warranty Deed, which offers more protection.

By keeping these takeaways in mind, you can navigate the process of using a Quitclaim Deed in New York with greater confidence and clarity.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer ownership of real estate from one person to another without any warranties or guarantees regarding the title. |

| Governing Law | The New York Quitclaim Deed is governed by New York Real Property Law, particularly sections 244 to 257. |

| Usage | This form is often used between family members, in divorce settlements, or to clear up title issues, as it conveys whatever interest the grantor has in the property. |

| Filing Requirements | After execution, the Quitclaim Deed must be filed with the county clerk's office where the property is located to be effective and to provide public notice of the transfer. |

Consider Some Other Quitclaim Deed Forms for US States

Quick Claim Deed Form - Quitclaim Deeds can be useful in transferring property in situations of joint ownership dissolution.

Quitclaim Deed Ohio - This form can simplify the process of gift-giving real property.

Quit Claim Deed Illinois Divorce - This deed form can help settle matters quickly when relationships dissolve.

Engaging in activities that involve potential risks necessitates the use of legal protections, and a Michigan Hold Harmless Agreement is one such measure that effectively safeguards individuals and businesses alike. By crafting this important document, parties can ensure that they are shielded from liabilities stemming from accidents or damages that may occur during the course of their engagement. For those looking to understand more about this crucial agreement, resources like OnlineLawDocs.com can provide valuable insights and assistance in navigating the complexities involved.

Quit Claim Deed Georgia - A quitclaim deed can simplify the process of gifting real estate to individuals without formal sales contracts.

Dos and Don'ts

Filling out a New York Quitclaim Deed form can seem daunting, but knowing what to do and what to avoid can simplify the process. Here’s a helpful list to guide you through.

- Do ensure that all names are spelled correctly. Accurate spelling is crucial for legal documents.

- Do include the full address of the property. This helps to clearly identify the property being transferred.

- Do sign the form in the presence of a notary. A notary's signature adds credibility to the document.

- Do check local laws for any specific requirements. Different counties may have unique rules.

- Do provide the correct tax identification number for the property. This is often required for tax purposes.

- Don’t leave any fields blank. Missing information can lead to delays or complications.

- Don’t use outdated forms. Always ensure you are using the most current version of the Quitclaim Deed.

- Don’t forget to file the deed with the appropriate county clerk’s office. This step is essential for the deed to be legally recognized.

- Don’t rush through the process. Take your time to review the document for accuracy before submission.

By following these dos and don’ts, you can navigate the Quitclaim Deed form with greater confidence and ensure a smoother transaction.